Results 21 to 30 of 30

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-08-2017, 09:20 PM #21NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

06-08-2017, 09:22 PM #22

California Legislature votes to raise gas taxes for road repairs and transit

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

06-09-2017, 12:22 AM #23

Nearly $1 billion in side deals by Gov. Brown and Democratic leaders cemented the legislative vote to raise the gas tax

ck McGreevy, Melanie Mason and John Myers Contact Reporters

In one of the biggest legislative victories of his storied political career, Gov. Jerry Brown pushed through an ambitious plan last week that will increase gas taxes and vehicle fees to raise $52 billion over the next decade for the repair of California’s system of crumbling roads, highways and bridges.

But the win didn’t come cheaply — Brown and legislative dealers promised nearly $1 billion for the pet projects of lawmakers who had been sitting on the fence before they were persuaded to vote for the bill.

The funding “arrangements,” as Brown called them, helped the governor and legislators break a two-year Sacramento stalemate on transportation funding.

Some legislators said the horse-trading taints the legislative process, but Brown defended the deals as justified, a moderate investment compared with the payoff of a bill that will generate $5.2 billion annually in the first 10 years for road repairs, and billions more in future years.

“I don’t think I’ve ever seen anything as big as this particular transportation bill,” Brown told reporters after the vote late Thursday night. “So I would say some of the arrangements that were entailed in this process, they may look large, but relative to $52 billion, it’s all pretty modest.”

Republican leaders said the deals were unseemly and set a bad precedent.

“Democrats just gave us the largest gas tax increase in state history — a deal so bad they needed $1 billion in pork to buy the votes to pass it,” said Assembly Republican leader Chad Mayes of Yucca Valley. “California deserves better.”

The bill, approved by two-thirds votes of the Senate and Assembly on Thursday, raises the gas tax by 12 cents per gallon, boosts diesel taxes and creates a new annual fee when cars and trucks are registered.

Similar proposals have languished for years, but Brown and legislative leaders set a quick-turn April 6 deadline for action, hoping to pressure a compromise before the Legislature’s spring break — ahead of big debates to come in 2017 on the state budget and hundreds of bills.

The side deals, which still require legislative approval, showed up in two changes to the budget bill language, with most of it made public at 4 a.m. on the day of the vote.

The biggest concession made was a $500-million budget allocation for pet projects helping the districts of state Sen. Anthony Cannella (R-Ceres) and Assemblyman Adam Gray (D-Merced), both of whom held out support for the bill until the day before the vote.

Cannella’s vote proved critical. Although Democrats enjoy a supermajority in both houses, Sen. Steve Glazer (D-Orinda) voted against the bill, citing opposition from his constituents and a concern that the bill could have been better crafted, leaving it one vote short of the two-thirds majority needed for passage.

The night before the vote, Cannella was called to a meeting with Brown, Senate leader Kevin de León (D-Los Angeles) and Assembly Speaker Anthony Rendon (D-Paramount) at the governor’s mansion.

There, the leaders agreed to provide $400 million in transportation funds through 2027 for the extension of the Altamont Corridor Express, a commuter rail line between the Bay Area and CentralValley. The project would extend the line from Lathrop to Ceres and Merced inside Cannella’s district.

“The ACE train is a big deal for me. It’s important for my district,” Cannella said before the vote.

The budget trailer bill was also amended to include $100 million from the State Highway Account through 2023 for a parkway project at the UC Merced campus.

Cannella said the conversation at the governor’s mansion was a long one, ending at 10 p.m. He prevailed.

“I got the things I asked for, so apparently I made the most compelling case,” he said. “It was very hard to get.”

Brown said the deals struck with lawmakers helped the state achieve the larger goal of fixing its roads and bridges.

“Look, everybody here has needs and they have problems,” the governor said. “Everyone I look [at] here has to face the voters. They want to face them with the best foot forward and we want to help them do that.”

The author of the gas tax bill, state Sen. Jim Beall (D-San Jose), downplayed the accommodation made for Cannella.

