Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Hybrid View

-

08-07-2010, 09:43 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

July Employment Situation, Lackluster Private Sector Job Gro

U.S. July Employment Situation, Lackluster Private Sector Job Growth Once Again

Economics / Employment

Aug 07, 2010 - 04:29 AM

By: Paul_L_Kasriel

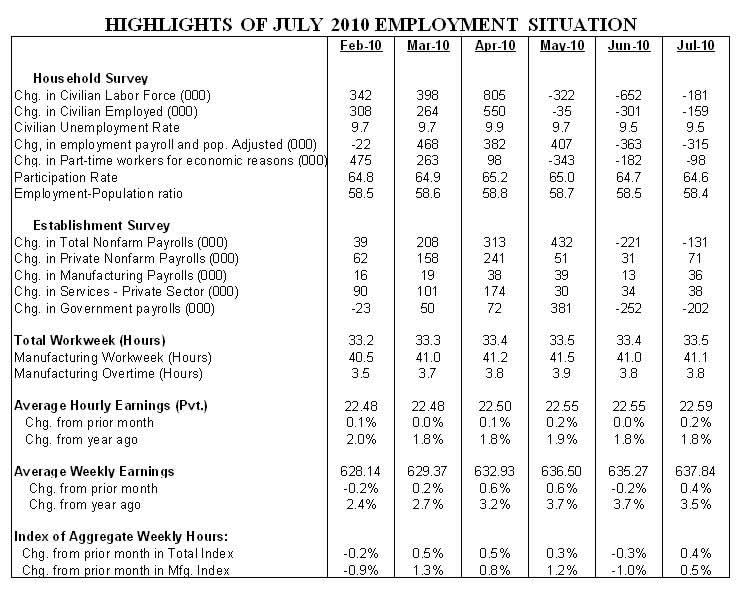

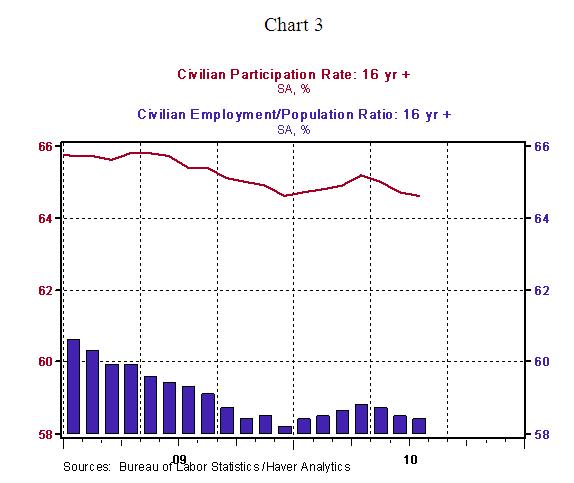

Civilian Unemployment Rate: 9.5% in July, no change from June's reading. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low for the expansion that ended in December 2007 is 4.4% in March 2007.

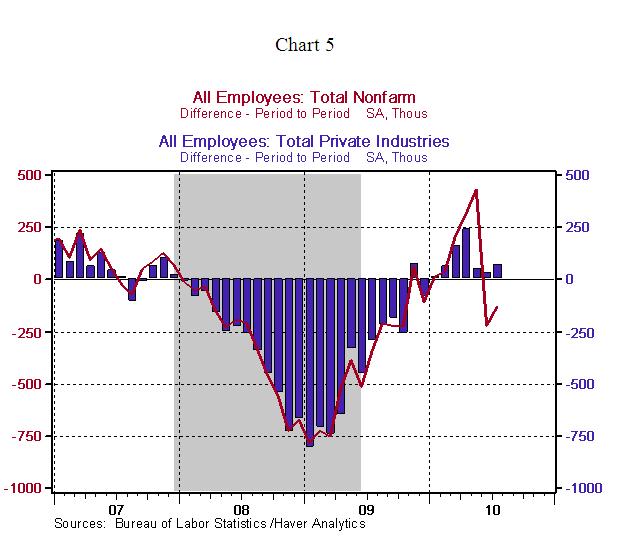

Payroll Employment: -131,000 in July vs. -221,000 in June, net loss of 95,000 jobs after revisions of payroll estimates for May and June. Private sector payrolls rose 71,000 after a downwardly revised gain of 31,000 in June.

