Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-20-2016, 04:46 PM #1

A third of cash is owned by 5 U.S. companies

A third of cash is owned by 5 U.S. companies

Matt Krantz, USA TODAY

10:52 a.m. MST May 20, 2016

(Photo: Mark Wilson, Getty Images)

The rising cash holdings of U.S. corporations is increasingly in the hands of a few U.S. companies, with just five tech firms having grabbed a third of it. And nearly three-quarters of cash held by non-financial U.S. companies is stashed overseas, outside the long arm of Uncle Sam.

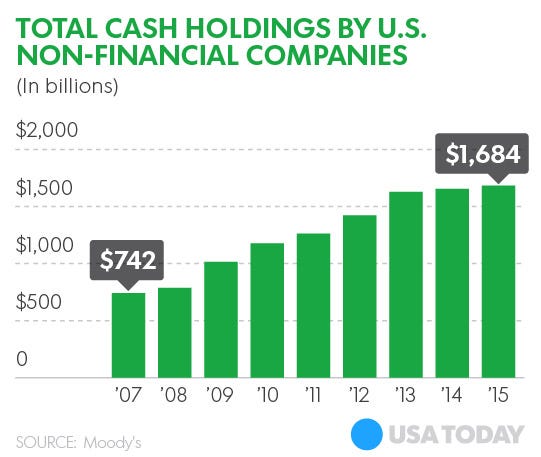

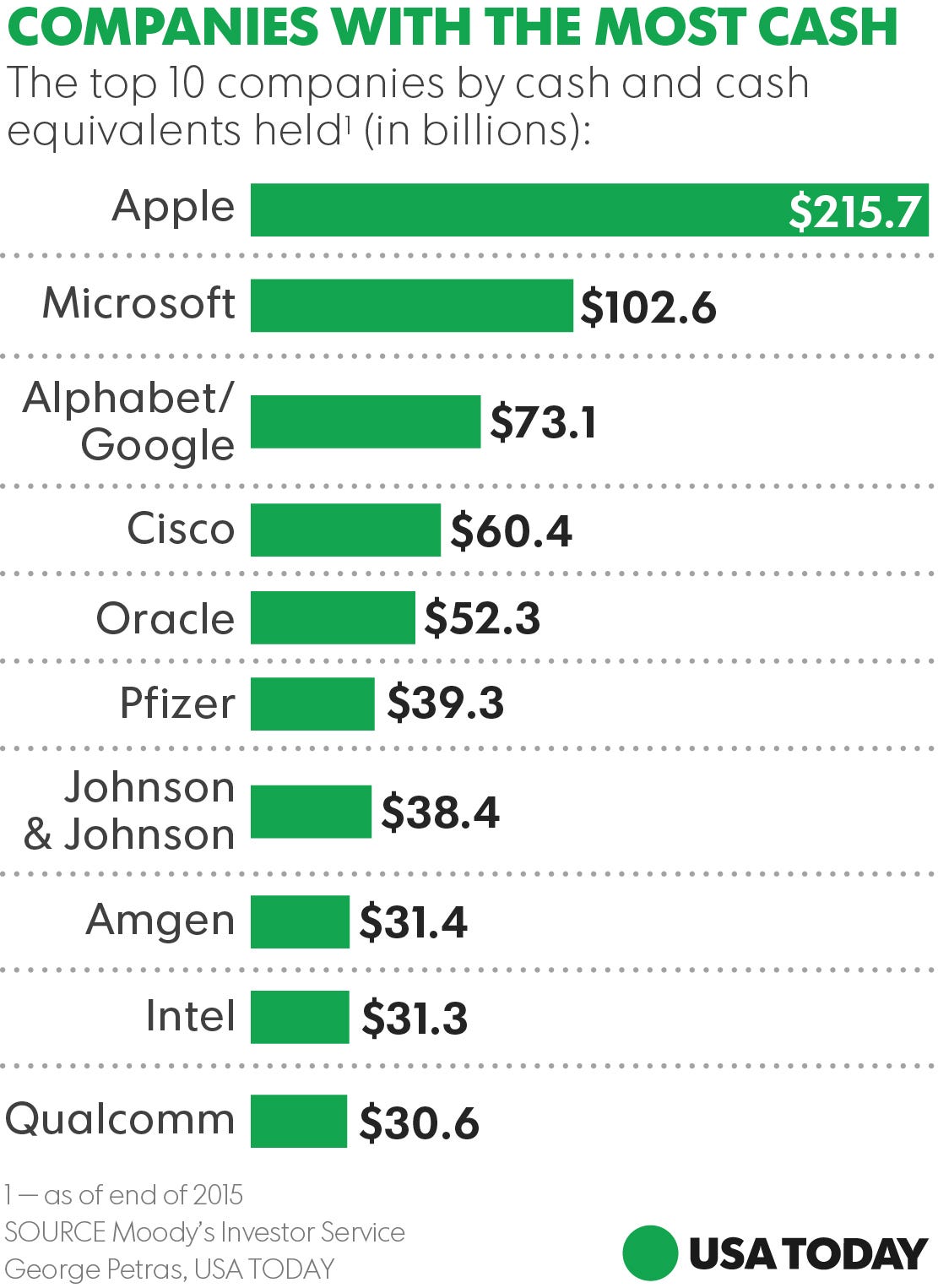

Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Cisco Systems (CSCO) and Oracle (ORCL) are sitting on $504 billion, or 30%, of the $1.7 trillion in cash and cash equivalents held by U.S. non-financial companies in 2015, according to an analysis released Friday by ratings agency Moody's Investors Service. That's even more cash concentration than in previous years, as these five companies held 27% of cash in 2014 and 25% in 2013. Apple alone is holding more cash and investments than eight of the 10 entire industry sectors.

Corporate America's rising pile of cash is becoming increasingly important to investors as profit growth and the stock market stalls. The amount of cash held by U.S. companies rose 1.8% in 2015. Unfortunately for U.S. investors, 72% of total cash held by all non-financial U.S. companies is stockpiled outside the U.S., up from 64% in 2014 and 58% in 2013, as companies try to avoid paying U.S. tax rates.

Investors are eyeing companies' growing cash piles as potential sources of dividend increases to maintain fat returns even if stock prices continue to go nowhere. Dividends rose 4% last year to a record high of $404 billion, while companies cut back on capital spending by 3% to $885 billion. Capital spending is the cash companies put into new plants and equipment with the hopes of driving higher profits in the future.

Companies have also been pulling back from using cash to buy back their own stock. That is a maneuver that can reduce a company's number of shares outstanding and in theory should make each share more valuable. Stock buybacks, net of new stock issuance, fell 7% to $269 billion in 2015.

Apple shows the strong disconnect between big cash balances and stock returns. The company is sitting on more cash than any other, yet investors have lost $240 billion in paper profits since the stock peaked.

There's only so much companies can do with their giant wads of cash since a vast majority isn't in the U.S. U.S. non-financial companies have $1.2 trillion in cash outside the U.S., up from $1.1 trillion in 2014 and $947 billion in 2013. Moody's thinks the cash stored overseas will only grow.

