Results 1 to 6 of 6

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

10-06-2010, 05:24 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Mint Raises Premiums 33% to Shut Off Physical Demand

U.S. Mint Raises Premiums 33% to Shut Off Physical Demand

Commodities / Gold and Silver 2010

Oct 06, 2010 - 11:27 AM

By: Dr_Jeff_Lewis

The US Mint is acting quickly to reduce extreme demand for American Silver Eagles. Just this week, the Mint declared that it would raise dealer premiums from $1.50 per ounce to $2.00, squeezing profit margins on the coins for dealers and making physical metals far more expensive than the spot price.

Prices Change Globally

Within hours of the announcement, prices for American Silver Eagles around the world jumped $.50 as dealers prepared to pay higher prices for future silver supplies.

Similar to how gas stations raise prices before a change at the wholesale level, or how cigarette prices rise before a new tax, dealers have to allow the new price changes to set in before they actually do. In marketing, we'd call this âanchoring,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 05:25 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Rich Move to Precious Metals

Commodities / Gold and Silver 2010

Oct 06, 2010 - 11:25 AM

By: Dr_Jeff_Lewis

Before this year, precious metals demand was mostly local, with a few large institutions and investment banks buying shorts on precious metals to mitigate any possible increase in price. However, as time goes on and investment banks around the global shutter their trading desks, big money is now moving into metals. So much big money is moving, in fact, that a number of investment banks are opening up new vaults to keep up with exploding demand.

Major Moves into Metals

JP Morgan was the first to reopen an underground vault in New York to cater to its wealthiest clientele. The company closed the vault in the 1990s when precious metals reached all time lows, but has since reopened it to make room for large buyers of gold to store their assets safely.

A number of news agencies are now reporting that other banks such as the German Deutsche Bank and Barclay's will open new vaults in London to store precious metals amidst physical demand that hasn't been this high since the 1980s.

JP Morgan's newest reopening follows another new depository that was built in Singapore to cater to Asian investors. With new vaults being opened for the first time in all major trading areas (New York, London, and Singapore), investors can be certain that the growth isn't just in the United States, but all around the world.

UBS Becomes Outspoken Gold Salesman

UBS has effectively cornered the market for wealthy investors and traders on both the equity and currency markets, but now it is pushing its clients to buy more and more physical metals, especially gold. In a note to investors, it now advises that they hold as much as seven to ten percent of their total assets in physical metals to protect against economic calamity and the possibility of inflation or a double dip depression.

Unlike speculative buyers who are looking to strike it rich with capital appreciation, wealthy investors are buying for the sake of insurance to protect their assets from a dip. Such insurance is available only through physical metals, where the assets are real, deliverable, and can be converted to cash anywhere in the world. As such, demand from the wealthiest of investors will come only in the form of physical metal, and it will likely have a huge impact on premiums going forward.

If the world's wealthiest were to allocate a small percentage, even 5 percent, of their overall assets to gold, we would see a bull-run in gold and silver like never seen before. All the gold ever mined is worth just over $7.5 trillion (assuming we can find it all, again), but the wealthiest in the world have assets that far outpace that amount.

Also, we have to consider that at any one time, only a very small percentage of the total gold and silver supply is for sale.

Therefore, considering all the big money variables, huge amounts of upside do surely exist, and that is without all the other elements that drive metals including: fear, inflation, and real manufacturing.

By Dr. Jeff Lewis

http://www.marketoracle.co.uk/Article23296.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 05:27 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

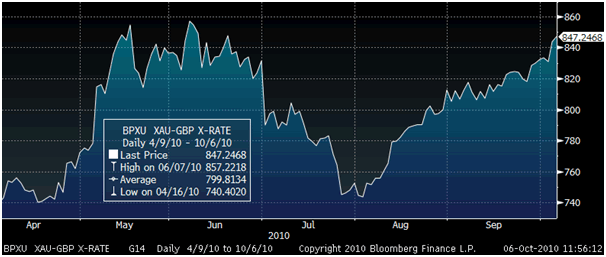

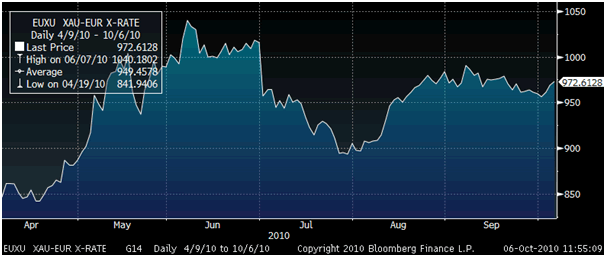

Gold Rises to Near Record Nominal Highs in British Pounds but Lags in Euros

Commodities / Gold and Silver 2010

Oct 06, 2010 - 11:18 AM

By: GoldCore

All currencies except for the yen have fallen against gold today. The dollar and sterling have sold off again and the dollar is looking technically vulnerable at 77.61 on the US Dollar Index. Currency markets continue to be the primary focus of markets with growing concerns about competitive currency devaluations. The IMF is now warning of currency wars and the increasing vulnerability of the global financial system.

