Results 11 to 15 of 15

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

12-05-2022, 12:20 AM #11

Alameda's Caroline Ellison Spotted In NY Amid Speculation She Is About To Roll On SBF After Hiring Iconic Clinton Lawyer

SUNDAY, DEC 04, 2022 - 10:11 PM

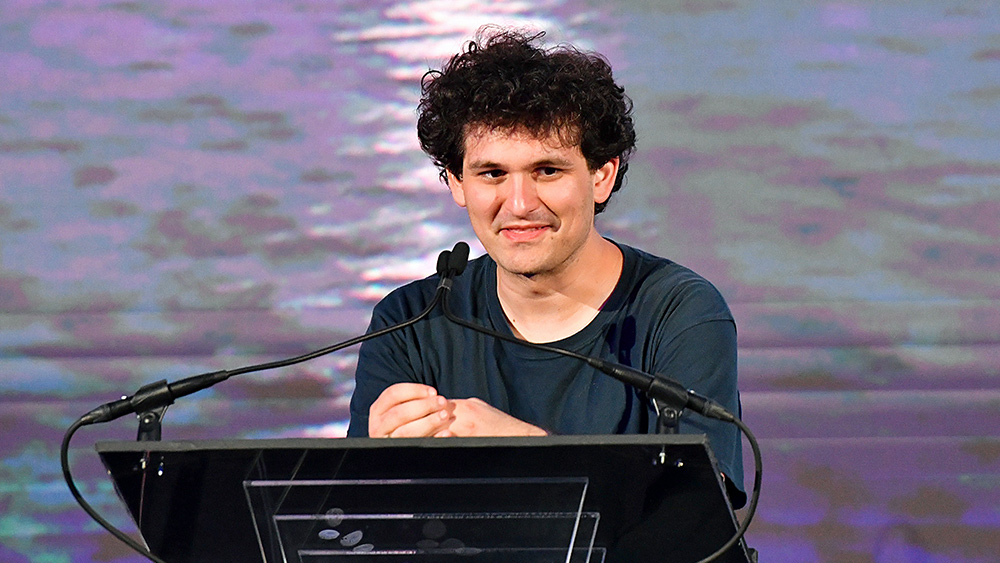

As Sam Bankman-Fried enters day six of his whirlwind media tour in which he makes one or more daily appearances - against the advice of his lawyers - in hopes of convincing someone that he was too dumb to be a criminal mastermind with billions in crypto in cold storage and in bank accounts in Dubai and Singapore (luckily all his wire transfers can be traced), also known as the Simple Jack defense...

zerohedge

@zerohedge

·

Follow

So today was day one of @SBF_FTX "i am too dumb to be a criminal mastermind" world tour. Join us tomorrow for day two when he channels Simple Jack next to Janet Yellen and Zelenskyy at the NYT summit of totally non-criminal folks.

9:42 PM · Nov 29, 2022

... the weakest link in SBF's defense was just spotted in a New York coffee shop, amid speculation she is preparing to blow up SBF's entire defense strategy.

According to Autism Capital, the former CEO of Alameda Capital (which as a reminder was ground zero of the FTX implosion after it blew up $8 billion in FTX client funds on trades gone horribly wrong), Caroline Ellison, was spotted at 8:15am this morning at the Ground Support Coffee on West Broad in SoHo Manhattan. This, as AC notes, "would mean she is not in Hong Kong and is in NY not in custody."

Autism Capital

@AutismCapital

·

Follow

PLEASE CONFIRM: A user claims that they spotted Caroline Ellison at Ground Support Coffee on West Broad in SoHo Manhattan at 8:15 AM. This would mean she is not in Hong Kong and is in NY not in custody.

1:10 PM · Dec 4, 2022

A statement from a barista at the coffee shop confirmed that it was in fact Caroline.

Autism Capital

@AutismCapital

·

Follow

Replying to @AutismCapitalCONFIRMED: The barista behind the counter has confirmed it was Caroline.

Daniel Mentado

@dmentado

Replying to @AutismCapital and @CryptoNCoffeee

Confirmed

1:35 PM · Dec 4, 2022

Why does this matter? Because while the prominent Democrat donor, who reportedly is "responsible for Biden being in office" and who - at least according to Musk - donated over $1 billion to democrats...

