Results 1 to 10 of 15

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

03-01-2018, 11:07 PM #1

IRS Admits It Encourages Illegals To Steal Social Security Numbers For Taxes

IRS Admits It Encourages Illegals To Steal Social Security Numbers For Taxes

Robert W. Wood , CONTRIBUTORI focus on taxes and litigation. Opinions expressed by Forbes Contributors are their own.

This isn’t exactly the kind of story the IRS wants buzzing around at tax time. The IRS and Justice Department normally want 'scared straight' stories just before Tax Day. Ideally, when an indictment or conviction for tax evasion hits the news, it makes you think twice. Somehow, you think just a bit more about all those deductions, or if you really reported all your income, before you sign your return under penalties of perjury.

Instead, we have the top dog at the IRS, the IRS Commissioner himself, admitting that, well, there’s a problem with illegal immigrants and taxes. In fact, the top IRS official this time wasn’t talking about how the IRS wipes some hard drives or can’t find emails. He wasn’t even asking for a bigger budget to give bonuses to IRS employees.

GalleryThe 9 Most Common Tax Filing Mistakes

Launch Gallery10 images

This time, he was talking about illegal immigrants, and about the IRS turning a blind eye. Or maybe worse. The IRS actually wants illegal immigrants to illegally use Social Security numbers, he suggested. IRS Commissioner John Koskinen made the surprising statement in response to a question from Sen. Dan Coats, R-Ind., at a Senate Finance Committee meeting. The question was a touchy one. Gee, is the IRS collaborating with taxpayers who file tax returns using fraudulent information? It wasn't put exactly that way. According to Senator Coats:

What we learned is that ... the IRS continues to process tax returns with false W-2 information and issue refunds as if they were routine tax returns, and say that's not really our job. We also learned the IRS ignores notifications from the Social Security Administration that a name does not match a Social Security number, and you use your own system to determine whether a number is valid."Commissioner Koskinen was asked to explain this. He suggested that as long as the information is being used only to fraudulently obtain jobs, the IRS was OK with it. In fact, he said that the IRS actually had an interest in helping the illegal immigrants to crook these rules. In fairness, perhaps it's just the 'that's not my department' response that abounds in big government. Perhaps this just isn't the IRS'sproblem, but it sure seems odd to have any agency chief encouraging illegal immigrant theft of SSNs.

You'll love this next part. The IRS chief tried to distinguish between the various bad uses and misuses of someone else's personal data. It is at least vaguely reminiscent of the flap a year ago that differentiated President Obama and Donald Trump over immigration and taxes. Mr. Trump said illegal immigrants get $4.2 billion in tax credits. A 2011 audit by the Treasury Inspector General for Tax Administration confirmed that individuals who are not authorized to work in the United States were paid $4.2 billion in refundable credits.

Of course, undocumented immigrants cannot legitimately get Social Security numbers, but it seems the IRS doesn't care. Besides, they can file taxes with an Individual Taxpayer Identification Number. ITIN. They are not supposed to get the Earned Income Tax Credit, but they can receive the additional child tax credit. If the President succeeds in legitimizing the status of illegal immigrants, they could even get the Earned Income Tax Credit that is responsible for billions in fraudulent refunds.

The recipe goes like this. First, get a Social Security number, then claim the Earned Income Tax Credit for the last three years. Then, wait for the IRS to send you three years of tax refunds. The gambit could apparently work even if you never paid taxes, never filed a return, and worked off the books. And the IRS says this is the way the Earned Income Tax Credit works.

The recipe goes like this. First, get a Social Security number, then claim the Earned Income Tax Credit for the last three years. Then, wait for the IRS to send you three years of tax refunds. The gambit could apparently work even if you never paid taxes, never filed a return, and worked off the books. And the IRS says this is the way the Earned Income Tax Credit works.

Cautious IRS Commissioner Koskinen himself explained the seemingly bizarre result to Sen. Charles Grassley (R-Iowa) in 2015. Illegal immigrants covered by the President’s amnesty deal can claim back tax credits for work they performed illegally, even if they never filed a tax return during those years. This written response clarified the IRS chief’s earlier statements, confirming that illegals can get back taxes.

In 2015, IRS Commissioner Koskinen said that to claim a refund, an illegal immigrant would need to have filed past tax returns. But the IRS chief later corrected himself and said that they can claim the money even if they never filed tax returns in the past. According to the IRS, illegal immigrants granted amnesty and Social Security numbers can claim up to three years of back tax credits.

For alerts to future tax articles, email me at Wood@WoodLLP.com. This discussion is not legal advice.

https://www.forbes.com/sites/robertw.../#2a6a97704c04

-

03-01-2018, 11:15 PM #2

This article is almost 2 years old, but I was researching how to know if someone has stolen your social security number. I think one way as citizens that we can help to make it more difficult for illegals is to not just research how to find out if someone is using our social security number, but we need to verify that know one is using our deceased parents/grandparents or loved ones and and our children's social security numbers.

If more and more citizens do this, we can start to make it harder for illegals. I've always wondered if illegals are using my deceased parents' social security numbers. I'm going to try to look into that. I don't want my parents' death to be a benefit to illegals.

And as far as this article goes, this is more than outrageous that the IRS, a government agency is encouraging illegal aliens to steal peoples' social security numbers. The people who are supposed to be protecting us, are the same people who are encouraging illegal aliens to steal our social security numbers.

-

03-01-2018, 11:24 PM #3

Illegal, but Not Undocumented

Identity Theft, Document Fraud, and Illegal Employment

PrintBy Ronald W. Mortensen on June 19, 2009

Download this Backgrounder as a pdf

Ronald W. Mortensen, PhD, is a retired career U.S. Foreign Service Officer and former Society for Human Resource Management senior executive.

This Backgrounder examines illegal immigration-related document fraud and identity theft that is committed primarily for the purpose of employment. It debunks three common misconceptions: illegal aliens are “undocumented;” the transgressions committed by illegal aliens to obtain jobs are minor; and illegal-alien document fraud and identity theft are victimless crimes. It discusses how some community leaders rationalize these crimes, contributing to a deterioration of the respect for laws in our nation, and presents a variety of remedies, including more widespread electronic verification of work status (E-Verify and the Social Security Number Verification Service) and immigrant outreach programs to explain the ramifications and risks of document fraud and identity theft.

The findings include:

- Illegal immigrants are not “undocumented.” They have fraudulent documents such as counterfeit Social Security cards, forged drivers licenses, fake “green cards,” and phony birth certificates. Experts suggest that approximately 75 percent of working-age illegal aliens use fraudulent Social Security cards to obtain employment.

