Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-20-2011, 10:25 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

EU Bank Run Downward Spiral, Goldman Final Phase World Domin

The European Bank Run Downward Spiral, Final Phase Of Goldmanâs World Domination Plan

Interest-Rates / Global Debt CrisisNov 20, 2011 - 10:39 AM

By: PhilStockWorld

Courtesy of ZeroHedge. View original post here. Submitted by Tyler Durden. http://tinyurl.com/7gfo2o8

"Nervous investors around the globe are accelerating their exit from the debt of European governments and banks, increasing the risk of a credit squeeze that could set off a downward spiral. Financial institutions are dumping their vast holdings of European government debt and spurning new bond issues by countries like Spain and Italy. And many have decided not to renew short-term loans to European banks, which are needed to finance day-to-day operations. "

So begins an article not in some hyperventilating fringe blog, but a cover article in the venerable New York Times titled "Europe Fears a Credit Squeeze as Investors Sell Bond Holdings." Said otherwise, Europeâs continental bank run in which virtually, but not quite, all banks are dumping any peripheral exposure with reckless abandon is now on. Granted, considering the epic collapse in bond prices of Italian, French, Austrian, Hungarian, Spanish and Belgian bonds which all hit record wide yields and spreads in the past week, and furthermore following last weekâs "Sold To You": European Banks Quietly Dumping â¬300 Billion In Italian Debt" http://www.zerohedge.com/news/sold-you- ... alian-debt which predicted precisely this outcome, the news is not much of a surprise. However, learning that everyone (with two exceptions) has given up on Europeâs financial system should send a shudder through the back of everyone who still is capable of independent thought â because said otherwise, the worldâs largest economic block is becoming unglued, and its entire financial system is on the edge of a complete meltdown. And just to make sure that various fringe bloggers who warned this would happen over a year ago no longer lead to the hyperventilation of the venerable NYT, below, with the help of Goldmanâs Jernej Omahan, we bring to our readers the complete annotated and abbreviated beginnerâs guide to the pan-European bank run.

But first some more details from the NYT: http://www.nytimes.com/2011/11/19/busin ... ted=2&_r=1

The flight from European sovereign debt and banks has spanned the globe. European institutions like the Royal Bank of Scotland and pension funds in the Netherlands have been heavy sellers in recent days. And earlier this month, Kokusai Asset Management in Japan unloaded nearly $1 billion in Italian debt.

At the same time, American institutions are pulling back on loans to even the sturdiest banks in Europe. When a $300 million certificate of deposit held by Vanguardâs $114 billion Prime Money Market Fund from Rabobank in the Netherlands came due on Nov. 9, Vanguard decided to let the loan expire and move the money out of Europe. Rabobank enjoys a AAA-credit rating and is considered one of the strongest banks in the world.

American money market funds, long a key supplier of dollars to European banks through short-term loans, have also become nervous. Fund managers have cut their holdings of notes issued by euro zone banks by $261 billion from around its peak in May, a 54 percent drop, according to JPMorgan Chase research.

Is this setting familiar to anyone? It should be: "Experts say the cycle of anxiety, forced selling and surging borrowing costs is reminiscent of the months before the collapse of Lehman Brothers in 2008, when worries about subprime mortgages in the United States metastasized into a global market crisis."

Ah, but there is one major difference: last time around, the banks were not all in on the wrong side of the worldâs worst poker hand (as described by Kyle Bass earlier). Now they are. And should Europeâs banks begin a domino-like spiral of collapse, there will be nobody to bail out first Europe, then Japan, then China, then the US and finally the world.

But lest someone suggest this is merely the deranged ramblings of yet another blogger, here is Goldman Sachs with a far more cool, calm and collected explanation for why we should all panic (which comes at the sublime moment: just as Goldman takes over all the key political locus points of the European continent: more on that in the conclusionâ¦)

Coreâ banks cut GIIPS debt by â¬42 bn (-31%) in 3Q; a manifestation of PSI side-effects?