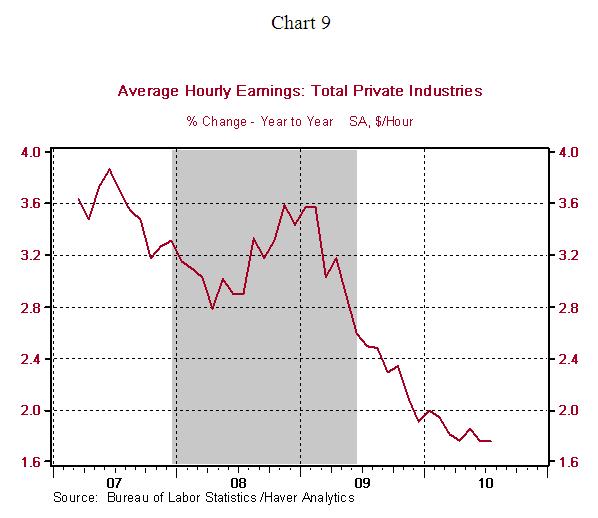

Private Sector Hourly Earnings: $22.59 in July vs. $22.55 in June, 1.8% yoy increase, matching the gain posted in June.

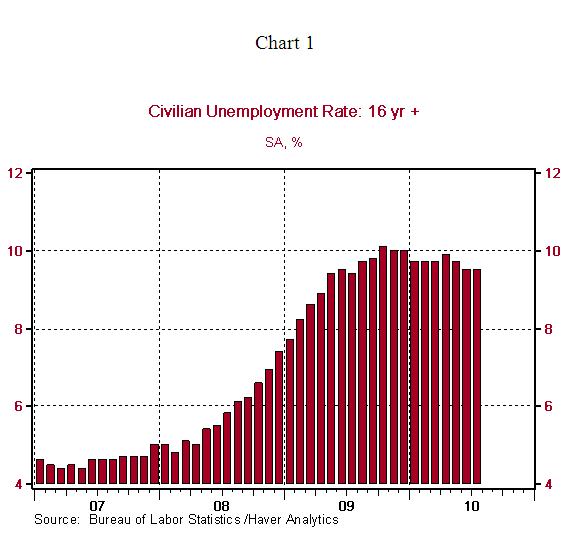

Household Survey - The civilian unemployment rate held steady at 9.5% in July. The broader measure of unemployment, inclusive of marginally attached workers and those working part-time because they are unable to find full-time jobs, was unchanged at 16.5% in July. The 0.75% reduction of the labor force during the May-July months of 2010 is the largest decline recorded since January 1968 (see chart 2).

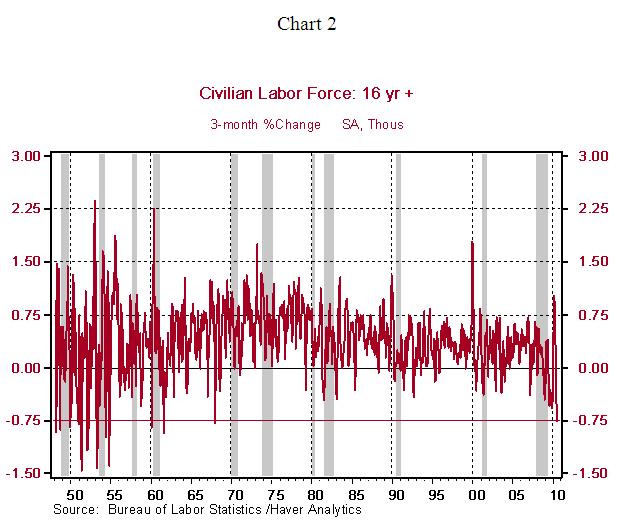

The civilian labor force participation rate (64.6%) and the employment-population ratio (58.4%) both dropped one-tenth of a point in July. These measures have declined by 0.6 percentage point and 0.4 percentage point, respectively, since April.

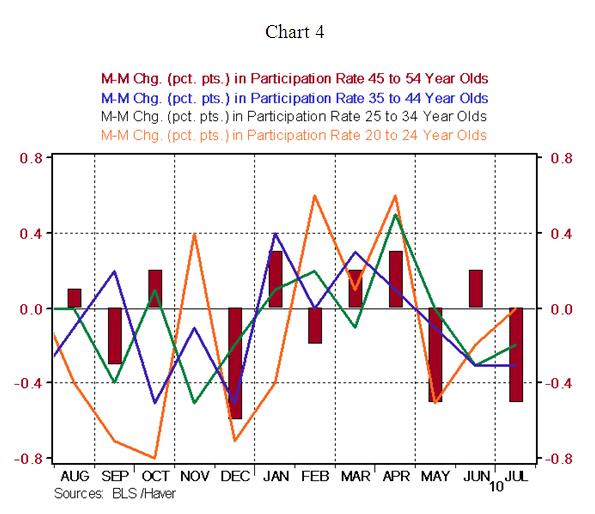

The 45 to 54 year olds cohort has recorded the largest decline in the participation rate in July. In the months ahead, if the 1.716 million folks who have left the labor force return seeking employment, the unemployment rate will likely edge higher as the pace of hiring is expected to fall short of the increase in the labor force. Firms are projected to increase their payrolls at a moderate pace given the part-time status of many on current payrolls and structural adjustments taking place in the labor market.