- Most (98 percent) Social Security number (SSN) thieves use their own names with stolen numbers. The federal E-Verify program, now mandated in only 14 states, can detect this fraud. Universal, mandatory use of E-Verify would curb this and stop virtually 100 percent of child identity theft.

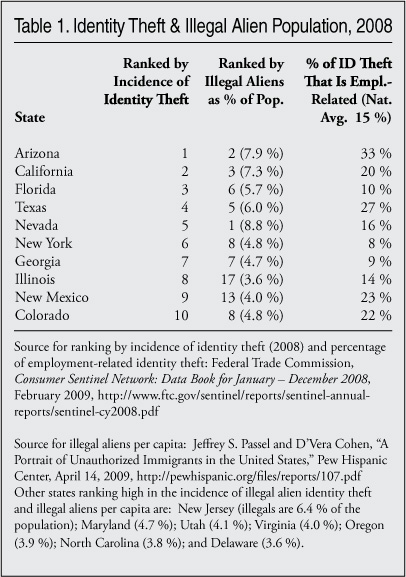

- Illegal immigration and high levels of identity theft go hand-in-hand. States with the most illegal immigration also have high levels of job-related identity theft. In Arizona, 33 percent or all identity theft is job-related (as opposed to identity theft motivated simply by profit). In Texas it is 27 percent; in New Mexico, 23 percent; in Colorado, 22 percent; California, 20 percent; and in Nevada, 16 percent. Eight of the 10 states with the highest percentage of illegal aliens in their total population are among the top 10 states in identity theft (Arizona, California, Florida, Texas, Nevada, New York, Georgia, and Colorado).

- Children are prime targets. In Arizona, it is estimated that over one million children are victims of identity theft. In Utah, 1,626 companies were found to be paying wages to the SSNs of children on public assistance under the age of 13. These individuals suffer very real and very serious consequences in their lives.

- Illegal aliens commit felonies in order to get jobs. Illegal aliens who use fraudulent documents, perjure themselves on I-9 forms, and commit identity theft in order to get jobs are committing serious offenses and are not “law abiding.”

- Illegally employed aliens send billions of dollars annually to their home countries, rather than spending it in the United States and helping stimulate the American economy. In October 2008 alone, $2.4 billion was transferred to Mexico.

- Tolerance of corruption erodes the rule of law. Corruption is a serious problem in most illegal aliens’ home countries. Allowing it to flourish here paves the way for additional criminal activity and increased corruption throughout society.

- Leaders support perpetrators and ignore victims. Political, civic, religious, business, education, and media leaders blame Americans for “forcing” illegal aliens to commit document fraud and identity theft. No similar concern is expressed for the American men, women, and children whose lives are destroyed in the process.

- The Social Security Administration and Internal Revenue Service facilitate illegal immigrant-driven identity theft. Both turn a blind eye to massive SSN fraud and take no action to stop it. The Social Security Administration assigns SSNs to new-born infants that are being used illegally. The IRS demands that victims pay taxes on wages earned by illegal aliens using their stolen SSNs, while taking no action to stop the identity theft.

- State and local governments need to adopt tougher laws to supplement federal efforts. The Bureau of Immigration and Customs Enforcement (ICE) is targeting large document fraud rings and the most egregious employers, but their resources are limited and stretched across multiple priorities. In 2007, identity theft cases represented only 7 percent of the total ICE case load.

- Employers must do their part. They can ensure that they have a legal workforce by using a combination of the federal government’s E-Verify and Social Security Number Verification Service systems and by signing up for the federal government’s IMAGE program or privately conducted audits.

Misconceptions

That Illegal Aliens Are Undocumented

William Riley, Former ICE Agent,

Explains Identity Theft:View the Full Interview

When Jean Pierre from Montreal crosses the border into the United States illegally, he lacks the documents to obtain employment and other benefits that legal residents of the United States are entitled to. When Maggie from Dublin and Raj from India overstay their tourist visas in order to work in the United States, they find themselves in the same situation.

Because it is virtually impossible to live and work in the United States without documents, they and millions of others turn to fraudulent document dealers for falsified Social Security cards, forged drivers licenses, counterfeit green cards, and a wide range of other phony documents.

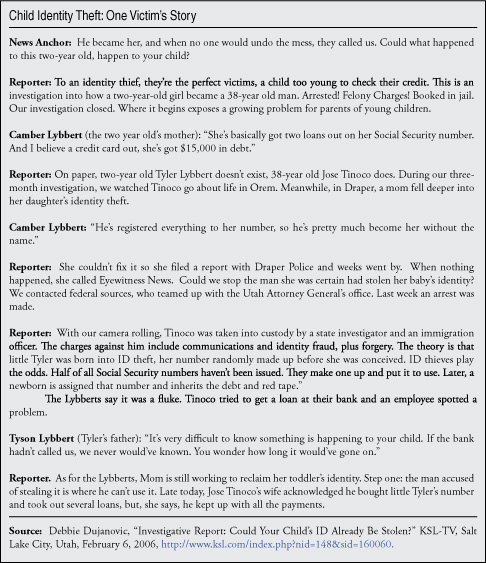

According to Richard Hamp of the Utah Attorney General’s Office, illegal aliens rarely steal Americans’ total identities (a victim’s full name, date of birth, and SSN) simply because doing so is more difficult and expensive. Instead, illegal aliens commit SSN-only identity theft by obtaining fraudulent Social Security cards in their own names, often with random numbers made up by dealers. However, since about half of all SSNs have been issued, there is a 50-50 chance that the SSN already belongs to another person. And even if the number hasn’t been issued, the Social Security Administration may later assign it to an infant, thereby giving a newborn an instant credit history, arrest record, and liability for back taxes.

That Illegal Aliens Are Law-Abiding

Illegal aliens who commit document fraud, use SSNs that do not belong to them, and falsify I-9 forms under penalty of perjury clearly are not ordinary law-abiding residents. They may be arrested and prosecuted for felony document fraud and perjury and in, certain states, they may be prosecuted for felony identity theft or felony identity fraud.

So, while simply living in the country without authorization is usually a civil offense, a large number of illegal aliens rapidly take the next step and commit serious felonies in order to obtain jobs and other benefits reserved for American citizens and legal residents.

Identity Theft Defined. The non-profit Identity Theft Resource Center defines identity theft as “a crime in which an impostor obtains key pieces of personal identifying information (PII) such as SSNs and drivers license numbers and uses them for their own personal gain.” According the Federal Trade Commission, “Identity theft occurs when someone uses your personally identifying information, like your name, SSN, or credit card number, without your permission, to commit fraud or other crimes…. They may get a job using your Social Security number.”1

Therefore, the use of an SSN belonging to someone else, whether knowingly or unknowing, is clearly identity theft according to these definitions. In addition, the victims of illegal alien SSN identity theft suffer clear and extremely serious harm.

