Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-19-2010, 12:04 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Will Connecticut Last Week? down to weekâs worth of cash

Financial Markets Which Way Wednesday - Will Connecticut Last A Week?

Stock-Markets / Financial Markets 2010

Aug 18, 2010 - 01:49 PM

By: PhilStockWorld

According to its Comptroller, http://www.reuters.com/article/idUSTRE6 ... mesticNews CT will be down to a weekâs worth of cash unless it issues $520M in debt by Fall.

If the planned offering of general bond obligations is delayed until 2011, "This coming fall the state would likely have just over a weekâs worth of expenses in the bank â a level lower than advisable," Napier wrote in an August 13 letter that is posted on her website. http://www.state.ct.us/ott/pressrelease ... 081310.pdf "Conceivably, the State may run out of funds for capital expenses that have already been authorized, allocated and incurred, such as school construction projects," she added. So before the end of the year, Connecticut expects to offer the $520 million of general obligations and as much as $600 million of special tax obligations, which would raise money for transportation. Both issues likely would be offered via negotiation.

Should we be surprised? Only if we have had our heads in the sand for the past two years. Should we be concerned? Not in the grand scheme of things, as people do seem to be willing to buy these bonds and CT has already approved $581M in borrowings - this is just an issue of timing but those of us who have seen businesses fail before (and I have been asked to consult on many BKs) are well aware of the signs of a flailing business gasping for breath and "emergency" notes from the CFO to the board of directors that contain distancing language like "I have endeavored to respond fully to those questions" are never a good sign.

Nothing against Ms. Nappier, kudos to her for being proactive here, especially as she is placing herself at odds with Representative Vince Candelora, who has been trying to make a name for himself as a fiscal conservative and fighting the bond issue. Why does Connecticut matter to my readers in Berlin? Because this is the drama that is being played out in all 50 US states and itâs $500M here and $2Bn there and, before you know it, youâre talking real money and that money is tied to jobs and those jobs are tied to state tax revenues and national unemployment and small business outlooks, etc.

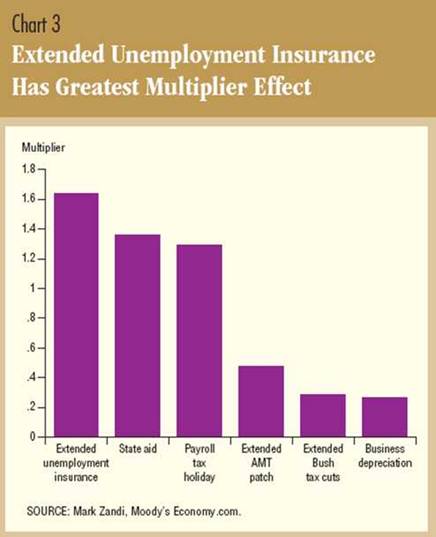

As you can see from this Moodyâs chart on the left, State Aid (or lack thereof) has a huge multiplier effect on the economy so I care A LOT more about whether the State of Connecticut can meet itâs needs to pay for vital local services (multiplier of 1.4) than I do about whether the top 0.01% of the citizens of Connecticut get to keep their 4% Bush tax cut (multiplier of 0.3). One could logically argue that itâs 5 TIMES more important to help the states than to continue to bail out the rich, who arenât even in the same boat as the people who are drowning in these various ships of state.

We have an implied Federal guarantee of the debt obligations of private banks but the states can go hang themselves? Doesnât that seem a little bit ridiculous? California has a $2,000,000,0000,000 GDP and is running a $20,000,000,000 deficit - just 1%, which is a damned site better than most nations on this planet (and if California were a country, it would be the #8, right behind the UK ($2.2Tn) and Italy ($2.1Tn) and 7 times greater than Greece ($330Bn). Yet California is generally treated on par with Greece in debt ratings (the city of Bell, CA just got lowered to junk by Fitch). http://www.bloomberg.com/news/2010-08-1 ... fitch.html Why is that? Because the US Congress, unlike the EU, does not stand behind the states they represent.

