Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Threaded View

-

11-01-2011, 06:05 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Bigger Than Solyndra: Over Half a Billion in Customer Funds

Bigger Than Solyndra: Over Half a Billion in Customer Funds Disappear Under Obama’s Top Wall Street Finance Man

Mac Slavo

November 1st, 2011

SHTFplan.com

84 Comments

Making news in the last few days is the collapse of MF Global, one of the handpicked elite primary dealers that serve as trading counterparties of the New York Fed in its implementation of monetary policy. Primary dealers are supposed to be heavily regulated and monitored, as they are required to participate in Treasury auctions. As of October 31, there were 21 primary dealer club members including the likes of behemoths that include JP Morgan, Citigroup, Goldman Sachs, and Morgan Stanley.

What you may not know about MF Global and why it is important is that they are not only a primary dealer, but also a broker-dealer, which means they trade securities on behalf of their customers. Yesterday, they filed for bankruptcy, making them the 8th largest bankruptcy in U.S. history, to the tune of $40 billion.

It turns out that as of this morning, there is about $700 million of customer funds that have disappeared.

The recognition that money was missing scuttled at the 11th hour an agreement to sell a major part of MF Global to a rival brokerage firm. MF Global had staked its survival on completing the deal. Instead, the New York-based firm filed for bankruptcy on Monday.

Regulators are examining whether MF Global diverted some customer funds to support its own trades as the firm teetered on the brink of collapse.

The discovery that money could not be located might simply reflect sloppy internal controls at MF Global. It is still unclear where the money went. At first, as much as $950 million was believed to be missing, but as the firm sorted through its bankruptcy, that figure fell to less than $700 million by late Monday, the people briefed on the matter said.

Source: NYT http://www.nypost.com/p/news/local/bam_ ... z1cPlfeeXZ

A few weeks ago, Ulsterman’s Wall Street Insider http://theulstermanreport.com/2011/10/0 ... an-option/ suggested that there would be more Obama administration scandals similar to Solyndra, as well as hinting that Wall Street funding for the President’s 2012 election was drying up.

Based on what’s happening with MF Global, it looks like he was right.

You see, MF Global is headed by none other than Jon Corzine who served as governor of New Jersey (2006 – 2010) and is a former CEO of the investment bank affectionately known for Doing God’s Work, Goldman Sachs. http://www.shtfplan.com/headline-news/d ... d_04162010

Perhaps just as important as Corzine’s résumé are his direct ties to the Obama administration, pointed out by Karl Denninger: http://market-ticker.org/

President Obama is desperately putting his Wall Street stock in an unlikely old buddy.

The beleaguered president has recruited former Goldman Sachs head honcho Jon Corzine to shore up re-election funds from the banking industry, which is furious over Obama’s financial regulations.

Corzine, the former governor of New Jersey who was blasted out of office by Republican Chris Christie in 2009, has attended secret meetings with the president and has been working on Obama’s 2012 campaign for months, The Post has learned.

The Democrat, who now leads Manhattan-based brokerage MF Global, has been tasked with scraping up the very little banking-industry support Obama can still get.

Source: NY Post

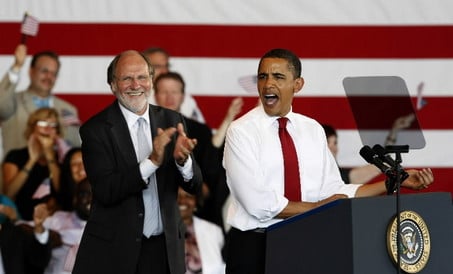

Pictured: Barack Obama and former New Jersey Governor Jon Corzine

Thus we have an elite primary dealer, headed by a former democrat governor who once ran one of the most despised firms in America and who is now the front man for President Obama’s Wall Street financing campaign, running a firm that disappeared $700 million in customer funds and declared the 8th largest bankruptcy in U.S. history… and we’re supposed to believe there was no political machinations behind the scenes to make MF Global a primary dealer in the summer of 2010 and that somehow regulators at the SEC, CFTC and the New York Fed missed it, and that President Obama in no way influenced the decision making process?

Denninger sums up the broader implications:

You cannot trust ANY balance sheet given to you today — in point of fact the government itself demanded that FASB allow lies as a business practice when it comes to the alleged value of securities. It’s that simple.

This is not the mark of a representative republic, it is not the mark of a free and fair market, and it is not “crony capitalism.�Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

IT'S AN INVASION BY AIR, LAND AND SEA - SEAL'S as in Seal Team 6

05-13-2024, 05:25 PM in Videos about Illegal Immigration, refugee programs, globalism, & socialism