Gold is currently trading at $1,344.30/oz, â¬969.14/oz, £847.60/oz.

Gold in GBP - 6 Months (Daily).

Printing money and inflation of the currency is a short term panacea but the medicine may in the long term do more damage than good. This will motivate more defensive investors to allocate more funds to gold.

Gold's recent rise has been primarily a function of the recent fall in the dollar and to a lesser extent sterling's fall against the euro and other currencies (see charts). Gold has also been strong in sterling and may challenge the record nominal sterling high of £857.22/oz in the coming days on further sterling weakness.

Gold in Euros - 6 Months (Daily).

Gold remains well below its euro high of â¬1,040.18/oz and actually fell in euro terms in September. The euro will likely fall again versus gold in the coming months when the euro again comes under pressure due to a continuation, and possible deterioration, of the bank and sovereign debt crisis.

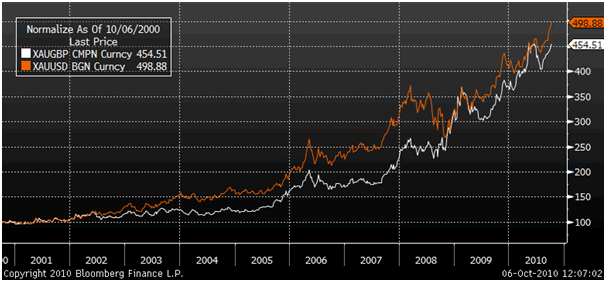

Gold in USD and GBP - 10 Year (Weekly).

The spectre of competitive currency devaluations loomed large for some months but were only recognised by many market participants and commentators recently. Similarly, today the threat of trade wars and capital controls is increasing but remains unacknowledged. The present macroeconomic and monetary conditions are likely to lead to a continuation and possibly a deepening of gold's bull market in all fiat currencies. However, gold is not rising in value - rather fiat currencies are being devalued and are falling against the finite currency and monetary reserve that is gold.

Silver

Silver is currently trading at $22.86/oz, â¬16.48/oz and £14.41/oz.

Platinum Group Metals

Platinum is trading at $1,697.25/oz, palladium is at $584/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

http://www.marketoracle.co.uk/Article23294.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 05:29 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold New Dollar Highs as Global Currency War Intensifies

Commodities / Gold and Silver 2010

Oct 06, 2010 - 08:01 AM

By: Adrian_Ash

THE PRICE OF GOLD rose to fresh Dollar records above $1350 an ounce early Wednesday, hitting its 16th new all-time high in 17 trading days at the London Fix this morning.

Global stock markets also rose, as did major-economy government bonds, while the US Dollar slipped and commodities held flat.

Silver prices touched their best level since 24 Sept. 1980 above $23 per ounce.

"Gold is now outpacing its long-term drivers," says today's note from Walter de Wet at Standard Bank, pointing once more to low global interest rates and money-supply liquidity â but "not necessarily inflation â as the key factors pushing gold higher.

"The gold price has been rising much faster than liquidity [so] we are certainly more cautious with gold at these levels. Speculative length [in the derivatives market] is building, and scrap gold continues to come to the market."

Short-term, "I wouldn't be surprised if we saw $1360 this week," says Carlos Sanchez at the CPM Group in New York, quoted by CNN.

"I think we'll see $1400 by the end of the year."

But "Sell, sell, sell," counters a trader quoted by the professional Platts newswire in London, adding that "It's over-done" on technical indicators of price appreciation, and that the UK's Sun tabloid newspaper today mentions gold investment on page 3 â previously reserved for topless glamor models.

Latest data from London's VM Group consultancy shows global gold investment swelling by 0.6% in the week-to-last-Tuesday, with growth in Japan's Tocom derivatives as well as institutional demand for New York futures, plus 2.0% growth in the gold held to back Barclays Global Investors US-listed exchange-traded trust fund.

"Given the continued price strength we expect speculative gold investment to show another rise in the course of this week," says VM's weekly report for ABN Amro Bank.

