Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-04-2010, 05:34 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold and Silver Stocks Breakout May Be Imminent

Gold and Silver Stocks Breakout May Be Imminent

Commodities / Gold and Silver 2010

Oct 04, 2010 - 03:16 AM

By: Clive_Maund

Two of our three requirements for a major uptrend developing across the Precious Metals sector that were set out in the last Gold and Silver Market updates have now been met - first silver has broken out to clear new highs, then gold broke out above the top line of its potential bearish Rising Wedge - the only condition remaining to be fulfilled is a breakout by the stocks indices - and that may be imminent. The important complication is that both gold and silver are now critically overbought as a result of being in unbroken uptrends for many weeks and we will come to the implications of that shortly.

On its 4-year chart we can see how gold has broken above the top line of the potential Wedge drawn across the highs from last December. The pale blue trendline shown, drawn from the early 2008 highs, does not mark the top boundary of a true Wedge, but is believed to have some significance and MAY trigger a temporary reaction, which the current critically overbought condition certainly makes very possible. Gold is deep into critically overbought territory on its RSI indicator shown at the top of the chart, but still has substantial upside leeway on its MACD indicator shown at the bottom of the chart, which it should be noted can get overbought and stay overbought for a long time as the price continues to ascend.

So, we have a situation where gold is in position to accelerate away to the upside, but is at the same time critically overbought on various short-term indicators, but is nowhere near so overbought on intermediate indicators. What are we to make of this? The probable scenario here is that now gold has broken out above the resistance at the top return line of the Wedge, as described, it accelerates away to the upside, the advance being punctuated by brief "air pocket" reactions that could be increasingly violent. The current critically overbought state makes such a reaction likely either immediately or very soon. These reactions may be deeply unsettling for those long, but if the reason for them is known in advance and they expected, they can be used by traders to pyramid positions at better prices. The MINIMUM target for this advance is the lower parallel return line shown, which is currently in the $1500 - $1600 area, which is Jim Sinclair's long-standing target that looks not just easily achievable but actually quite modest - our upper parallel return line gives a MUCH higher target. Small wonder then that PM stocks look so attractive here, as despite their gains of recent weeks, they haven't even collectively broken out yet!. Many big weighty gold stocks look set to make their biggest gains in a long time and their gains can be leveraged by means of options, and the better juniors and mid-caps look set to go ballistic - we haven't been able to write them up fast enough on clivemaund.com

The 1-year chart for gold shows recent action in more detail. On this chart we can see that although the RSI is showing a critically overbought extreme calling for consolidation or reaction soon, the uptrend to date has been steady and considerably less steep than that of last Fall or the big 2007 - 2008 rally shown on the 4-year chart , circumstances which we interpret as allowing for acceleration of the uptrend, despite a probable "air pocket" reaction soon. Thus the advance is likely to steepen considerably, with occasional scary but brief reactions along the way. It is thought that it will be a good strategy to buy aggressively on any such sharp down days, as gold is likely to turn on a dime and go roaring up again.

With the Precious Metals so strong in recent weeks, it is hardly surprising to observe on our 6-month for the US dollar index that it has been in ragged retreat. The US has always had a reputation for doing things in style, and when it comes to currency debasement no one is going to steal a march on them - while other countries are frantically trying to keep up with their own competitive devaluations and can be expected to increasingly follow the US example and indulge in a little QE (Quantitative Easing) of their own, compared to what the US is doing this is "lemonade stand" stuff - for as we can see on the US dollar index chart, the dollar is definitely winning the "race to the bottom" at this time. The US has every incentive to win this race, as it has racked up astronomic debts and obligations that are best dealt with by devaluing the currency.

An outright headline grabbing Sovereign Default by the US would certainly not be what one associates with Triple A ratings and might result in the country being "put in the doghouse" economically, not to mention getting the Tea Party mob stirred up, so it's far better to engage in a creeping default by simply creating more and more money. With most other countries aiming to follow suit it's small wonder that the outlook for gold and silver is now so rosy. It's kind of sad really for the naive, trusting overseas holders of US Treasuries. The deflation dragon, which had been lurking menacingly in the background earlier this year, is being suffocated in a sea of newly created cash. Hyperinflation? - "We'll deal with that problem when we come to it". When the United States is completely bankrupted the surplus holding Asian Tiger economies will ride to the rescue, buying up corporations and vast tracts of Real Estate at pennies on the dollar - and put America to work again - for new masters OUTSIDE the country, albeit at decidedly competitive rates of pay. See? - no big military required.

