Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-29-2010, 03:51 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

UPDATE: America’s Second Great Depression

UPDATE: America’s Second Great Depression (Part 1)

Economics / Great Depression II

Apr 28, 2010 - 08:37 AM

By: Mike_Stathis

Overview - Washington, Wall Street and their partners in crime, the media, have continued to spread the myths of an economic recovery since late summer 2009.

In response to the propaganda, the stock market has continued to rally. But most individual investors have been left out of this tremendous rally.

But that was NOT the case for subscribers of the AVAIA newsletter, as can be seen here http://www.avaresearch.com/files/20100425040440.pdf (examine the market forecasting section; ever since my public recommendation to buy into the Dow at 6500, http://www.marketoracle.co.uk/Article9274.html I have kept subscribers in the market since then for about 90-95% of the gains since then).

Yet, the economic data paints a different picture than the media presents. Make no mistake, we are seeing the early stages of what will written in history books as America’s Second Great Depression, just as I predicted in America’s Financial Apocalypse (2006). http://www.avaresearch.com/files/20090514024432.pdf

Who are you going to trust? The media and their government hacks who have been wrong over and over, or someone who has been right about virtually everything over the past five years?

Who are you going to trust, people with clear political and financial agendas, or someone with neither?

Ever since the implosion of the largest real estate and credit bubble in history, I have published numerous unfortunate realities.

Since then, I have not altered these views.

With the national debt approaching $13 trillion, no real improvements to the worst and longest recession since the Great Depression, blue chips slashing dividends for the first time in history (eg. DOW), century-old financial institutions now in bankruptcy (Lehman Brothers, Bear Stearns, Washington Mutual), trillions of dollars in bailouts, the largest year-over-year decline in GDP, state tax revenues and housing starts since the Great Depression, over 7 million foreclosures, an additional 7 million more foreclosures over the next 2 to 4 years, more than 8 million lost jobs with about 32 million Americans out of work, more than 40 million Americans on food stamps, a healthcare crisis that has not been addressed, a continuing trend of excessive inflation for food, energy and healthcare, and consumer spending coming to a halt…you can be assured of many things over the next several years:

Several more stimulus packages (which won’t offer any permanent assistance)

Soaring consumer loan defaults

Soaring commercial real estate defaults

Several million additional foreclosures

Rapidly rising and high interest rates

Muted real wage growth

Declining job quality

Lingering high unemployment for several years

Significant downside in the U.S. stock market

Continuation of employee benefit cuts

Continuation of healthcare inflation with millions more medical bankruptcies

A deepening of the entitlement crisis

Excessive inflation over an extended period OR massive inflation that will be countered by double-digit interest rates

A long period of muted consumer spending

Much higher taxes (not just income, but all taxes)

A worsening of America’s Second Great Depression, with up to two lost decades.

World War III

At best, the U.S. will continue to experience economic malaise for well over a decade. As the nation progresses through this treacherous period, any of the small improvements will be offset by longer-term issues that are virtually impossible to overcome.

Most of the 80 million baby boomers will never be able to fully retire.

They did not have adequate retirement savings even before the economic collapse. Now they are in much worse shape. As a result, they will not only pull out of the stock market much faster as a means to survive, but they will be dead consumers.

Most states will continue to struggle with budget gaps for many years. This will lead to even more cuts to vital programs.

The entitlement tsunami will engulf Washington’s budget, causing a sustained period of massive deficits. This will be addressed by further cuts to benefits and premium hikes to Medicare and Medicaid.

The massive national debt will continue to threat the solvency of the U.S. This will lead to a long period of high interest rates even after the approaching interest rate surge, expected to mount within a couple of years.

A Broad Look at the Economy

Now let’s examine some facts about the economy.

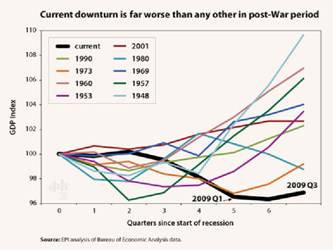

The current recession is not only the most severe since the post-war period, but is or was (according to official statements that it has ended) the longest in duration, as illustrated by the first chart.

Furthermore, the “previous�Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

US Border Patrol apprehends 13 undocumented migrants from the...

05-17-2024, 05:26 PM in illegal immigration News Stories & Reports