Results 1 to 7 of 7

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

09-30-2011, 11:15 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Housing Prices Unlikely to Recover Before 2020, FICO Survey

press release

Sept. 30, 2011, 11:00 a.m. EDT

Housing Prices Unlikely to Recover Before 2020, FICO Survey Finds

73% of bankers surveyed see elevated level of mortgage foreclosures for at least five years

MINNEAPOLIS, Sep 30, 2011 (BUSINESS WIRE) -- FICO's latest quarterly survey of bank risk professionals offered a decidedly pessimistic outlook, reversing the growing optimism seen in late 2010 and early 2011. The survey, conducted for FICO by the Professional Risk Managers' International Association (PRMIA), shows that bankers expect delinquencies on consumer loans to rise, underwriting standards to become stricter, and the housing sector to continue struggling far into the future.

No recovery in sight for beleaguered housing sector

When asked if housing prices nationally would climb back to 2007 levels before the year 2020, 49 percent of respondents said no. By comparison, 21 percent said yes. And the negative sentiment extended beyond property values. Among bankers surveyed, 73 percent believed mortgage defaults would remain elevated for at least five more years. Furthermore, 46 percent of respondents expected mortgage delinquencies to increase over the next six months, and only 15 percent of respondents believed mortgage delinquencies will decline during that period.

"Housing has been an enormous drag on the economy for over three years as U.S. households lost trillions of dollars in equity," said Dr. Andrew Jennings, chief analytics officer at FICO and head of FICO Labs. "While the housing sector will almost certainly gain strength during the next nine years, many bankers clearly believe prices will remain depressed for half a generation. This puts the devastation of the housing crash into perspective."

Consumer credit health seen declining

Bankers expressed concern about consumer credit health beyond mortgages. When asked their opinions about the next six months, a large number of survey respondents indicated that they expect delinquencies to rise on auto loans, credit cards and student loans. Auto lending had been a bright spot in FICO's previous quarterly surveys, but in the latest survey, 30 percent of respondents indicated that they expect auto delinquencies to rise, while 21 percent expected them to fall. For credit cards, 40 percent expected delinquencies to rise and 23 percent expected them to fall. And for student loans, 48 percent of respondents expected delinquencies to rise and 13 percent expected them to fall.

Small businesses expected to face challenging credit environment

By a margin of 36 percent to 17 percent, survey respondents expected delinquencies on small business loans to increase rather than decrease. And while 57 percent of bankers surveyed expected the amount of credit requested by small businesses to increase over the next six months, only 34 percent expected the amount of credit that is actually extended to small business to increase. This "credit gap" between supply and demand has been persistent over the past six quarters.

"Small businesses have traditionally been providers of much-needed jobs during economic recoveries," said Jennings. "But the tight credit conditions facing small businesses today make it difficult for them to invest and expand. Rather than something to be counted on, the notion of small-business job creation seems, for the moment at least, aspirational."

Credit usage expected to rise slowly

A large plurality of survey respondents (50 percent) expected credit card balances to increase over the next six months. The increases are likely to be driven by higher spending among some consumers and smaller monthly payments from others. However, in a sign that bankers aren't optimistic about the ability of consumers to power the economic recovery, 64 percent of respondents expected credit card usage to remain below pre-recession levels for at least five more years.

A detailed report of FICO's quarterly survey results is available at http://www.prmia.org/PRMIA-News/Fico-3r ... 2011FF.pdf . The survey included responses from 188 risk managers at banks throughout the U.S. in August 2011. FICO and PRMIA extend a special thanks to the Columbia Business School's Center for Decision Sciences for its assistance in analyzing the survey results.

About PRMIA

The Professional Risk Managers' International Association (PRMIA) is a higher standard for risk professionals, with 65 chapters around the world and nearly 80,000 members in nearly 200 countries. A non-profit, member-led association, PRMIA is dedicated to defining and implementing the best practices of risk management through education, including the Professional Risk Manager (PRM) designation and Associate PRM certificate; webinar, online, classroom and in-house training; events; networking; and online resources. More information can be found at www.PRMIA.org .