“He’s getting something specifically earmarked in a way where he can feel comfortable to vote for it,” Beall said. “In the real way of looking at transit funding, it’s still is a system where everybody gets their fair share.”

The money, the governor said, would be well spent.

“Sometimes these bills that take all these different arrangements and compromises help the very people that we came here to serve,” Brown said.

The $100-million parkway request for UC Merced would help connect the campus to the 99 Freeway. That side deal gave Gray cover to vote for an unpopular tax increase.

“I can go home straight-faced and say to people: ‘This is tough. We’ve got to dig deeper.’ Nobody likes diesel and gas taxes. But this is a tangible, real benefit that I can point to,” Gray said.

He acknowledged that other members might not receive the same infusion of dollars in their districts.

“It’s a fair point, although I would make the argument [that] we’ve historically been underserved. And they’ve historically been overserved,” he said, noting specifically Los Angeles’ large share of transportation dollars.

The new budget language also provides $427 million for transportation projects in Riverside County. The area’s representative, Sen. Richard Roth (D-Riverside), held off supporting the bill until the last day.

Roth and Assemblywoman Sabrina Cervantes (D-Corona) said the extra money was necessary to guarantee that the county was no longer neglected when it came time to distribute road repair dollars. Roth felt Riverside County has not received its fair share of transportation funds in the past.

The governor and top legislators spent pre-dawn hours on Thursday and most of the afternoon of the vote trying to coax Cervantes. She ended up voting yes immediately as the Assembly vote roll was opened.

“For too long, Sacramento has failed to provide Inland Southern California with the resources we deserve,” the two lawmakers said in a joint statement after the vote. “Though this was a difficult vote, the cost of our region not getting its fair share is too high.”

The allocation offered by the governor includes $180 million for construction of a connector between State Route 91 and Interstate 15 North and $84.4 million for a bridge to take McKinley Street over busy railroad tracks in Riverside.

The two legislators said they also secured a commitment from Brown to support a bill of Roth’s that would provide $18 million to the cities of Eastvale, Jurupa Valley, Menifee and Wildomar to reimburse them for vehicle license fee revenue they lost through a change in law on newly incorporated cities.

Brown had vetoed previous bills to provide bailout funds for the cities.

Sen. Connie Leyva (D-Chino), also a holdout vote until the end, said she was able to convince Democratic leaders that something was needed to mitigate pollution from trucks that serve warehouses, including those in her district.

The budget trailer bill was amended at the last minute to include $50 million from the state Air Resources Board, much of it for grants that warehouses could compete for to provide heavy-duty vehicles that have zero or near-zero emissions.

She said an emissions reduction program already exists at a Fontana warehouse in her district and added that she also represents areas with massive warehouses in Ontario and Chino.

“For me this is all about mitigation and air quality and how do we make sure in this deal that we are not further polluting the air, not only in the Inland Empire but also in the ports, Long Beach and Oakland,” Leyva said.

Shortly before 11 p.m. Thursday, just minutes after the gas-tax bill passed the Assembly with no votes to spare, Brown was clearly excited as he stood in front of his Capitol office to talk to reporters about the victory many pundits predicted would elude him.

Asked about the side deals that got him the votes, Brown voiced no regrets.

“You could get a train going to the Central Valley? Does anyone want trains more than me? No,” Brown said. “You could get projects and parks in some of the poorest neighborhoods in California? Hallelujah!”

Privacy Policy

Copyright © 2017, Los Angeles Times

http://www.latimes.com/politics/la-p...409-story.html"The only thing necessary for the triumph of evil is for good men to do nothing" ** Edmund Burke**

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts athttps://eepurl.com/cktGTn

-

06-09-2017, 06:30 AM #24

Trump's infrastructure deal suggests or proposes $200 billion of federal money to raise $1 trillion for infrastructure improvements over the next 10 years with the remaining 80% of funds coming from states, cities and private partnerships.

