Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

09-21-2009, 09:34 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

September 20 2009: Boy, is it ever broke

Sunday, September 20, 2009

September 20 2009: Boy, is it ever broke

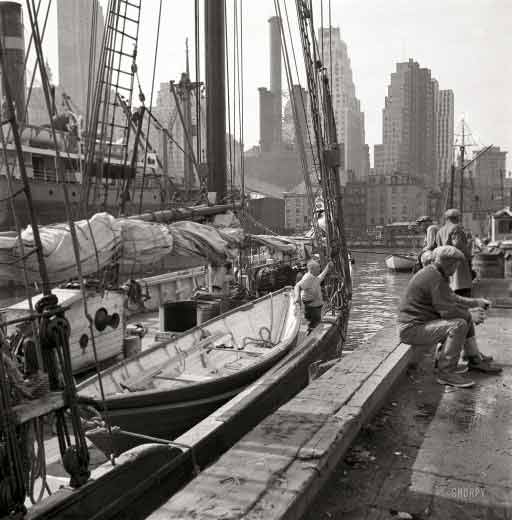

Samuel H. Gottscho Da dock of da bay April 20,1934

New York City, Pier in Brooklyn, view to Manhattan over East River

Ilargi: Bear is bull and bull is bear; hover through the fog and filthy air.

Shakespeare, Macbeth, sort of like

There's a theory that one way to tell when a market rally may end is to look at how many pessimists have turned optimist (it works in reverse as well). At the rallyâs peak, many will have turned that would never be expected to. Investor Jim Grant is seen as a real bear, and he's just turned bullish. Does that mean the really is over? Well, it's not that simple of course, it's just a theory after all, but it's getting interesting. And there's no doubt that markets often turn when just about everyone has started donning a party-hat first thing in the morning. The larger the herd is, the more it behaves like one.

Michael Panzner says this about Jim Grant's "rebirth", which sums up my reservations as well:

Jim Grant: Ringing the Bell at the Top?

* Aside from discounting the fact that there are aspects to the current unraveling that are historically unique and extraordinarily unsettling (e.g., total credit market debt relative to gross domestic product is well beyond anything this country has ever witnessed), Mr. Grant makes a number of curious assertions.

For one thing, he assumes that the current downturn is near its nadir, instead of a temporary floor built on a massive stimulus injection and a knee-jerk bout of inventory restocking. Among logicians, such an analytical approach might be described as "begging the question."

As you may have gathered by now, Iâm way behind the curve on this one. Iâm even still trying to figure out what on earth there is to be bullish about. Now, there is of course little or nothing rational about herd behavior. But those inside the herd will try to rationalize their way into their new-found position regardless, so let's see if we can reason ourselves into some sense of it all.

I think the main fault in the "bullpen" may be the assumption that a stock market rally somehow also means a recovery in the real economy. If such a recovery is not forthcoming, many would agree, a rally will necessarily be shortlived. So, once again, let's focus on that real economy, since that is where the key is, not in the stock markets, which can remain disconnected from it only for so long.

The main drivers of the real economy are consumers. They are running out of credit, and they are cutting their spending. Then again, some will argue that they can change their attitudes rapidly if circumstances warrant it. At this point in time, I would argue that the best indicators of the state of the economy are banks and houses. Please allow me to explain why and how.

We are moving towards a society where everybody owns an interest in everybody else's home through the government, interests that are moved through an opaque system of ever-changing agencies and semi-private enterprises that just about nobody to date has been asking any serious questions about. The myth of the grandeurs and benefits of home-ownership has been sold and advertised so well that by the time people figure out what a scheme it is, it will be too late.

Ask yourself this: if everybody owns a piece of all homes, wouldnât it be easier if they all just owned their own? There is one difference only, isn't there? In the present system, lenders, banks, middlemen, whatever you call them, get to rake in fees, commissions and interest rates, in essence simply for being redundant. And if home prices rise, it's the banks that profit, not the buyers. So theyâre not only redundant, there's much more going on. And that's where the government comes in.

The only way the scheme has been able to continue until now is through wide-spread government interference that guarantees elevated real estate prices. And the citizens have believed for decades that this is in their best interest, a scheme, supported by their own government, that guarantees that they can buy a home only at many times its real value. It is not, and never has been. And it's falling apart, fast. That is a good thing, even though it will hurt like hell.