About FICO

FICO /quotes/zigman/226195/quotes/nls/fico FICO +4.18% delivers superior predictive analytics solutions that drive smarter decisions. The company's groundbreaking use of mathematics to predict consumer behavior has transformed entire industries and revolutionized the way risk is managed and products are marketed. FICO's innovative solutions include the FICO(R) Score -- the standard measure of consumer credit risk in the United States -- along with industry-leading solutions for managing credit accounts, identifying and minimizing the impact of fraud, and customizing consumer offers with pinpoint accuracy. Most of the world's top banks, as well as leading insurers, retailers, pharmaceutical companies and government agencies, rely on FICO solutions to accelerate growth, control risk, boost profits and meet regulatory and competitive demands. FICO also helps millions of individuals manage their personal credit health through www.myFICO.com . Learn more at www.fico.com . FICO: Make every decision count(TM).

For FICO news and media resources, visit www.fico.com/news .

Statement Concerning Forward-Looking Information

Except for historical information contained herein, the statements contained in this news release that relate to FICO or its business are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the success of the Company's Decision Management strategy and reengineering plan, the maintenance of its existing relationships and ability to create new relationships with customers and key alliance partners, its ability to continue to develop new and enhanced products and services, its ability to recruit and retain key technical and managerial personnel, competition, regulatory changes applicable to the use of consumer credit and other data, the failure to realize the anticipated benefits of any acquisitions, continuing material adverse developments in global economic conditions, and other risks described from time to time in FICO's SEC reports, including its Annual Report on Form 10-K for the year ended September 30, 2010 and its last quarterly report on Form 10-Q for the period ended June 30, 2011. If any of these risks or uncertainties materializes, FICO's results could differ materially from its expectations. FICO disclaims any intent or obligation to update these forward-looking statements.

FICO and "Make every decision count" are trademarks or registered trademarks of Fair Isaac Corporation in the United States and in other countries.

SOURCE: FICO

http://www.marketwatch.com/story/housin ... 2011-09-30Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:19 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Housing Market into the 2020's

Housing-Market / US Housing

Jan 25, 2011 - 01:48 AM

By: Tony_Caldaro

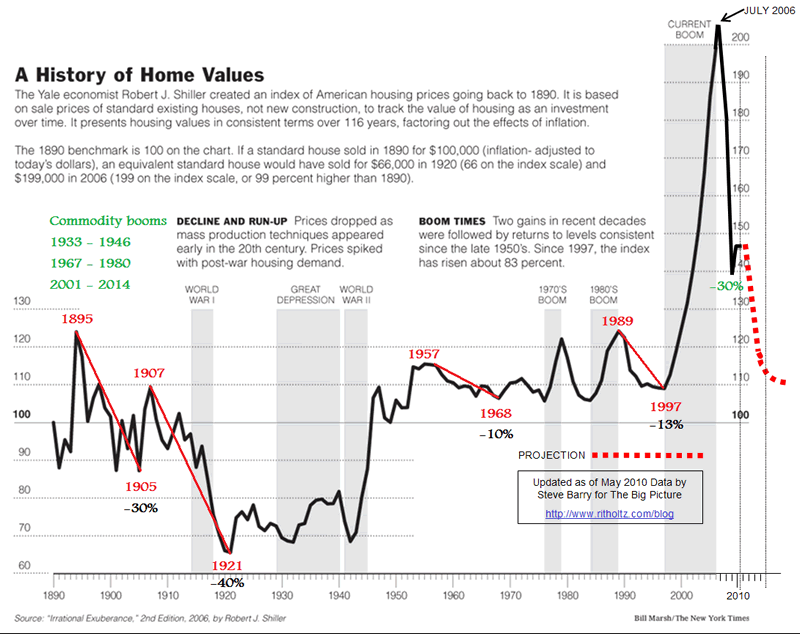

From time to time we have been reviewing the historical housing market index, provided by Case-Shiller, in an attempt to identify historical patterns. Since the historical index is not provided in nominal terms (inflation included), but real terms (inflation excluded), this has been a difficult task. Everything we track, in OEW terms, is quoted in nominal prices. After several attempts over the past few years we feel we have identified enough historical patterns to offer an educated projection for the US housing market going forward. We present the history of US housing prices using a chart courtesy of Steve Barry/Barry Ritholtz. This chart displays the past 120 years of US existing home prices in real terms, with a dashed line forecast by Robert Shiller of Case-Shiller.