A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

06-10-2017, 06:33 PM #25

APRIL 28, 2017 1:11 PM

California gas tax increase is now law. What it costs you and what it fixes

BY JIM MILLERhttp://www.sacbee.com/news/politics-...147437054.html

jmiller@sacbee.com

Now that Gov. Jerry Brown has signed into law billions of dollars in higher fuel taxes and vehicle fees, the state will have an estimated $52 billion more money to help cover the state’s transportation needs for the next decade.

The money comes largely from a 12-cent increase in the base gasoline excise tax and a new transportation improvement fee based on vehicle value. Other money will come from paying off past transportation loans, Caltrans savings, and new charges on diesel fuel and zero-emission vehicles.

The bulk of the revenue raised will go to various state and local road programs, as well as public transit, goods movement and traffic congestion.

The measure, Senate Bill 1, sets ambitious goals. By the end of 2027, it says least 98 percent of state highway pavement should be in good or fair condition, at least 90 percent of culverts should be in good or fair condition and at least 500 bridges must be fixed.

In June 2018, meanwhile, California voters will get to weigh in on another part of the package: a constitutional amendment supporters say will keep lawmakers from diverting the money to other purposes.

Taxes and fees

Gas taxes

Existing: The base excise tax is 18 cents a gallon. A price-based excise tax is currently set at 9.8 cents a gallon, for a total rate of 27.8 cents a gallon.

Nov. 1, 2017: The base excise tax will increase to 30 cents a gallon.

July 1, 2019: The price-based excise tax will reset to 17.3 cents a gallon, about half-a-cent more than the rate the Brown administration projects will be in effect by then anyway.

The 47.3-cent combined excise tax in effect July 1, 2019 will be adjusted for inflation beginning July 1, 2020.

Average annual revenue: $2.4 billion

Diesel taxes

Existing: The base excise tax is 16 cents a gallon. The state also collects two categories of sales taxes on diesel fuel: the regular state and local sales tax, which averages 8.44 percent, and an additional 1.75 percent sales tax.

Nov. 1, 2017: Base diesel fuel excise tax will increase to 36 cents a gallon. The 36-cent excise tax will be adjusted for inflation beginning July 1, 2020.

Nov. 1, 2017: The 1.75 percent diesel fuel sales tax will increase to 5.75 percent.

Estimated annual revenue: $1.08 billion

Transportation improvement fee

Existing: The Department of Motor Vehicles’ base registration fee is $53.

Jan. 1, 2018: People will pay a new “transportation improvement fee” ranging from $25 to $175, depending on the value of their vehicle:

Value Fee Up to$4,999 $25 $5,000-$24,999 $50 $25,000-$34,999 $100 $35,000-$59,999 $150 $60,000 and up $175

The fee will be adjusted for inflation beginning Jan. 1, 2020.

Estimated revenue: $1.6 billion

Zero-emission vehicles

Existing: There are no ZEV-specific charges.

July 1, 2020: New $100 “road improvement fee.” The fee will be adjusted for inflation beginning Jan. 1, 2021.

Estimated revenue: $20 million

Other revenue

▪ $706 million in one-time revenue from the general fund’s repayment of transportation loans

▪ $100 million annually from unspecified Caltrans savings

Where will the money go?

Road Maintenance and Rehabilitation Program – $3.24 billion a year on average: Off the top, the program allocates several hundred million dollars to various endeavors:

▪ $400 million to maintain and repair state bridges and culverts

▪ $200 million for Sacramento and 23 other counties with local transportation taxes

▪ $100 million to increase the number of trips by bike and on foot

▪ $25 million for the freeway service patrol program

▪ $25 million for sustainable communities planning grants to local governments

▪ $7 million total for transportation-related research and education at UC ($5 million) and CSU ($2 million)

▪ $5 million in workforce development grants to local agencies

Of the roughly $2.48 billion remaining, half would go to Caltrans for state highway maintenance and rehabilitation.

The other half would go to cities and counties for road maintenance and repair projects and railroad grade separations. It also pays for an emphasis on “complete streets” that are safer for walkers and bikers, capture stormwater, and include other features.