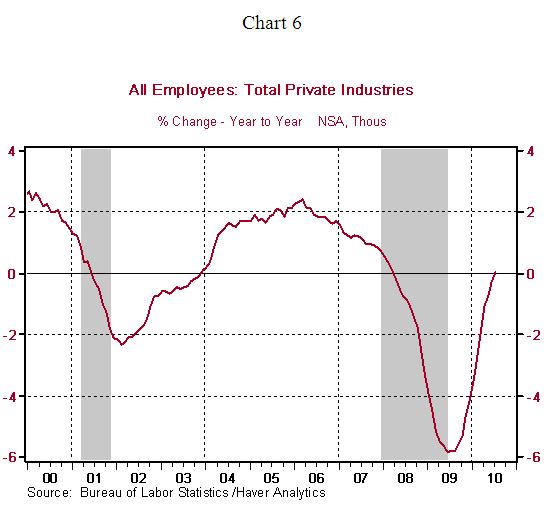

Establishment Survey - Nonfarm payrolls fell 131,000 in July, reflecting the termination of temporary federal government employment related to Census 2010. Excluding government jobs, private sector employment increased 71,000 in July after a downwardly revised gain of 31,000 jobs in June (previously estimated as an increase of 83,000 jobs). Private sector payrolls were unchanged from a year ago, following a string of consecutive monthly declines starting in April 2008 (see chart 6)

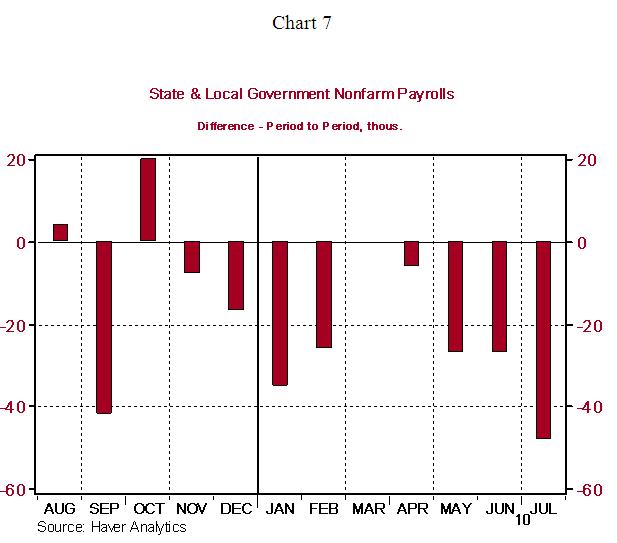

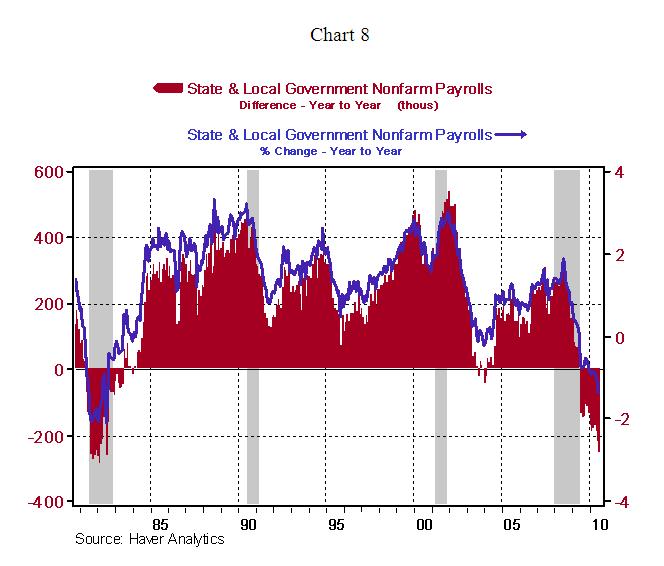

In the past twenty years, state & local government employment has accounted for about 14% of total nonfarm payrolls. But those jobs are now beginning to vanish given the budgetary challenges being faced by these government entities. Chart 7 shows that state & local government payrolls have fallen in six of the seven months of 2010, remaining unchanged in March. Chart 8 shows that in the 12 months ended July 2010, state & local government payrolls have declined by 252,000 or by 1.4%. It is unlikely that private sector labor demand will increase enough in the next year to re-employ a large proportion of these former state & local government employees.