U.S. "option" mortgages to explode, officials warn

* The federal government and states are girding themselves for the next foreclosure crisis in the country's housing downturn: payment option adjustable rate mortgages that are beginning to reset. "Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said [..] "That's the next round of potential foreclosures in our country" [..]

* Option-ARMs are now considered among the riskiest offered during the recent housing boom and have left many borrowers owing more than their homes are worth. These "underwater" mortgages have been a driving force behind rising defaults and mounting foreclosures.

* In Arizona, 128,000 of those mortgages will reset over the the next year and many have started to adjust this month, the state's attorney general, Terry Goddard, told Reuters after the meeting. "It's the other shoe," he said. "I can't say it's waiting to drop. It's dropping now."

Still, before the final curtain, much more blood and water will flow under all of America's bridges. People used to lavish sums of money for nothing are not known for easily giving up their golden geese. As Fannie Mae and Freddie Mac have become over-indebted liabilities, understudies Ginnie Mae and the FHA have come to fill in as the protagonists. The FHA announced last week that its reserves are now below 2% of its obligations. In other words, another government agency leveraged over 50:1. And another inevitable candidate for a bail-out.

The Bill Comes Due, Vexing Housing and Banking Agencies

* A year ago, as the financial system was threatening to collapse, federal regulators offered all sorts of assistance to ward off catastrophe. The strategy worked, at least so far, but the bill is starting to come due. The Federal Housing Administration, which is supporting the housing market by insuring loans for millions of struggling buyers, said Friday that its cash reserves had fallen below 2 percent for the first time. Raising its insurance premiums would replenish the reserves, but could also hamper the housing recovery. Another unpleasant option: asking for a federal bailout.

I don't see a way to stop this, wrong as it may be. The government -yes, that means you- has trillions of dollars at stake in the real estate market, and it looks like it's just getting started, itâs now in 90% of the new loans. Which makes me think of what Meredith Whitney said 10 days ago:

Home Prices Could Fall by Another 25%

* Home prices in the US could fall by another 25 percent because of high unemployment and another leg down will come for stocks, banking analyst Meredith Whitney told CNBC Thursday.

* "No bank underwrote a loan with 10 percent unemployment on the horizon," [..] "I think there is no doubt that home prices will go down dramatically from here, it's just a question of when." Local governments and states are chronically under-funded and "most states are under water," adding to the problem of low private consumption [..]

* "If you look at the drivers for unemployment I don't see that reversing very soon," Whitney said. If consumers were to decide to spend, "that would be a game-changer, but it would be an unnatural thing to do in a recession. A lot of themes are constant, which is the US consumer and the small business don't have any credit, credit is still contracting,"

Now, I have long said that home prices will fall 80% or more, but that, even after the 30%+ drop we've already seen as per Case/Shiller, still remains too much of a left field fly-ball for most. Perhaps they'll listen to Meredith?

Thing is, no matter who you do or don't listen to, if domestic real estate prices do plunge 25% more, itâs sort of all bets are off. For that would -make that will- break a million straws on a million camelsâ backs. All the public funding, through direct subsidies and indirect guarantees, hasn't been able to halt the downfall until today. With a widely acknowledged pattern of millions more foreclosures and millions more unemployables, the chance of halting it approaches zero. Which means the government, -and again, that means you- is set for trillions of dollars in additional losses.

It means millions more foreclosures. It means as many as 75% of mortgagees will be underwater on their loans. Hence this headline:

Homeowners who 'strategically default' on loans a growing problem

It means a situation that can no longer be "solved" by trying to hide our sore and battered lives and asses from reality. It means Jim Grant and his newfangled bully buddies are painfully wrong. It also means that hundreds of banks that acted as lenders are beyond salvation. Which brings us to the FDIC, which, it just so happens, is set to prove everyone wrong who's claimed it was bankrupt, by drawing on either of two direct lines with the Treasury, one for $100 billion, another for $500 billion. There is a problem here though: the Treasury doesn't have that kind of money. It will have to borrow it from you. You who are already about to lose trillions through the government mortgage guarantee schemes.

