Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-12-2011, 06:33 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Federal Debt of the United States - Q and A (Part I)

Federal Debt of the United States - Q and A (Part I)

Interest-Rates / US Debt

Jan 12, 2011 - 01:44 AM

By: Asha_Bangalore

We have encountered questions about debt of the United States in the past few weeks and thought a Q and A about debt would be handy. This is the first of two installments of noteworthy highlights about federal debt.

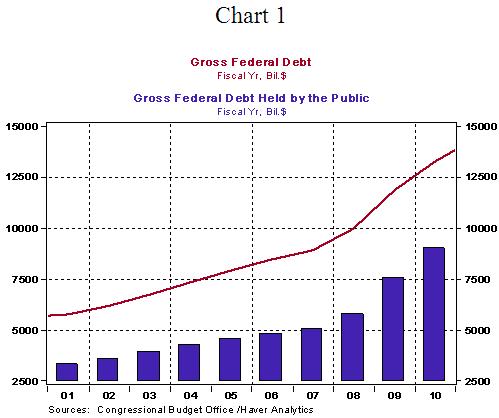

1. What is total amount of U.S. federal debt outstanding?

Total debt of the federal government as of January 6 is $14.011 trillion (Debt to the Penny). http://www.treasurydirect.gov/NP/BPDLog ... ication=np Roughly 67% of federal debt is held by the public inclusive of the Federal Reserve's holdings. Federally issued debt is also held in government accounts such as Social Security, Medicare, Civil Service Retirement Transportation accounts. Total debt consists of both publicly held federal debt and those held by government accounts. Debt of the federal government increases when it sells debt to the public to acquire financial resources to meet its obligations in situations when federal revenues are short of federal outlays.

2. What is the projected level of federal debt in the next 10 years?

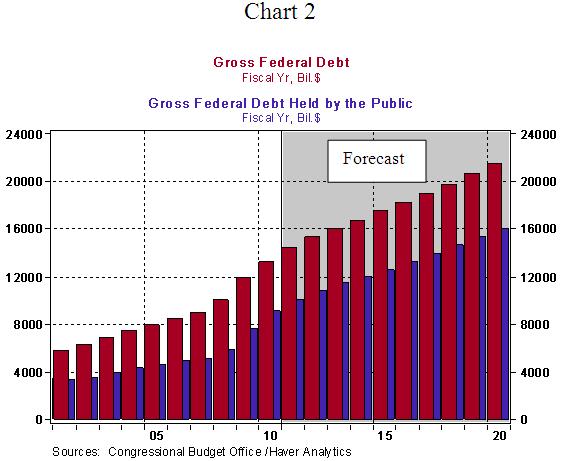

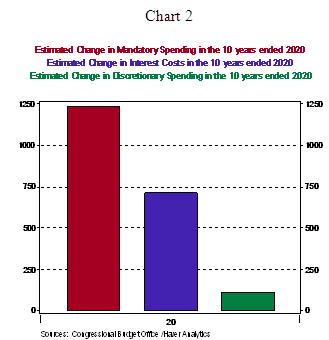

The Congressional Budget Office (CBO) estimates that by 2020, total federal debt would be $21.4 trillion under current law (see Chart 2).

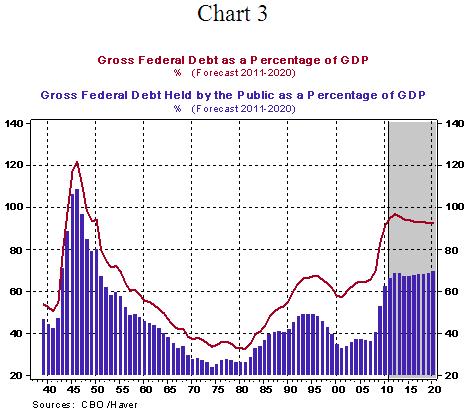

Frequently, the financial press refers to debt in relation to GDP of the nation. The numbers in Chart 2 as a percent of nominal GDP are presented in Chart 3. Federal debt as a percentage of GDP is projected to scale new heights by 2020 from 83.4% in 2009 and 91.4% in 2010.

3. What is the statutory debt limit of the United States?

The current statutory debt limit is $14.294 trillion, with expectations of the Treasury touching this limit in the near term. As noted earlier, the current level of debt ($14.011) is very close to this limit. Reaching this limit prevents the Treasury from raising funds through issuing new debt and the Treasury may find itself unable to meet its day-to-day obligations. The statutory debt limit has been raised on ten occasions since 2001. The second installment will be published tomorrow.

Asha Bangalore â Senior Vice President and Economist

http://www.northerntrust.com

http://www.marketoracle.co.uk/Article25524.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

01-13-2011, 01:08 AM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Federal Debt of the United States - Q and A (Part II)

Interest-Rates / US Debt

Jan 12, 2011 - 03:24 PM

By: Asha_Bangalore

[Part I, question 1-3] published on Jan 11, 2011.