In spite of this, under federal and many state statutes, a person using someone else’s SSN or other personal information must “knowingly” do so in order to be convicted of felony identity theft. The United States Supreme Court has ruled that prosecutors must prove that an illegal alien is knowingly using another person’s SSN in order to convict the illegal alien of identity theft under the federal statute, thereby, leaving the victims of these serious and often devastating crimes unprotected.

At the state level, Utah faced the problem of defense attorneys claiming that their illegal alien clients should get off because they were not knowingly using the SSNs of Utah children. Therefore, in 2006, in order to protect all American citizens and legal residents including tens of thousands of children, Utah’s identity fraud statute was amended to clearly state that it is not a defense to argue “that the person did not know that the personal information belonged to another person.”

Following the U.S. Supreme Court ruling, County Attorneys in Arizona expressed confidence that that state’s felony identity theft statute would withstand challenge and called on Congress to revise federal statutes to hold illegal aliens committing identity theft liable for their actions.2 Prosecutors in Kansas said that they would press legislators to revise identity theft statutes and it is anticipated that other states around the nation also will amend their statutes in order to protect their citizens from illegal alien-driven identity theft.3

The Relationship Between Identity Theft and Illegal Immigration. U.S. law enforcement agencies have observed that identity theft and immigration “go hand in hand.”4 In Weld County, Colo., which has large numbers of illegal aliens employed in the meat packing industry, District Attorney Ken Buck reports that the principal driver of identity theft is job related5

Identity theft is one of the fastest-growing crimes in the United States and impacts millions of American citizens and legal residents each year, though actual numbers are difficult to determine because most governments and police departments don’t track identity theft. Even the Federal Trade Commission, which is the lead agency for reporting identity theft, only captures a small number of actual identity theft cases.

But we know that illegal aliens routinely use fraudulent SSNs belonging to American citizens and legal residents. In a 2002 report to Congress, the General Accounting Office stated: “INS has reported that large-scale counterfeiting has made fraudulent employment eligibility documents (e.g., Social Security cards) widely available.”6 The Social Security Administration assumes that roughly three-quarters of illegal aliens are paying payroll taxes through withholding, which generally requires an SSN.7

For example, an immigration raid at an Agriprocessors, Inc., meat processing plant in Pottsville, Iowa, last year found that 76 percent of the plant’s employees had bogus SSNs.8 And during an April 2008 raid at Pilgrim’s Pride meat packing plants, more than 280 employees at facilities in five states were arrested on suspicion of committing identity theft and other criminal violations in order to obtain jobs.9According to press reports, ICE agents said their investigation of Pilgrim’s Pride started when the victims of identity theft came forward after having problems with taxes and credit reports.10

Illegal aliens’ fraudulent document use was further confirmed by Domingo Garcia, General Counsel for the League of United Latin American Citizens (LULAC), who, according to press reports, said that it was well known that around 80 percent of the workers at Pilgrim’s Pride had fake identification.11

So its no surprise that Table 1 shows that states with the highest percentage illegal aliens in their total populations tend to have the highest incidence of overall identity theft, including significant levels of employment-related identity theft.

Of the 10 states with the highest incidence of identity theft, eight are among the 10 states where illegal aliens account for the largest percentages of total population. The two remaining top-10 identity theft states are ranked 13 and 17 in terms of percentage of illegal aliens.

In 2008, 15 percent of all identity theft in the United States was employment-related, up from 14 percent in 2007.12 Six of the 10 states with the highest identity theft have employment-related identity theft rates that exceed the national average. In Arizona, where substantive illegal immigration-related legislation was passed and where employment verification is now required, employment-related identity theft dropped significantly, from 39 to 33 percent of all identity theft cases. In Colorado, employment-related identity theft increased from 17 to 22 percent between 2007 and 2008. In New Mexico, the increase was from 19 to 23 percent; in Texas, from 24 to 27 percent; and in California, from 17 to 20 percent.

ICE Efforts Are Improving. ICE is the lead agency addressing immigration-related document fraud and identity theft. In 2006, the agency established the Document and Benefits Fraud Task Forces (DBFTF), which are now in place in 17 ICE field offices. Their mission is to investigate and dismantle criminal organizations that make, sell, and distribute identity documents to circumvent immigration laws or for any other criminal purpose and to seize their equipment and assets. For example, ICE agents in Denver, assisted by other field offices and federal agencies, took down the notorious Castorena family organization. The family ran a massive nationwide network of fake document rings, producing papers such as green cards, Social Security cards, drivers licenses, and other types of documents. Their franchises reached all 50 states.

The work of the DBFTFs intersects with other agency work, including counter-terrorism investigations and worksite operations. Many of ICE’s recent worksite enforcement operations have been launched as a result of information or activity uncovered by the DBFTFs. The 2006 operation conducted against the Swift & Company meat processing business, which resulted in the arrest of nearly 1,300 illegal aliens, was launched after ICE agents discovered hundreds of victims of identity theft from illegal workers at the Swift plants.

While ICE has recently been able to increase its efforts in this area, the agency has limited resources that are stretched across multiple priorities. In 2007, ICE worked 5,080 identity and/or benefit fraud cases, generating hundreds of indictments, arrests, and convictions.13However, this represented only 7 percent of ICE’s total case load, reflecting the reality that violent criminals and drug smuggling are a more pressing investigative priority for ICE. Further, the DBFTFs must focus their efforts on dismantling large criminal enterprises. They do not have the resources or personnel to investigate every individual alien identity thief. As with other kinds of criminal activity, it is up to state and local law enforcement agencies to identify and address what is happening in their jurisdiction, and be the prosecutors of first resort.

That Illegal Imigration Is a Victimless Crime

Illegal alien-driven identity theft is not a victimless crime. It impacts millions of Americans of all ages. Newborn infants and children often are the victims of illegal alien identity thieves. IRS agents, law enforcement officials, people with disabilities, the unemployed, and even those serving time in jail have been victimized by illegal aliens using their SSNs in order to obtain jobs and other benefits. According to the Wall Street Journal, American citizens with Hispanic surnames are 1.5 times more likely to be victims of job-related identity theft than are other Americans.14

Following the Swift meat packing raids, Department of Homeland Secretary, Michael Chertoff told reporters that:

Anybody who has ever been a victim of identity theft understands the hardship, and, in fact, the persistent hardship, that follows from this kind of crime, and the hardship that is felt by innocent people.