There's another problem too: the FDIC closed two small banks on Friday, while an unofficial Problem Bank List which Calculated Risk publishes, added 17 banks last week, and removed 5, 3 through failure. The 436 banks presently on the list have $294 billion in assets. The FDIC has less than $10 billion to insure those assets, and the trillions more in deposits in the hands of banks which are not yet, but soon will be, "challenged".

In the end, you'll wind up paying for the costs of insuring your own deposits. Deposits which don't even exist anymore other than in a digital database that can be wiped clean in microseconds; your bank gambled them away in search of profits and bonuses.

One such bank, one of the most troubled and one of the biggest at the same time, is Wells Fargo. The perfect, albeit not exactly shining, example of what is going on and going wrong. Or, more accurately, what went so wrong in the past that the consequences can no longer be hidden in the present.

Wells Fargoâs Commercial Portfolio is a Ticking Time Bomb

* [..] the bank has hired help from outside experts to pour over the books⦠and they are shocked with what they are seeing. Not only do the bankâs outstanding commercial loans collectively exceed the property values to which they are attached, but derivative trades leftover from its acquisition of Wachovia are creating another set of problems for the already beleaguered San Francisco-based megabank, Wachovia, which Wells purchased last fall as it teetered on the brink of collapse, was so desperate to increase revenue in the last few years of its existence that it underwrote loans with shoddy standards and paid off traders to take them off their books.

* [..] Wachovia promised to pay the buyerâs risk premium by writing credit default swap contracts against these subordinate bonds.

* [..] The real question is, however, was enough disclosed to investors about this practice when Wells purchased Wachovia? One top hedge fund manager who has experience in outing accounting fraud told Bank-Implode "They needed to estimate that CDS liability upon the purchase of Wachovia. If they didnât, theyâve committed fraud."

The author then makes a weird mistake, one that is becoming common, Richard Mogambo Daughty did it too. That doesn't make it any less ugly and potentially damaging to one's credibility, though.

* [..] Harry Markopolos, the whistleblower on Bernie Madoff, gave a speech this summer at the Greek Orthodox Church in Southampton predicting more major scandals will soon be revealed about the unregulated, $600 trillion, credit default swap market. Ouch!

There are "only" some $60 trillion in CDS. The $600 trillion is more likely to represent all remaining outstanding derivatives. A 90% mistake? Ouch, indeed.

* [..] Wachoviaâs third quarter 2008 filings, which reflect their assets three days before Wells Fargo agreed to the acquisition, shows the bank held a whopping $230 billion in its commercial loan portfolio.

* [..] [Wells Fargoâs] Construction and Development portfolio, with $38.2 billion in loans, is defaulting at a level eight times greater than the rest of the nationâs banks

* According to Meredith Whitney, founder and CEO of Meredith Whiney Advisory Group, Wells is working an accounting game of "extend and pretend." "If the bank doesnât change a maturity date, then it does not have to take an impairment charge on its books, which would affect earnings," says Whitney. If the loans donât look like they are impaired, the rating agencies then do not have to downgrade the billions of CMBS that Wachovia sold to other banks and investors.

* Adds Whitney "Weâve seen Wells Fargo play modification games with its own loans. Why wouldnât they do it with the loans they took on from Wachovia?"

And there's more on Wells Fargo, none of it very pleasant.

Bove: Wells Fargo Sitting On A Volcano About To Explode http://www.businessinsider.com/bove-wel ... ode-2009-9

* Richard Bove says the gap between management views of the company and shareholders may be growing and he outlines a set of reasons that could lead one to believe Wells is either delusional or trying to do its best to postpone the inevitable.

* The most troublesome point is the bankâs "questionable" loans and securities, which seem like a ticking time bomb. Bove says that outsiders are convinced that the bank is understating its loan problems in the home equity, commercial real estate, and credit card arenas. Bove adds that there are significant issues being raised concerning the bankâs valuation techniques in its derivatives portfolio and its accounting in these areas.

There is constant argumentation over the bankâs methodologies in valuing its mortgage servicing portfolio. Additionally, a number of state attorney generals are unhappy with certain of the bankâs mortgage sales practices.

