Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-15-2010, 09:44 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Why This Recession Is Different; Mish On What To Do About It

Thursday, April 15, 2010

Richard Koo On Why This Recession Is Different; Mish On What To Do About It

The Business Insider has a very interesting presentation by Richard Koo on The Real Reason Why This Recession Is Completely Different. Here are a few slides. http://www.businessinsider.com/richard- ... -2010-4#-1

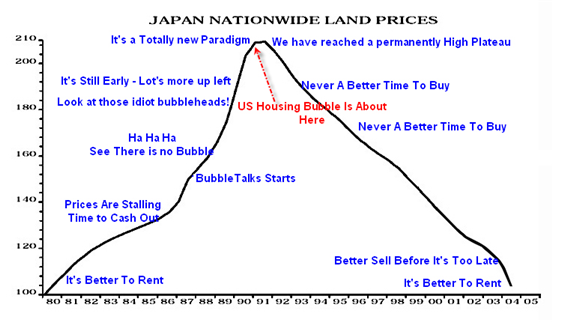

US Housing Prices Follow Japanese Experience

Interest Rate Policy Did Not Revive Housing In Japan or the US

Demand For Loans Drops In Spite of Fed's Heroic Efforts

Japan Land Prices and Private Sector Deleveraging

There are 27 slides in Koo's presentation. It is well worth a closer look.

Japan Nationwide Land Prices

Inquiring minds may be familiar with the line in hot pink in the chart immediately above. I have commented on it many times.

Flashback March 26, 2005: It's a Totally New Paradigm http://globaleconomicanalysis.blogspot. ... adigm.html

Here are some excerpts from that post.

* Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors says that "South Florida is working off of a totally new economic model than any of us have ever experienced in the past." He predicts that a limited supply of land coupled with demand from baby boomers and foreigners will prolong the boom indefinitely.

* "I just don't think we have what it takes to prick the bubble," said Diane C. Swonk, chief economist at Mesirow Financial in Chicago, who was an optimist during the 90's. "I don't think prices are going to fall, and I don't think they're even going to be flat."

* Gregory J. Heym, the chief economist at Brown Harris Stevens, is not sold on the inevitability of a downturn. He bases his confidence in the market on things like continuing low mortgage rates, high Wall Street bonuses and the tax benefits of home ownership. "It is a new paradigm" he said. http://www.nytimes.com/2005/03/27/reale ... &position=

I called the tip of the housing bubble in summer of 2005 based on the Time Magazine Cover "Why We're Going Gaga Over Real Estate" and have been updating the chart ever since. http://globaleconomicanalysis.blogspot. ... orial.html

Here is a fresh update made just today. I moved the arrow another notch.

Koo Video

Richard Koo, Chief Economist, Nomura Research Institute, on The Age of Balance Sheet Recessions

http://www.youtube.com/watch?v=YuoFMwyd ... r_embedded

The reason the recession is different is this is credit bubble busting depression not a recession. The effects are masked because of food stamps, unemployment insurance, and because of foreclosure policy.

Unlike the soup lines in the 1930's which were very visible, Food Stamp Usage at a Record 39 Million, 14th Consecutive Monthly Increase is not visible.

Record Unemployment

Likewise, 14 million unemployed are not readily visible because of unemployment insurance and because many are living in their homes for free courtesy of banks that have not foreclosed long after people stopped paying their mortgage.

That is the extent of my agreement with Koo.

Koo blames cutbacks in fiscal stimulus in 1999 and 2001 as the reason Japan remains mired in deflation. I do not buy it.

Arguably Japan picked two of the worst times to get fiscal religion (heading right into a dotcom bust and headed into the 911 attack).

However, Japan is deep in debt to the tune of 200+% of GDP and two short cutbacks in spending and stimulus (both aborted) certainly did not cause that problem.

Real Lesson of Japan's Lost Decades

The real lesson is no matter how much money you throw around, economies cannot recover until noncollectable debts are written off. That is why you have âzero interest rates and still nothingâs happening.âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Treasonous Congress Funds Billions For Middle East Invasion...

05-02-2024, 01:28 AM in Videos about Illegal Immigration, refugee programs, globalism, & socialism