Will Manidis

·

Dec 1, 2022

@WillManidis·

Follow

SBF donating $40m to not go to jail for stealing $10b+ is one of the highest ROI trades of all time

Elon Musk

@elonmusk

·

Follow

That’s just the publicly disclosed number. His actual support of Dem elections is probably over $1B. The money went somewhere, so where did it go?

5:50 AM · Dec 3, 2022

... continues his deluded daily media appearances while casually throwing his former alleged lover, co-worker and penthouse-mate, Caroline - and pretty much all other co-workers - under the bus by claiming he has no idea how $8 billion in FTX client funds just vaporized in SBF's personal hedge fund, Alameda (implying that only Alameda's CEO, Ellison, was responsible for the theft and fraud) Caroline is two-steps ahead of SBF and is already cooperating with members of the DOJ, and specifically the SDNY, which we previously reported is probing the collapse of FTX.

Autism Capital

@AutismCapital

·

Follow

The general consensus is that Caroline Ellison is likely in NY cutting a deal and cooperating with SDNY prosecutors to roll on Sam.

2:11 PM · Dec 4, 2022

Subsequent reports have only reinforced this rumor, and the latest is that Ellison is being represented by DC law firm, WilmerHale...

Autism Capital

@AutismCapital

·

Follow

A highly credible source claims that Caroline Ellison is currently being represented by WilmerHale, a well known DC insider law firm. Please verify.

8:41 PM · Dec 4, 2022

... best known for its Government Affairs Department Chair, Jamie Gorelick, who was the former No. 2 ranking member in the Clinton Justice Department, and in a recent interview, she referred to Garland as her "wingman."

If indeed Ellison is working the Feds while currying favor with SBF's former closest friends, the days of Bankman-Fried - who may or may not soon commit Epsteincide - outside of a prison cell are numbered.

As for SBF, who is still wasting his time "uhhhm"-ing and "like"-ing across various interviews hoping to demonstrate to the world - and his future jurors - just how bloody stupid he really was...

(276 I Accidentally Interviewed SBF And He Hated It - YouTube

I Accidentally Interviewed SBF And He Hated It - YouTube

... and blaming it all on messy accounting, poor risk management, and of course, Caroline Ellison - not his premeditated fraud of course - even the CEO of Coinbase is no longer buying his relentless bullshit, saying earlier that no matter how "messy you accounting is (or how rich you are) - you're definitely going to notice if you find an extra $8B to spend" adding that "even the most gullible person should not believe Sam's claim that this was an accounting error" (here he is referring to Bill Ackman, of course), and correctly concluded that "it's stolen customer money used in his hedge fund, plain and simple."

Brian Armstrong

·

Dec 3, 2022

@brian_armstrong·

Follow

I don't care how messy your accounting is (or how rich you are) - you're definitely going to notice if you find an extra $8B to spend. Even the most gullible person should not believe Sam's claim that this was an accounting error.

Brian Armstrong

@brian_armstrong

·

Follow

It's stolen customer money used in his hedge fund, plain and simple.

4:53 PM · Dec 3, 2022

All that's missing is the definitive proof, and if the above rumors are correct, Caroline Ellison is in the process of, or already has provided it to the Feds. Which incidentally, may explain why SBF's "I am Simple Ja-ja-ja-jack, i'm so-so-so-sorry" tour just came to a crashing halt, when late on Sunday, the commingling masterming told Maxine Waters he won't be voluntarily appearing before Congress - where any lie is a perjury - on the 13th (or ever for that matter).

SBF

@SBF_FTX

·

Follow

Rep. Waters, and the House Committee on Financial Services:Once I have finished learning and reviewing what happened, I would feel like it was my duty to appear before the committee and explain.I'm not sure that will happen by the 13th. But when it does, I will testify.

Maxine Waters

&

U.S. House Committee on Financial Services

@RepMaxineWaters

&

@FSCDems

.@SBF_FTX

, we appreciate that you've been candid in your discussions about what happened at #FTX. Your willingness to talk to the public will help the company's customers, investors, and others. To that end, we would welcome your participation in our hearing on the 13th.

