Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-26-2010, 10:09 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Spain, Portugal Deny Bailout: China Adviser US Sell Gold

Friday, November 26, 2010 11:55 AM

Spain, Portugal Deny Need for Bailouts; Swaps Soar on âSacrosanctâ Senior Europe Debt; Bank of China Adviser Tell US to Sell Gold

Not that anyone can possibly believe these stories, but Spain's Prime minister says "says no chance Spain will need bailout".

In other humorous news on this Black Friday, Portugal denies the need for a bailout, and the always late S&P drops Anglo Irish Bank six notches to a junk-bond B grade.

Topping off the humorous news stories of the day, an adviser for the PBOC tells the US to sell gold to balance its budget.

Spain "Absolutely" Rules Out Bailout

Spain's Prime Minister says says no chance Spain will need bailout http://finance.yahoo.com/news/PM-Zapate ... 5.html?x=0

Prime Minister Jose Luis Rodriguez Zapatero said Friday there was no chance Spain would seek a bailout. Asked in an interview on Spain's RAC 1 radio if he ruled out financial help from the European Union, Zapatero said "absolutely."

The markets were not convinced, however. The yield on Spain's 10-year bonds rose to nearly 5.2 percent Friday. Germany's 10-year bonds, a benchmark of lending safety, stood at 2.7 percent, bringing the spread against the Spanish bonds to 249 basis points, among its highest since the euro was introduced in 2002.

Portugal Denies Bailout Talk

The odds Portugal is not in some kind of discussion with the EU regarding bailouts seems rather slim, yet Portugal Denies Bailout Talk http://www.marketwatch.com/story/portug ... =rss&rss=1

The epicenter of Europeâs sovereign-debt crisis shifted from Ireland to the Iberian peninsula on Friday, with European Union, Portuguese and Spanish officials scrambling to head off speculation that Lisbon or Madrid could soon be forced to seek help to meet their borrowing needs.

A spokesman for the Portuguese government said a report in the Financial Times Deutschland newspaper -- that Lisbon was under pressure from the European Central Bank and a majority of euro-zone countries to seek a bailout in order to ease pressure on Spain -- was âtotally false,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-26-2010, 10:16 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Friday, November 26, 2010 9:58 AM

Merkel's Dilemma; Eurozone Borrowing Costs Hit Record; Expect Sovereign Defaults

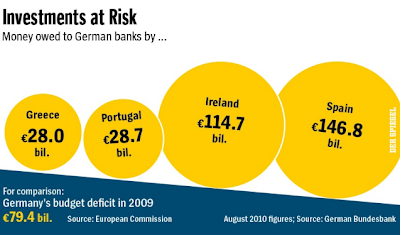

The Spiegel Online shows the severe problem facing facing Germany in terms of investments at risk, the enormous amount of money owed German banks by the PIGS (Portugal, Ireland, Greece, and Spain).

Please consider Merkel's Dilemma, Chancellor Faces Tough Sell on Irish Bailout http://www.spiegel.de/international/ger ... 78,00.html

For the second time in just a few months, Angela Merkel will have to explain to voters why Germany must bail out a fellow euro-zone member state. Skepticism is growing -- amongst voters, in the media and within her party. Many want to see Dublin raise its low corporate tax.

Germany will be the largest guarantor of the bonds that the European Union rescue fund, which was set up in the spring, will likely issue to borrow money to help stabilize Ireland. Unofficially, there is talk of guarantees worth an estimated â¬90 billion ($122 billion), with Germany's share possibly amounting to around â¬25 billion.

In order to secure popular acceptance for a bailout, Merkel and her colleagues want to put pressure on Dublin to implement a tough reform program that would also address the issue of government revenues. Ireland's low rate of corporate tax, which is just 12.5 percent, has attracted many companies to the country. For the time being, the German government has not revealed what it wants from Dublin in terms of concrete demands.

But many people in Merkel's conservative-liberal coalition want Ireland to raise its tax rate. "It is unacceptable that countries such as Ireland poached companies in Europe through low tax rates only to rely on aid from other countries during a crisis," said Michael Fuchs, a CDU expert on small- and medium-sized enterprises. Ireland must take action on both spending and revenues and aim for a "European level" for its corporate tax rate, Fuchs told SPIEGEL ONLINE.

Misplaced Blame on Ireland's Corporate Tax Structure

Note the repeated blame placed on Ireland's corporate tax structure.

The blame really should be placed on German banks stupid enough to fund Ireland's property bubble.

Investments at Risk

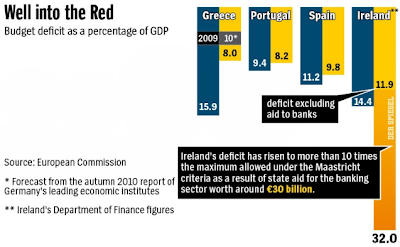

Ireland's Budget Deficit 10 Times Maximum Allowed Under Maastricht Treaty

There is much more in that Spiegel Online column, please give it a look.

In what way is Ireland responsible for that debt structure? Did Ireland put a bazooka to Germany's head demanding those loans?

If not, and the answer is "not", then why should either German citizens or Ireland's citizens have to pay for a bailout of Ireland?

German, UK, and US holders of Irish debt (banks) should have to (and will have to) take a big haircut on that debt. It's as simple as that.

Eurozone Borrowing Costs Hit Record

One look at the above is all you need to understand to figure out this would happen: Eurozone borrowing costs hit record http://www.ft.com/cms/s/0/d0976a74-f8ca ... z16NeWD5t7

Irish, Portuguese and Spanish bond yields surged to their highest points since the launch of the euro, as traders said even some of the bigger eurozone countries could soon be affected. Matt King, global head of credit strategy at Citi, said the danger was the selling could develop a momentum of its own.

Myles Clarke at RBS said: âSome people want to put on a just-in-case euro break-up trade and theyâre looking for any way to do this. You canât do trades in any size in the stressed peripherals like Ireland or Spain, so people are looking for what else might work.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

IT'S AN INVASION BY AIR, LAND AND SEA - SEAL'S as in Seal Team 6

05-13-2024, 05:25 PM in Videos about Illegal Immigration, refugee programs, globalism, & socialism