Year-to-date, private sector employment has risen 630,000, with roughly two-thirds of it occurring in the March-April period. In July, hiring was concentrated in factories and health care facilities. Factory employment moved up 36,000 in July, partly due to fewer layoffs from summer auto plant shutdowns. The implication being that fewer auto industry jobs will be reported for August. Auto sector jobs were up 20,700 in July, with the year-to-date tally at 52,700. Health care employment rose 26,600 in July, following a gain of 14,000 in June. In the first seven months of the year, health care employment had increased 131,600. In the financial sector, the pace of job losses has slowed; 17,000 job losses were recorded in July, putting the year-to-date monthly average decline at 12,000. In 2009, on average, 28,580 financial sector jobs were lost each month.

Highlights of Job Losses/Gains in July:

Construction: -11,000 vs. -21,000 in June

Manufacturing: +36,000 vs. +13,000 in June

Autos: +20,700 vs. -2,400 in June

Private sector service employment: +38,000 vs. +34,000 in June

Retail employment: +7,000 vs. -21,000 in June

Professional and business services:-13,000 vs. +23,000 in June

Temporary help: +20,500 vs. +31,100 in June

Financial activities: -17,000 vs. -12,000 in June

Health care employment: +26,000 vs. +14,000 in June

The overall workweek rose 0.1 hour to 34.2 hours during July. The factory workweek also increased 0.1 hour to 40.1 hours, while overtime hours held steady. Hourly earnings rose 4 cents to $22.59 in July; the year-to-year increase of 1.8% underscores the decelerating trend.

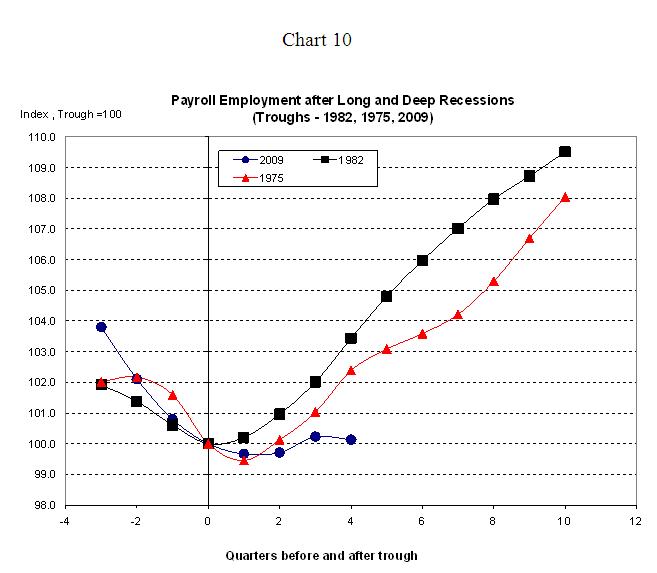

Conclusion - Private sector hiring remains unimpressive after four quarters of economic growth. The pace of hiring is significantly weaker than prior recoveries following long and deep recessions (See chart 10. Chart 10 is an index chart where payroll employment in the first quarter of a recovery is set to 100. Payroll employment before and after a trough are computed accordingly. A reading of 102 is a 2.0% increase in employment from the trough, while a reading of 98 stands for a 2.0% decline of payroll employment). The current recovery shows no change in employment since the trough versus gains of 2.4% and 3.4%, respectively, posted after four quarters of economic growth during the two economic recoveries following the 1973-75 and 1981-82 recessions.

Note: The level of July payroll employment is the proxy for third quarter payrolls in chart 8. It is assumed that the recession ended in June 2009.

There are only a few "Johnny One Notes" on the FOMC, such as Richmond Fed President Lacker and Philadelphia Fed President Plosser, who are concerned about the Fed's current low interest rate policy igniting inflation in the next several years. Rather, the majority of FOMC members, and certainly Fed Chairman Bernanke, are becoming more concerned about the anemic job growth taking place in this recovery and the lack of bank credit creation to spur future job growth. Thus, the odds are rising that the Fed could take some additional token easing actions. One such action would be for the Federal Reserve Board to reduce the interest rate the Fed pays on depository institution reserves to zero from its current level of 0.25% in an effort to induce these institutions to put some of their over $1 trillion of excess reserves to work as loans and investments. The FOMC could authorize at its meeting on August 10 the reinvestment of its maturing mortgage-backed securities holdings into similar securities or U.S. Treasury securities. Although the level of the interest rate on conventional 30-year maturity mortgages has come down since the Fed's cessation of open market purchases of mortgage-backed securities at the end of March, the spread of this mortgage rate over the yield on the 10-year Treasury security has increased by about 30 basis points.

by Paul Kasriel and Asha Bangalore

The Northern Trust Company http://www.ntrs.com/

Economic Research Department - Daily Global Commentary http://www.ntrs.com/pws/jsp/display2.js ... E=interior

http://www.marketoracle.co.uk/Article21709.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Migrants Breach Fortified Border Barrier, March Through Texas...

05-16-2024, 08:20 PM in illegal immigration News Stories & Reports