10:01 AM · Dec 2, 2022

Alameda's Caroline Ellison Spotted In NY Amid Speculation She Is About To Roll On SBF After Hiring Iconic Clinton Lawyer | ZeroHedgeIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-14-2022, 10:34 AM #12

FTX founder Sam Bankman-Fried (2nd L) is led away handcuffed by officers of the Royal Bahamas Police Force in Nassau, Bahamas, on Dec. 13, 2022. (Mario Duncanson/AFP via Getty Images)

CRYPTOCURRENCY

FTX Founder Sam Bankman-Fried Denied Bail in Bahamas After Arrest, Faces up to 115 Years in Jail

By Katabella Roberts

December 14, 2022 Updated: December 14, 2022

0:00-5:05 audio available at the page link

Sam Bankman-Fried, the owner of the failed cryptocurrency exchange FTX, has been denied bail after his arrest in the Bahamas at the request of the U.S. government on Monday.

In a hearing that lasted more than three hours on Tuesday, Chief Magistrate Joyann Ferguson-Pratt ruled that Bankman-Fried’s $250,000 bail request would be denied on the basis that Bankman-Fried poses a flight risk because of his access to financial resources, The New York Times reported.

The judge ordered the 30-year-old to be remanded to a Bahamas correctional facility until Feb. 8, 2023.

Bankman-Fried was arrested on Monday by Bahamas law enforcement at the request of the United States attorney for the Southern District of New York, who notified the Bahamas Attorney General’s Office that it had filed criminal charges against the former crypto billionaire, who once had an estimated net worth of $26 billion.

An extradition treaty has been in place between the United States and the Bahamas since 1994, and the former said it would likely request Bankman-Fried’s extradition. His legal team reportedly told the court they plan to fight any extradition order to the United States.

Attorneys for the Southern District of New York announce the indictment of Samuel Bankman-Fried in New York on Dec. 13, 2022. (Stephanie Keith/Getty Images)Prosecutors Unveil Multiple Charges

Prosecutors, including the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), have filed charges against Bankman-Fried, including wire fraud, as well as conspiracies to commit wire fraud, commodities fraud, securities fraud, money laundering, and fraud against the United States.

He faces up to 115 years behind bars if he’s convicted of all eight charges.

SEC Chair Gary Gensler said the former FTX boss “built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto” and orchestrated a scheme to defraud equity investors in FTX.

The CFTC has charged Bankman-Fried with fraud and material misrepresentations and claimed that his actions prompted the loss of over $8 billion in FTX customer deposits.

In a statement, the CFTC accused FTX of comingling customer funds with that of its sister hedge fund, Alameda Research.

According to an indictment (pdf) unsealed on Tuesday morning, U.S. prosecutors allege that Bankman-Fried had engaged in a scheme to defraud FTX’s customers by misappropriating those customers’ deposits and using them to pay the expenses and debts of Alameda Research.

They also accuse him of making “tens of millions of dollars in illegal campaign contributions” to both Democratic and Republican candidates and campaign committees that were not under his name, according to Damian Williams, the U.S. attorney for Southern New York.

Bahamas-based FTX was once valued at $32 billion after raising $400 million from investors, and Bankman-Fried became known for his philanthropic lifestyle, becoming the second-largest individual donor to the Democratic Party, while also claiming to have contributed a similar amount to Republicans.

FTX founder Sam Bankman-Fried speaks during the New York Times DealBook Summit in the Appel Room at the Jazz At Lincoln Center in New York on Nov. 30, 2022. (Michael M. Santiago/Getty Images) Bankman-Fried Denies Committing Fraud

However, in November, the crypto exchange spectacularly collapsed amid a liquidity crisis after it was revealed that Alameda had been using FTX customer assets to keep it propped up. A potential rescue deal by larger rival Binance was subsequently pulled and traders rushed to pull billions from the platform.

FTX filed for bankruptcy on Nov. 11. Millions of people who used the exchange have been left unable to access their crypto wallets.

According to a court filing, FTX owed its 50 largest creditors almost $3.1 billion.