By Clive Maund

CliveMaund.com

http://www.marketoracle.co.uk/Article23206.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-04-2010, 05:40 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold and Silver, It Could Well be a Whole New Ballgame!

Commodities / Gold and Silver 2010

Oct 04, 2010 - 08:38 AM

By: Peter_Degraaf

The most recent COT (Commitment of Traders) report (chart courtesy Cotpricecharts.com), shows the ânet shortâ position of commercial gold traders to be at its highest level since December 18th 2009 (purple bar at far right). In the past whenever the number rose to the level of the last three weeks (300,000 see table at left), a correction soon followed. Not so much because of the large number of short positions (because these will eventually have to be covered), but because of the large number of long positions (blue-grey vertical bars), representing gold that is held for the most part by hedge funds. Many of these hedge funds use computer generated trading programs which kick in with a domino effect. Once a few begin to take profits, they all try to exit at the same time.

At the present time the price of gold does not seem to be intimidated by the large COT ânet shortâ number, as in the past. Could it be that the hedge fund operators and large investors sense a possibility that the commercials are âon the ropesâ? Some of these commercial traders have carried a large short position for many months. All of these short positions are now âunder waterâ. Every time gold rises, the holders of short positions have to raise margin money or buy back a losing position. The upward pressure on price is due to fundamentals for gold that are extremely bullish and these include:

⢠The US money supply is today twice as large as it was just a few years ago.

⢠The Obama administration is without a clear economic policy â three out of four members of the economic team have just resigned - and the fourth, Tim Geithner, has never held a position in the business world aside from being involved in the banking business at Goldman Sachs. The man canât even keep correct personal income records.

⢠Worldwide money supply is expanding at an average rate of 10%.

⢠The US dollar is in a long-term decline against gold (see chart below).

⢠The Euro is in a long-term decline when measured in gold (see chart below).

⢠Gold is rising not only in US dollar terms but also as expressed in a number of currencies â this reflects a âflight to safety from fiat currencies.â

⢠Gold production is declining, despite higher prices.

⢠It takes longer (due to regulations) to build a gold mine than ever before, and the rising cost of materials and fuel makes it very expensive to build a mine.

⢠The period between US Labor Day and Christmas is usually the most gold-bullish period of the year. In seven of the last eight years gold rose during this period.

⢠The expiration of options on August 26th did not have a negative effect on the gold price, compared to options expiration days in June and July. This proves strong underlying physical demand.

⢠China is buying up local gold production, thus withholding it from the market.

⢠Russia is buying up local gold production, thus withholding it from the market.

⢠Gold ETFs are more popular than ever before, drawing bullion away from the market.

⢠The US gold supply that is stored at Fort Knox has not been audited since 1953 and is most likely all or partly gone. It has either been sold or leased.

⢠Central banks have stopped selling gold and some have become buyers.

⢠Gold thrives when âreal interest ratesâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-04-2010, 05:42 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Silver Up 22% In September

Commodities / Gold and Silver 2010

Oct 04, 2010 - 05:28 AM

By: Howard_Katz

Ah, yes, the silver bubble of 1978-80 was a time to remember in financial history. Bunker Hunt, heir to the H.L. Hunt fortune, became an aggressive bull on silver and tried to engineer a silver corner. But no one has ever engineered a corner on a free market, and Bunker Hunt did not become the first. He stayed too long. He overplayed his hand. And when the bubble collapsed, he lost his daddyâs fortune.

WHAT IS A SPECULATOR?

This article is dedicated to those who are, or would become, successful speculators. So we begin, as usual, by asking what is a speculator?