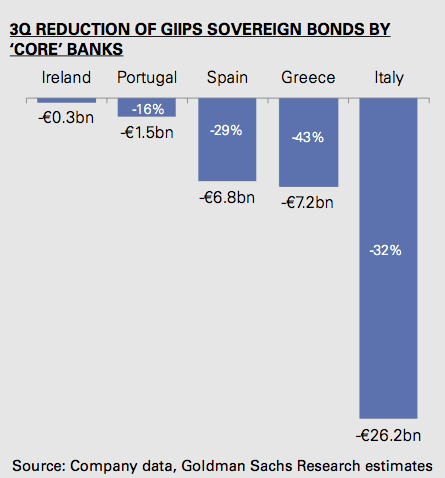

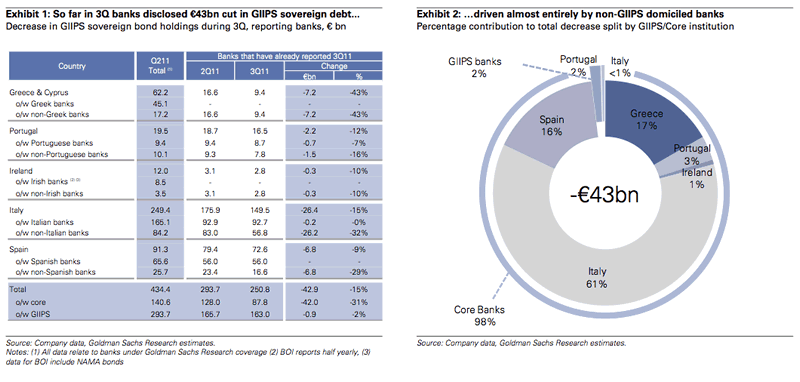

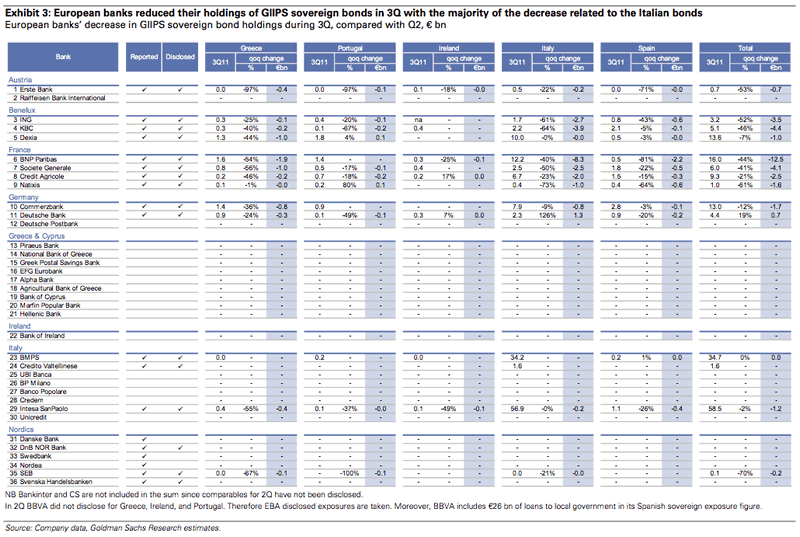

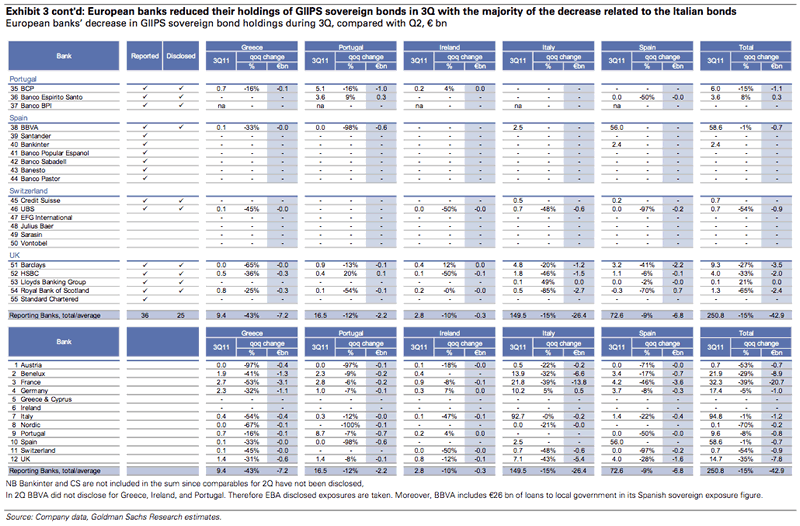

In 3Q2011, banks from the âcoreâ cut their net GIIPS sovereign debt holdings by â¬42 bn (or by one-third), mostly Italian (â¬26 bn), Spanish (â¬7 bn) and Greek (markdown of â¬7 bn). French and Benelux banks cut their exposures most, by â¬21 bn and â¬9 bn, respectively. GIIPS portfolios remained unchanged with periphery banks.

