Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-21-2010, 05:34 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Geopolitical Sovereign Risk as S&P and Moodys Warn US

Gold Supported by Geopolitical and Sovereign Risk as S&P and Moodys Warn US

Commodities / Gold and Silver 2010

Mar 15, 2010 - 09:02 AM

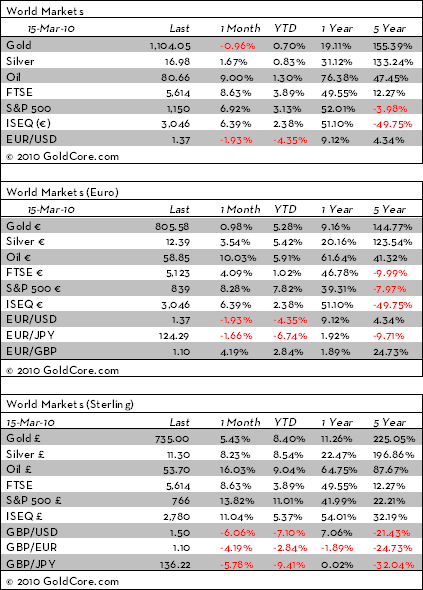

Gold fell in US trading on Friday from $1,119/oz to $1,098/oz to close with a loss of 0.54% and a loss of nearly 3% for the week. Silver was again more resilient and fell less than 2% last week. Gold has range traded from $1,102/oz to $1,106/oz so far in Asian and European trading this morning. Gold is currently trading at $1,103.00/oz and in euro and GBP terms, gold is trading at â¬804/oz and £732/oz respectively.

World equity markets are under pressure after mixed US economic reports and Chinese monetary policy tightening concerns. Asian stocks were mostly down, as are European shares so far this morning. Increasing geopolitical tensions between the US and China is likely making markets somewhat jittery (see below).

Sovereign debt issues and currency risk remain prevalent and look set to keep gold buoyant for the foreseeable future. Indeed, gold is increasingly being seen as a safe haven currency as seen in the recent record (nominal) highs in euro and sterling due to the challenges facing the UK and European economies.

These sovereign debt issues also face the US and thus the world's reserve currency the dollar. Late last week, S&P warned that the US' AAA credit rating is not guaranteed and today Moody's is warning that unless the US gets public finances into better shape, there would be "downward pressure" on its triple A credit rating.

Concerns about gold being a bubble are overdone with gold today only 19% above the price it was 12 months ago (and up 11% in sterling terms and 9% in euro terms). While many equity markets are up by some 40% to 70% in the same period.

Silver

Silver reached as high as $17.08/oz this morning in Asia. Silver is currently trading at $16.96/oz, â¬12.38/oz and £11.27/oz. Silver outperformed gold again last week and continues to exhibit signs that it might soon begin to play catch up with gold and target recent record (nominal) highs.

Platinum Group Metals

Platinum is trading at $1,610/oz and palladium is currently trading at $464/oz. Rhodium is at $2,550/oz.

News

Geopolitical tensions between China and the US appear to be escalating which is another bullish factor for gold. China PM, Premier Wen Jiabao, has defended China's increasingly assertive trade and foreign policies and vowed to fight any new signs of economic crisis and currency "protectionism". Tensions over Taiwan and Tibet continue and he chided the US for a 'disturbance' in relations.

Wen turned the tables on the U.S., renewing appeals for assurances from Washington about the safety of China's $800 billion in foreign exchange reserves invested in U.S. Treasury securities. Wen said the value of the U.S. dollar was a "big concern" and asked Washington to take unspecified steps to reassure investors.

The UK housing market has stalled again, fueling fears of a double-dip recession. There are growing concerns that the housing market could be facing a double-dip recession, as data released today shows house prices in March have risen by the smallest margin on record.

Finance ministers from the 16 countries using the euro meet today in Brussels to discuss the Greek debt crisis and Greece's progress in introducing the austerity measures needed to regain the confidence of the markets.

This update can be found on the GoldCore blog here. http://www.goldcore.com/goldcore_blog/

Mark O'Byrne

http://www.marketoracle.co.uk/Article17897.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

03-21-2010, 05:57 PM #2

Triple A this.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote Click to embiggen

Click to embiggen Click to embiggen

Click to embiggen Click to embiggen

Click to embiggen

72 Hours Till Deadline: Durbin moves on Amnesty

04-28-2024, 02:18 PM in illegal immigration Announcements