* Then, regarding the bankâs balance sheet, he says that Wells may be forced by the imposition of Basel II accounting rules to add hundreds of billions in assets to it [..]

These problems could make Wells Fargo a giant headache for the FDIC, unless the Treasury itself jumps in with a bail-out.

Wells Fargo's total assets? $1.284 trillion. Yours to guarantee, swallow, take your pick. Wells is WAY too big to fail. It's also WAY too big to survive on its own. Bail-out it is.

You ever think there's any chance guys like Jim Grant change teams just because it all looks so much easier from that side of the turf? Extend and pretend till nature calls?

Oh, before I forget: There's also a whole bunch of major US companies about to go bellytittling upwards. No more Sprint calls, no more AMD (go all the way, Intel!!), Goodyear (make that "not"), and what have Macy's and CBS ever done for you anyway? Donât think of them as losses. Think positive.

Thereâs a world full of opportunities out there. And boy, is it ever broke.

Audit Integrity Announces Results of Corporate Bankruptcy Study; Identifies Companies Most Likely to Declare Bankruptcy http://www.reuters.com/article/pressRel ... BW20090916

In response to amplified concern in the market for risk related to corporate insolvency, Audit Integrity, an independent financial research and risk modeling firm, today released the results of its bankruptcy model research and has identified 20 corporations, with $1 billion or more in market capitalization, that have the highest probability of declaring bankruptcy in the next twelve months.

According to the U.S. Bankruptcy Courts, the number of business bankruptcy filings during the first six months of the year rose 64 percent over the first half results in 2008. With the increased incidence of company failures, corporate stakeholders such as insurance companies, auditing professionals, procurement executives and regulators, find corporate survival to be a critical risk issue.

Current approaches to determining bankruptcy risk generally fail to react quickly to changes to the economic environment, and do not factor in the potential for corporate fraud. By incorporating these risk factors into the Audit Integrity Business Risk Model, this new approach has been found to greatly improve the identification of companies at risk of bankruptcy. Against the most widely used bankruptcy model, the Altman Z-Score, the Audit Integrity bankruptcy Risk Model results have been more than 20 percentage points higher in predicting bankruptcy.

The results from Audit Integrity`s bankruptcy research indicate that the media and transportation industries are especially vulnerable. Of the over 2,500 U.S. corporations receiving bankruptcy risk scores from Audit Integrity, TV and Publishing companies were found to be over four times as risky as other companies, while automobile and airline industries were just slightly less risky.

The findings suggest that fraudulent accounting and poor governance impact bankruptcy risk in addition to more generally accepted factors such as measures of liquidity, leverage and profitability.

"Evidence shows that bankruptcy filings tend to lag after an economic downturn so its extremely important that investors and those concerned with the risks around corporate failure mitigate their exposure to companies likely to collapse," said Jack Zwingli, CEO of Audit Integrity. "Market volatility and sudden downturns such as we have been experiencing must be factored into bankruptcy risk. Fraud also plays a part, especially when companies are faced with survival decisions. These are the toughest companies to identify because, on paper, they appear solvent. Our model uncovers the underlying fraud that can be behind seemingly healthy financial statements."

Audit Integrity has identified the following companies that have the highest probability of declaring bankruptcy among publicly traded firms with more than $1 billion market capitalizations:

* Advanced Micro Devices, Inc.

* Amkor Technology, Inc.

* AMR Corporation

* Apartment Investment and Management Co.

* CBS Corporation

* Continental Airlines, Inc.

* Federal-Mogul Corporation

* Hertz Global Holdings, Inc.

* Interpublic Group of Companies, Inc.

* Las Vegas Sands Corp.

* Liberty Media Corporation (Capital)

* Macy's, Inc.

* Mylan Inc.

* Oshkosh Corporation

* Redwood Trust, Inc.

* Rite Aid Corporation

* Sirius XM Radio Inc.

* Sprint Nextel Corporation

* Textron Inc.

* The Goodyear Tire & Rubber Company

10 Big Companies That Are Veering Toward Bankruptcy http://www.businessinsider.com/10-house ... tcy-2009-9

Despite a few green shoots in the economy and a rocketing stock market, many large companies are still struggling to avoid bankruptcy. A new report by Audit Integrity identifies some high-profile names "that have the highest probability of declaring bankruptcy among publicly traded firms."