A speculator is a person who tries to make money on his capital by buying low and selling high. This is as distinct from an investor, who tries to make money on his capital by using it to make real interest (or return on capital). The speculator lives and dies by price fluctuations. The investor is unconcerned about them. If he is in bonds, he wants the yield. If he is in stocks, he wants the earnings. If he is in real estate, he wants the rent.

Now here is the secret to successful speculation. All markets hit their lows when traders are most bearish. (A trader is either a speculator or an investor.) They hit their highs when traders are most bullish. A case of the first is the 1999 low in gold when even the gold mines were selling short on their own product. A case of the second is the Jan. 21, 1980 spike top, when gold hit $875/oz. (interday on the Comex).

The difficulty here is that man is a social animal. He is influenced in his beliefs by the people around him. But the person who allows himself to be so influenced in the markets is a loser. He sells at the low and buys at the high.

So the first virtue needed to be a successful speculator is an independent mind.

The job of the speculator is to figure out when there are either over valuations or under valuations in a market, and to do this, as noted, he must go against the people around him. That is, he must figure out when the people around him are wrong.

Here we must take a new tack. It is often stated that the man who is most successful in life is the one who has the best information. This is, unfortunately, a bad mistake. It ignores the fact that âinformationâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-04-2010, 05:51 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold Stocks, SP500 and U.S. Dollar Turning Points, Whatâs Next?

Stock-Markets / Financial Markets 2010

Oct 04, 2010 - 03:00 AM

By: Chris_Vermeulen

Investors around the globe are concerned with the economic outlook, not only with the United States but with virtually every country. This has caused not only investors but banks and countries to start buying gold & silver in order to be protected incase of a currency melt down in the coming years.

While the majority is concerned about the eroding economy, we have seen the opposite in the financial market. Gold and equities have risen⦠That being said the volume in the market remains light simply because the average investor is no longer putting money into the market for long term growth. Instead individuals are now focusing on saving and paying down debt.

That being said we all know light volume market conditions allow Wall Street powerhouses to bid the market up. Not to mention with quantitative easing taking place Iâm sure that has also helped the market of late. While we donât know for sure that QE is taking place as we speak, the sharp drop in the dollar and strong move up in gold are pricing this into the market.

Letâs take a look at some chartsâ¦

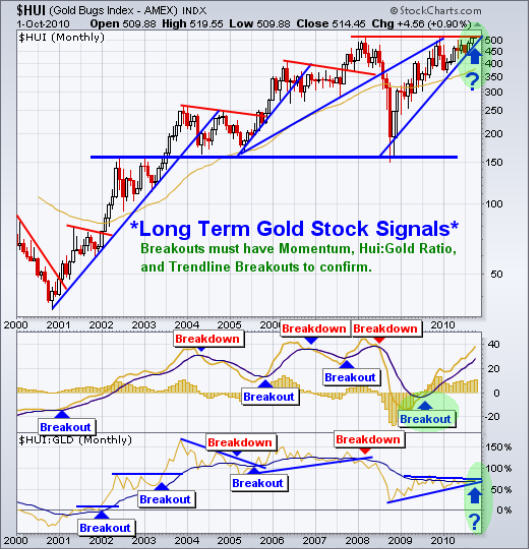

HUI â Gold Stock Index

This long term monthly chart of the HUI index provides valuable trading signals for both gold stocks and gold bullion. As you can see below this index is trading at a key resistance level after forming a bullish 3 year Cup & Handle pattern. The next 1-2 months for the precious metals sector will be interesting as it tries to break above key resistance. I would really like to see the HUI:GLD ratio break to the upside to confirm if the breakout occurs.

SPY â Daily Long Term Trend

The broad market looks to be forming a short term topping wedge. If this is to occurI expect it to take several weeks to play out. Looking at the chart if we use Fibonacci retracements along with trend line support we can get a feel for where this pullback should correct to.

That being said the broad market breadth and internals seem to be holding up indicating higher prices over the long run. While the short term price action is overbought and I expect a pullback to form, my analysis is pointing to higher prices as we go into year end.