Greek PSI sets a risky precedent, in our view, as the prospect of âvoluntaryâ haircuts becoming a template for GIIPS crisis resolution could drive exposure reduction. Core banks now have â¬88 bn of GIIPS sovereign bonds remaining. We expect this to decline. Problematically, we observe that GIIPS bond reductions are not resulting in âcoreâ bond purchases but in a rise in deposits at the ECB.

The disposal of GIIPS sovereign debt accelerated during 3Q2011, and we highlight the following.

Banks cut net GIIPS sovereign exposure by â¬43 bn. The largest reductions relate to Italian (â¬26 bn), Spanish (â¬7 bn) and Greek (â¬7 bn) net sovereign debt positions.

Almost all of the reduction (â¬42 bn) came from banks in the European âcoreâ, where the GIIPS bond positions therefore fell by just over one-third (31%). At the same time the banks from the âperipheryâ kept their exposures unchanged.

French (â¬21 bn) and Benelux (â¬9 bn) banks reduced their exposure most.

Individually BNP (â¬12 bn), KBC (â¬4.4 bn), SG (â¬4.1 bn), BARC (â¬3.5 bn) and ING (â¬3.5 bn) cut the net sovereign exposures most, in absolute terms.

We expect this trend to extend into 4Q and to ultimately lead to a long-term reduction GIIPS bond holdings by core banks.

Greek PSI â and the âvoluntaryâ 50% haircut â has changed the risk perception of GIIPS bonds. We believe it has allowed for an assumption that PSI will be used as a template in helping other GIIPS sovereigns improve their public finances. Such intention is denied by policy makers. Banks, on the other hand, express their view of the likelihood of such an event through the changes in their net positions.

It is important to emphasizes that a bankâs decision to hold sovereign debt is not an expression of an investment preference. Rather, it is a decision related to liquidity management. As such banks seek ârisk freeâ assets that can be used to access liquidity at any time, particularly at the time of crisis. Regulators continue to treat sovereign debt as highest-quality and risk free (0% risk-weight) collateral. With no RWA constraint and full refinancing eligibility, banks are encouraged to hold sovereign debt; its (selective) transition from a ârisk freeâ to a âriskâ asset is therefore unexpected and highly damaging.

Earlier we said all but two entities have been dumping PIIGS (or GIIPS as Goldman prefers to call them). Sure enough, one of the unlucky two tasked with buying everything sold in the secondary market is of course the ECB: the same bank that everyone is accusing of not doing more to help.

Funding: Increasingly reliant on the ECB

The use of ECB facilities rose again in October, driven by Spanish (â¬7 bn) and Italian (â¬6 bn) banks. For 4Q, we expect a sharp increase in use by Italian banks, driven by: (1) LCHâs increased margin requirements on Italian REPOs, which now make market REPOs comparatively more expensive than those at the ECB; and (2) a steady fading of the ECB funding âstigmaâ. It is possible that the majority of the â¬300 bn of interbank funding and market REPOs could end up on ECBâs balance sheet. That alone would have the capacity to lift current ECB use from â¬579 bn to just below â¬900 bn. This level of use would compare with previous crisis peak levels (2009) of â¬870-897 bn.

We have long argued that the ECB has capacity to back-stop bank funding requirements â and there is no change to this view. That said, a gradual closing of the last functioning wholesale funding market â short-term REPOs, backed by government bonds â is certainly not an encouraging sign. The re-opening of the long-term funding markets has been pushed further out, in our view.

LCH triggers increased margin requirements on Italian REPOs

On November 9, 2011, LCH.Clearnet (LCH) announced its decision to increase âdeposit factorsâ applied to Italian debt repo transactions (e.g. haircut on collateral) by 3.5% to 5% depending on the duration of the collateral. The move was not a surprise as LCHâs Risk Management Framework states that it âwould generally consider a spread of 450bp over the 10-year AAA benchmark to be indicative of additional sovereign riskâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-20-2011, 10:28 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Taxpayers in Revolt, State Bankster System in Europe is Collapsing, Next Stop USA

Interest-Rates / Credit Crisis 2011Nov 09, 2011 - 04:56 AM

By: Gary_North

Think of Europe's finances as a gigantic liquor supply system. There is a system of profit-seeking taverns (commercial banks). There is a clientele (sovereign states). Finally, there is a distiller (the European Central Bank).

The governments have been on a bender like none seen in modern times, especially those governments in sunny climates, plus Ireland, which has always known how to have a party. They all ran up their tab with their bartenders at pubs throughout the continent. It looked like the party would go on forever. It didn't.

