Results 1 to 5 of 5

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-02-2011, 07:34 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Poll: 73% Give Washington Thumbs Down in Debt Debacle

Newsmax/InsiderAdvantage Poll: 73% Give Washington Thumbs Down in Debt Debacle

Tuesday, 02 Aug 2011 12:10 PM

By Jim Meyers

Americans narrowly disapprove of the deficit reduction bill agreed upon in Washington on Monday, but they disapprove of Congressâ and President Obamaâs handling of the debt ceiling crisis by a wide margin, according to a Newsmax poll conducted by InsiderAdvantage.

The survey also found that House Speaker John Boehner gets the highest approval marks among prominent members of Congress who played key roles in the agreement.

In the poll of more than 1,500 registered voters, 44 percent of respondents said they approve of the legislation, but 47 percent donât like it, and the rest have no opinion.

Democrats are more likely than Republicans to approve of the bill: 51 percent of Democrats approve and 40 percent disapprove, while just 38 percent of Republicans approve and 51 percent disapprove. Among independents, 51 percent disapprove and 39 percent approve.

âThe poll results show that the nation is pretty well split,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-02-2011, 07:42 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Sen. Coburn on Debt Deal: 'Politicians Won, and America Lost'

Tuesday, 02 Aug 2011 08:49 AM

By Hiram Reisner

Sen. Tom Coburn says the debt-ceiling compromise might have been âgreat theaterâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-02-2011, 07:45 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

America didnt just lose; it got Body Slammed and the carcus was stomped repeatedly as they called you a terrorist

Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-02-2011, 07:46 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Dow Dives 265, Finishes Under 12,000

Dow Skids 2.2% to Below 12,000 on Economic Fear

Tuesday, 02 Aug 2011 03:51 PM

A sell-off erased this year's gains in the stock market Tuesday as investors grew increasingly concerned about the economy.

The Dow Jones Industrial Average lost 265.87 points, or 2.2 percent, to 11,866.62. The Dow has lost 858 points, or 6.7 percent, in the last eight trading days.

The Standard & Poor's 500 -- the benchmark for most U.S. mutual funds -- lost 2.6 percent and fell to its lowest point of the year. It is down 0.3 percent for the year and is off nearly 8 percent since reaching a high for the year of 1,363 on April 29.

A series of weak economic reports and poor earnings reports from several big companies spurred the decline.

The Commerce Department reported that consumers cut their spending in June for the first time in nearly two years. Analysts had predicted a slight increase. Incomes also rose by the smallest amount since September, reflecting a weak job market.

The report came one day after a weak manufacturing report. And on Friday the government said that in the first half of the year, the economy grew at its slowest pace since the recession ended in June 2009.

"The market is starting to wonder where the growth is going to come from," said Nick Kalivas, a vice president of financial research at MF Global. "It hasn't hit the panic button yet, but that's where we're drifting."

The S&P 500 lost 32.89 points, or 2.6 percent, to 1,254.05. It has fallen for seven straight days, losing 6.8 percent in that time. That's the S&P's longest string of losses since the height of the financial crisis in October 2008.

The Nasdaq composite fell 75.37, or 2.7 percent, to 2,669.24. And the Russell 2000, an index of smaller companies that many investors look to as a sign of market optimism about growth, fell 3.3 percent. It is now down 2.2 percent for the year.

All 30 Dow industrial stocks lost ground. General Electric Co., Pfizer Inc. and Home Depot Inc. led the index lower with losses of 4 percent or more. All but 13 of the 500 companies in the S&P index fell.

Archer Daniels Midland Co. dropped 6 percent after the agricultural conglomerate said it missed Wall Street's profit forecasts. High-end retailer Coach Inc. lost nearly 7 percent after the company said margins declined, cutting into profits. A pullback in spending could threaten profits at the company; it is making less from each purchase because of higher costs.

The yield on the 10-year Treasury fell to a low for the year of 2.61 percent from 2.75 percent Monday. Yields fall when bond prices rise. Gold, another asset investors buy when they're worried about the direction of the economy, gained 1.4 percent to $1,645 an ounce.

Even with the current streak of losses, the S&P and Dow are near the same levels as they were at the end of June. But some investors say that there's a strong likelihood both indexes will decline further this year because the economy is not as strong as they thought it was in June. At that time, investors still believed the economy was growing at a quicker pace.

And last year when the economy slowed sharply, the Federal Reserve began a bond-buying stimulus program, known as quantitative easing. That was credited with helping the U.S. economy avoid another recession.

Now, the Fed has indicated it does not have plans to implement another round of stimulus. And the new focus on deficit reduction in Washington makes it even less likely that more help could come, analysts said.

"With this debt debate going on, there is not an expectation for more fiscal or monetary stimulus and that's a real concern," said Jim Peters, the head of Tactical Allocation Group, a money manager in Michigan with $1.5 billion under management.

The S&P index fell through its long-term moving average, a measure that technical traders look at to determine whether the market is moving up or down longer term. Many investors use these averages as a sign of when to sell while they can still take some profits.

"The market broke through some pretty critical support levels," said Richard Ross, the global technical strategist at Auerbach Grayson, and dampened market optimism. He said that investors will wait for the market to settle before they buy again.

