Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-08-2010, 07:25 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Debt for Diploma Schemes and the Cookie Monster Principle

Monday, March 08, 2010

Debt for Diploma Schemes and the Cookie Monster Principle

Inquiring minds are investigating a 44 page PDF by the Center for College Affordability on why financial aid is ineffective. Please consider Financial Aid in Theory and Practice. http://www.centerforcollegeaffordabilit ... actice.pdf

Executive Summary

Financial aid programs are supposed to improve access and affordability in higher education. The effectiveness of these programs is increasingly being questioned as college attainment figures stagnate and the financial burden on students and families continues to climb year after year. This report identifies the main culprit for this unsatisfactory state of affairs as a misunderstanding of the effect of financial aid on schools.

Currently, financial aid programs take costs per student as a given, and attempt to offset some of those costs. However, costs are not given. In fact, it is widely acknowledged that colleges and universities are engaged in an academic arms race. Thus, when financial aid programs make more money available to schools, this money is spent and results in higher costs per student. The end result is more costly higher education, generally accompanied by higher tuition, which has negative implications for access and affordability.

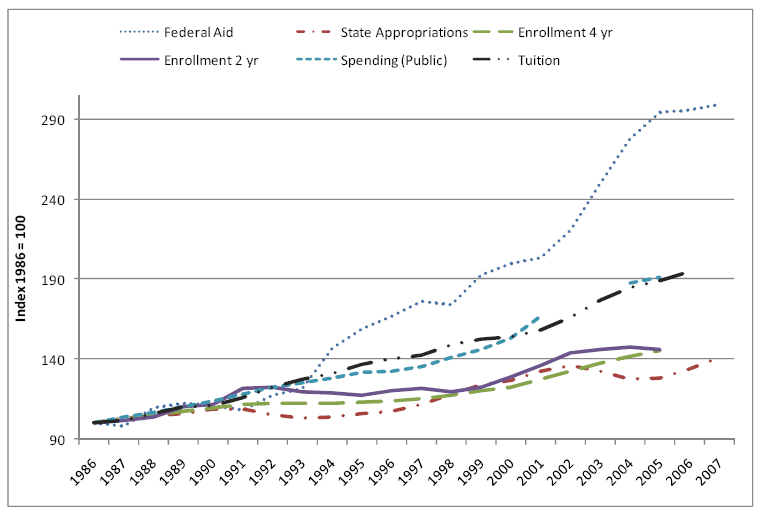

Figure 5: Financial Aid, Enrollment, Spending and Tuition, 1986-2007

The original theory of financial aid would predict that the increases in federal aid and state appropriations over the last twenty years should primarily affect enrollments and affordability. Figure 5 shows the trends over time for a number of variables (inflation adjusted where appropriate), each of which is indexed using 1986 as the base year. Since 1986, federal aid has nearly tripled, while state

appropriations (total, not per student) have increased by slightly more than 40 percent. But enrollments at both two and four year schools have only increased by about 40 percent. If one looks at graduates, rather than enrollments, the figures are even worse. Moreover, the financial burden on students, as measured by the level of tuition and required fees, has almost doubled, as has spending per student.

Unintended Consequences: Ravenous Cookie Monsters Engaged in an Arms Race

Fundamentally, there are unintended consequences of the current financial aid system because from the perspective of competing schools, it does not make sense to take their costs, subtract the state subsidy per student, and charge the remainder in tuition (some of the money for which comes from grants and loans to students). Schools have an incentive to spend as much as possible, because spending is useful in building a better school (or at least what appears to be a better school).

The ravenous need of schools for money was originally described as âBowenâs Rule - All universities, and in particular major institutions with or seeking elite status, will use any and all funds they receive for the pursuit of perceived excellence and improvement.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

03-08-2010, 08:35 PM #2

Hmmm.........I wonder if this could be applied to HCR? Everything the feds touch turns to mush.

If you don't mind StokeyBob, I will use your analogy of being beat with your own stick.

When the feds enter the market, (free market?) with collected masses of taxes, taken from each of us, then they use this money in a charitable(?) manner by re-distributing it in areas where idiots demand equality from their slave masters at the federal and state levels,....viola! You have just been beat over the head with your very own, bought and paid for, ugly stick! That massive amount of extorted, re-distributed money, forces the market to respond. Manna from heaven(?) courtesy of the federal government(?).

As a business which pile of money should you like to go after? The pile that the government extorted from the dim witted public? (easy come, easy go!) Or the private funds that are hard earned and held dearly?

As a consumer, which dollar is held tighter? The hard earned dollar? Or the government loan that WAS money extorted from fools?

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

2024 will be last election decided by US citizens: Elon Musk

05-12-2024, 12:51 PM in General Discussion