Some of the biggest holders of cash are also the same companies with much of their cash outside the U.S. Apple, Microsoft, Cisco, Alphabet and Oracle have $441 billion saved overseas, or 87% of their total cash.

T

Don't expect that cash to come home anytime soon, Moody's says.

"We expect that overseas cash balances will continue to grow unless tax laws are changed to encourage companies to repatriate money," the Moody's report says. "There has been little progress toward corporate tax reform that would incentivize U.S. companies to permanently repatriate funds held overseas."

TOP FIVE CASH HOARDERS PILE UP OVERSEAS*

Company, 2014 % cash offshore, 2015 % cash offshore

Apple, 88%, 93%

Microsoft, 91%, 94%

Cisco, 94%, 94%

Alphabet, 60%, 59%

Oracle, 90%, 87%

Source: Moody's Investors Service

*as of 2015

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

05-20-2016, 05:55 PM #2Senior Member

- Join Date

- Jan 2012

- Posts

- 4,815

Intel Lays Off 12,000 After Seeking Visas to Import 14,523 Foreign Professionals Since 2010

Reuters

Reuters

by Warner Todd Huston21 Apr 2016

Technology giant Intel announced April 19 it will fire 12,000 skilled U.S.-based professionals — after already swelling its workforce with 14,523 requests in Washington D.C. since 2010 for visas to import foreign professionals through the controversial H-1B and Green Card programs.

The company said the layoffs were part of a restructuring plan to help shift its focus from desktop PCs to mobile devices. But the company is very profitable, and first-quarter 2016 profits were 14 percent above predictions.

Amid the layoffs, Intel is one of the nation’s largest users of the H-1B outsourcing program which allows companies such as Disney and Abbot Laboratories to replace white-collar American professionals with cheaper professionals from India, China, and other countries.

Intel has insisted that it cannot find enough skilled American workers to fill its needs. From 2010 to 2015, it filed requests for up to 8,351 H-1B visas, plus 5,172 applications for permanent Green Cards for its foreign employees, according to MyVisasJobs.com. That data shows the company sought to hire 14,523 foreign professionals instead of many Americans eager to work at Intel.

The MyVisaJobs.com site, which presents data prepared by government agencies, also shows that the company even sought work visas for 445 people who arrived in the country as students carrying F-1 visas.

The number of foreign professionals hired is uncertain. However, the MyVisaJobs.com data shows that 2,654 Green Card requests were approved in the five years between 2015 and 2011. Also many of the H-1B requests were made when the economy was stalled, and so many were likely granted. If one-third of its H-1B visa-requests were granted, then Intel was able to hire 3,000 H-1B workers from 2010 to 2015.