The morning after began in October 2008, but the hangover hit Europe in full force in the spring of 2010, when Greece announced that it could not pay its bar tab. It turns out that none of the PIIGS nations can. At best, they can make token payments.

This is true of all of the governments, but the ones in the north still have pretty good credit. The taverns can remain open to keep the clients coming in, but the party is clearly over. It's down to regular patrons consuming a few beers and making token payments on their tabs.

The trouble is this: the governments, like all alcoholics, have built up a tolerance for booze. It takes more and more just to keep their heads from hurting. They are no longer looking for a high. They just want to get through the day. They are now morning drinkers. Afternoons, too.

How did it happen? It began with the European Central Bank in 2000. It controlled the flow of funds. It did not keep a tight hand on the spigot. The party got out of hand.

THE TASKS OF CENTRAL BANKERS

Almost every nation has a central bank. The bank does three things: (1) it supplies the government with funds at low interest rates; (2) it limits the expansion of money by the commercial banks; (3) it bails out the largest banks when a banking crisis hits. It officially promotes the first two goals. It does not talk about the third.

Beginning in October 2008, the third task has become dominant in the United States and Europe. The main bailouts took place in the United States. Large European banks got lots of aid from the Federal Reserve, but this was done quietly. The FED concealed this from the public and Congress.

Europe is the scene of the latest crises. These show signs of becoming a permanent condition. The crises are escalating. Four groups are involved: (1) the European Union; (2) the individuals nations; (3) the European Central Bank; (4) the commercial banks.

The ECB so far has been adamant that it will not supply money â "booze" â for the hangover-impaired PIIGS. It has done so on the sly, and in violation of its charter, but it is trying to save face. It is trying to look responsible. The problem is, the PIIGS may soon default on their bar tab. The tavern industry may go under. And that would affect all their other clients, who would not be able to celebrate.

It is bad enough that the PIIGS are in severe hangover mode. If the northern nations, especially France, cannot pay their tabs, the tavern industry goes down. If the largest commercial banks fail, this will create a domino effect all over the world, just as it did in 1931, when Austria's Creditanstalt bank failed. The leaders of Europe are terrified of this prospect. They should be.

From the beginning of the Greek debt crisis in April 2010, the Greek bailout has been about saving the banks that had purchased the Greek government's IOUs. The member states must be provided with euros, so that they can continue to make interest payments to the banks.

This has left the hangover-burdened governments of the north with the task of coming up with bailout money. The money is going to Greece. This is a test of the north's willingness to supply the money to banks by way of the Greek government. The northern nations are using the European Financial Stability Facility to do this. But this has proven insufficient to control the panic. Another bailout facility is now being considered, one that is much bigger and more permanent. It is called the European Stability Mechanism (ESM).

THE EUROPEAN STABILITY MECHANISM

A new European Union treaty is now being considered for ratification by Europe's parliaments. The public is in the dark about it. There is no suggestion by European leaders that this document should be submitted to the voters. They know it would be turned down flat.

The treaty deals with European debt. A new international agency will be set up which will have the power to compel every European government to fork over at least a trillion dollars' worth of euros.

It is an imitation of the International Monetary Fund. Member nations will put up money, much of it borrowed, to create a default insurance fund. The IMF used its money to bail out Third World governments that threatened to default on money borrowed from the commercial banks of rich nations. But the ESM must deal with nations inside the eurozone. They have borrowed far more than Third World nations ever did or could have.

This initial call for Europe's national governments to pony up the cash will be merely the first round. The key word is "initial" This is from the "preamble" of the treaty, before the articles.

(4) If indispensable to safeguard the financial stability of the euro area as a whole, access to ESM financial assistance will be provided on the basis of strict economic policy conditionality under a macro-economic adjustment programme and a rigorous analysis of public-debt sustainability. The initial maximum lending volume of the ESM, after the complete run down of the EFSF, is set at EUR 500 000 million.

Once the money is gone, there will be further calls for more rounds of contributions. This is what the IMF has done for decades. (My first task on the job as Ron Paul's staff economist in June of 1976 was to write a minority report against the IMF's call for more funding, which Congress soon granted, virtually without opposition.) This is what the ESM will do. After all, "initial" means "first round." Any nation that refuses to add to its commitment will lose a proportionate voting share. It is like the dilution of a stock. Access to future bailout money will be reduced.

No nation will lawfully be allowed refuse to pay up its fair share, once it commits.

