Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

07-26-2011, 12:06 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The worst may still be ahead for housing – 3 million homes

The worst may still be ahead for housing – 3 million homes foreclosed on in the last three years with another 5 to 7 million foreclosures in the pipeline. One third of homeowners believe they are underwater.

25 Jul, 2011

many links on this post

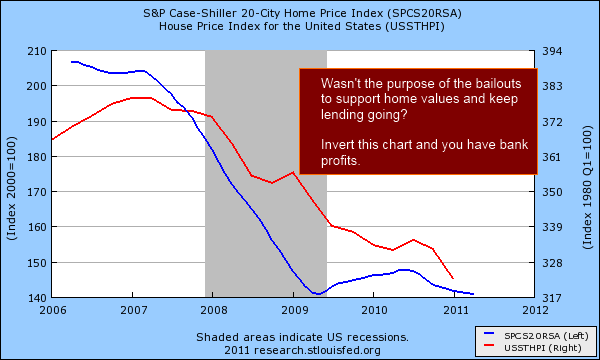

Ignoring a problem might bring temporary relief but ultimately a day of reckoning must occur. The underlying problems with housing have been swept under the rug for many years like dust trying to be ignored. Yet the dust is still there and it will ultimately need to be cleaned up. The housing market is simply in a temporary lull yet more troubles are ahead. Take for example the HAMP program that was designed to help 3 to 4 million homeowners. As of the first quarter of 2011 only 634,000 loans have been modified. Why was this program such a major failure? Simply put the program sought to fix an issue that was temporary in nature yet the reality was that the housing collapse is much more systemic than a temporary problem. It was a massive bubble embedded in our banking system. Perspective is important here. Over the last three years some 3 million loans have fallen to foreclosure. Yet some in the industry are projecting another 5 to 7 million foreclosures by the end of 2012. If we figure that foreclosure is the ultimate sign of housing failure then the worse may still be ahead for housing.

Home prices falling for five solid years

Home prices continue to move lower and are now bouncing in a short-term trough. For some parts of the country home prices are more justified with local area incomes but other markets like in California remain stubbornly in a bubble holding pattern. I think the psychology in bubble states keeps prices inflated even longer because people want to believe that somehow the rules of economics do not apply to their own area. Of course, home prices have fallen hard in many once untouchable markets yet many are still willing to bet that things will somehow miraculously turn around even though the economy is weak. What is even more surprising is the notion that with broke state governments and a broke Federal government that somehow taxes will not be going up. It is only a matter of time that taxes move up and in a state like California where property receives favorable treatment I would suspect that this will be on the table shortly. Taxes seem to be blistering high on everything but property in the state. Regardless of the politics money is running out and tough choices need to be made. So how do we envision price appreciation in property with this economic climate in mind?

Loans currently in foreclosure

Over 2 million loans are currently in the foreclosure process. To envision 5 million more foreclosures in the next two years isn’t hard to imagine since nearly half of those homes are already in the process and only waiting to be finalized. It should be obvious to most of you that the banking bailouts were merely programs to protect financial institutions from facing reality. That was it. It was one giant bread and circus spectacle to fool the public into believing that somehow these bailouts were necessary in keeping home values inflated (instead they inflated the pocketbooks of bankers). Now the government is talking about renting out REOs as some kind of solution. We have gone back to square one except we have already spent most of the money on propping up the financial institutions that caused this mess. People are losing faith in the system especially with the insanity now going on with the debt ceiling. Apparently we have no problem dolling out trillions of dollars to banks so they don’t have to practice normal accounting procedures but when it comes to paying our bills we now have to tighten our fiscal belts? What an odd universe we live in at the moment.

Half of mortgage holders think they have equity

It would seem that homeowners have a better grasp on reality than those on Wall Street. Only half of homeowners actually believe that they have equity in their home:

“(DSNews) Less than half of homeowners – 49 percent – currently believe their home is worth more than the amount they still owe on their mortgage.

…One-third of homeowners believe they are underwater with their mortgage, and 18 percent of respondents said they weren’t sure.�Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

07-26-2011, 12:51 AM #2

More homes for Fannie and Freddie to redistribute as section 8 rentals or sell to people that are receiving HUD taxpayer funded grants that are determined by HUD Grantees, many of which I can't pronounce very well becausee English is my native language , that have a 10 day window on every forclosure to allow them the first pick of forclosed homes.

Thank Hilda Solis....Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Larry Fink: Migration Is Bad for Productivity and Wealth

05-03-2024, 08:42 PM in illegal immigration News Stories & Reports