Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-16-2011, 09:45 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

China Inflation: Getting Worse Coming To A Wal-Mart Near You

China Inflation: Getting Worse and Coming To A Wal-Mart Near You

Economics / Inflation

Feb 16, 2011 - 09:09 AM

By: Dian_L_Chu

On Tuesday Feb. 15, China reported its consumer prices (CPI) rose 4.9% year-over-year (yoy) in January, which came in less than expected. Economists were expecting 5.4% inflation, based on a Bloomberg survey.

However, after digesting the data, Asian markets closed mixed on that news, with Chinaâs Shanghai Composite staying flat after a choppy trading session.

Well, the reason why markets reacted that way is because the lower figure is partly the beneficiary of a previously announced change--effective January 2011--in the weight of items included the CPI basket calculation.

Index Calculation Change

Food previously accounted for a third of the index calculation and was the main driver of inflation last year. According to Blomberg, National Statistics Bureau (NSB) said that a reweighting of the CPI, including cutting the contribution from food, boosted the headline rate by 0.024%. http://links.visibli.com/share/8600df

Bloomberg quoted Mizuho Securities Asia Ltd. Saying that the CPI calculation shift effect is more like 0.2%. That is, without the change, the CPI may have been 5.1%.

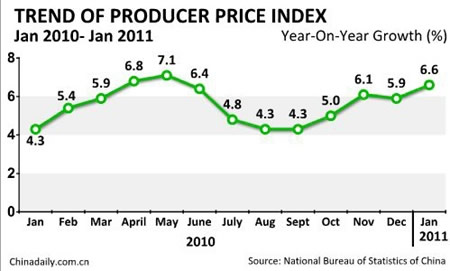

Manwhile, NSB said the Producer Price Index (PPI) spiked 6.6% yoy in January after escalating at 5.9% in December. The component calculation of the PPI also has been revised, including an addition of about 2000 products to the basket and adjusting the weightings.

The change reduced Januaryâs yearly PPI inflation by 0.05%, which means the index would have seen an increase of 6.65% without the basket change.

Spilled Over to Non-food

Chinese statistic bureau did not disclose a breakdown of the basket for either index. So, the alterations made it quite impossible to directly compare the January data on an apple-to-apple basis to earlier months. Nevertheless, there are still plenty of clues.

First of all, it is evident that there's now a broadening escalations spilled over to non-food items as well. Core inflation, stripped of food, rose 2.6% yoy, the highest in at least a decade after rising 2.1% yoy in December.

Residence costs jumped 6.8% from a year ago, the most since August 2008. Not to mention food prices soared 10.3% after rising 9.6% in December - Grain escalated 15.1%, fresh eggs climbed 20.2%, and fruit spiked 34.8% from a year ago, according to the official report.

Previous Tightening Not Enough

Regardless which way you calculate, January also marks the fourth straight month that the inflation has exceeded Beijing's 4% target. This clearly illustrates measures taken by the Chinese government, e.g., multiple interest rate hikes, raising bank reserves requirement, and letting Yuan appreciate, have not been enough to control surging prices.

Furthermore, I personally prefer PPI as an inflation predictor and indicator, as it shows the coming pricing pressure that could be passed down through the supply chain. And the current reading of 6.6% just further supports the view that Chinaâs inflation is far from being under control.

Feed the Inflation

Chinaâs inflation problem could be attributed mostly to the over abundant money supply, increasing domestic demand from a growing middle class, and bad weather hurting food supplies. On top of these existing culprits, China may also increase retail gasoline and diesel prices to reflect higher international crude prices, Peopleâs Daily said Feb. 11. China last increased fuel prices by around 4% on December 22. http://english.peopledaily.com.cn/90001 ... 84040.html

Moreover, the worst drought in 60 years hitting China northern âwheat beltâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Texas AG Paxton files injunction to halt Non-Profit...

05-08-2024, 02:38 PM in illegal immigration News Stories & Reports