Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

09-07-2010, 05:58 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Labor Day Insanity from Clinton's Secretary of Labor

Monday, September 06, 2010

Labor Day Insanity from Clinton's Secretary of Labor

It's Labor Day. The markets are closed. Those working for government, banks, schools etc have the day off. All totaled, 17.3 million citizens do not have a job today nor a job they can return to on Tuesday. Another 8.9 million will not work as many hours as they would like, this week, next week, or the week after that.

How NOT to End the Great Recession

In a New York Times Op-Ed, Robert B. Reich, a secretary of labor in the Clinton administration, and professor of public policy at the University of California, Berkeley comes to all the wrong conclusions about where we are, how we got here, and what to do about it.

Please consider How to End the Great Recession http://www.nytimes.com/2010/09/03/opini ... ted=1&_r=1

Reich: THIS promises to be the worst Labor Day in the memory of most Americans. Organized labor is down to about 7 percent of the private work force. Members of non-organized labor â most of the rest of us â are unemployed, underemployed or underwater.

Mish Comment: When organized labor is at 0%, both public and private, we will be on our way to prosperity. Organized labor in conjunction with piss poor management bankrupted GM and countless other manufacturing companies. Now, public unions, in cooperation with corrupt politicians have bankrupted countless cities and states.

Reich: The Labor Department reported on Friday that just 67,000 new private-sector jobs were created in August, while at least 125,000 are needed to keep up with the growth of the potential work force.

The national economy isnât escaping the gravitational pull of the Great Recession. None of the standard booster rockets are working: near-zero short-term interest rates from the Fed, almost record-low borrowing costs in the bond market, a giant stimulus package and tax credits for small businesses that hire the long-term unemployed have all failed to do enough.

Thatâs because the real problem has to do with the structure of the economy, not the business cycle. No booster rocket can work unless consumers are able, at some point, to keep the economy moving on their own. But consumers no longer have the purchasing power to buy the goods and services they produce as workers; for some time now, their means havenât kept up with what the growing economy could and should have been able to provide them.

Mish Comment: Consumers no longer have the purchasing power because of a number of factors.

1. Loose monetary policies at the Fed that encouraged asset speculation, including housing.

2. Rampant property price escalation (until the crash) and rampant property tax increases even though wages did not keep up.

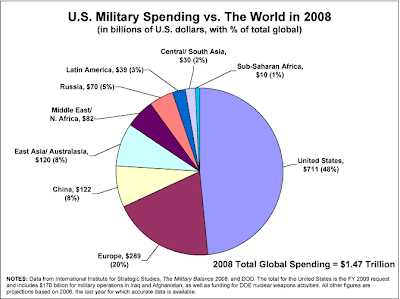

3. A sinking dollar because of inane amounts of government spending. The US has troops in 140 countries around the globe, and a military budget as nearly big as the rest of the world combined.

Quite literally we are spending ourselves to death, with absolutely nothing to show for it.

The above chart from The FY 2009 Pentagon Spending Request - Global Military Spending http://www.armscontrolcenter.org/policy ... st_global/

It's not what one makes that matters, it's how far the dollar goes. Our policies ensure the dollar does not go very far.

Reich: This crisis began decades ago when a new wave of technology â things like satellite communications, container ships, computers and eventually the Internet â made it cheaper for American employers to use low-wage labor abroad or labor-replacing software here at home than to continue paying the typical worker a middle-class wage. Even though the American economy kept growing, hourly wages flattened. The median male worker earns less today, adjusted for inflation, than he did 30 years ago.

Mish Comment: The crisis started when Congress perpetually spent more money than it took in, when social engineering and regulation made it undesirable to do business in the United States, when tax policy encouraged flight of jobs and capital. The internet was an enabler, it is not to blame.

Reich: Eventually, of course, the debt bubble burst â and with it, the last coping mechanism. Now weâre left to deal with the underlying problem that weâve avoided for decades. Even if nearly everyone was employed, the vast middle class still wouldnât have enough money to buy what the economy is capable of producing.

Mish Comment: The underlying problems still remain. Unfortunately Robert Reich is clueless about what the underlying problems are.

Reich: THE Great Depression and its aftermath demonstrate that there is only one way back to full recovery: through more widely shared prosperity. In the 1930s, the American economy was completely restructured. New Deal measures â Social Security, a 40-hour work week with time-and-a-half overtime, unemployment insurance, the right to form unions and bargain collectively, the minimum wage â leveled the playing field.

Mish Comment: Payment for the absurd policies of FDR are now coming due. Social Security is broke, there is no "lock box" demographics are unfavorable, and acts like Davis Bacon and collective bargaining have wrecked many cities and states.

When it comes to jobs creation, we need to get the most done for the cheapest amount and the way to do that is scrap the Davis-Bacon act. Please see Thoughts on the Davis Bacon Act for details. http://globaleconomicanalysis.blogspot. ... n-act.html

Socialists like Robert Reich point out alleged benefits of FDR's policies. The Fact of the matter is FDR's policies were extremely destructive.

The baby boom following WWII is what got the economy humming, not inept policies or unions. We recovered in spite of piss poor policies, not because of them. Indeed unions sewed the seeds of their own destruction which is exactly why only 7 percent of the private work force is unionized. We need to celebrate this fact, not bemoan it.

In the decades after World War II, legislation like the G.I. Bill, a vast expansion of public higher education and civil rights and voting rights laws further reduced economic inequality. Much of this was paid for with a 70 percent to 90 percent marginal income tax on the highest incomes. And as Americaâs middle class shared more of the economyâs gains, it was able to buy more of the goods and services the economy could provide. The result: rapid growth and more jobs.

By contrast, little has been done since 2008 to widen the circle of prosperity. Health-care reform is an important step forward but itâs not nearly enough.

Mish Comment: Once again Reich does not understand what it takes to create jobs in the real world. Reich lives in academia, insulated in his womb of academic theory, theories that anyone living in the real world can easily see are fatally flawed in today's world.

It would behoove Reich to read Small Business Trends - Yet Another Disaster http://globaleconomicanalysis.blogspot. ... other.html

From the NFIB ...

The expiration of the Bush tax program and the implementation of the health care bill represent the two largest tax increases in modern history. Add to that serious talk of a VAT and passing cap and trade. Nothing here to create optimism about the future for business owners or consumers. Top that off with government borrowing of $1.8 trillion last year and $1.5 trillion this year and on into the future, it is no surprise that owners are fearful and pessimistic.

Whatâs missing from the âdebateâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Durbin pushes voting rights for illegal aliens without public...

04-25-2024, 09:10 PM in Non-Citizen & illegal migrant voters