State highways – $1.49 billion

Local streets and roads – $1.48 billion

Public transit – $700 million: Receives an additional one-time $256 million from the transportation loan payback.

The money will pay for local bus and light-rail systems, new equipment and other capital expenses.

Trade – $365 million: Pays for projects to improve movement of goods from the state’s large ports and other trade facilities.

Traffic – $250 million: Congested Corridors Program is intended to reduce traffic on California’s most heavily traveled roads.

Parks, boats: The State Parks and Recreation Fund will collect the revenue from the 12-cent gas excise tax increase on gas purchases for boats and other off-highway vehicles. The money will be used for state parks, boating programs, off-highway vehicle parks and other services.

Other provisions

▪ Creates a $30 million program to reduce the burden of transportation projects on the environment.

▪ Creates a state transportation inspector general within a new Caltrans Independent Office of Audits and Investigations.

▪ Sets regulations giving commercial truckers more time to comply with pollution-control regulations.

Jim Miller: 916-326-5521, @jimmiller2

Last edited by JohnDoe2; 06-10-2017 at 06:35 PM.

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

02-28-2018, 04:41 PM #26NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

05-18-2018, 10:19 PM #27

Caltrans: San Diego Infrastructure Projects Underway Thanks To Additional Gas Tax Funds

Friday, May 18, 2018

By City News Service, Matt Hoffman

CREDIT: MATT HOFFMAN/KPBSAbove: Caltrans Director Laurie Berman is joined by local and state politicians in Balboa Park announcing new infrastructure projects thanks to SB 1 funding, May 18, 2018.

The California Transportation Commission this week awarded an additional $312 million in Senate Bill 1 funds to local infrastructure projects, the San Diego Association of Governments announced Friday.

Part of the award, $195 million, will go toward carpool lanes and other improvements meant to reduce congestion along the North Coast corridor of Interstate 5.

The California-Mexico Border System Project, created to improve border crossings, also was awarded $82 million to increase mobility at the Otay Mesa Port of Entry, California's busiest commercial land port.

RELATED: Mayor Faulconer Pushes $633M Infrastructure Investment

Additional funds will go toward assorted rail, road and marine terminal projects.

Caltrans, SANDAG members and other elected officials — including Senate President Pro Tem Toni Atkins, Sen. Ben Hueso and Assemblyman Todd Gloria — held a news conference Friday highlighting local SB 1 funding.

SB 1 went into effect in November. It raised gas and diesel taxes by 12 cents and 20 cents per gallon, respectively. Vehicle registration fees also increased $25 to $175, depending on the value of the vehicle.

RELATED: California Gas Tax Rises 12 Cents To Pay For Road Repairs

The increase is expected to raise more than $5 billion for transportation costs annually.

"For so long politicians have kicked the can down the road because it’s difficult to talk about this issue," said California State Assemblyman Todd Gloria of the 78th District. "It’s difficult to ask for more money."

The future of the tax increase could be in voters hands this November. A San Diego based group said they have collected enough signatures to put a repeal measure to voters.

"What I think will be difficult to do is sell people on the notion that the status quo is acceptable," Gloria said. "Which is what they’re saying. That everything is hunky-dory and things are fine as they are. They’re not fine. We have too much potholes, too much traffic congestion — not enough forward progress.”

Caltrans said, the San Diego region has received over $800 million from SB 1 this year.

http://www.kpbs.org/news/2018/may/18...n-funding-for/

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

05-18-2018, 10:25 PM #28

Metro receives 26 percent of statewide SB-1 gas tax funding

BY DAVE SOTERO , MAY 17, 2018

We posted a couple weeks ago about the California Transportation Commission’s staff recommendations for state grant funding to Metro. It’s now official, with the CTC having voted to approve the grants on Wednesday.

Here’s Metro’s news release:

The California Transportation Commission today approved $703.6 million in SB-1 funding for the Los Angeles County Metropolitan Transportation Authority (Metro) as part of its transportation funding allocations for agencies statewide.