ESM Members hereby irrevocably and unconditionally undertake to provide their contribution to the authorised capital stock, in accordance with their contribution key in Annex I. They shall meet all capital calls on a timely basis in accordance with the terms set out in this Treaty (Article 8, Section 4).

The money will be used to create a stream of income for the largest banks. This will be the ultimate big bank bailout.

The treaty does not mention the banks. It speaks only of nation-states. But the final beneficiaries are large commercial banks, which lent the money to the PIIGS. They are being threatened with non-payment. The PIIGS cannot pay off their bar tabs. They may not be able to meet payment for more drinks. Their hangovers may get so bad they are forced into withdrawal. It's the DTs for southern Europe. Tavern owners around Europe and around the world shudder at the thought.

THE KEY WORD IS "IMMUNITY"

The ESM will have total sovereignty over the bailout money. Once pledged, the individual nations will have no sovereignty over this money.

The treaty is 55 double-spaced pages long in English. A researcher will get to the heart of the matter by searching for the word "immunity." Here is the crucial passage.

The ESM, its property, funding and assets, wherever located and by whomsoever held, shall enjoy immunity from every form of judicial process except to the extent that the ESM expressly waives its immunity for the purpose of any proceedings or by the terms of any contract, including the documentation of the funding instruments. (Article 27:3)

This is the classic mark of political sovereignty. The agency which possesses the power to issue commands is not subject to any higher court with respect to these commands. Those under it answer to it; it answers to no one.

Immunity means sovereignty. The conspirators, beginning with Jean Monnet at the Versailles Conference (1919), have worked to persuade parliaments to surrender economic authority on the terms of cross-border trade. This authority has been transferred, year by year, to international regulatory agencies that do not answer to the parliaments. This is a surrender of political sovereignty under the cover of economic liberalization. The member governments gave up the right to impose tariffs, i.e., sales taxes on imported goods. What did they get in exchange? Economic growth.

But any nation could have attained this goal merely by unilaterally legislating reductions of tariffs and quotas. It would have taken no binding treaty to do that.

Then why the earlier treaties? They were a means of creating acceptance of cross-border agreements that transferred sovereignty to a series of inter-European regulatory agencies. This precedent was a kind of lobster trap. The deeper the economies of the nations relied on each other to extend the division of labor and increase per capita wealth â a legitimate economic goal â the more dependent they became on the continuing authority of the inter-governmental regulatory bureaucracies. They got used to the idea of surrendering sovereignty along with the surrender of economic authority to the free market, as guided by the bureaucrats. This was managed trade, not free trade.

The regulatory agencies received judicial immunity from lawsuits from member nations. This was crucial for the extension of the New World Order.

Equally important was the creation of a judicial lobster trap. Once bound by a treaty, a nation's parliament cannot secede. Anyway, this is the official position of the inter-governmental bureaucracy known as the European Union. The European model was the Germanic Zollverein, or customs union, which began in 1818 and continued to expand until 1871. It eliminated tariffs between separate national jurisdictions, and it subjected them all to high tariffs nationally. This led to the establishment of national sovereignty in 1871: Germany. It was begun by Prussia, and it culminated in a nation dominated by Prussia. After 1871, secession was militarily impossible.

Critics of the Common Market have been warning against the economic unification of Europe ever since the formation of the European Coal and Steel Community in 1951. This was the predecessor of the Common Market (1957). They have said that economic liberalization under a series of treaties was a gigantic bait-and switch operation, that the ultimate goal was the destruction of national sovereignty in Europe. They were right in 1951. For 60 years, they have been right.

Any politician who dared to criticize this process was crushed. This is still true. The unification agenda remains unassailable, despite voter resistance.

TIMELINE

The ESM treaty was released to the public on July 11, 2011. We read this on the website of the European Commission's Economic and Financial Affairs.

On 11 July, finance ministers of the 17 euro-area countries signed the Treaty establishing the European Stability Mechanism (ESM). The Treaty follows the European Council decision of 25 March 2011 and builds on an amendment of Article 136 of the Treaty on the Functioning of the European Union (TFEU).

In July 2013, the ESM will assume the tasks currently fulfilled by the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM). Although the Treaty was signed by the 17 euro-area countries, the ESM will also be open to non-euro area EU countries for ad hoc participation in financial assistance operations.

If the treaty is ratified by December 31, 2012, the New World Order of Europe will come into full-scale maturity on January 1, 2013. Once the bankers have a near-guaranteed bailout arrangement, international political power over money is transferred to them. The details of who pays how much inside each nation's borders is irrelevant to the bankers. The bankers' reckless lending and the politician's insatiable demand for borrowed money has created the crisis. The solution? More of the same.