Despite the incredible collapse of the company and looming questions regarding billions in missing funds, Bankman-Fried has continued to give multiple interviews to various media outlets and recently spoke at the New York Times DealBook Summit on Nov. 30.

During such interviews, the former billionaire has repeatedly denied committing any fraud at FTX but has admitted to making multiple “mistakes” while heading the company.

In an interview with the BBC published on Saturday, Bankman-Fried revealed his plans to set up a new business in an effort to pay back investors who have lost billions of dollars.

“I’m going to be thinking about how we can help the world and if users haven’t gotten much back, I’m going to be thinking about what I can do for them,” he said. “And I think at the very least, I have a duty to FTX users to do right by them as best as I can.”

The Epoch Times has contacted Bankman-Fried for comment.

FTX Founder Sam Bankman-Fried Denied Bail in Bahamas After Arrest, Faces up to 115 Years in Jail (theepochtimes.com)

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-14-2022, 01:59 PM #13

How many times was he a "guest" in the White House?

When will the cell phones from the corrupt elite be confiscated at 2 am in the morning with arrests being made?

ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

12-17-2022, 05:47 PM #14

SEC to file additional charges against accused crypto fraudster and FTX boss Sam Bankman-Fried

Friday, December 16, 2022 by: JD Heyes

Tags: Alameda, Bahamas, big government, Bubble, conspiracy, corruption, criminal charges, crypto fraud, cryptocurrency, deception, fraud, fraudulent, FTX, Justice Department, money supply, risk, Sam Bankman-Fried, scam, SEC

850VIEWS

(Natural News) As much trouble as Sam Bankman-Fried, the alleged crypto-fraudster and former CEO of now-defunct FTX, is in, thanks to charges being filed against him by the Justice Department, it’s not over yet for him.

Now, the Securities and Exchange Commission is preparing to file additional charges against the accused thief and big-time Democratic donor, according to Wednesday reports.

Besides seeking to ban SBF from the cryptocurrency industry permanently, the SEC will also charge him with “orchestrating a scheme to defraud equity investors in FTX,” charges that necessarily include conspiracy, which — if he’s found guilty — will only lengthen his jail term, according to a press release.

“Investigations as to other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing,” the press release stated, adding:

According to the SEC’s complaint, since at least May 2019, FTX, based in The Bahamas, raised more than $1.8 billion from equity investors, including approximately $1.1 billion from approximately 90 U.S.-based investors. In his representations to investors, Bankman-Fried promoted FTX as a safe, responsible crypto asset trading platform, specifically touting FTX’s sophisticated, automated risk measures to protect customer assets.

The complaint alleges that, in reality, Bankman-Fried orchestrated a years-long fraud to conceal from FTX’s investors (1) the undisclosed diversion of FTX customers’ funds to Alameda Research LLC, his privately-held crypto hedge fund; (2) the undisclosed special treatment afforded to Alameda on the FTX platform, including providing Alameda with a virtually unlimited “line of credit” funded by the platform’s customers and exempting Alameda from certain key FTX risk mitigation measures; and (3) undisclosed risk stemming from FTX’s exposure to Alameda’s significant holdings of overvalued, illiquid assets such as FTX-affiliated tokens.

The complaint further alleges that Bankman-Fried used commingled FTX customers’ funds at Alameda to make undisclosed venture investments, lavish real estate purchases, and large political donations.

The complaint further alleges that Bankman-Fried used commingled FTX customers’ funds at Alameda to make undisclosed venture investments, lavish real estate purchases, and large political donations.

SEC Chairman Gary Gensler provided additional details surrounding his agency’s enforcement against SBF.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” he said, according to the press release. “The alleged fraud committed by Mr. Bankman-Fried is a clarion call to crypto platforms that they need to come into compliance with our laws.

“Compliance protects both those who invest on and those who invest in crypto platforms with time-tested safeguards, such as properly protecting customer funds and separating conflicting lines of business. It also shines a light into trading platform conduct for both investors through disclosure and regulators through examination authority. To those platforms that don’t comply with our securities laws, the SEC’s Enforcement Division is ready to take action,” Gensler noted.