The California Transportation Agency (CalSTA) also recently announced its SB-1 award for funding Transit and Intercity Rail Capital Improvements, with more than $1 billion designated for Metro. With today’s award of $703.6 million from the CTC and the award of $1.088 billion from CalSTA, the State has made a commitment to fund more than $1.8 billion in projects for Metro over a number of years.

SB-1 is the state’s “gas tax” and vehicle fee transportation funding program approved by the Legislature in 2017 and signed into law by Gov. Jerry Brown.

The awards represent the largest allocation of SB-1 funds in California to date. Metro received approximately 26 percent of total funding available statewide, underscoring the magnitude of needed transportation improvements for the congested L.A. region. The funding will go to Metro’s program of projects which include highway, transit and goods movement elements.

The county’s annual transit ridership is four times that of any other county in the state.

Metro also has the highest annual passenger miles of any other operator in California. L.A. County has seven of the state’s 10 most congested highway corridors and its ports handle 86 percent of all containers for California.

“The path to a more sustainable, resilient tomorrow runs through our investments in infrastructure today,” said Los Angeles Mayor and Metro Board Chair Eric Garcetti. “SB-1 is putting billions of dollars to work fixing our roads and creating more sustainable transportation options — giving Californians healthier air to breathe, less congestion and good-paying jobs that will stimulate economic growth across our state.”

Metro will combine SB-1 gas tax funds with its own locally generated transportation sales tax contributions to continue transforming L.A. County’s transportation system and delivering Measure M and R projects.

“Metro is now leading a transportation revolution in Los Angeles County thanks to our locally funded Measure M and R programs,” said Metro CEO Phillip A. Washington. “Our programs depend on significant funding participation from both the state and federal governments. These SB-1 funds will help us leverage our local funding commitments to fully and quickly implement our region’s critically needed transportation improvements.”

Metro’s projects were selected as some of the best solutions to transform the county’s urban bus and rail system, reduce greenhouse gas emissions and vehicle miles traveled and improve overall mobility in the region.

Metro transportation projects announced for SB-1 funding in several program categories include:

Local Partnership Program

Solutions for Congested Corridors Program

• Airport Metro Connector 96th Street Transit Station Project: $150 million

Trade Corridor Enhancement Program

• Interstate 5 Golden State Chokepoint Relief Project: $247 million

• SR-57/60 Confluence: Chokepoint Relief Program: $22 million

• America’s Global Freight Gateway: Southern California Rail Project: $128.6 million

• Interstate 605/State Route 91 Interchange Improvement: Gateway Cities Freight Crossroads Project: $32 million

• State Route 71 Freeway Conversion Project: $44 million

The CalSTA’s Transit and Intercity Rail Capital Improvements Program seeks to modernize transportation infrastructure, improve safety and grow rail ridership. The Transit Capital projects that were awarded multi-year funding include:

Transit and Intercity Rail Capital Program – $1.088 Billion

• Gold Line Foothill Light Rail Extension to Montclair

• East San Fernando Valley Transit Corridor

• West Santa Ana Branch Light Rail Transit Corridor

• Green Line Light Rail Extension to Torrance

• Orange/Red Line to Gold Line BRT Transit Corridor

• Vermont Transit Corridor

https://thesource.metro.net/2018/05/...s-tax-funding/NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

05-18-2018, 10:49 PM #29

California drivers pay some of the highest gas taxes in the nation

In this Monday, Oct. 30, 2017 photo, Cristian Rodriguez fuels his vehicle, in Sacramento, Calif. Gasoline taxes will rise by 12 cents per gallon Wednesday, Nov., 1, to raise money for fixing roads and highways. It is the first of several tax and fee hikes that will take effect after they were approved by the Legislature earlier this year. (AP Photo/Rich