Now, this is not only a case about illegal immigration, which is bad enough. It’s a case about identity theft in violation of the privacy rights and the economic rights of innocent Americans…. These individuals suffered very real consequences in their lives. These were not victimless crimes. 15

Thus, when illegal aliens use SSNs or other documents belonging to American citizens and legal residents, the damage can be substantial. The true owners risk being saddled with the illegal aliens’ credit, arrest, and medical records. Victims may be denied jobs, unemployment insurance, Social Security payments, and Medicaid benefits. It costs victims hundreds of hours and thousands of dollars to undo the damage and recover their names and lives.

In addition, all Americans are impacted by the fallout from illegal alien-driven document fraud and identity theft. Rather than spending their earnings in the United States and helping fuel the consumer-driven American economy, illegal workers minimize their expenditures in the United States so they can send billions of dollars back to their home countries. During a recessionary period, this transfer makes it all the more difficult to turn the economy around.

When the economy hits hard times and Americans and legal residents lose their jobs, illegal aliens can continue to work using their stolen identities and fraudulent documents. If an illegal alien who is laid off uses his fraudulent documents to obtain unemployment benefits, this drives up the cost of unemployment insurance. If an illegal alien is using an American’s SSN to obtain unemployment benefits, that citizen will be denied benefits that he or she is legally entitled to.

Children Are Prime Targets. Children do not use their SSNs for employment or to obtain credit so parents generally do not check their children’s credit histories, allowing a person using a child’s SSN to go undetected for years. Sometimes document vendors sell fraudulent identity packages using unassigned SSNs that are later assigned to a child, causing them problems before they are even born.

“We have a major problem with workers in medical offices stealing patients’ identities, selling them, and making a direct profit,” according to Sergeant James Bracke of the Phoenix Police Department.16 The stolen numbers are sold to immigrant smuggling groups who use them to fabricate fraudulent documents for people they bring into the United States via Arizona. The result of this is that in Arizona, child identity theft is nearly four times the national rate and an estimated 1.1 million Arizona children have had their identities stolen.117

State and local investigators in Utah uncovered a crime spree involving illegal aliens using the SSNs of tens of thousands of children. They identified 1,626 companies paying wages to the SSNs of children on public assistance under the age of 13.18 One child’s SSN was being used by 37 adults.

Illegal aliens used the Utah children’s SSNs to get jobs, start businesses, and open bank accounts. One suspect told investigators he paid $100 for a boy’s SSN. Victims included a five-year-old girl who supposedly traveled 80 miles to her job at a steak restaurant, an eight-year-old boy who apparently owned a cleaning company and worked as a prep cook at two upscale restaurants, and an 11-year-old boy who supposedly worked for an express air freight company. The suspects were charged with third degree felony counts of identity fraud and forgery.19

Employment-related identity theft is the largest single driver (27 percent) of identity theft in the state of Texas. Almost 900,000 people became victims of identity theft in Texas in 2007. The cost to Texas victims was an estimated $435.7 million and Texas residents spent an estimated total of 3.5 million hours resolving identity theft issues.20

The link between illegal aliens and identity theft was further confirmed by the Social Security Administration’s Special Agent in Charge in Salt Lake City. As reported in the May 3, 2006, Salt Lake Tribune:According to Ronald Ingleby, Special Agent in Charge of the Social Security Administration’s Office of the Inspector General in Utah, real Social Security numbers and accounts are being created, or purloined, by undocumented workers to circumvent employers’ efforts to certify their legality….Ninety-eight percent of Social Security-related ID theft cases involve people who use their own names but use someone else’s Social Security number. Two percent involve perpetrators using the numbers to assume their victims’ identities.... 21Identity Theft Victims Suffer Real Consequences. Victims of identity theft suffer real consequences. The victims of workers at the Swift packing plants included an individual in Texas whose personal information was being used by an illegal alien for employment. The victim was pulled over and arrested because the illegal alien had used his identity to conduct criminal activity.22

In Utah, the staff of the state’s Workforce Services office has seen children denied Medicaid benefits because adults were using their SSNs. Based on information developed by Workforce Services, Utah Attorney General, Mark Shurtleff warned the public about the devastating impact that illegal alien identity theft has on children when he said:Identity thieves are no respecters of age. They will steal your children’s ID, ruin their credit, and hurt them in ways never thought possible before they can graduate from grade school. Children are vulnerable even if parents do everything right.23In Illinois, an American citizen was denied a job at a Target store because one of 37 people who were using her SSN was already employed by the company. According to MSNBC, “The woman found herself in a financial nightmare. All those imitators made a mess out of her work history, her Social Security records, and her credit report. She was haunted by bills and creditors. She received threatening letters from the IRS, asking her to pay taxes on money earned by imposters. She was told to re-pay unemployment benefits she had received, after the government discovered she was ‘working’ while drawing benefits.”24

A man whose SSN was used to obtain employment in at least three states was told by the IRS that he owed $64,000 in unpaid taxes in spite of the fact that he had been incarcerated in a state penitentiary during the time the income was earned.25

A nursing home resident nearly lost his disability benefits because a worker at a Pilgrim’s Pride meat plant was using his identity and it appeared that the disabled patient was working.26 An Air Force veteran was arrested on a warrant for unpaid parking tickets incurred by an illegal alien using his identity. He was only released after paying a $340 fine for tickets that he did not incur. He continued to receive demands for the payment of outstanding taxes on income that he had not earned and he saw his credit rating destroyed.27

These stories are just the tip of the iceberg. Millions of Americans either knowingly or unknowingly are sharing their SSNs with illegal aliens and are having their lives slowly usurped by the identity thieves. They will only learn of the damage done when they are denied credit, receive a notice for taxes on income they didn’t earn, are denied benefits that they are entitled to, find that their medical records have been corrupted with possibly life-threatening consequences, or when collection agencies start calling.

A Culture of Corruption

Even those American citizens or legal residents whose identities are not stolen by an illegal alien still suffer the consequences of rampant document fraud and identity theft.

One of the key elements of a free and democratic society is respect for the rule of law by both the government and individuals. However, in most illegal aliens’ homelands, the rule of law is routinely disregarded and official corruption is a serious problem.