The first observation we made is that there have only been four previous periods when housing prices declined for a decade: 1895-1905, 1907-1921, 1957-1968 and 1989-1997. We count the major decline from 1895-1921 as two events for two reasons. The rally from 1905-1907 was over 25% and the second decline was due to mass production building techniques which lowered the building costs of new houses substantially. Keep in mind this chart is in real dollars, not nominal dollars.

The first two of these decade long declines were steep: -30% and -40%. The second two, after mass production and manufacturing led to the economic expansion of the US, were quite minor: -10% and -13%. These minor corrections should be, and were, considered the norm in modern times. The next striking observation is that US housing dropped 30% between 2006 -2009/10, just four years. This type of quick and steep straight line decline had previously occurred only once in the entire 120 years: the 30% decline between 1916-1920. Historically this type of major event, which is similar to a stock market crash, eventually leads to a important low within a few years and/or a long base building consolidation period around the crash lows. Notice after the recent 30% straight line decline housing prices did get a small bounce.

We also identifed the typical relationship of housing prices to the commodity bull market cycle. Naturally, as raw materials rise in price the building costs of new homes rise in price as well. This puts upward price pressure, regardles of inflation, on existing home prices.

During the 1933-1946 commodity boom: home prices bottomed in 1932, rose about 15%, made a second bottom in 1942, and then started a sustained rise in price. During the 1967-1980 commodity boom: home prices bottomed in 1968, rose about 5%, made a second bottom in 1977, and then had a 15% rally into 1979. Notice after both commodity booms ended there was a decline in prices (1947-1949 and 1979-1985), and then another rally to higher highs (1949-1957 and 1985-1989).

This commodity boom (2001-2014) has been quite different. While the two previous bull markets in housing were price/demand driven. The recent bull market in housing was credit/demand driven. When prices became too high during a price/demand cycle, demand slackened, and prices corrected 10% to 13%. When the poor credit home owners, during the recent credit/demand cycle started to default because of interest rate resets, foreclosures started to increase total housing supply. This put downward pressure on housing prices, and they began to decline, creating even more foreclosure/supply. As these interest rate resets continued the foreclosures eventually flooded the housing market with supply. Then housing prices began to plummet and demand decreased substantially. So instead of a normal 10% to 13% decline over a number of years, we experienced a major 30% decline in a matter of just 3 â 4 years. Had credit not been so readily available housing prices would have risen normally, like they have during the past two commodity booms. With easy credit for normally unqualified applicants, future demand was front loaded into the present creating a credit/demand default cycle and a housing crash. Every bear market, however, is followed by a bull market.

After we combine all these price observations we still need to review the fundamentals. Banks are still holding, possibly, two years of supply in existing/future foreclosures. New homes are still being built and normal seasonal supply cycles are still ongoing. Demand remains on the low side with 9% unemployment. The present economy is not encouraging either small businesses, corporations, nor banks to return to normal operations. Thus unemployment may remain high for a number of years. The consumer has only recently become a net saver, after decades of net consumption with easy credit. And, banks are demanding larger deposits and higher credit ratings from potential buyers before even considering offering a mortgage. Also, government incentives have had a limiting effect. Yet, the FED has aided the housing industry by keeping long term rates quite low. This is generally helping qualified home buyers to secure more property per income dollar than they would obtain otherwise. After considering the fundamental and technical factors we can now make some assumptions.

We anticipate that the housing market will remain under pressure from 2006 â 2015 or so. Typically these types of declines take about one decade to complete. On the downside we are not expecting much more or a decline. Possibly into the 130â²s area over the next few years, with an outside chance of hitting the 1989 high around 125. This would represent a total decline between 33% and 38%. Housing has already declined 30%. Once the bottom occurs we would expect a multi-year rally and then a retest of the lows, somewhat similar to the 1932-1942 and 1975-1985 periods. The second bottom should occur by the mid-2020â²s. Then a new bull market in US housing should get underway.