The S&P, down 8 percent since reaching its highs for the year on April 29, is more than half of the way towards a 10 percent drop that signals a market correction. A drop of more than 20 percent would put an end to the bull market that started in March of 2009.

In 2008, the S&P had a much steeper decline. Over eight straight days of declines, the index lost 22.9 percent when it closed on Oct. 8, 2008. It fell even further over the next six months. Since March 2009, the S&P is up 85 percent, not including dividends.

The consumer spending pullback was the latest indication that the U.S. economy may be slowing. Many economists, including Federal Reserve Chairman Ben Bernanke, have said the U.S. economy would gain momentum in the second half of the year as gas prices fall and Japan's factories recover from the earthquake disaster in March. Slow U.S. manufacturing growth, a weak job market and concerns about spending cuts in the debt deal have cast doubt on those predictions.

The growth of China's and India economies have also slowed recently after their respective central banks raised interest rates. American corporations have counted on increasing profits in China as a way to make up for slower revenue growth in the U.S. As a whole, companies in the S&P 500 index are expected to make nearly half of their profits overseas in 2011.

President Barack Obama signed a compromise bill Tuesday to raise the country's borrowing limit, hours ahead of a midnight deadline after which the U.S. government wouldn't have enough money to pay all its bills. The passage of the bill averted the possibility of a default on U.S. debt.

Four stocks fell for every one that rose on the New York Stock Exchange. Volume was higher than average at 5.3 billion shares.

http://www.moneynews.com/FinanceNews/Do ... /id/405833Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-04-2011, 09:20 AM #5working4changeGuest

Gallup Poll: Republican Base More Dissatisfied With Debt Cei

Gallup Poll: Republican Base More Dissatisfied With Debt Ceiling Deal Than Democratic Base

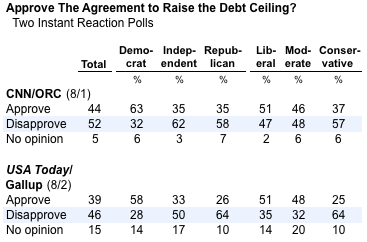

WASHINGTON -- A new USA Today/Gallup poll conducted Tuesday night finds that more Americans oppose (46 percent) than favor (39 percent) the debt ceiling agreement passed by Congress this week, largely confirming the results of a CNN/ORC survey conducted the day before. While both show a lack of enthusiasm about the deal across political lines, Republicans and conservatives express far more disapproval than do Democrats.

The two surveys provide a largely consistent picture of how attitudes about the agreement break down along party and ideological lines. According to the Gallup poll, a majority of Democrats (58 percent) and liberals (51 percent) approve of the deal, although significant minorities of both groups express disapproval (28 and 35 percent respectively). The results are reversed on the other side, with large majorities of Republicans (64 percent) and conservatives (64 percent) expressing disapproval. Although the CNN poll found fewer Americans with no opinion than the Gallup poll did, their results were similar by party and ideology.

Self-described independents are far more negative about the deal than Democrats, although less so according to the more recent Gallup poll (33 percent approve, 50 percent disapprove) than according to the prior night's CNN poll (35 percent approve, 62 percent disapprove).

Results from the Gallup poll suggest two sources for the negativity: First, only 20 percent of Americans describe the agreement as a "step forward" in addressing the federal debt, while 22 percent believe the agreement represents a "step backward" and 50 percent say it represents neither.

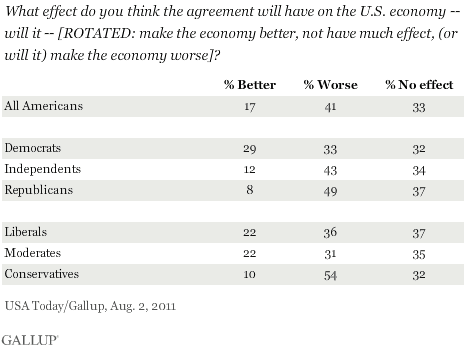

Second, and probably more important, even only 17 percent of Americans believe the agreement will help make the economy better, while 41 percent believe it will make the economy worse and 33 percent say it will make no difference.

Respondents were far less polarized on the question of economic impact than they were over whether or not they approved of the deal; all groups felt pessimistic about the deal's effect on the economy. More Democrats believe the deal will make the economy worse (33 percent) than better (29 percent). Nearly six times as many Republicans and conservatives, meanwhile, are negative about the deal's economic impact than are positive.

Although neither poll release examines the combination of party and ideology, the results imply that self-described liberals are more likely to disapprove of the deal than other Democrats. In the Gallup poll, for example, liberals were more likely to express disapproval (35 percent) than all Democrats (28 percent). Liberals were also less likely to say the deal would have a positive effect (22 percent) than all Democrats (29 percent).

Nevertheless, the biggest differences appear across party lines. While dismay has been evident among those in President Barack Obama's liberal base, the deal may provoke even more of an intra-party backlash against Republican lawmakers who supported it.

http://www.huffingtonpost.com/2011/08/0 ... 17660.html

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

JOE BIDEN WANTS TO BRING IN GAZA RESIDENTS AND GIVE THEM...

05-02-2024, 01:19 PM in Videos about Illegal Immigration, refugee programs, globalism, & socialism