How is it possible that the people we send to Washington, DC, FROM these states, turn around and bite the very hand that feeds them by either denying them aid in the Stateâs time of greatest need or, in the very least, fail to champion the cause of their home states? The problem is that pretty much everyone in Congress thinks they are running for national office but WE, THE PEOPLE, of your home states sent you there to represent US - not your fantasy constituents across America. California is 13% of the nationâs GDP, New York is 12%, Florida 8%, Connecticut 2% - donât you think they should get a pretty big say in what goes on in Washington. After all, itâs THEIR money Congress is spending!

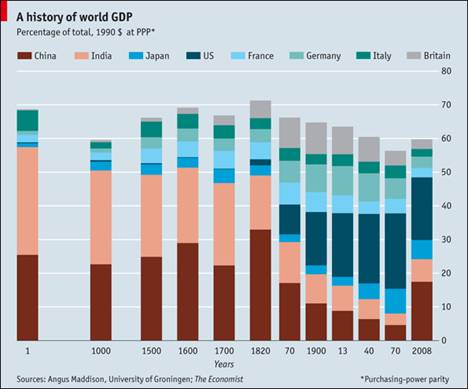

Zooming out to a more global perspective (gotta keep the boys in Berlin interested too!), Barry had a great chart this morning on the History of World GDP (right), which dovetails nicely into what we were discussing after hours yesterday in Member Chat, where I said in response to a question of the sustainability of US GNP and itâs likely effect on the World moving forward (yes we do this all day!):

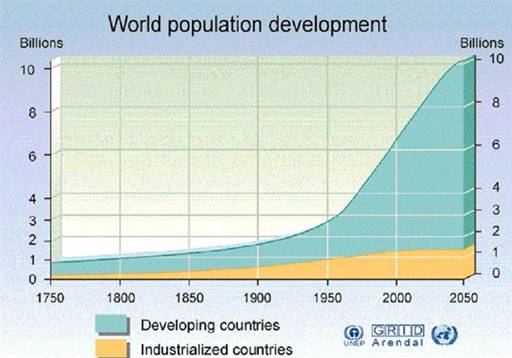

GNP - Well thereâs lots of ways to measure success and, right now, not going down is good. China didnât grow for 50 years and you didnât care did you? Russia shrank since 1985, Japan since 1980 and Europe has flatlined for years as they got into the EU mess for the past decade and we didnât care at all. Now we are contracting and the World is coming to an immediate end? Thatâs just not how it works. There are 6.7Bn people and there will be over 10Bn by 2050 so hard to avoid global GDP growth to $90Tn with no inflation at all. Being realistic and assigning 3% inflation at least, weâre looking at well over $100Tn so a good $1Tn a year of GROWTH in the world. Will Japanâs ($6Tn) population decline 20% over 40 years? Maybe it will so thereâs $1.2Tn off the $100Tn. Who else will decline 20% while the rest of the World grows? US - knock $3Tn off the gains. Europe - another $3Tn bites the dust. Still over $90Tn, which is up $30Tn in 40 years. Letâs say that 3rd World growth doesnât impact global GDP as much as Industrialized growth and knock 1/2 off again. Still $15Tn over 30 years, which is $500Bn a year up for grabs for people and corporations who are not to afraid to be real Capitalists.

Treasury is right, the real danger is inflation. If China and Indiaâs GDP grows too fast then 1Bn people want IPhones and the IPhone alone uses up 50% of global storage and more glass is used on 1Bn 6 square-inch IPhone screens than on 15M 20-inch monitors and what do we get? Very painful global inflation. Anyway, the point is that unless we have a global de-populating event, as Jeff Goldblum observes in Jurassic Park - Life WILL find a way and if life is finding a way to grow - then there will be some clever guy standing by ready to sell them 3-D glasses and a happy mealâ¦.

