Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-25-2014, 09:40 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Two Years Until Social Security Disability Trust Fund Is Empty

Two Years Until Social Security Disability Trust Fund Is Empty

Friday May 23rd, 2014

Posted by Craig Eyermann at 11:07pm PDT

1 Comment

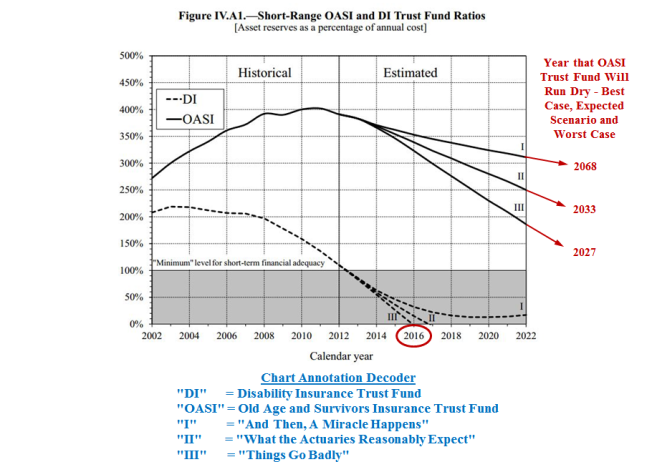

The trust fund in question is Social Security’s Disability Insurance (SSDI) trust fund, which is set to be fully depleted sometime in 2016. Brianna Ehley of the Fiscal Times has the details on the fund that provides up to 20% of the money paid to recipients of Social Security disability benefits:According to the Social Security Administration, spending on the program has more than tripled since 1983 from $43 billion to $139 billion, adjusted for inflation. It now accounts for about 20 percent of the Social Security Administration’s total budget.There are two ways that this situation might be avoided without reducing disability benefits, and also assuming that disability benefits aren’t expanded beyond their currently projected levels:

The trust fund in question is Social Security’s Disability Insurance (SSDI) trust fund, which is set to be fully depleted sometime in 2016. Brianna Ehley of the Fiscal Times has the details on the fund that provides up to 20% of the money paid to recipients of Social Security disability benefits:According to the Social Security Administration, spending on the program has more than tripled since 1983 from $43 billion to $139 billion, adjusted for inflation. It now accounts for about 20 percent of the Social Security Administration’s total budget.There are two ways that this situation might be avoided without reducing disability benefits, and also assuming that disability benefits aren’t expanded beyond their currently projected levels:

Spending has ticked up so fast in recent years that revenue can’t keep up. The government has paid out more than it has taken in every year since 2009, according to the Social Security Board of Trustees.

If the pattern continues and the program runs out of money by 2016, the millions of Americans collecting disability will see their benefits cut by at least 20 percent.

- The U.S. Congress would need to permanently increase Social Security taxes by at least 0.3% to keep paying disability benefits at their promised level.

- The U.S. Congress could shift taxes already being collected so that a larger share goes into the Disability Insurance trust fund.

That second option would mean that Social Security’s other, more well-known trust fund, the Old Age and Survivor’s Insurance trust fund, would itself run out of money much sooner, as there is no other trust fund that the U.S. government might tap to make up those shortfalls in benefit payments.

At present, if this money is not tapped to cover the cost of providing disability benefits, that fund will last until 2033, at which time Social Security’s retirement benefits would need to be cut by at least 23%. Avoiding that situation would require that Social Security payroll taxes be increased by at least 2.4%.

Today, Social Security payroll taxes are equal to 12.4% of an individual’s income, with half of those taxes being paid by U.S. employers. Unless the growth rate and eligibility for its retirement and disability benefits are reigned in, making Social Security’s trust funds solvent enough to provide Social Security benefits at their expected rate of escalation would require those taxes to be permanently increased to 15.1%.

At that rate, there would most certainly be some unintended consequences that would further damage the U.S. economy while never delivering true solvency. And so, it would become necessary to hike those payroll tax rates even more.

Alternatively, the federal government could take steps to restrict eligibility requirements for these social welfare programs and reduce their spending growth rates, which would actually be pretty painless if competently executed.

Which of course explains why no U.S. politician or government bureaucrat has even considered it.

http://www.mygovcost.org/2014/05/23/...fund-is-empty/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

How healthy is the Social Security trust fund?

By JohnDoe2 in forum Other Topics News and IssuesReplies: 0Last Post: 12-11-2011, 06:29 PM -

Social Security disability on verge of insolvency

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 3Last Post: 08-22-2011, 06:31 AM -

What Happened to $2.6 Trillion Social Security Trust Fund

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 4Last Post: 07-16-2011, 12:16 PM -

Senators Question Whether Social Security Disability Program

By kathyet in forum Other Topics News and IssuesReplies: 1Last Post: 05-23-2011, 12:05 PM -

Recession Puts a Major Strain On Social Security Trust Fund

By Dixie in forum Other Topics News and IssuesReplies: 1Last Post: 04-01-2009, 02:29 PM

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Washington Times: Musk’s X bans post about illegal immigrant...

04-22-2024, 09:57 PM in illegal immigration Announcements