Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-25-2010, 11:05 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Weekly Unemployment Claims Spike: Economic Reality Set In?

U.S. Weekly Unemployment Claims Spike, Will Economic Reality Soon Set In?

Economics / Recession 2008 - 2010 Feb 25, 2010 - 12:56 PM

By: Mike_Shedlock

Yesterday the market rallied the moment Bernanke started yapping to Congress about holding interest rates low for a considerable length of time. Pray tell what did he say that anyone should not have expected?

Perhaps today the reality of "why" Bernanke feels compelled to hold rates low will set in. Following news that unemployment claims spiked to 496,000 the S&P 500 gapped down 15 points. Is there more where that comes from?

With that backdrop, let's take a look at the report.

Inquiring minds are investigating the Unemployment Weekly Claims Report for February 25, 2010. http://www.workforcesecurity.doleta.gov ... 021810.asp

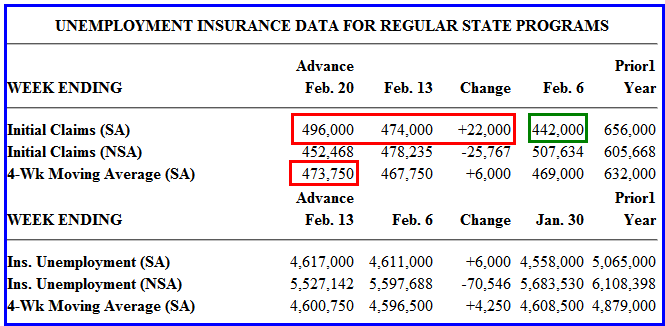

In the week ending Feb. 20, the advance figure for seasonally adjusted initial claims was 496,000, an increase of 22,000 from the previous week's revised figure of 474,000. The 4-week moving average was 473,750, an increase of 6,000 from the previous week's revised average of 467,750.

Weekly Unemployment Claims

In reference to Feb 6, last week I said "After last week's unexpected huge dip, this week sports an unexpected huge rise. That's why it's best to focus on the trend in the 4-week moving average."

Today I suggest that perhaps that February 6th "green shoot" is an outlier. It is the only thing keeping that 4 week moving average as low as it is.

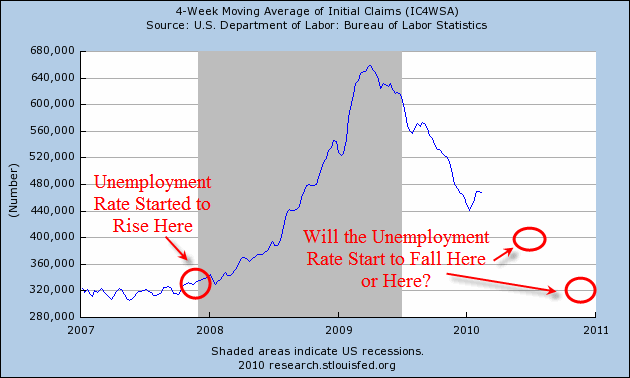

4-Week Moving Average of Initial Claims

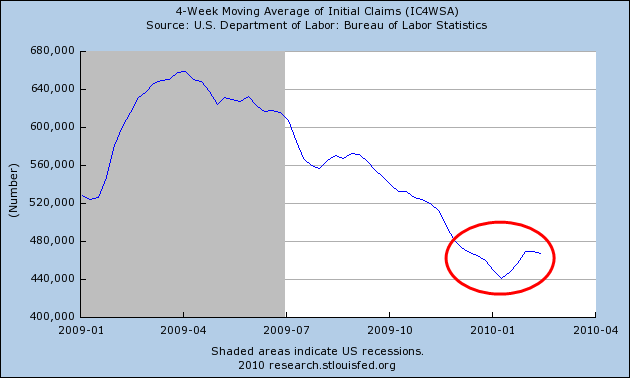

4-Week Moving Average of Initial Claims Detail

The 4-week moving average of claims for the last three weeks is above where it was on December 12, 2009 and just slightly better than it was on December 5, 2009. By this measure, the recovery has stalled.

Is Bad News Finally Bad News?

The day is still early. Bad news buyers may still save the day.

At some point however, reality will eventually set in. Without jobs, all this happy talk about the impending recovery, and all of Bernanke's yapping about low rates, will not satisfy the market. It is going to take both jobs and an increase in consumer spending to lift the economy.

From where I sit, neither is coming.

Right now, the dollar is firm, treasuries have a bid, the stock market is down, commodities are down, and gold and the $HUI are up. That action suits me just fine.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

http://www.marketoracle.co.uk/Article17493.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-25-2010, 11:26 PM #2Senior Member

- Join Date

- Jul 2008

- Location

- NC

- Posts

- 11,242

Mish has forgotten to take one thing into consideration: the weather. People could not go to their jobs, much less find their cars, in many places. Businesses that had to close due to the storms undoubtedly realized that they could not afford all the workers, and perhaps a few realized that the loss of business because of the storms was enough to put them over the edge from solvency. Or the entire place was leveled when the roof collapsed or a tree crashed in, with the insurance company telling them they do not cover acts of God.

That is a seasonal adjustment I can palate.Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Panama Might Help Shut Down the Invasion of Illegals, As the...

05-09-2024, 10:13 PM in illegal immigration News Stories & Reports