Pedroncelli)By KEVIN SMITH | kvsmith@scng.com | San Gabriel Valley Tribune

April 17, 2018 at 3:00 pm

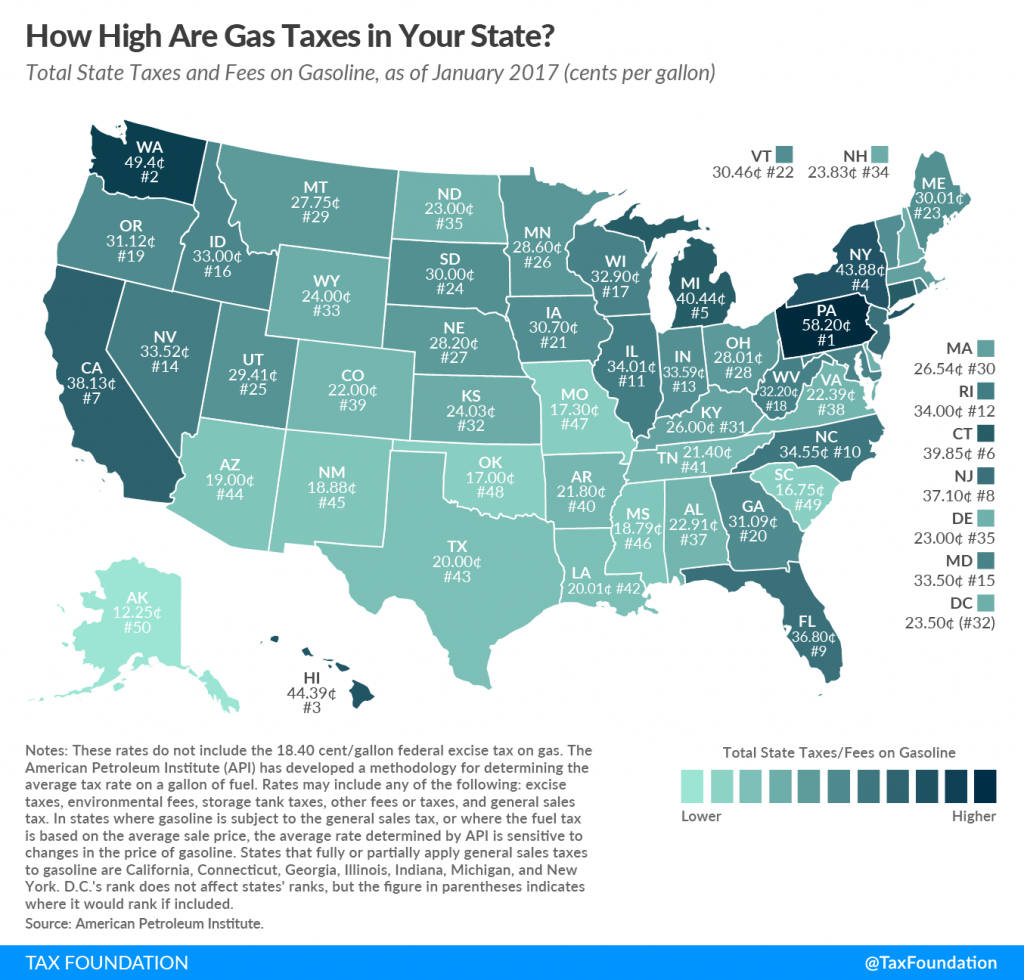

California motorists are grappling with some of highest gas taxes in the nation and they’re continuing to rise, according to report from price tracker GasBuddy.com.

The study shows California drivers are paying more than 73 cents per gallon in local, state and federal gas taxes, a 15 cent increase over 2017. That’s the second highest amount in the nation. The Golden State ranks second only to Pennsylvania where motorists pay more than 77 cents per gallon in gas taxes.

California’s burden is particularly high when contrasted with the national average, which is a little more than 52 cents per gallon.

A typical California motorist who drives 15,000 miles a year will use 600 gallons of gas, the report said, which means they’re spending $438.78 a year on gas taxes. That’s nearly $96 more than they spent last year.