"Too much gold has been bought in too short a time, particularly by speculators," warns Wolfgang Wrzesniok-Rossbach at the Good Delivery-bar refining group Heraues in Hanau, Germany.

"[But] any correction will most likely be a prelude to the next rally," believes Wrzesniok-Rossbach â the prize-winning speaker at last week's London Bullion Market Association conference in Berlin â because "the general direction will not be changed."

Noting the launch of gold futures and options trading on Germany's Xetra-Gold exchange, "Interest for gold in Germany appears very much present," he says, pointing also to "relatively robust demand for investment bars in the past few days" even though the political climate is nowhere near "as tense" as it was during the Greek deficit crisis of April and May.

"National debt problems could this time also be part of the reason behind physical gold buying."

Following Monday's rumors of intervention by the Bank of Israel to weaken the Shekel, and Tuesday's fresh "quantitative easing" by the Bank of Japan, the Brazilian government today hiked the tax charged on foreign holdings of its bonds from 2% to 4%, in a bid to stem the Real's appreciation on the currency market.

Brasilia's finance minister, Guido Mantega, last week said we've entered an "international currency war" as countries compete for export-market share.

"A core group of major economies needs to agree urgently on a multilateral and coordinated package of policy measures...to avoid the damaging consequences of continued unilateral action," says Charles Dallara, head of the Institute for International Finance, in an open letter to the International Monetary Fund (IMF).

Ahead of this month's G20 meeting of advanced and fast-growing economy finance chiefs â and amid US accusations of "currency manipulation" â Chinese premier Wen Jiabao said last weekend that Beijing "has already bought and is holding Greek bonds...and will undertake a great effort to support Eurozone countries."

Analysis from Lombard Street Research economist Gabriel Stein notes that China's action helps buoy the Euro against the Dollar â thus making Chinese exports to the United States more competitive.

The gold price in Euros touched a two-week high in early trade on Wednesday, before slipping back from â¬31,365 per kilo.

British investors wanting to buy gold today saw the price hit its highest level since June 20th above £849 per ounce.

By Adrian Ash

BullionVault.com

http://www.marketoracle.co.uk/Article23286.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 05:32 PM #5Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Silver Blow Out, But Where To Buy?

Commodities / Gold and Silver 2010

Oct 06, 2010 - 06:02 AM

By: Bob_Clark

How to enter silver safely - If you have been following my posts on this site, you will know that I am a fan of silver. I have written a few articles about how I thought it would trade. Approximately 1 year ago in "Gold a recipe for disaster" I presented the argument that gold had just made an 8 year low when it went clunk in 2008 At that ime I said the metals would not top out the next move up until 2012 at the earliest.

Nine months ago I wrote "Will gold get compressed",at that time I suggested that due to seasonal factors gold and silver would not advance dramatically and that late summer would be a better time to allocate funds. Then at the beginning of August I wrote "The time to buy silver nears",at that time I suggested that we were at the point where we could expect the silver market to start to move up and resume it's uptrend.

In the articles I write, I try to stay with a trade and do follow up to see how we are progressing, that way I can give something of value to my readers. Following a trade is how we learn.

What the cycles are saying

Silver and SLV (the exchange traded fund that many trade) have broken through to new multi year highs and the questions becomes, is this the start of something big? How high will we go? Is it too late to enter and if not, where can we enter safely?

As we are in new high ground, I thought it would be a good time to take a look at where we stand today and maybe answer a few of the questions.

The chart below on the left is gold, not silver. I used a gold chart because all the silver charts are too compressed to show the strong 8 year cyclicality we have seen over the last 30 years and they both have the same longer term cycles. On the right is a chart to orient us. It begins at 2001 and is current. It contains the 8 year cycle represented by the blue lines in the gold chart. As you can see the 8 year cycle is dominant and any analysis has to include it. The important thing to notice is that the last 8 year top occurred very late. This is a sign that the sum of all trends large than the 8 year cycle are going up. If the cycles bigger than 8 years are pushing up, it means that the 8 year we are in now should push higher for at least 4 years which would be to the middle of the 8 year cycle we are in now. That should be the minimum before we top out. So 2012 at the earliest.

There is a 24 year cycle present as well and it made a low around 2001 . If we look at the chart of gold, we see the sum of all trends larger than 24 years seems to be going up as well, so cyclically, there is a lot of lift under silver (and gold). If we assume that the 24 year cycle will turn in the middle of it's duration, then that fits again with 2012. I want to point out that there is no reason to think both cycles won't translate or top later in their respective spans. In fact they should. So 2012 seems like a bare minimum for timing a top.