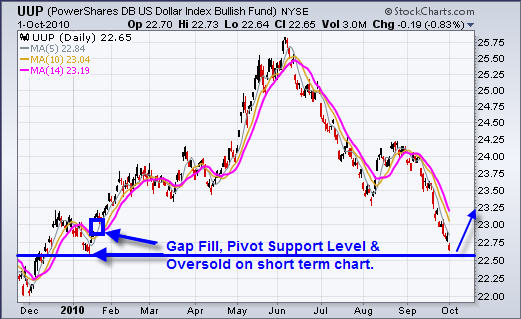

UUP â US Dollar Daily Price Action

Although the majority of investors have a bearish outlook on the economy, we have seen a large price appreciation in equities and precious metals. This is largely due to the fact that the US dollar is quickly getting devalued. Simply put, as the dollar drops, it helps boost commodities and stock prices.

While a rising stock market is great to see, at some point the dollar will become so cheap that it will start to have a very negative affect on the US economy, commodities and stocks. Being from Canada it has always been more expensive to take holidays in the United States, and I remember paying $1.50-$1.70 for every $1 green back. But now the dollar is almost at par making holidays very affordable. The big question/concern is when will they ease off on the printing? At the rate which they are printing the greenback will be at par with peso⦠well not that extreme but you get the point Eh!

Weekend Market Conclusion:

As we all know the market has a way of making sure the majority of traders miss major turning points. The saying is, âIf the market doesnât shake you out, it will wear you outâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-04-2010, 05:55 PM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Silver makes Clear Breakout by Clearing Major Resistance

Commodities / Gold and Silver 2010

Oct 04, 2010 - 03:20 AM

By: Clive_Maund

Two of our three requirements for a major uptrend developing across the Precious Metals sector that were set out in the last Gold and Silver Market updates have now been met - first silver has broken out to clear new highs, then gold broke out above the top line of its potential bearish Rising Wedge - the only condition remaining to be fulfilled is a breakout by the stocks indices - and that may be imminent. The important complication is that both gold and silver are now critically overbought as a result of being in unbroken uptrends for many weeks and we will come to the implications of that shortly.

On its 4-year chart we can see how silver has made a clear breakout to new highs this past week. This is an IMPORTANT BULLISH DEVELOPMENT that is believed to mark the start of a major uptrend in silver. However, the latest gains came at the cost of driving silver deep into critically overbought territory making consolidation/reaction very probable soon. This is evident from the RSI indicator at the top of the chart. Thus we have a situation where a major new intermediate uptrend has been signalled but where further short-term potential is limited by the extremely overbought condition. What we should therefore look for is consolidation/reaction soon to alleviate this overbought condition somewhat and restore upside potential. The current gap between the price and the 200-day moving average is about $4, but early in 2008 this gap widened to $7 which gives some idea of the medium-term potential for silver, and there is nothing to say that this gap cannot be wider. While the short-term overbought condition clearly needs to moderate, we should note that silver will be expected to maintain a generally overbought condition for weeks and possibly for months as it continues to climb.

The shorter-term 6-month chart shows that silver has been in a remarkably tidy, if steep, uptrend since it broke out of its Triangle in August. On account of its now being deep into critically overbought territory on its RSI indicator, failure of the steep uptrend can be expected to lead to a rapid convulsion as short-term traders suddenly hit the exits. However, any such sudden weakness can be bought into, as the medium-term trend, which is up, can be expected to suddenly reassert itself once the sudden correction has done its work of easing the overbought condition. We can expect numerous "air pockets" of this type as the price ascends, mostly minor and lasting perhaps a few days, with a few larger ones thrown in to keep traders on their toes. Any such sharp drops can be bought into aggressively. The now large gap with the 50-day moving average is making a "short sharp shock" increasingly likely.

It is obvious that the steep advance of the past few weeks has been fuelled in part by a short squeeze, but with regard to this it is thought likely that some shorts have held out up to now, in order not to book massive losses for the third quarter. Now that we are into October they may finally decide to "take their lumps" and their buying in coming days could force the price even higher, resulting in an even more overbought extreme.

By Clive Maund

CliveMaund.com

http://www.marketoracle.co.uk/Article23207.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

More Than Half Of US Voters Want Illegal Immigrants Rounded Up...

05-21-2024, 08:56 AM in illegal immigration News Stories & Reports