This is a very important perspective people need to have - the chart above IS happening and thatâs without curing aids or cancer, which can spike it up dramatically. Underlying that trend is global GDP is still almost $10K per person on average http://en.wikipedia.org/wiki/List_of_co ... P_(nominal)_per_capita with an average of $30,000 for the 1.5Bn of us lucky enough to be in the first world ($45Tn out of $55Tn) and average of $2,500 for the rest of the schlubs. While it is relatively difficult for us to raise our standards of living above $45Tn, it is fairly easy to double up the GDP of those below us (China and India have done it in a decade and are on path to do it again) since all you really need to do is take people who live as subsistence farmers and get them some running water, electricity and a cell tower and suddenly they are shopping at AMZN and getting deliveries from UPS. So figure the bottom 80% can be counted on for 20Tn of growth EASILY in the next 40 years plus inflation is another $10Tn so thereâs all the growth Iâm talking about done if the developed World does NOTHING for 40 years.

Again, itâs a matter of having a GLOBAL perspective because it Iâm a Martian selling Nikeâs to Earth people, I could not give less of a damn WHO is having a good year or a bad or who is having babies as long as those babies have feet and some percentage of those growth feet end up wearing my shoes - other than that, they all look-alike to me and I donât give a damn about their petty, stupid socio-political differences (as very well illustrated in Star Trek: 5:45). http://www.youtube.com/watch?v=tQgmU2eE ... re=related

So we can bemoan the current difficulties while still having a generally bullish LONG-term perspective, canât we. Looking at Barryâs bar chart one could argue that we are only just now recovering from the two century-long collapse of China and India, which was only partially offset by the rise of the America. Like England, France and Germany, the USâs turn at the top of the food chain may be drawing to a close and the world of 2,200 is much more likely to look like the World of 1800, with China and India dominating the global economy as 3Tn peopleâs standard of living moves up, probably while our excesses are paired down. As long as they all have feet, brush their teeth and enjoy the occasional Coke, Iâm sure weâll find something to sell themâ¦.

Back in the 21st century, Asia was mixed with India up 1.15% (208 points) to 18,257 and the Nikkei up 0.86% (78 points) to 9,240 while the Hang Seng (-0.54%) and the Shanghai (-0.21%) were weak on bad finishes as the Dollar once again collapsed against the Yen and our 3am trade saw an entry at 85.5 Yen to the dollar but, just after the Nikkei closed, it slipped all the way back to 85.20. Nothing bad happened in Asia that I saw. In fact Foxconn, who just agreed to double their workersâ salaries,announced plans to add 400,000 workers over the next 12 months. http://www.bloomberg.com/news/2010-08-1 ... cides.html

Over in Europe they are flat ahead of the US Open as the BOE voted to hold rates steady (as expected) while weakening commodity prices took a toll on the markets (this was our main fear for this week, especially oil, which should have another poor inventory report at 10:30). Thereâs a nice article in the Journal about Trichet and Europeâs "Two-Speed" economy http://online.wsj.com/article/SB1000142 ... 07454.html that is well worth reading as it feeds back to our own issues with our states and their relationship back to the Federal level.

German Retail Sales are up, Iceland cut their interest rates, Swiss life had very nice profits - the World is hardly ending, folks⦠Commodities will hold us down today and possibly weâll pin this through the week, which is hardly a surprise to anyone who reads us regularly, as we expired at 10,100 last options expiration day (July 16th) on a big, bogus, 250-point drop that more than reversed the next week and, as we tell you over and over again - whatever happens between the two expiration days is meaningless so the fact that we went up 500 and down 500 and blah, blah is all very exciting but all we know is the puts and calls we sold last month are all expiring worthless and now we can do it again for the next round of suckers who think they know which way the market is heading. Ah, blissful agnosticism in a range-bound market!

By Phil

www.philstockworld.com http://www.philstockworld.com/

http://www.marketoracle.co.uk/Article22006.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Flyers Distributed by a Mexican NGO Instruct Illegal Aliens to...

04-16-2024, 09:43 AM in illegal immigration News Stories & Reports