Just a theory.

How high will we go? My proprietary targeting methods project an objective of $32.97.

Is it too late to enter safely, will there be another drop like we saw in 2008?

I don't think there will be a big drop, I think the Fed wants higher precious metals prices. Crazy talk? Maybe, but try this idea on for size. The global consensus is that rising gold and silver prices are a sign of quantitative easing. Here is the thing, the business people and market participants world wide, want easy money to push up asset prices and create demand from consumers. Look at the reaction to Japan's latest actions, they are salivating like Pavlov's dogs. I think the Fed has figured out that rising metals prices instill confidence, not fear. A big clunk in the metals market is the last thing the fed wants now. Yes they will try to keep things from running amok on the upside, but there is not the urgency there used to be keep a lid on them.

One more chance

There is a chance to enter silver coming. Later this month we should make a 3 month trading cycle low. It may not be much of a dip, maybe just a nod of the head to the cycle but that is when to enter if you are not in yet. If you are already in, that is the place to add. After this window there should be nothing until next year.

In the above chart we see some interesting things. I have marked the first 3 month low in orange. Ihave marked it on the blue one year cycle line as well. This is the low we are expecting toward the end of this month. Except for the first 3 month low in 2009, we have had large percentage moves out of the first lows in all the other years. The fact that we compressed into this summer's 1 year low and then broke out to new highs, suggests that we will get another large move from the coming 3 month low.

I want to point out that the low in 2007 did a dirty and came in a month later and took out what many thought was an important low from the previous month. That is always a possibility, don't be fooled.

Bottom line

A breakout of major resistance this early in the 8 year cycle (only 2 years along) points to a sustained drive toward a possible 4 year top in 2012. That means that the silver market should see buying on dips and a late top of the current 1 year cycle, sometime in the spring of 2011. The target for that top is $32.97.

There should be some turbulence coming later this month (Oct) which may spill over into November. It will be a good time to enter the silver market.

Struggling? If you are trying to trade using conventional technical tools and having mixed results, there is a reason. Trading is not like anything else we do. There is a dominant force in the markets that has to be known and understood. Until you do, you will struggle. I have created a 4 video set that will change your perspective forever. Check my blog for details.

Markets are manipulated, you are either with them or a victim.

http://www.marketoracle.co.uk/Article23279.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

10-06-2010, 06:08 PM #6Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold Crude Oil Ratio Signals and Latest QE Path

Commodities / Crude Oil

Oct 06, 2010 - 04:04 AM

By: Ashraf_Laidi

In my September 1st piece, I argued the importance of valuing Gold relative to Silver via the Gold/Silver ratio, concluding that gold will UNDERperfom silver despite its status in the limelight. Indeed, the G/S ratio has fallen 7% since the article, hitting a new 13-month low of 59.0. My case for "faster" gains in silver remain in place.

So how about Gold/Oil ratio?

Readers of my book and previous articles on the topic recall that the G/O index bears a highly negative correlation with risk appetite/stocks/market sentiment. The rationale being that when G/O ratio ceases to rise and begins to pull lower, it is a case of re-emerging energy prices relative to metals, usually reflecting improved appetite/higher growth/weak-US-based gains in energy prices. The converse case applies.

The G/O ratio is especially valuable during the early stages of a rebound as it predicts deteriorating risk appetite and falling equities (2008 example) while a peak followed by an early stage decline, usually suggests rising stocks, led by higher energy prices (April example) and May example .

With the above evidence continuing to prove effective since 2007 (time of writing my book), let us integrate it into the G/O relationship of today. The chart below shows the G/O ratio in the upper panel and the S&P500 in the lower panel. The latest correlation between S&P500 and G/O ratio on a 2-month rolling basis stands at -0.63. The red lines indicate the inverse correlation of the overall trend. Note how G/O ratio began drifting lower (due to faster oil appreciation relative to gold last week), which has been accompanied with a clear increase in the S&P500 (and other stocks). The break out of the S&P500 above 1,150, could mean further decline in G/O ratio ââ¬âpotentially towards the 6-month trend line support of 15.20.

And if the above dynamics continue i.e. further declines in G/O ratio and higher S&P500, this could well take the form of rising oil prices revisiting the $86-87 level.