Which companies appear the worst off? We took the list and removed any company with a market cap under $3 billion. We then ranked the remaining names by a simple measure of the market's perceived bankruptcy risk - Market Cap (MC) divided by Enterprise Value (EV). The less MC vs. EV, the less residual shareholders' value (above what debt holders can claim) the market is pricing-in for the company. Thus a lower MC/EV means the market thinks the company is more likely to go bankrupt.

Hertz

When you have tons of debt financing your fleet of cars, falling rental demand really hurts. While the company raised new capital in May for some breathing room, Fitch and Moodyâs actually cut their ratings for the company in July. Ignoring the downgrade, shares kept rallying and are now at over five times the March $2 low. Best of luck.

Market Cap (MC)/Enterprise Value (EV) = 32%

Textron

What a crappy time to be selling business jets. Textron wrote down $2.3 in its backlog this year after it cancelled a new jet design, and demand for its other aircraft-related offerings has plummeted. Shareholders may be heartened by the companyâs ability to push back some debt maturities lately, but deteriorating credit quality at the companyâs leasing arm makes the outlook uncertain at best.

MC/EV=39%

Sprint Nextel

Sprint Nextel is bleeding customers, and could lose as many as 4.4 million net post-paid subscribers this year. This is a huge problem when you have large amounts of maturing debt over the next few years. A recent Deutsche Telekom acquisition rumor offered some hope, but that appears to have faded. Facing a difficult road ahead on its own, the company better keep its lawyers on speed-dial.

MC/EV=41%

Macy's

Does anyone even shop at department stores anymore?Same store sales will likely keep falling at Macyâs right through 2009. With $2.4 billion of maturing debt over the next five years, the company is trying to cut costs, and has already reduced its dividend. Hopefully the US consumer will bounce back soon, and actually want to shop at Macy's.

MC/EV=47%

Mylan

In a classic case of management empire building, Mylan overpaid big time when it bought Merckâs generic business back in 2007 and is now stuck with $5 billion of long-term debt as a result. From 2007 â 2008, the company lost over $1.3 billion very much due to goodwill write-downs. While the company could earn $300 million this year, theyâll have to earn far more than that in the future to make their debt manageable.

MC/EV=51%

Goodyear

Demand for Goodyear tires has sunk, and the company is saddled with massive debt and pension obligations. It doesnât help that The United Steelworkers union prevents the company from proper cost control by forcing factories to stay open. Shareholders have to wonder how much value will be left of the company after bondholders and the union members have their way.

MC/EV=53%

CBS

Weak advertising and falling license fees have sent CBS's earnings off a cliff in 2009. If they remain depressed for too long, the company could have trouble refinancing $3.2 billion of debt coming due over the next five years. It will really come down to whether or not CBSâs earnings collapse is merely cyclical, or the result of structural trend whereby traditional TV is dying. As a business blog, we can't help but feel partly guilty here.

MC/EV=55%

Advanced Micro Devices

When will AMD actually make money again? The question is becoming more important by the day since it carries over $5 billion in long-term debt. After losing almost $3 billion from 2007 â 2008, analysts expect the company to lose more money in 2009 and 2010. While the shares rallied from their February $2 low, they still appear stuck in a long-term down trend from $40 highs way back in 2006.

MC/EV=55%

Las Vegas Sands

Las Vegas Sands over-expanded and over-levered in the last few years and now has over $10 billion in debt to deal with. Despite jumping 13 times from their March low, Las Vegas Sands shares still face an uphill battle. Conditions in Las Vegas are horrible, Asian expansion isnât enough, and if this lasts too long then LVS will end up in bankruptcy court looking like it bit off more than it can chew.

MC/EV=60%

Interpublic Group

As one of the largest advertising and marketing companies in the world, IPG was slammed by the global recession. As the companyâs CEO said during recent second quarter results, the downturn âis proving steeper and more lasting than expectedâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Red State Slapped With Lawsuit Over Law Allowing Officials To...

05-10-2024, 08:39 AM in illegal immigration News Stories & Reports