Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

12-15-2009, 06:06 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Yield Curve Happenings: Long Bond Yield Drops, Everything El

Monday, December 14, 2009

Yield Curve Happenings: Long Bond Yield Drops, Everything Else Rising

Curve Watchers Anonymous noted an interesting thing on Friday and again today. The long end of the yield curve is rallying or steady (yields declining), while the middle portion of the curve is selling off (yields rising).

This happened on Friday and again today.

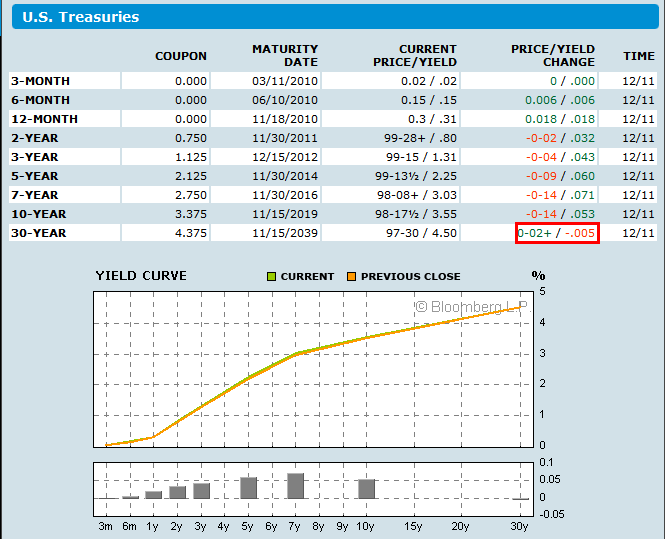

Yield Curve as of Friday's Close (2009-12-11)

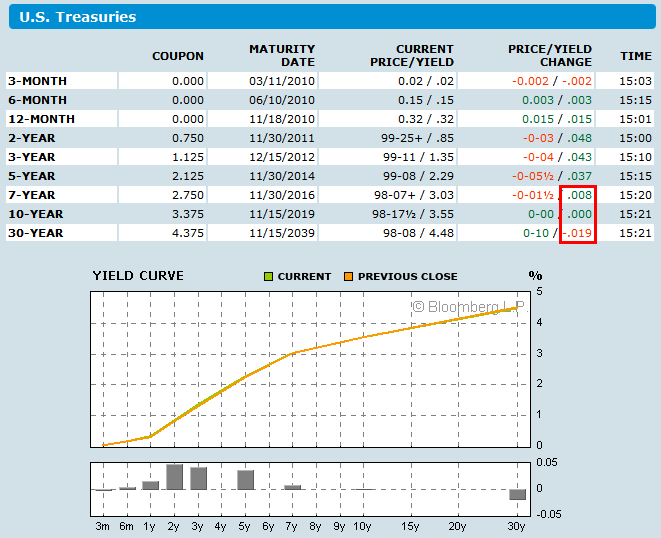

Yield Curve as of Monday (2009-12-14 15:21 EST)

On Friday, the 2-year, 3-year, 5-year and 7-year yields rose, with the 5-year and 7-year yields rising more than the 10-year yield. The long bond yield dropped.

Today, the long bond (30-year) treasury yield is lower again, with the 10-year yield flat, while the 2-year, 3-year and 5-year yields are rising.

This is not normal action to say the least.

On December 11, in Yield Curve Steepest Since 1980; Hard Times Ahead in 2010 http://globaleconomicanalysis.blogspot. ... -hard.html I stated "Judging from action in the 5-year treasury, it appears as if there is a long 3-to-5 year, short 30-year trade in play."

Here is a chart I made last Thursday, and posted Friday.

Yield Curve As Of December 10 2009

Flashback July 16, 2009: Pimco Says Improving Economy to Steepen Yield Curve http://www.bloomberg.com/apps/news?pid= ... V3oQYVeSkc

The difference between Treasury two- and 10-year yields may widen to record levels set last month as the U.S. economy recovers, according to Pacific Investment Management Co., which runs the worldâs biggest bond fund.

âLong-term rates will rise at a faster speed than short- term rates,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

We must push through early Thurs at this critical moment

04-24-2024, 10:44 PM in illegal immigration Announcements