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, added: “FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary ‘risk engine,’ and FTX’s adherence to specific investor protection principles and detailed terms of service. But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent.”

“FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike,” Grewal noted further. “While we continue to investigate FTX and other entities and individuals for potential violations of the federal securities laws, as alleged in our complaint, today we are holding Mr. Bankman-Fried responsible for fraudulently raising billions of dollars from investors in FTX and misusing funds belonging to FTX’s trading customers.”

In addition to the SEC and Justice Department charges, Bankman-Fried also faces charges from the Commodity Futures Trading Commission. SBF is charged with violating anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Sources include:

ZeroHedge.com

SEC.gov

SEC to file additional charges against accused crypto fraudster and FTX boss Sam Bankman-Fried – NaturalNews.comIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

12-18-2022, 07:18 AM #15

SBF Changes Mind On Extradition To US After Four Days In Bahamian Jail

SATURDAY, DEC 17, 2022 - 06:00 PM

After spending just five days in a Bahamian jail cell, FTX founder Sam Bankman-Fried is backpedaling on his decision to contest extradition to the United States to face fraud charges, Reuters reports, citing a person familiar with the matter.

According to the report, SBF will appear in court on Monday to formally consent to extradition - which will pave the way for him to appear in US court to face charges that he commingled customer deposits to cover expenses and debts, and to make investments through his crypto hedge fund, Alameda Research LLC.

That said, legal experts tell Reuters that a trial is likely over a year away.

As Fox News reported last week, the Bahamas prison where SBF was reportedly heading - Fox Hill - is "harsh" due to "overcrowding, poor nutrition [and] inadequate sanitation," along with cells that are "infested with rats, maggots, and insects."

File video from 2022 shows squalid condition as Nassau, Bahamas' correctional facility known as Fox Hill Prison. (Nassau Guardian via Reuters / Reuters Photos)"He will be in sick bay for orientation purposes and then we will determine where best to place him," said Bahamian Commissioner of Correctional Services Doan Cleare in a statement to Reuters.A 2021 U.S. State Department report said prisoners at Fox Hill described "infrequent access to nutritious meals and long delays between daily meals.""Maximum-security cells for men measured approximately six feet by 10 feet and held up to six persons with no mattresses or toilet facilities. Inmates removed human waste by bucket. Prisoners complained of the lack of beds and bedding," according to the report. "Some inmates developed bedsores from lying on bare ground. Sanitation was a general problem, and cells were infested with rats, maggots, and insects."

"Overcrowding, poor sanitation, and inadequate access to medical care were problems in the Bahamas Department of Correctional Services men’s maximum-security block," the report continued. "The facility was designed to accommodate 1,000 prisoners but was chronically overcrowded."

On Thursday, Bankman-Fried sought bail from the Bahamas Supreme Court following his Dec. 12 arrest. On Tuesday he was remanded to Fox Hill Prison after Chief Magistrate JoyAnn Ferguson rejected his request to remain at home while awaiting a hearing on his extradition to the US.

SBF Changes Mind On Extradition To US After Four Days In Bahamian Jail | ZeroHedge

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

EP. 2755A - [CB]/[JB] ARE DIGGING THE HOLE DEEPER AND DEEPER, NO WAY OUT WATCH

By Airbornesapper07 in forum Other Topics News and IssuesReplies: 0Last Post: 04-19-2022, 07:30 PM -

Disaster Within Disaster: Time To Investigate the Aid Fiasco

By carolinamtnwoman in forum Other Topics News and IssuesReplies: 0Last Post: 01-20-2010, 03:19 AM -

Mexican Credit Card Hole Gets Deeper and Deeper

By JohnDoe2 in forum Other Topics News and IssuesReplies: 2Last Post: 07-31-2009, 09:00 PM -

Internment Camps: Disaster relief or civil rights disaster?

By carolinamtnwoman in forum Other Topics News and IssuesReplies: 0Last Post: 04-08-2009, 12:26 AM -

States face deeper and deeper cuts to balance budgets

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 1Last Post: 11-17-2008, 12:28 PM

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Tenth List of Content Moved to Archive "Americans Killed by...

04-30-2024, 06:46 PM in Americans Killed By illegal immigrants / illegals