Naturally, regional areas will vary from the overall average both up and down. The areas with strong employment growth will recover faster than those with increasing or stable unemployment. Also, the quality of jobs available will impact the housing recovery in these regional areas as well. Generally home prices do best in areas with high and growing employment needs in quality jobs. The Dallas FED region currently leads the nation in this area. As a result we are likely to see a housing market recovery first in Texas and its surrounding areas. Nationally, a bottom in 2015, a bounce into 2020, then a retest of the low in 2025. Then a new bull market in housing in real prices nationwide. Land at bargain basement prices is always a good deal. Weâll update this housing report when something of interest unfolds. Happy house hunting.

CHARTS: http://stockcharts.com/def/servlet/Favo ... =ID1606987

http://caldaroew.spaces.live.com

http://www.marketoracle.co.uk/Article25833.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:23 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Survey sees no housing recovery until 2020

by JIM BUCHTA , Star Tribune

Updated: September 30, 2011 - 8:44 PM

The national survey of bank risk managers found that most expect problems to persist in the housing market for years.

[img]http://stmedia.startribune.com/images/565*425/30heard0601.jpg[/img]

Bankers have dusted off their crystal balls, and what they see isn't pretty.

A new survey of risk managers across the country found that about half of them don't expect housing prices to return to 2007 levels until 2020. The survey by consumer credit firm Fair Isaac Corp. and the Professional Risk Managers' International Association found that most expect mortgage defaults to be a significant problem for years.

"They don't see things getting any better, and the data reflects that," said Andrew Jennings, chief analytics officer at Minneapolis-based Fair Isaac (also known as FICO) and head of FICO Labs. "They don't see the future being any brighter."

While clearly one of the most pessimistic views of the housing market to date, the FICO report is one of several recent assessments to point to a long and slow recovery.

Pat Newport of IHS Global Insight said that while he thinks the banker survey is severe, it's not far from his own forecast, which calls for house prices to return to 2006 levels by 2017.

"Their call is pessimistic, but I don't think it's unreasonable," Newport said.

At a time when some housing fundamentals have never been better -- mortgage rates dropped to record lows this week -- such warnings leave prospective buyers and sellers in a difficult position. Act now? Or wait out the market?

Jennings said the survey didn't try to address those specific questions, and he urges consumers to focus more on the health of local markets. Key, he said, is jobs. "People are uncertain about whether they'll still have their jobs, which is holding people back," Jennings said.

In the Twin Cities metro area the unemployment rate is slightly better than the national average, and sales agents have said that they expect that home prices have already or are about to hit bottom.

That's why Brad Fisher, a sales manager for Edina Realty and a former president of the Minneapolis Association of Realtors, said that he's surprised by the FICO forecast. "This may be too much of a national perspective to apply to our local market," he said.

The latest data for the Twin Cities metro area from Case-Shiller showed that prices increased over the past few months, but are down significantly from last year. Year-over-year sales are down as well, according to the Minneapolis Area Association of Realtors.

FICO also polled bankers about other financial issues, and those responses were equally as sobering.

â¢73 percent believe mortgage defaults will remain elevated for at least five more years.

â¢46 percent of respondents expect mortgage delinquencies to increase over the next six months

â¢15 percent of respondents believe mortgage delinquencies will decline during that period.

Jennings said the survey, which is conducted quarterly, was the most pessimistic since 2009.

Across the country, the newest concern for the housing market is that there could be another wave of employment-related foreclosures in the coming months and years, which would cause home prices to fall.

"The message in the market overall is that there are lots of things preventing the foreclosure overhang from clearing," Jennings said.

Jim Buchta ⢠612-673-7376

http://www.startribune.com/business/130889963.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:34 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gear up for another lost decade in real estate. Housing will remain stagnate from 2010 to 2020. Demographic shifts, higher mortgage rates, and shifting consumer taste in real estate.