Intel’s press aides declined to respond to calls and emails from Breitbart.

Intel’s hires are not lower-status “tech workers,” such as software-testers or software-maintenance programmers. Instead, Intel imported foreign college-graduates for prestigious jobs such as electronics engineers, industrial engineers or computer and information research scientists. These H-1B workers can stay for six years, or longer, and some get Green Cards, which grant lifetime work permits.

There’s no shortage of U.S. engineers looking for jobs at Intel.

The U.S. marketplace includes many Americans — often older and experienced, but who ask for higher wages to pay for their families — who are eager to work at Intel’s outsourced jobs. For example, on April 21, Indeed.com offered resumes of 16,576 people seeking jobs as electronics engineers in Santa Clara, Calif., the company’s home town. They included Robert Hill of Cupertino, Calif., Ray Chen in San Mateo, Calif., and Aubrey Calder in Mountain View., Calif.

Nationwide, companies and universities employ roughly 800,000 lower salary white collar guest workers. That total is roughly equivalent to the number of Americans who graduate each year with degrees in business, medicine, technology, computers, and architecture. The resident population of white collar guest-workers includes roughly 100,000 lower wage professors, doctors, scientist and other professionals employed by U.S. universities and their affiliated business partners. These guest-workers help lower first-year salaries for American graduates, so lowering the Americans’ lifetime earnings.

The H-1B visa program isn’t the only program used to import foreign workers into the country. Late last year the Obama administration expended the Optional Practical Training (OPT) visa program, which is allowing 120,000 foreign students to work with companies, many of whom rely on the universities for hires.

Because of corruption, agencies are trying to crack down on fake universities that import foreign fake students for work at U.S. companies, and companies that use the H-1B system to get foreign workers for rent to American companies.

Intel’s critics say Intel has used illegal methods to reduce white-collar salaries in California’s Silicon Valley. Intel was a defendant in a 2011 class action lawsuit filed against a group of tech companies, including Apple and Google. The lawsuit was settled in 2015 for $415 million.

For its part, Intel claims that the H-1B visa program is a good thing for the country and, according to Intel spokesperson Lisa Malloy, “sustains our national competitiveness, drives economic growth, and creates jobs in the process.”

Along with other companies, such as Microsoft and Qualcomm, Intel was part of the group of business giants that allied with Democrats and with Florida Republican Sen. Marco Rubio to pressure GOP politicians to accept the 2013 “Gang of Eight” immigration bill. The unpopular bill, which included a huge increase in the importation of immigrants and H-1B guest workers, as well as a blanket amnesty for millions of illegals already here, failed when GOP voters ejected GOP House Majority Leader Rep. Eric Cantor, in his June 2014 primary election.

Since then, political outsider Donald Trump has put himself on track to the GOP’s 2016 nomination by promising to reform the nation’s immigration and guest worker systems to help Americans. For example, he has said he would reduce the inflow of H-1Bs by raising the minimum wage for H-1B workers, and has called for one year “pause” in legal immigration. Trump’s main rival, Sen. Ted Cruz, has also called for a pro-American reform of the labor market, saying it will drive up Americans’ wages and spur technology development.

Their failed GOP rivals — including Gov. Jeb Bush and Gov. Marco Rubio — declined to call for pro-American immigration reform. In fact, Bush’s economic platform called for increased outsourcing of U.S. jobs to imported foreign professionals.

Currently, four million Americans turn 18 each year, and the nation’s government annually imports roughly one million new legal immigrants and workers, plus hundreds of thousands of illegal immigrants and roughly 700,000 temporary guest workers, including the six-year H-1B professionals. In 2013, the inflow of foreign labor helped reduce wages and boosted the stock market.

Follow Warner Todd Huston on Twitter @warnerthuston or email the author at igcolonel@hotmail.com

http://www.breitbart.com/big-governm...rs-since-2010/

Similar Threads

-

Companies awash in cash, when will they spend it?

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 06-02-2013, 04:40 PM -

The 29 Public Companies With More Cash Than The US Treasury

By HAPPY2BME in forum Other Topics News and IssuesReplies: 0Last Post: 07-15-2011, 01:11 PM -

Cash-Strapped NYC To Close 20 Fire Companies...

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 04-07-2011, 01:33 AM -

Big companies are awash in cash as economy picks up

By JohnDoe2 in forum Other Topics News and IssuesReplies: 3Last Post: 03-23-2010, 10:03 PM -

Creditors seek millions from companies owned by Salvadoran e

By butterbean in forum Other Topics News and IssuesReplies: 0Last Post: 01-20-2008, 05:55 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Durbin pushes voting rights for illegal aliens without public...

04-25-2024, 09:10 PM in Non-Citizen & illegal migrant voters