“That’s a monumental amount of taxes for California drivers to be paying,” said Patrick Dehaan, who heads up petroleum analysis for GasBuddy. “And that comes on top of the fact that California is already an area that sees high gas prices due to the West Coast being a kind of petrol island. It doesn’t have an interconnection to the rest of the nation’s refiners that would help keep costs down.”

Gas prices are high

The average price for a gallon of regular gas in Los Angeles County was $3.60 on Tuesday, up 56 cents from a year ago, according to GasBuddy. Orange County’s average price was $3.57, up 54 cents from a year earlier. San Bernardino County’s average was $3.50 a gallon, up 51 cents, and Riverside County stood at $3.52 a gallon Tuesday, up 54 cents. The national average was $2.74 a gallon.

A host of other factors have conspired to keep California prices high. DeHaan noted that last month, for example, U.S. commercial oil inventories weredown 100 million barrels from a year ago. California refiners also are in the midst of switching over to their environmentally stringent summer gas blend, which typically crimps the state’s available inventory.

“Southern California refineries have already made the change, but areas of Northern California have until June 1 to make the switch,” DeHaan said Tuesday.

The “mystery surcharge”

Additional environmental and climate fees attached to each gallon of fuel and the state’s cap-and-trade program, which adds about 12 cents, also figure into the mix. And amid all of that, there’s a “mystery surcharge” that accounts for about 30 cents per gallon of California’s gas taxes, according to Severin Borenstein, a professor at the Haas School of Business at U.C. Berkeley and a researcher at the Energy Institute at Hass.

Borenstein said that surchage is costing California about $12 million a day, or $4 billion a year. As chairman of the now defunct Petroleum Market Advisory Committee, he attempted to get to the bottom of the surcharge — to no avail. “We spent two years trying to find out what that mystery surcharge was, but we couldn’t dig deep enough to get that information,” he said.

Fire’s impact

Borenstein is also troubled by the fact that California gas prices have remained stubbornly higher than they should be in the wake of a 2015 fire at a Torrance refinery. From 2000 until the Torrance fire, California’s price differential from the rest of the country went up and down. But on average, there was no premium above what might be expected from the state’s tax differences and other costs.

But three years after the Torrance fire, California prices remain abnormally high.

DeHaan figures Southern California gas prices are nearing their high point for 2018.

“I think prices will plateau in mid-May and begin to drop in June,” he said. “If you likened this to a rally at a baseball game I’d say we are at the 7th inning stretch. It’s close to the game being over and California seeing a peak price.”

https://www.pasadenastarnews.com/201...in-the-nation/"The only thing necessary for the triumph of evil is for good men to do nothing" ** Edmund Burke**

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts athttps://eepurl.com/cktGTn

-

05-19-2018, 02:40 PM #30

$25 BILLION A YEAR SPENT ON ILLEGAL ALIENS IN CA

HMMMM...I WOULD RATHER HAVE NEW ROADS AND BRIDGES

CALIFORNIA...GET YOUR HEAD OUT OF THE SAND!

BOOT THEM OUT.ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

Similar Threads

-

California would increase fuel taxes under $52 billion road repair plan

By JohnDoe2 in forum Other Topics News and IssuesReplies: 4Last Post: 04-07-2017, 12:46 PM -

House votes to fund highways, transit, veterans' health care

By JohnDoe2 in forum General DiscussionReplies: 0Last Post: 07-29-2015, 10:23 PM -

California Legislature ends session without new taxes or spending spree

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 09-16-2013, 02:57 PM -

California Democrats debate how to raise taxes at statewide convention

By MontereySherry in forum Other Topics News and IssuesReplies: 0Last Post: 02-12-2012, 11:01 PM -

CA Alert! California Legislature votes to restrict use of E-

By TakingBackSoCal in forum General DiscussionReplies: 13Last Post: 10-29-2011, 09:46 PM

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Durbin pushes voting rights for illegal aliens without public...

04-25-2024, 09:10 PM in Non-Citizen & illegal migrant voters