Posted by mybudget360 in banks, california housing, debt, economy, foreclosure, government, home equity loans, housing, loan modification, loss mitigation, mortgages, real estate

11 Comments

many links on this post

The dynamics for housing moving forward point to a very bleak future and a potential lost decade yet again from 2010 to 2020. Housing has a treacherous path moving forward and deep down demographic shifts will keep a lid on any significant housing appreciation moving forward. The economy is in the process of deleveraging from a market highly dependent on real estate. Wall Street and the government are doing everything they can to bring back the economy of yesterday but have had little success. This recession has shrunk the middle class so those looking to buy homes have declined simply because many can no longer afford to purchase a home even at todayâs lower prices. Focusing on housing first was a big expensive policy mistake where we should have focused on creating sustainable jobs. The market is slowly shifting to a new housing paradigm. Family growth rates, employment trends, baby boomers, and wages will all keep a lid on housing prices moving forward.

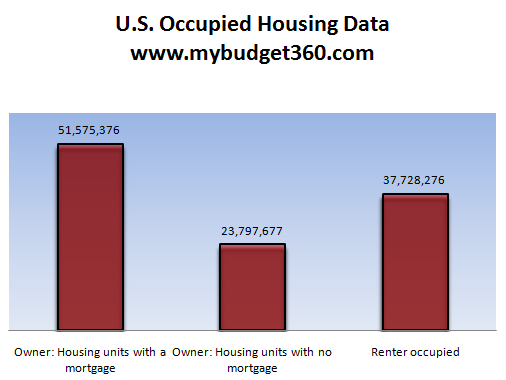

First we should break down the entire housing market:

Source: Census

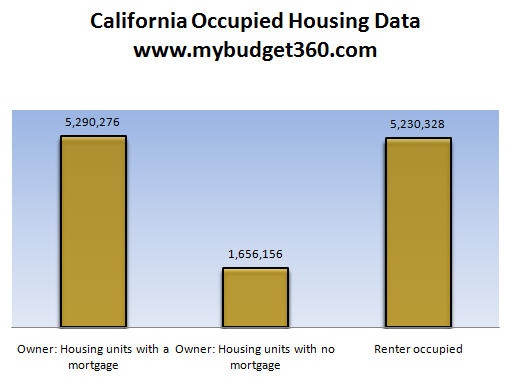

The U.S. has a large number of homeowners. A total of 75 million Americans can lay the claim to owning their home. 23 million of this group (31 percent) actually owns their homes outright with no mortgage. Of course not having a mortgage does not mean that these homeowners have no housing associated cost. They still need to pay yearly property taxes, insurance, and all the cost in maintaining a home. Another 37 million American households rent. These are the basic dynamics of the housing market.

Of those homeowners with a mortgage, 7.2 million (14%) are in foreclosure or 30+ days late on their mortgage. This practically guarantees a few years of cheaper housing hitting the market in a steady trickle. This puts a herculean hold on any significant home building going forward.

From the recent Federal Reserve Flow of Funds Report, we find that current outstanding mortgage debt is $10.334 trillion. We have to break out the renters and the homeowners with no mortgage and find that the average mortgage debt for homeowners is:

$10.334 trillion / 51.575 million mortgaged households = $200,374

The current median home price comes in at approximately $170,000. Now some would argue that housing will regain traction and go on to rising to new levels. Yet this assumption assumes that middle class wages will be growing moving forward. If we look closely at the data the only real winner so far in this economic crisis is Wall Street but average Americans have seen very little benefit from the current bailout measures. Now those with big investment bank salaries can afford their piece of prime real estate in Manhattan or the Hamptons but this does not make up the bulk of the housing market. The bulk of the housing market is highly dependent on how middle class Americans are doing.

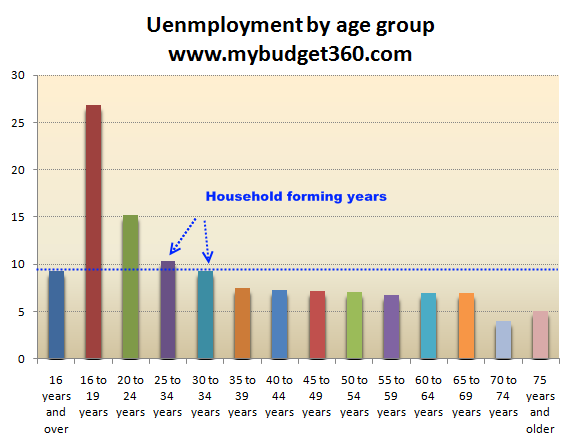

If we look at the current unemployment levels by age group, we see that those in the household forming age ranges or those entering into these categories, are taking on the brunt of this recession:

total national average. These are prime age groups for forming households and if a family is not feeling safe financially, they will delay on purchasing a home. The middle class young family is also delaying on having children so the necessity for a bigger home is also being pushed out. This demographic shift is happening at the same time that baby boomers start entering retirement age and many will want to downsize.

And many of these people have a buffer for equity to sell since they bought prior to the housing bubble. Take for example data on current owner households:

Moved in before 1989: 20.5% of all homeowners

Moved in before 1999: 40.9% of all homeowners

It is highly likely that in this group, you have many baby boomers that will sell to downsize in the years coming forward and the current decline in prices will only cut into their equity but not put them underwater given the decade long bubble. They purchased before that. Those that moved in before 1989 will have a much larger cushion. So there is a large group of people that will sell regardless of market trends because they will have to simply because of life changing events.

And then on the other hand we have the fact that one-third of homeowners in certain states are underwater on their mortgages. Take for example California:

California has a large renting population and most that own a home carry a mortgage (77 percent). Of those that carry a mortgage a stunning one-third are underwater. In other words 1.76 million mortgages in California are attached to homes that are worth less than the actual balance of the mortgage creating a large incentive to walk-away. Many of these loans come from Alt-A paper and option ARMs. These loans will impact the market at least until 2012 and hurt the state. California isnât immune and other states like Nevada, Florida, and Arizona have similar dynamics. In fact, here is the amount of mortgage debt in a negative equity position according to a recent Deutsche Bank analysis:

California: $969 billion

Florida: $432 billion

Arizona: $140 billion

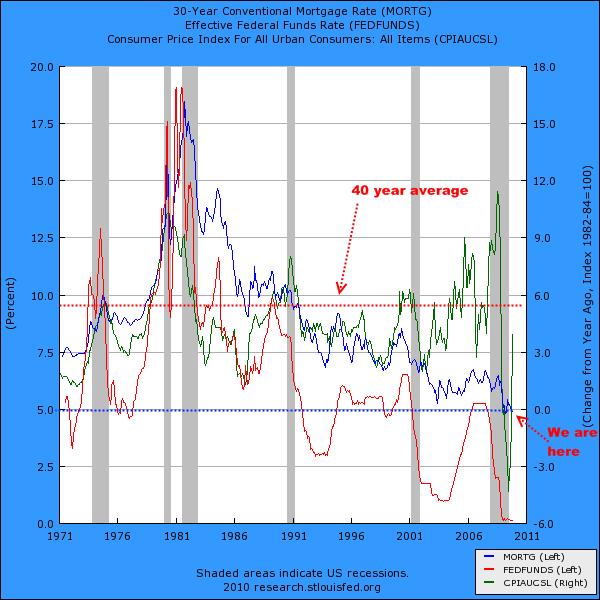

The only way that things would improve for banks is if prices moved higher. But how can prices move higher if middle class Americans are dealing with high unemployment and stagnant wages? The Federal Reserve and U.S. Treasury have really reached the end of options in terms of what they can do. Even the 30 year fixed mortgage is at all time lows in the midst of all this turmoil:

The 40 year average for 30 year rates is closer to 9 percent. Today it is under 5 percent. That is unsustainable and as we move forward with insurmountable levels of national debt, the rate will have to rise. I know this seems impossible for many but as we have seen with other debt ridden countries, the market can turn on like a tornado and quickly change the dynamics of the situation. For the housing market, this will mean even more pressure to keep prices muted.

The only way home prices can rise in a healthy manner is if we start seeing wage inflation. We saw some of this in the 1970s where wages went up in tandem with home prices. In the last decade, wages moved sideways while home prices went into a bubble. As far as the economy going forward, the big job sectors seem to be in low paying service sector jobs. Certainly someone can purchase a house with these jobs but not at current prices even though they appear to be solid.

