Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-14-2010, 02:23 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Commercial Real Estate - Pricing in a Taxpayer Bailout

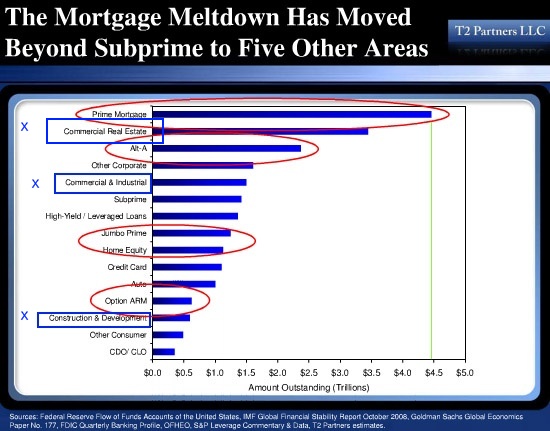

Commercial Real Estate Collapse Bigger than Subprime Implosion – Why is the Market Ignoring the $3.5 Trillion Commercial Real Estate Market Implosion? Pricing in Another Bailout.

Most people that follow real estate even at a cursory level have heard of the problems in commercial real estate. The enormous $3.5 trillion market in commercial real estate (CRE) has deep and profound problems. At the peak CRE was estimated to be valued at $6.5 trillion. Today the value is closer to $3.5 trillion or closer to the loan amount outstanding. This market is now sitting in a zero equity position. In fact from market trends it is very likely that much of CRE bought during the last few years is significantly underwater. This trend is a few years behind the residential housing bust that shocked the markets into record declines. Why is the market not reacting as negatively to the bust in CRE as it did to residential housing?

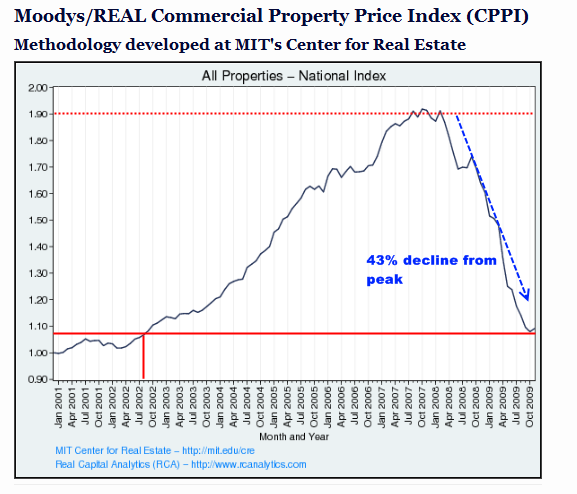

Commercial and construction loans combined are bigger than the entire subprime market and CRE values have now fallen by 43 percent from their peak across multi-family units, hotels, and retail space. And with the CRE collapse there is a harder time selling off this space if there is no economic demand for certain spaces. You also have a smaller pool of borrowers looking for retail space. Take for example retail space near empty suburban housing divisions. With the busted homes if you lower prices enough, there will be a market created at a certain point. Yet this takes time. But with commercial real estate you may have no market at any price. Much of the CRE space is used as a business. With no business there is no need for CRE. So we have a giant $3.5 trillion market of loans that are largely toxic but the market seems to be ignoring this. Take a look at the combined CRE collapse from data collected by MIT:

And the worst isn’t behind us. It is still to come:

“(Moody’s) The delinquency rate on CMBS conduit and fusion loans increased by more than 50 basis points in January, bringing the total rate to 5.42%. The total delinquent balance is now more than $36 billion, a $3 billion increase over the month before. By dollar and basis points, this is the largest increase in the delinquency rate thus far in the downturn, as measured by the Moody’s Delinquency Tracker (DQT).�Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-14-2010, 02:31 AM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-14-2010, 09:47 AM #3

Saw this coming over a year ago. I knew it would be just a matter of time. But the general consesus of the folks I talk to said the same thing they said before the housing bubble burst, oh that'll never happen. The government won't let it happen. As if the governement can really do anything about it.

My uncle who was an economics major was the only person who agreed with me, and actually took it up a couple notches, and pointed out a few things that I didn't see.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

New Terror Threat: Cartels using fentanyl bombs & Drones?

05-09-2024, 02:09 PM in illegal immigration Announcements