Ministers reaffirmed their absolute commitment to safeguard financial stability in the euro area. To this end, Ministers stand ready to adopt further measures that will improve the euro area's systemic capacity to resist contagion risk, including enhancing the flexibility and the scope of the EFSF, lengthening the maturities of the loans and lowering the interest rates, including through a collateral arrangement where appropriate. Proposals to this effect will be presented to Ministers shortly.

How long will this go on? Until the eurozone breaks up. The key word is "multi-year."

Ministers discussed the main parameters of a new multi-annual adjustment programme for Greece, which will build on strong commitments to fiscal consolidation, ambitious growth-enhancing structural reforms and a substantial privatisation of state assets. Ministers welcomed the reinforcement of monitoring mechanisms of the programme of Greece, the nomination of the board of the privatisation agency, which comprises two observers representing euro area Member States and the European Commission, and agreed to provide extended technical assistance to Greece. They called upon the Greek government to sustain its on-going efforts to meet these commitments in full and on time.

Ministers welcomed the decision by the IMF to disburse the latest tranche of financial assistance to Greece, as well as the proposals from the private sector to voluntarily contribute to the financing of a second programme, building on the work already underway. The ECB confirmed its position, reaffirmed by its Governing Council last Thursday, that a credit event or selective default should be avoided.

I like that: "credit event." It means "selective default." That would trigger a crisis: default-insurance contracts. The issuers would have to come up with overnight money in the hundreds of billions.

While the responsibility for resolving the crisis in Greece lies primarily with Greece, Ministers recognised the need for a broader and more forward-looking policy response to assist the government in its efforts to bolster debt sustainability and thereby safeguard financial stability in the euro area.

So, the press release coincided with the release of the treaty. Greece got the headlines. The press release hinted at what is to come.

Ministers commit to continue negotiating with the European Parliament the legislative proposals to reinforce economic governance in the European Union in order to agree on an ambitious reform as soon as possible. The reinforced governance should be fully operational without delay.

In other words, the timing was perfect. The public was focused on Greece. The heart of the matter was the ESM treaty â the so-called "ambitious reform."

Let us return to the promotional page for the treaty.

As of 1 July 2013, the ESM will enjoy preferred creditor status similar but junior to the IMF. Euro-area Member States will support equivalent creditor status of the ESM and that of other EU Member States lending bilaterally alongside the ESM. . . .

This is another layer of multinational lending. The goal is officially to keep member nation-states from falling into insolvency, i.e., not being able to make regular payments in their bar tabs. They need to do this in order run up their tabs day by day, "just to clear our heads." The ESM is about preserving the nations' ability to keep the taverns in business.

The document ends:

The treaty now needs to be ratified by the euro-area Member States before 31 December 2012 to enter into force following approval of signatories representing no less than 95 % of the total subscriptions.

We see here the extension of the grasping hands of the EU. It must grasp, for it must stand ready to bail out the PIIGS, so that the PIIGS will meet their interest payments to the banks

The EU is trying to bypass the voters. It wants no public debate over whether to pony up the cash to the EU's ESM. The EU's lack of control over national fiscal policy is mitigated if the ESM can get parliaments to vote for European-wide safety net. The pitch: "If you don't pony up, there will be no bailout for you." The politicians know how close to the edge every nation's finances are. They want a safety net. That's what modern politics is all about: buying votes by promising safety nets.

CONCLUSION

I came up with three laws of bureaucracy 40 years ago.

1.No matter how tightly the by-laws are written for a tax-funded agency, some agency bureaucrat will exceed common sense in his attempt to follow the text.

2.The bureaucracy will back up the bureaucrat who does this until such time as there is a revolt by those funding the bureaucracy.

3.All bureaucracies seek to secure guaranteed future income from the taxpayers, no matter what the taxpayers say or do.

4.The taxpayers will finally revolt.

The taxpayers will revolt in Europe. The Eurocrats think they can gain sovereignty by getting legislators to agree to another treaty, once and for all. They can't.

At some point, the nations will default. A Great Default is coming. This may be all at once. It may be piecemeal. But the big banks will get stiffed. So will the voters who have become dependent on income promised by politicians, who will finally have to go cold turkey.

The DTs are coming.

http://www.marketoracle.co.uk/Article31455.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Treasonous Congress Funds Billions For Middle East Invasion...

05-02-2024, 01:28 AM in Videos about Illegal Immigration, refugee programs, globalism, & socialism