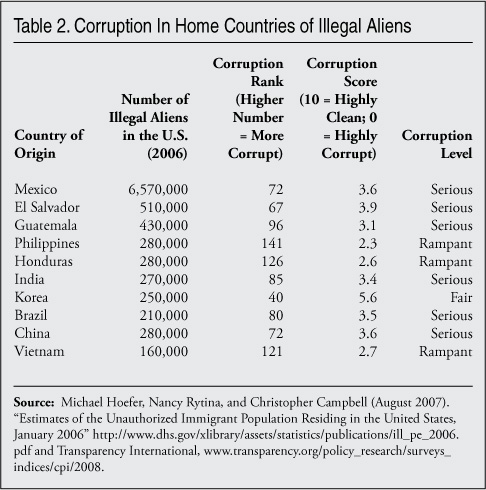

Transparency International’s Corruption Prevention Index (CPI) ranks 180 countries by their perceived levels of corruption. CPI scores range between 10 (highly clean) and 0 (highly corrupt). The average score for the 10 countries that account for the vast majority of illegal aliens in the United States is 3.43, indicating a serious level of corruption (see Table 2).

In contrast, the least corrupt countries in the world are Denmark, New Zealand, and Sweden, with scores of 9.3. Canada, which has 67,000 illegal aliens in the United States, comes in at 8.7, and the United States’ score is 7.3, or 18th in the world. The United States’ score is one of the lowest scores among the industrialized nations and it has gone down in the past few years.

As Transparency International points out, “People are as corrupt as the system allows them to be. It is where temptation meets permissiveness that corruption takes root on a wide scale.”28 Thus, under a permissive U.S. system that fails to control the nation’s borders, that allows a fraudulent document market to flourish, that allows employers turn a blind eye to the legal status of their workers, and where civic, religious, and political leaders support felons over victims, it is not surprising that illegal aliens without a pre-existing allegiance to the rule of law see nothing wrong with using fraudulent documents to obtain jobs and benefits that they are not entitled to.

Those sworn to uphold the law also contribute to the permissiveness that leads to corruption and a weakening of the rule of law. When a human trafficking bill was being debated in the Utah House of Representatives, an attorney and former judge amended the bill to allow farmers to transport illegal aliens up to 100 miles without being charged with trafficking.29 Utah’s Attorney General told illegal aliens present at a massive rally for illegal alien rights that “Many of my fellow Republicans will criticize me for being here. They’ll tell me instead of speaking to you, that as the chief law enforcement of Utah I should be arresting you. [That’s] not going to happen.”30 In some cities, sanctuary policies prohibit law enforcement officials from questioning aliens about their immigration status or from contacting or assisting ICE.

This culture of corruption is reinforced when illegal aliens are offered special benefits such as in-state tuition, drivers licenses, financial services, and religious offices and privileges in spite of their multiple, ongoing violations of civil and criminal law. The increasing acceptance of corruption has a debilitating effect on the overall respect for the rule of law with the result that illegal aliens become involved in a wide range of other criminal activities including tax fraud; mortgage fraud; violation of drivers license, insurance, and traffic laws; and gang membership.

Tax Corruption

Illegal aliens and their employers are frequently involved in tax fraud. This results in lower revenues for governments at all levels and higher taxes for American citizens and legal residents. Some illegal aliens work “off the books” and thus pay no income taxes on earned income, while their employers avoid payroll taxes.

Many illegal aliens use a combination of Individual Taxpayer Identification Numbers (ITIN) and fraudulent SSNs to obtain tax refunds that they are not entitled to. For example, in Weld County, Colo., law enforcement officials uncovered tax fraud that involved 1,300 illegal immigrants using fraudulent SSNs to obtain more than $2.6 million in tax refunds.31 Treasury Department auditors have noted disapprovingly that the IRS allows illegal aliens filing returns with ITINs to obtain millions of dollars in credits and deductions to which they are not entitled as non-permanent aliens.32

In spite of this, the IRS has distributed about 15 million ITINs since 1996, with a large share believed to be assigned to illegal aliens.33 As reported by The New York Times,In the Queens center, Ana Andrade, 32, from Mexico….presented a W-2 form that showed withholding of more than $3,000 from the $24,000 she had earned as a cook in a Manhattan restaurant, at $10 an hour. Like more than seven million such W-2 forms nationwide, hers bore a false Social Security number.Financial Corruption

No problem, the senior tax specialist explained. Her return would be filed under her ITIN, with the problematic W-2 form, and the IRS would simply credit her wages to her ITIN. The result: a $2,000 refund, based mainly on child credits for her two American-born children.34

America’s leading financial institutions accept foreign identity documents as well as ITINs that are only supposed to be used for the payment of taxes. Some banks and credit unions facilitate money transfers to foreign countries by illegal aliens. They design financial products specifically for illegal aliens, including credit cards. Some have set up special banking units to serve illegal aliens’ special needs and they actively solicit the business of illegal aliens.

Financial institutions also issue risky mortgages and loans to illegal aliens who are not authorized to work and who are subject to arrest and/or removal at any time, which can lead to a default on their mortgages or loans. In Denver, for example, fraudulent documents were used by illegal aliens to get Federal Housing Administration-backed loans and in one case the counterfeit documents were used to purchase 300 homes valued at $51 million. The FHA insurance fund lost millions of dollars.35

Economic Corruption

Illegal aliens working with stolen identities and fraudulent documents transfer billions of dollars to foreign nations that would otherwise have been spent and invested in the United States. In October 2008, at a time the United States economy was reeling from an unprecedented financial crisis and a sharp drop in consumer spending, remittances to Mexico rose to $2.4 billion, a 13 percent jump from $2.2 billion in remittances in October 2007. If this were to continue at the same level for the entire year, the amount of remittances ($28.8 billion) just to Mexico would exceed the total amount initially requested to bail out the three major American automakers.36

During a time of recession, illegal aliens using fraudulent documents may continue to be employed while American citizens and legal residents doing many of the same jobs are let go. When this occurs, the illegal aliens are, in fact, doing jobs that Americans are more than willing to do. In addition, the illegal aliens continue to transfer a significant portion of their earnings out of the country rather spending them in the United States in order to help the economy recover from recession.

According to a study by the Pew Hispanic Center, the unemployment rate for native-born Hispanics was 9.6 percent in the third quarter of 2008. The rate for immigrant Hispanics, when adjusted for individuals dropping out of the workforce, was 7.8 percent. Wage losses for native-born Hispanics were actually larger than those for foreign-born Latinos. From the third quarter 2007 to the third quarter 2008, employment of Latinos in the construction industry declined by 5.3 percent while employment of non-Latinos decreased by 5.9 percent. Long-term trends show that the differences between Hispanic and non-Hispanic participation in the labor force remained relatively stable. Thus, while recent statistics show that unemployment rates have grown among immigrants,37 it does not appear that illegal immigrant workers, who are predominantly Hispanic, are being disproportionately laid off and, in fact, it looks as if many illegal aliens continue to work after American citizens doing the same type of work are terminated.38

When governments take action to stimulate the American economy through huge public works and other taxpayer funded programs, it is imperative that the jobs created go to American citizens and legal residents, not to illegal aliens. This requires strict employment verification requirements for businesses or other entities receiving these funds in order to preclude the employment of illegal aliens and to ensure that the stimulus money is put back into the American economy rather than being transferred out of the United States to foreign countries. The U.S. Congress declined to impose such a requirement on the federal stimulus bill, but since it appears much of the funding will be distributed in state block grants, states will have the ability to establish requirements for employment verification to ensure legal hiring.

