Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-11-2023, 11:22 PM #1

Baby Boomers Are Moving To Vegas And Tampa, Millennials Prefer Austin: America's Grea

Baby Boomers Are Moving To Vegas And Tampa, Millennials Prefer Austin: America's Great Migration In Real-Time

SUNDAY, JUN 11, 2023 - 08:00 PM

Until now, Bank of America would periodically publish a snapshot of consumer spending and retail sales that was based on real-time debt and credit card data, that provided a far more accurate economic picture months ahead the Census Bureau's distorted, seasonally adjusted (frequently for political reasons) data. Now, it has expanded into geo-tracking, and in a time when we are seeing unprecedented migration patterns across the continental US, the bank has started using internal data on checking, savings, credit and/or other investment accounts to construct near real-time estimates of domestic migration flows, giving the bank and its clients an almost one year of extra insight over and ahead of Census Bureau data.

Cutting straight to the punchline, BofA finds pandemic migration trends are not reversing and America continues to see faster population inflow into sunbelt cities like Austin and Tampa. But, in a curious twist, BofA also finds that house prices are weakening even in cities with growing populations. Why? In addition to high mortgage rates that are dampening demand in the near term, demographic composition also matters. For example, the data shows that population inflows into Austin skew younger, which might be putting more upward pressure on rents instead of on home prices.

Looking through the current housing downturn, local housing markets with more Millennial and Baby Boomer residents could see strength as the former enter prime home-buying age and the latter downsize their houses or move after retirement. Bank of America data suggests Baby Boomers are relocating to Las Vegas and Tampa while Millennials prefer Austin. Both groups are leaving the larger cities of San Francisco and New York.

Let's dig into the data.

A key theme that shaped the housing market during the pandemic was domestic migration (i.e., people moving within the US). While data from the Census Bureau is broken down by metropolitan statistical areas (MSAs), it is only updated annually and can be outdated for real time analysis.

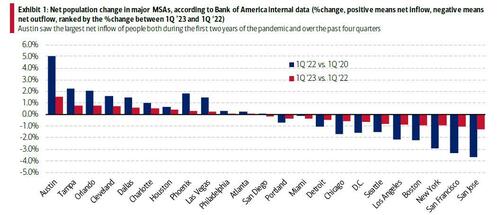

Utilizing aggregated and anonymized Bank of America customer data, the bank has constructed near real-time estimates of domestic migration flows and found that pandemic migration trends are not reversing. Data as of 1Q 2023 suggests that cities that saw a large influx of people during the pandemic have still been growing faster than other cities in recent quarters. As Exhibit 1 shows, among the major MSAs, Austin saw the largest net inflow of population both during 2020-2021 and over the past four quarters.

Also high on the list are Tampa and Orlando, both with a net increase of customers of +0.8% between 1Q 2022 and 1Q 2023. Interestingly, while Phoenix and Las Vegas saw strong increases in population during the first two years of the pandemic, the pace of growth has slowed noticeably in recent quarters, up just 0.3% and 0.2% year-over-year (YoY), respectively, in 1Q 2023.

On the flip side, cities such as San Jose, San Francisco and New York saw the biggest outflow of people during the early years of the pandemic and the rate of decline in 2023 continues to be the highest among major MSAs.

Note that the analysis is based on the group of Bank of America customers who had an open consumer checking, savings, credit and/or other investment accounts for every quarter between 4Q 2018 and 1Q 2023. Migration pattern is then extracted based on customer home addresses. This methodology yields a fixed sample size and allows for granularity by demographic breakdowns.

Macro conditions outweigh population growth in the near term

Large population inflows usually increase both home and rental prices. However, home prices are slowing rapidly, according to data from Freddie Mac, even in cities with growing populations, including Austin. In Bank of America's view, many variables are at play in the near term.

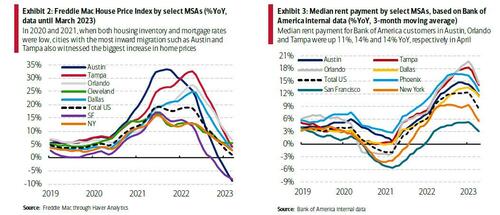

In 2020 and 2021, when both housing inventory and mortgage rates were low, cities with the most inward migration such as Austin and Tampa also witnessed the biggest increase in home prices (Exhibit 2). But, as Fed rate hikes pushed up borrowing costs for these homes, demand dampened despite continued population growth in these popular cities, which has led to a correction in home price appreciation.

In contrast to home prices, rental prices remain strong in cities with positive inflow of residents. In addition to the fact that population increases lead to higher demand for rental units, low affordability in the home purchasing market has likely also pushed some prospective buyers into the rental market, leading to even more upward pressure on rent levels.

Exhibit 3 shows that MSAs with large population increases continue to see very strong rent increases. In April 2023, median rent payments for Bank of America customers in Austin, Orlando and Tampa were up 11%, 14% and 14% YoY, respectively. This compares to the national average of 8% and just 3% for San Francisco.

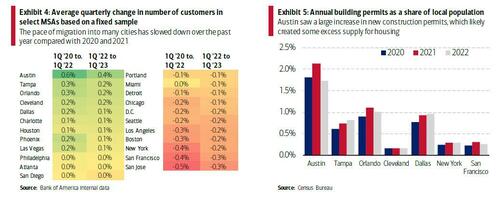

Among major cities, Austin stands out given its steep drop in home prices over the past year – a similar pace to that of San Francisco whose population has been decreasing. One reason for this is that the pace of migration into Austin has slowed noticeably over the past year compared with 2020 and 2021 (Exhibit 4). Excess supply was another factor, with a much higher number of building permits, which tracks the number of units approved for construction, than in other cities with an influx of residents (Exhibit 5).