Diamond in the Energy Rough

The weekly US crude oil chart below shows a rare "diamond formation", which in technical analysis is a rare pattern. Diamonds could be either continuation patterns (bullish) or reversal patterns (bearish). In this case, the weekly chart broke above the $80.50 trend line resistance last week (falling trendline line), showing a continuation out of the multi-month pattern, whose 1st half held up during Oct 2009-May 2010. The importance of last week's break out and this week's follow-through is highlighted by the break of the all-important 200-week MA. The next test emerges through a required break above $83, which is the high from Aug 2010 (small red circle). Tuesday's closing price was at $82.82 was not enough. A Friday close above $83 would be necessary, while a close above $75-76 is required to maintain the uptrend.

In the event that $83 is broken with a weekly close (preferably), this stands the chance of extending S&P500 towards its next resistance of 1,190 (200-week MA, which was broken in June 200 and 11,200 on the Dow Jones Industrials Index. Is this plausible? An "upbeat" US earnings season and rising confidence that US markets will be "liquefied" by Fed asset purchases could well do the trickââ¬Â¦for now. The implications for the USD index suggest a possible decline below the 76 trendline and into a prelim target of 74.

and 11,200 on the Dow Jones Industrials Index. Is this plausible? An "upbeat" US earnings season and rising confidence that US markets will be "liquefied" by Fed asset purchases could well do the trickââ¬Â¦for now. The implications for the USD index suggest a possible decline below the 76 trendline and into a prelim target of 74.

Bank of Japan Follows Fed into Zero, ECB Stands out as "Hero"?

Today's BoJ decision to jump back into zero interest rates along with the Fed means the ECB is left alone with 1.0% policy interest rate, a notion that is hard to resist by FX traders favouring further gains in EUR. This is especially the case as the ECB shortens the duration of available funding. Meanwhile, FRBNY pres Bill Dudley reminded us last week that additional QE is a defacto easing of fed funds rate.

Don't Confound Inadequate Liquidity with Unnecessary Liquidity

Many have wrongly stated that rising EURIBOR rates (Eurozone interbank rate) as a sign of inadequate liquidity, which is a sign of lack of confidence. But they confuse rising EUR interbank rates -- resulting from inadequate liquidity due to lack of lending & trust among banks, with rising EURIBOR ââ¬â usually associated with lack of need of funds (the case today after Eurozone banks demanded less loans from ECB). Last week, Eurozone banks demanded EUR 104 bln from the ECB's 3-month liquidity operation, well below the expected EUR 150 bln. JC Trichet has expressed this as sign of less need for funding. But the unexpectedly low demand could further drive up EONIA as excess liquidity declines by an estimated EUR 80 bln. EUR 3-month LIBOR is now at hit a 15-month high of 0.89%, extending the spread over its US counterpart to 0.58 bps, the highest since Feb 2009. As long as the ECB and Eurozne banks are content with shorter marturity loan facilities and any event-risk is averted with regards to the P-I-I-G-S, euro shall remain supported at $1.33. But with my $1.3850 target been hit (see prev IMTs and tweets on twitter.com/alaidi), I need a new fundamental catalyst for a break above $1.3940.

BoJ Easing Will Not be Enough

The decision by the Bank of Japan to purchase everything in sight except for stocks reflects the desperate situation of the central bank. The BoJ slashed its policy rate from 0.1% to between 0% and 0.1%, while creating a temporary fund of about 35 trillion yen to buy various financial assets (government bonds, corporate bonds, and commercial paper). Will the BoJ buy stocks as it did 2 trillion yen worth of bank shares in 2002-3? For those who were around in 2002, remember, the BoJ included stocks in its shopping list well into mid 2003, until.. you guessed it.. it resorted to pure yen-selling intervention into March 2004. The BoJ's measures may be sufficient to prevent yen strength vs. commodity and European currencies but are unlikely to reverse the USDJPY beyond the 85 yen level.

My QE is Bigger than your QE

And if you think the 35 trillion yen announced from the BoJ is large, it is only the equivalent of about $420 billion, which is less than half the anticipated +$1.0 trillion in treasury purchases expected from the Fed. As the Fed's QE2 is set to overwhelm the easing measures of the BoJ, any rebound in USDJPY will be short-livedââ¬Â¦just as short-lived as today's bounce in USDJPY to 84.00 before falling back to 82.97. Can the BoJ ultimately resort to fresh wave of yen-selling intervention? Perhaps, but its case is increasingly untenable considering i) yen is in fact weakening vs most of other currencies; ii) interventions are politically incorrect as they were frowned upon by EU and US officials. I expect gradual selling momentum to re-emerge, triggering 81, with 79.70 an increasing likelihood before year end.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

http://www.marketoracle.co.uk/Article23271.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

San Diego Sector of Southern Border Reaches Top Spot for Illegal...

05-11-2024, 02:51 PM in illegal immigration News Stories & Reports