4. Will Congress entertain not raising the statutory debt limit?

Congress will increase the statutory debt limit prior to the deadline. There is not even an inkling of doubt about this eventuality. But, unfavorable posturing by politicians, prior to taking the appropriate action, is nearly certain and tentative market concern will prevail. The terms of the deal the Republicans will strike to raise the debt limit is the source of uncertainty not whether they will raise the borrowing limit. The Treasury Department estimates that the national debt will hit the statutory limit between March 31 and May 16. In the meanwhile, Treasury Secretary Geithner has indicated that the Treasury could take "exceptional actions" to delay the deadline by suspending the sale of state and local government securities, which would buy time for a few weeks.

5. What are the implications of the growth in federal debt?

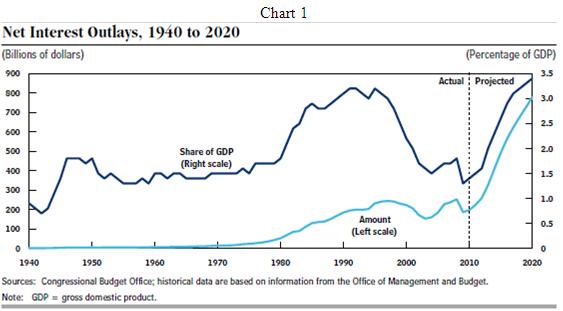

First, interest costs have to be considered. Net interest outlays in 2010 amounted to $197 billion or 1.4% of GDP (see Chart 1). The Congressional Budget Office's estimates focus only on the publicly held debt. Most of the difference between total federal debt and that held by the public is accounted for securities held in the Social Security Trust Fund. The low interest rate environment helped to contain interest costs despite a large increase in federal debt. Going forward, interest costs as a share of GDP are expected to double reflecting growing debt and higher interest rates.

Second, the United States has a small window to repair the strategy to tackle the imbalance. For now, financial markets have not questioned the status of U.S. federal debt and they continue to view these securities as a "safe haven" in situations of market upheaval. Future interest rates and deficits are uncertain and will be determined by the economic growth trajectory and future legislative actions. Recent projections of the federal deficits and debt (see Charts 2 and 3 in Part I, comment of January 10, 2011) suggest that the current market assessment of the U.S. debt situation will be subject to reconsideration if there is no effort to contain the growth of federal debt. The United States has a small window between now and when the economic and market environment return to normal conditions to address the severe fiscal imbalance. Third, each percentage point in the U.S. debt-to-GDP ratio translates into higher interest costs, with additional economic costs such as "crowding out" of private investment. This in turn lowers the size of the economic pie and erodes the standard of living of future generations. In the near-to-medium term, financial markets will focus on the policy changes implemented to address reduction of federal debt.

6. What are the reasons for growth of federal debt?

A major part of the increase in the federal deficit, following the financial crisis and the Great Recession, reflects a severe loss of tax revenue, a jump in outlays, partly from an increase in expenditures from automatic stabilizers and partly due to legislative action to stabilize financial institutions and the economy. These deficits translated into a sharp increase in publicly held debt from 36% at the end of 2007 to 62% by 2010. It is important to note that the projected increase in federal debt during the decade ahead is due to entirely different reasons. Medicare, Social Security, and interest costs are the three major factors accounting for the growth of public debt. Therefore, these costs need to be addressed after self-sustained economic growth becomes evident. Contrary to common understanding, discretionary outlays are predicted to show only a small increase in the next decade (see Chart 2).

Small Business Optimism Index Declines, Poor Sales Persists as the Foremost Problem

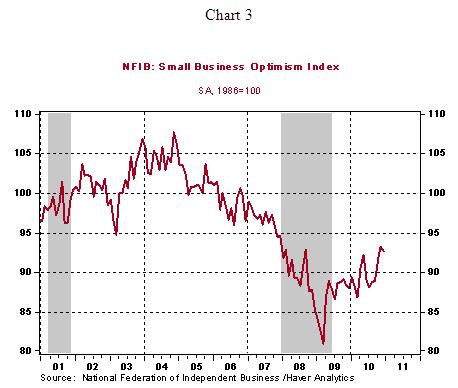

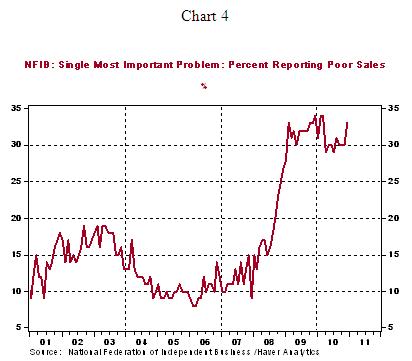

The Small Business Optimism Index edged down to 92.6 in December from 93.2 in the prior month (see Chart 3). More importantly, a significantly large percentage of respondents (33%) continue to indicate that poor sales are the foremost problem (see Chart 4) in December compared with tally in the September-November (30%) period.

Asha Bangalore â Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

http://www.marketoracle.co.uk/Article25547.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Illegal immigration is costing American hospitals billions of...

04-27-2024, 07:55 PM in General Discussion