Corruption of the Rule of Law

Rather than using mass transit because they are ineligible for drivers licenses or automobile insurance, many illegal aliens break the law by driving without licenses or with fraudulent licenses. In addition, studies suggest that Hispanic illegal aliens may have an exceptionally high rate of alcohol-related automobile accidents and fatalities.39 States contribute to the culture of corruption by allowing illegal aliens to register their vehicles. A handful of states give in to illegal aliens who threaten to drive without licenses or insurance and issue drivers licenses or driving privilege cards rather than enforcing existing laws.40

A continual weakening of the rule of law results in illegal aliens contributing to a community’s gang problem. Gangs are considered the single most important public safety threat today — a recent federal assessment said gangs were responsible for 80 percent of crime in some communities.41 Some illegal aliens have gang ties even before unlawfully entering the United States and many others become involved in gang activity once in the United States. According to a recent Center for Immigration Studies Backgrounder, “Immigrant gangs are considered a unique public safety threat due to their members’ propensity for violence and their involvement in transnational crime…. Once in the United States, immigrant gang members rarely make a living as gangsters. They typically work by day in construction, auto repair, farming, landscaping, and other low-skill occupations where employers are less vigilant about checking status, often using false documents.”42 In spite of this, employers continue to hire individuals without verifying their documents and identities and cities continue to enforce sanctuary policies. Both of these practices facilitate gang activity.

Justifying and Facilitating Illegal Alien Identity Theft

In spite of the damage caused by rampant illegal alien document fraud and identity theft, many of America’s political, media, civic, religious, education, and business leaders continue to defend illegal aliens. When forced to acknowledge that illegal aliens are committing felonies, these elites often rationalize the criminal acts and offer support to those committing the crimes rather than supporting the rule of law. They rarely, if ever, acknowledge the victims. They criticize those who enforce the laws and resolutely oppose efforts to protect American citizens and legal residents from illegal alien-driven document fraud and identity theft.

Illegal Aliens “Forced” to Commit Felonies

America’s political, media, civic, religious, and educational leaders try to justify illegal alien document fraud, perjury, and identity theft by arguing that the unauthorized workers are forced to commit these crimes in order to obtain jobs. For example, in 2006, when asked about illegal alien driven identity theft, former United States Representative Chris Cannon (R-Utah) replied: “This is a huge problem, that we sort of force people into.”43 [emphasis added]

The Associated Press had earlier used the same rationale when its reporter wrote:In 2004, the IRS got 7.9 million W-2s with names that didn’t match a Social Security number. More than half were from California, Texas, Florida, and Illinois, states with large immigrant populations, leading experts to believe they likely represent the wages of illegal immigrants. Even immigrants who use ITINs to file taxes are forced to make up a Social Security number when they get a job.44 [emphasis added]An editorial in the Deseret News (Utah) stated that the solution to illegal immigration would be to give illegal aliens a “work permit that keeps them from having to forge Social Security cards.”45 [emphasis added]

Illegal aliens, who are used to operating in the often more corrupt systems of their home countries, do what is necessary to get the documents required to work in the United States. When asked why they violate American law, they justify their actions by saying that they had no other choice, that it’s just like the bribe to the policeman or to the corrupt government official in their home countries. For example:

- “If I could do it again — I wouldn’t do it [buy an identity and Social Security number for $850], but the laws of this country force you to do it.”46 (emphasis added) This person had been convicted of identity theft and was being deported.

- “You know, there’s a lot of people, they make documents and we buy them. That’s the only way you can work. It’s not legal, but what can you do?” The ID this person bought belonged to an IRS agent, which under Minnesota law is a criminal offense.47

- “We were working, we weren’t stealing,” she said although she had been convicted of identity theft.48

- “In Spanish, Ramos said all she wanted was a job and that she never knew the identity she was using actually belonged to another woman.” Ramos had used a stolen identity when hospitalized leaving the victim with a $17,000 bill and possibly life threatening, corrupted medical records.49

Turning Criminals into Victims

By excusing criminal behavior and turning lawbreakers into victims, advocates for illegal aliens encourage corruption and subvert the rule of law. In 2008, former Rep. Chris Cannon described the December 12, 2006, raids on the Swift meat packing plant that resulted in the arrest of 147 illegal aliens on identity theft charges as “inappropriate” and “politically motivated” and he expressed concern that the arrests had ruined Christmas for the illegal aliens and their families.50 No mention was made of the victims, including a person who was in a motorcycle accident and was denied disability payments from the Social Security Administration because the records showed him continuing to work hundreds of miles from his actual residence; nor was any concern expressed for a police training officer in Los Angeles County who was pursued by the IRS for $60,000 in taxes owed by individuals using his stolen SSN, and who was unable to buy a home because his credit rating had been destroyed.51

Following a raid at the Agriprocessors, Inc., plant in Postville, Iowa, that resulted in 297 individuals pleading guilty to identity theft and other crimes, the media and Congressional focus was not on the crimes committed, but on the hardships faced by those who were benefiting from the crimes. Iowa Republican Congressman Tom Latham’s spokesman, James Carstensen, told reporters that Latham “views the raid as a blow to families seeking a better life and for the community, which is suffering economically.”52

A Wall Street Journal editorial made no mention of the victims of the illegal aliens arrested in Iowa but it did ask if homeland security officials didn’t have anything better to do than to raid businesses that hire willing workers. The editorial encouraged Americans to keep things in perspective pointing out that there are only about seven million illegal immigrants in the workforce (5 percent of the total). The Journal then asked if this (seven million people using fraudulent documents and, in many cases, the stolen identities of American citizens) is a big enough problem to justify requiring employers to verify the identity of the persons they are hiring. Its conclusion was that it wasn’t.53

During a Congressional hearing on the arrests of hundreds of illegal aliens for identity theft, Democrats focused on the impact that the arrests had on the perpetrators, their families, and the community. No mention was made of the victims. Illegal aliens were absolved of their criminal activity because they “apparently had no idea what a Social Security number or card even was. It may have been the employer tagging them with the number so it could hire them,” according to Zoe Lofgren, chair of the House Judiciary subcommittee on immigration.54

This permissiveness, corruption, and disregard for the rule of law has reached such a level that when a legal resident from Honduras who had her identity stolen by an illegal alien contacted 50 senators, 30 government departments, and two governors none of them were willing to help her. The victim continued to receive notices for back taxes on income that she had not earned from the IRS and collection agencies hounded her day and night for unpaid medical, furniture, and cell phone bills. Ultimately, she had to hire a private detective who found the identity thief and finally forced the police to take action.55

Employers Fight Changes

Just as the financial industry opposed limitations on its activities, the American business community consistently and aggressively opposes employment verification requirements that would limit a business’ ability to hire illegal aliens.

