Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Threaded View

-

08-15-2010, 05:40 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Housing 10% Below Fundamentals, Must Drop 15% More

U.S. Housing 10% Below Fundamentals, BubbleOmics Says Must Drop 15% More

Housing-Market / US Housing

Aug 15, 2010 - 04:51 AM

By: Andrew_Butter

From Felix Salmon today: The government does need to get the housing market going, because the alternative is unthinkable: if the government just kicked away the housing marketâs multi-trillion-dollar scaffolding overnight, as Santelli suggests it should, then the entire banking system would become insolvent, and weâd soon be reminiscing wistfully about how painless and shallow the 2008 financial crisis was, compared to the one of 2011. http://seekingalpha.com/article/220524- ... ut-housing

Bravo, the penny finally drops!!

But itâs the wrong penny. The point is that the banks ARE insolvent and unless American taxpayers collectively (i.e. via the government), take on a load more debt to pay them for their stupidity; at some point someone is going to find out.

Outside of the government handing out $50,000 tax credits, or the latest idea which is just to forgive a couple of trillion dollars (thatâs Keynes on LSD speaking), there is little anyone can do to reverse the relentless grind of reality.

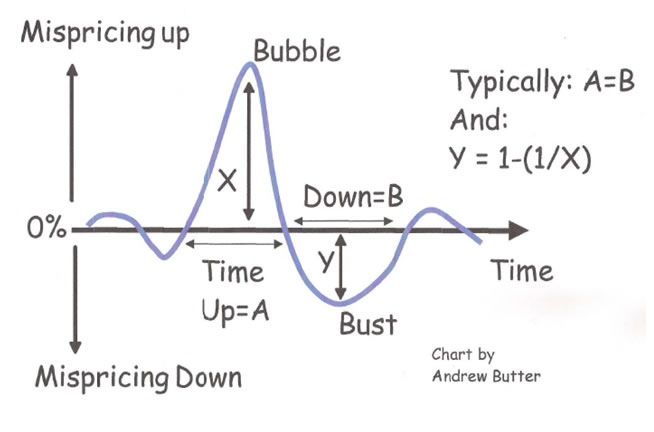

This is the reality of a bubble:

When you are creating a bubble with tax-credits, and facilitating loans with a repayment that is half what the inflation in the âmarketâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

2 foreign nationals in ICE custody after alleged attempted...

05-18-2024, 07:35 AM in General Discussion