Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-09-2011, 10:29 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Cisco Misses Estimates, Warns of Dwindling Public Spending

Wednesday, February 09, 2011 8:17 PM

Cisco Misses Estimates, Warns of Dwindling Public Spending; CEO Chambers Not Worth a Cent; Lather, Rinse, Repeat

I do not often comment on individual stocks, especially technology stocks. However, I want to point out a couple of things that I have been saying for quite some time that came up in Cisco's second-quarter results announced this evening.

1.Margin compression will start affecting corporate earnings.

2.Cutbacks at state and local governments will have a bigger impact than most think.

Cisco managed to tie those two themes together. CEO John Chambers blamed the public sector for a miss on profits and competition for a miss on margins. Please consider Cisco spooks Street again with weak outlook, margins http://news.yahoo.com/s/nm/20110210/bs_nm/us_cisco

Network equipment maker Cisco Systems Inc's CEO John Chambers spooked investors for the third time in as many quarters, warning of dwindling public spending and weaker margins from tough competition.

Chambers upset investors last August with a warning of "unusual uncertainty," and followed up last quarter with a weaker-than-expected outlook that he blamed on weak orders from debt-burdened government agencies.

He offered no relief this quarter.

"Unfortunately, we believe that our concerns in the public sector will continue to be challenging in the developed world for the next several quarters," he said, adding that Cisco's government accounts in the United States, Europe and Japan had all been hit in the fiscal second quarter.

"The challenges at state, local, and eventually federal level in our opinion will worsen over the next several quarters," he said of the U.S. market.

Cisco's second-quarter gross margin fell to 62.4 percent from 64.3 percent in the previous quarter, raising analysts' concerns that growing competition may be forcing the company to cut prices to protect market share.

The company forecast margins to be around 62 to 63 percent for the rest of the fiscal year, which ends in July.

Cisco also let down investors with a third-quarter outlook of earnings excluding items of 35 cents to 38 cents per share, below Wall Street expectations for 40 cents. And it said sales growth for the full year would likely be at the mid- to low-end of a previous 9 to 12 percent outlook.

Analysts said the outlook and low margins, a signal it may be cutting prices in response to tough pressure from competitors like Hewlett-Packard Co, overshadowed stronger-than-expected results for the second quarter.

"I think that's a way to cover up that they are facing competition in their more mature business lines and that they are most likely going to use price as a weapon to hold market share, and this is going to pressure earnings and margins," said Channing Smith, managing director and co-manager of Capital Advisors.

Cisco and HP used to be resale partners, but turned rivals after Cisco in 2009 unveiled plans to enter HP's territory of data center servers. HP in turn challenged Cisco by buying network equipment maker 3Com for around $3 billion.

Both sides have lately been raising the stakes with discounts, zero-interest leasing and pay-later schemes.

"We believe long-term investors should ride out the storm. If your time-frame is longer than the next six months, we believe Cisco's growth opportunities rival that of Apple and Google," said Smith.

Growth at What Price?

Channing Smith's idea that Cisco's growth rivals Apple or Google seems rather preposterous. Regardless, the important question is "How much you want to pay for the growth at Apple or Google, vs. Cisco?"

I suppose one can make a case many ways on that, but it is important to phrase the issue properly.

John Chambers 2010 Stock Sales

Inquiring minds just may be interested in Cisco Insider Sales. Here are the transactions for John Chambers alone. http://finance.yahoo.com/q/it?s=csco

â¢Sep 16, 2010 285,000 Acquisition (Non Open Market) at $0 per share.

â¢Aug 18, 2010 243,178 Automatic Sale at $22.50 per share - $5,471,505

â¢May 18, 2010 22,273 Automatic Sale at $25 per share $556,825

â¢May 17, 2010 1,000,000 Option Exercise at $16.01 per share.

â¢May 17, 2010 1,250,000 Automatic Sale at $24.61 per share - $30,762,500

â¢Mar 05, 2010 1,800,000 Option Exercise at $16.01 - $20.53 per share.

â¢Mar 05, 2010 1,800,000 Automatic Sale at $25 per share - $45,000,000

â¢Feb 08, 2010 2,000,000 Option Exercise at $18.57 per share.

â¢Feb 08, 2010 2,000,000 Automatic Sale at $23.73 per share - $52,206,000

Lather, Rinse, Repeat

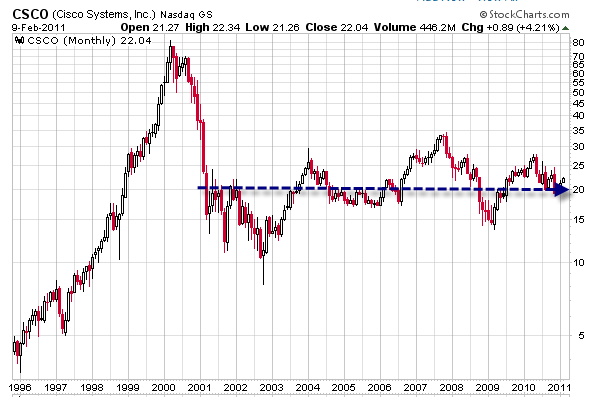

Cisco Monthly Chart

Chambers has not done a damn thing for shareholders for 10 years, cashing out hundreds of millions of dollars along the way. From the perspective of a shareholder of a publicly traded company, Chambers is not worth a damn cent.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

http://globaleconomicanalysis.blogspot. ... ns-of.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-09-2011, 10:38 PM #2Banned

- Join Date

- Nov 2009

- Posts

- 4,714

Nice chart Sapper7.... Good article...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Panama Elects New President Who Vows To Shut Migrant Trail,...

05-06-2024, 08:14 PM in illegal immigration News Stories & Reports