Demographic composition also plays a role. Bank of America data shows that the population inflow into Austin skews to the younger side while Baby Boomers have been leaving Austin over the last year. Given the lack of affordability in many housing markets, many younger prospective buyers are staying on the sidelines, which could in part explain the weakness in home prices but relative strength in rent levels in Austin.

Demographic composition matters over the long term

While the housing market is heavily influenced by monetary policy and macroeconomic conditions in the near term, demographics play a critical role in the long term. The most direct impact is that home prices in cities with net population inflow will see upward pressure from increased demand for housing in the long run. Another important factor to consider, in our view, is the composition of the population. This is because not all generations have the same demand for housing, but two generations are especially important right now: Baby Boomers and Millennials.

The rise of Boomers as the main homebuyer

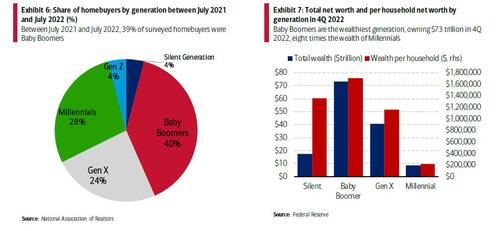

The latest Home Buyers and Sellers Generational Trends report from the National Association of Realtors found that for the first time since 2014, Baby Boomers overtook Millennials as the generation with the biggest share of homebuyers. From July 2021 to July 2022, 39% of surveyed homebuyers were Baby Boomers, followed by 28% of Millennials and 24% of Gen X (Exhibit 6).

The rise of Baby Boomers as the primary homebuyers can be attributed to three main reasons. First, as this generation retires, they move closer to family and friends. Second, demand for smaller homes increases as their children move out. Last but not least, Baby Boomers hold the greatest wealth across generations at $73 trillion in 4Q 2022, eight times that of Millennials (Exhibit 7). In the current environment of high home prices and interest rates, Baby Boomers are better equipped financially for home purchasing. In fact, only 49% of older Boomers (68-76 y/o) financed their home purchase in 2022, compared with 93% of those aged 33-42 y/o, according to the same National Association of Realtors report.

Given the importance of Baby Boomers in the housing market, where are they moving to?

The generational breakdown of Bank of America internal data suggests Baby Boomers’ migration patterns over the past few years have been different from other generations. Specifically, while Austin continues to attract inward migration overall, the number of Baby Boomers in the city has declined over the past year. The exodus of the group with the most cash could have added to the downward pressure on Austin’s home prices over the last year.

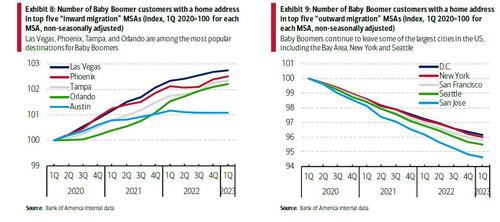

Las Vegas, Phoenix, Tampa, and Orlando are among the most popular destinations for Baby Boomers, according to Bank of America internal data (Exhibit . Note that the pace of migration slowed for Vegas and Phoenix over the past year, but was relatively unchanged for Tampa and Orlando. This could partly explain the still resilient home price appreciation in Tampa and Orlando relative to other cities.

. Note that the pace of migration slowed for Vegas and Phoenix over the past year, but was relatively unchanged for Tampa and Orlando. This could partly explain the still resilient home price appreciation in Tampa and Orlando relative to other cities.

Alternatively, Baby Boomers, similar to other generations, are leaving some of the largest cities in the US, including the Bay area, New York and Seattle (Exhibit 9).

Millennials will likely drive home buying in the longer term

For Millennials, the most popular destination for domestic migration is Austin, with the number of Millennial customers up 16% in 1Q 2023, relative to three years ago, which led other cities by a wide margin. Cleveland, Tampa, and Dallas each saw a 6% increase in Millennial population over the past three years.

In the near term, many of this cohort are staying on the home buying sidelines. A recent Bank of America Global Research survey found that increasing concerns about affordability are the top reason many Millennials are staying out of the housing market. But hopeful buyers who may be waiting for the market to cool are still forging ahead in their own way. In a separate Bank of America 2023 Homebuyer Insights Report, over half of respondents who are not planning to purchase a home in the near term are still actively scrolling through real estate marketplace apps.

This means that demand for home purchasing will likely return when we move past the current housing cycle, especially in the case of younger Millennials, who are entering prime home buying age. In 1Q 2023, the home ownership rate for those younger than 35 years old was 39%, 23 percentage points lower than that for 35–44-year-olds.

Therefore, in the longer term, it is likely that cities with a large inflow of Millennial residents will see a meaningful boost to the local housing market. For now, however, Millennials are leaving the same cities as Boomers. San Francisco, New York and San Jose are high on the list. But the pace for San Francisco and New York has slowed in the past year compared with the early years of the pandemic.

More in the full report available to pro subscribers.

Baby Boomers Are Moving To Vegas And Tampa, Millennials Prefer Austin: America's Great Migration In Real-Time | ZeroHedge

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Wealthy millennials are leaving these states – and moving to these instead

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 06-10-2019, 06:26 PM -

Millennials To Outnumber Baby Boomers In 2015

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 01-19-2015, 10:21 PM -

Baby boomers may have no one to care for them in old age

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 08-26-2013, 05:15 PM -

ObamaCare And The Baby Boomers

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 08-10-2009, 03:03 PM -

Poor Baby Boomers

By usaave in forum General DiscussionReplies: 10Last Post: 01-13-2007, 04:55 AM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Report: White House Considers Inviting Gaza Palestinians as...

05-01-2024, 04:27 AM in General Discussion