The Federal Reserve and the U.S. Treasury have done everything to slam the dollar and create some level of inflation. Yet other central banks are doing the same. So what happens is easy money flows to Wall Street for gambling while the real economy stagnates. It is hard for many to believe that we will have another lost decade in housing but there is little reason to believe that prices will soon start to outpace inflation. In fact, in the last year or two we have been dealing more with aspects of deflation. We need to keep an eye on the real value of home prices adjusting for inflation/deflation.

http://www.mybudget360.com/lost-decade- ... -retiring/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:50 PM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Next Real Estate Boom Not Till 2020 - Real Estate Market Forecasts

The nation's real estate markets are not expected to boom again until at least 2020, according to Housing Predictor analysts.

www.housingpredictor.com/boom.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:54 PM #6Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Housing Should Bottom Before 2020 | Elliott Wave Market Service

The dynamics for housing moving forward point to a very bleak future and a potential lost decade yet again from 2010 to 2020.

www.elliottwavemarketservice.com/2010/0 ... efore-2020Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

09-30-2011, 11:59 PM #7Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Great Housing Depression of 2008-2020?

Gary Weiss|August 30, 2011|0|0

(Taber Andrew Bain via Flickr)

The stock market, as measured by the S&P 500, rose almost 3% yesterday, perhaps pleasantly surprised that the Northeast doesn't resemble the Gulf Coast -- Katrina-cable-TV hype notwithstanding.

So as traders picked their way across tree limbs and flooded roads on their way to work Monday, perhaps they overlooked a commonplace sight that was even more prevalent than clogged waterways: for-sale signs on lawns, sometimes with the nauseating come-on "auction today."

We're in the middle of a real-estate depression, folks, and it's not getting any better. Perhaps it's good news that the financial markets have gotten used to the bad news out of the housing market, because the bad news keeps coming strong.

But if the housing-market woes are an indication of the direction of the economy, we're in sorry shape. And as with a number of questions I've explored recently, it comes down to this: what, if anything, is the Obama administration going to do about it?

Yesterday, it was reported that foreclosures comprised 31% of housing sales in the second quarter, less than the 37% recorded at the peak two years ago, but still six times what you see in a healthy housing market, according to foreclosure-tracking firm RealtyTrac. The silver lining, if you can call it that, is that the percentage declined a bit from the previous quarter.

But, meanwhile, another bad housing number got worse. The percentage of "short sales" -- homes sold for less than what's owed on them -- climbed to 12% in the second quarter. And Bloomberg reported the other day that a third of the country's 800,000 foreclosed properties are owned by Fannie Mae, Freddie Mac and the Federal Housing Administration. In other words, Uncle Sam is now the biggest owner of misery-bedecked real state in the nation.

All these numbers have a kind of numbing effect on people. It's a bit like what motorists were seeing in upstate New York yesterday, as hundreds of miles of the New York State Thruway were closed because of not-quite-Hurricane Irene. You curse, and then you get out a map and plot out a detour, and then pull out your map again when the detour is blocked by downed power lines and flooding.

Forces greater than oneself are like that. But the housing crisis isn't exactly a force of nature, and that's what's frustrating about the Great Housing Depression of 2008-20??. It's understandable for you or I to be numbed by these horrendous housing numbers. But sometimes it seems as if Timothy Geithner and his colleagues in the Obama administration are like motorists driving around the fallen tree limbs but seem helpless to do anything about it.

The sorry fact is that record-low interest rates just aren't sufficient, in themselves, to bring people into the market. The horrid numbers we are seeing are evidence enough of that. So what's the answer? Well, one idea that seems reasonable enough is to extend to under-water property owners the same largesse that two consecutive administrations have bestowed upon the big banks. There's a plan reportedly under consideration that would push Fannie Mae and Freddie Mac to loosen their refinancing guidelines. That way, homeowners would be able to refinance even if their homes wouldn't otherwise qualify.

http://articles.businessinsider.com/201 ... tree-limbsJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Congressman Eli Crane says Biden administration is stonewalling...

04-24-2024, 05:07 AM in illegal immigration News Stories & Reports