The U.S. Chamber of Commerce, the Society for Human Resource Management (SHRM), the Associated Builders and Contractors, the American Council on International Personnel, and the HR Policy Association all actively oppose employment verification even though it offers significant benefits to both their members and their clients. For example, the use of E-Verify protects employers and especially HR personnel from criminal charges and fines should it be determined that a company has hired illegal aliens. Furthermore, as noted above, it could prevent nearly all of the job-related SSN-only identity theft and child identity theft. Yet, in spite of these benefits, these business and HR associations filed suit in federal court to stop President Bush’s executive order requiring federal contractors to use E-Verify from taking effect.56

In Arizona and Oklahoma, Chambers of Commerce also took legal action against employment verification legislation. If they succeed in blocking employment verification requirements, among other things, they will preserve their members’ ability to hire illegal aliens who are using fraudulent documents and stolen identities. Employers also sued the Department of Homeland Security to stop the issuance of Social Security mismatch letters, which would stop illegal aliens from using SSNs that belong to American citizens and legal residents.

SSA and IRS Protect Identity Thieves

The Social Security Administration turns a blind eye to illegal misuse of SSNs. It does not notify American citizens and legal residents when someone else uses their SSN nor does it inform law enforcement authorities. It does not remove a SSN that it has not issued from its database once that number begins to be used for fraudulent purposes. It would, however, issue that number to a new-born child, thereby giving the infant an instant credit history, possibly even an arrest record, and liability for any unpaid income taxes.57

Every year, the IRS receives millions of W-2s with names that don’t match their SSNs. In spite of the fact that a majority of these come from states with large illegal alien populations and high rates of identity theft, the IRS allows even this obvious illegal activity to go largely unchallenged. As Mark W. Everson, the Commissioner of the IRS, said “We want your money whether you are here legally or not and whether you earned it legally or not.”58

However, if an illegal alien using another person’s SSN doesn’t pay taxes on the income earned under that number, the IRS demands that the true owner of the number pay the outstanding taxes. In addition, if an illegal alien has already filed a return using an American citizen’s SSN, the IRS will require the citizen to clear the matter up before accepting and processing the citizen’s return. Even then, according to a report by the IRS’s Taxpayer Advocate, “The IRS does not tell the taxpayer that identity theft is a possible cause of the problem nor does it describe the consequences of an insufficient or untimely response.”59 Furthermore, according to Weld County Colorado Sheriff John Cooke “They [the IRS] know the Social Security numbers are stolen and they choose to ignore it.”60

Credit Bureaus Facilitate Identity Theft

Like the IRS and Social Security Administration, the major credit reporting bureaus fail to support the rule of law and protect citizens and legal residents from SSN-only identity theft. Citing privacy concerns, they don’t advise individuals when someone else starts using their SSN. They may, however, create sub-files under the true owners’ names without any notification and when individuals review their credit reports, the credit bureaus will hide the sub-files from them in order to protect the privacy of the persons who have stolen their SSNs. The credit reporting bureaus will, however, allow businesses or other clients to see the sub-files and they may combine the credit scores of all of the files in the primary owner’s record.61

Leaders Reward Fraud and Identity Theft

Ten states currently offer in-state tuition to illegal aliens who graduate from their high schools. When the beneficiaries of these programs are profiled in the press, some openly talk about their jobs and how hard they work to earn money to pay their tuition and living expenses. However, since the students are illegally in the United States and undocumented, the only way they could have gotten jobs with reputable employers was to commit two and possibly three felonies — document fraud, perjury on an I-9 form, and possibly identity theft.

In spite of this, when it appeared that Utah’s special in-state tuition program for illegal aliens would be terminated, the president of the University of Utah, Michael Young, told the campus newspaper that he was willing to reduce the number of scholarships available for American citizens and legal residents in order to provide larger scholarships for illegal aliens. According to the paper, Young said “the U would have to tap into other scholarship funds, which they would be willing to do, but they would essentially have to decide whether to give scholarships to three documented students or one undocumented student.”62

In 2008 when Utah legislators proposed a compromise bill that would have allowed students illegally in the United States to continue to be eligible for in-state tuition if the students would agree to refrain from working illegally, the University of Utah objected to the compromise. Gov. Jon Huntsman’s office labeled the effort “punitive.” Utah’s Attorney General said that it was not appropriate to entangle students in the identity theft debate. The Commissioner of Higher Education’s office took the position that the current law should remain unchanged. The Church of Jesus Christ of Latter Day Saints called on legislators to show compassion for illegal aliens and the Alliance for Unity, which is made up of the religious, political, business, and civic elite of Utah, issued a statement calling for in-state tuition to remain unchanged.

Throughout the debate on in-state tuition, religious, political, business, government, education, and civic leaders opposing the no-work requirements consistently sent the message that it is acceptable to break the law in order to earn money to pay for a college education. Those supporting the students further turned a blind eye to the fact that students illegally in the United States. won’t be able to work legally in the United States after graduation.

Controlling Identity Theft

A comprehensive approach is required if the United States is to control illegal alien document fraud and identity theft. First, immediate steps must be taken to stop both ongoing and new cases of illegal alien document fraud and identity theft. Then fundamental reform of the United States immigration laws must be undertaken.

1. Verify Employee Identity

The recent ruling by the U.S. Supreme Court that allows illegal aliens to use the identities of American citizens and legal residents as long as they do not knowingly do so makes employment verification all the more important since the vast majority of illegal alien, job-related document fraud and identity theft could be stopped immediately if employers would simply verify the identities (name, date of birth, and SSN) of all new hires and current employees.

Employers can ensure that they have a legal workforce by using a combination of the federal government’s E-Verify63 and Social Security Number Verification Service (SSNVS) systems and by signing up for the federal government’s IMAGE program or privately conducted audits.64 E-Verify is a free, voluntary system that determines employment eligibility and the validity of SSNs of new hires. It returns results in seconds and is used by over 100,000 employers. SSNVS is a program that allows employers to match the SSNs of all current employees against the agency’s records. The IMAGE program allows employers to verify the accuracy of I-9 forms submitted by all current employees and to ensure that they are doing everything possible to avoid employing illegal aliens. Alternatively, employers who do not want to use the federal government’s systems can use fee-based, private employee verification and background checking services.

