Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Hybrid View

-

02-16-2011, 09:55 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

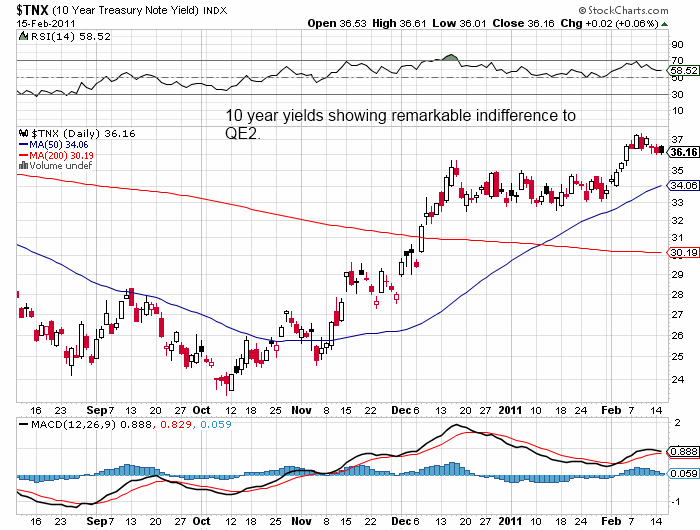

U.S. Bond Market Failure China, Russia, PIMCO Selling U.S. T

U.S. Bond Market Failure as China and Russia Join PIMCO in Selling U.S. Treasury

Interest-Rates / US Bonds

Feb 16, 2011 - 03:56 AM

By: Justin_John

The 10 year yield is waiting like dynamite with fuse lit, ready to blow the top off. 10 year yield are holding at 3.6% and any clean break of 3.7% will see 5.3% as the next target literally killing the recovery and taking down equities with it for the next 10 years.

These flows occurred as the yield on 10-year notes jumped from a low of 2.46 per cent to a high of 2.96 per cent during the first half of November. With Treasury yields having recently stabilised â the 10-year note is around 3.40 per cent, down from a high of 3.56 per cent in mid-December â it remains to be seen whether official sales of US government debt continued late last year and into 2011.

The ultimate in market failure is upon as the much feared collapse of the 100 trillion bond market is now upon us.

Source: http://dawnwires.com/investment-news/ch ... ome-sight/

By Justin John

http://dawnwires.com

http://www.marketoracle.co.uk/Article26338.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

DHS says 'privacy' of migrants on terrorist watchlist is greater...

05-17-2024, 09:42 PM in illegal immigration News Stories & Reports