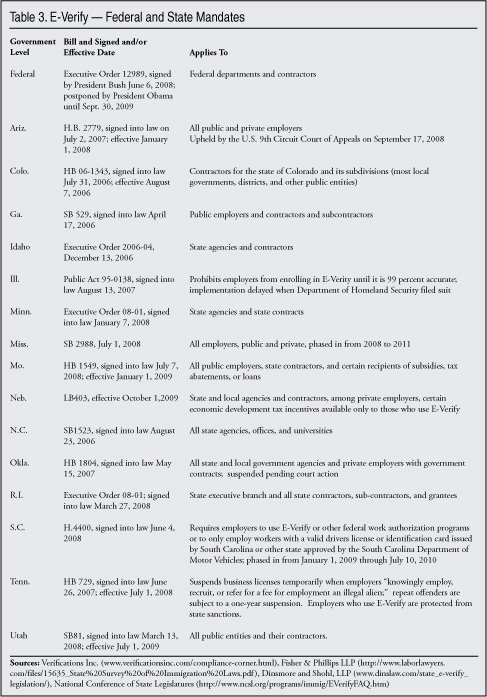

Although E-Verify was set up as a voluntary program, a growing number of governmental entities have either mandated its use or have provided incentives for employers to use it. At the federal level, former-president Bush issued Executive Order 12989 in June 2008, though implementation has been repeatedly delayed by the Obama administration.

Fourteen states have imposed some form of employment verification requirements on employers. In the majority of states this has been done through legislation. In other states, it has been done by executive order. Arizona and Mississippi require all employers in the state to use the federal government’s free E-Verify program while other states limit the mandate to a varying combination of public employers, contractors, and sub-contactors. In South Carolina, state grantees are required to use E-Verify. Employers in Tennessee can have their business licenses suspended or terminated if they knowingly hire an illegal alien; however, employers who use E-Verify are protected from sanctions should they inadvertently hire an illegal alien. Illinois passed legislation prohibiting employers from using E-Verify or any other verification program until federal government databases were able to meet stringent guidelines.65 The Illinois law is on hold pending the outcome of a court challenge filed by the Department of Homeland Security.

At the local level, elected officials in Mission Viejo, Calif., enacted an ordinance that requires the city and its contractors to use E-Verify. An ordinance passed by the city of Valley Park, Mo., denies business licenses to organizations that employ illegal immigrants. Under the Valley Park ordinance, employers who use E-Verify cannot have their licenses suspended if they were using E-Verify prior to the incident leading to the threatened suspension.66 The Valley Park ordinance was upheld by a U.S. District Court and he 8th Circuit Court of Appeals. At the county level, Washington County, Utah, requires its contractors to certify that they do not knowingly hire illegal aliens and it sponsors a program that formally recognizes employers that voluntarily use E-Verify. Beaufort County, S.C., audits county businesses to help them complete the I-9 process correctly and to identify possible instances of document fraud.67

Table 3 provides a list and short description of the actions taken by federal and state governments through the end of 2009.

The benefits of implementing employment verification programs extend beyond stopping illegal alien-driven document fraud and identity theft. Employment verification also prevents American citizens and legal residents from using fraudulent documents and stolen identities to obtain employment. For instance, pedophiles are no longer able to readily use fraudulent documents and identities in order to get jobs that provide them access to children.68 It is much more difficult for deadbeat parents to hide their true identities in order to avoid having their wages garnished for child support payments. Gang members and others who are using fake identities and SSNs to cover up serious criminal convictions are no longer able to do so and parents who have ruined their own credit find it more difficult to use their children’s SSNs to obtain additional credit.

The importance of universal employment verification cannot be overemphasized because it puts an end to easily created fraudulent documents that use the individual’s own name and date of birth coupled with someone else’s SSN. When employers use E-Verify to confirm employment eligibility and identities of new hires, verify SSNs, and conduct I-9 audits, the only alternative left for illegal aliens and others involved in criminal acts is to steal the total identities of American citizens and legal residents.

Total identity theft is significantly more difficult, especially on a large scale, than SSN-only identity theft. An individual has to obtain and use the exact full name, the exact date of birth, and the corresponding SSN of an actual person of the same gender. In addition, the person whose identity is stolen must be roughly the same age and the name should be appropriate for the person adopting it.

It would, therefore, be difficult for a 55-year-old man to take the identity of a 20-year-old man, for example. Because the birth date of the stolen identity has to be entered on the I-9, the human resource person processing the I-9 (if they are not complicit in the illegal hiring) should notice the discrepancy and refuse to enter the information into the E-Verify system. Child identity theft for employment purposes would no longer be possible because an adult could not use a child’s birth date on the I-9 form and without it he could not clear the E-Verify check.

The Department of Homeland Security recognizes that E-Verify as currently constituted is not automatically able to detect total identity theft, although it has set up a monitoring unit to analyze queries with this goal. And, in order to address this problem, E-Verity is being upgraded to include photos.69 Once photos are available, not only will the name, date of birth, and SSN have to exactly match, but the identity thief’s physical appearance, too. This will make total identity theft even more difficult than it already is.

Many employers already routinely conduct drug testing, run credit checks, verify education records, confirm past employment histories, check the police records of new hires, and garnish wages for taxes or for child support. Verifying employment or responding to Social Security mismatch letters is not all that different from these forms of due diligence. Thus, employers’ protests that employment verification is too burdensome are hard to justify.

In fact, employment verification, either through E-Verify or through other government or commercial employment verification systems, provides clear and specific benefits to both employers and to American citizens who are victims of document fraud and identity theft. The benefits that come from using E-Verify or a similar employment verification program include:

- Protection of American citizens from rampant SSN-only ID theft committed by illegal aliens who are not subject to prosecution as long as they deny knowingly using an SSN belonging to someone else.

- Exclusion of the vast majority of pedophiles, deadbeat parents, illegal aliens, and others using fraudulent documents and stolen identities from the workforce.

- Elimination of most Social Security mismatch letters, saving employers costs incurred when unauthorized workers have to be dismissed and new workers hired.

- Improved accuracy of wage and tax reporting by employers, alleviating the time and financial resources that otherwise would be necessary to correct previously submitted information.

- Protection of jobs for authorized U.S. workers who will spend and invest their wages in the local community rather than transferring a large portion to foreign countries.

- Reduction of verification-related discrimination and the protection of civil liberties and employee privacy.

- Protection for human resource professionals and hiring managers who may otherwise be pressured by employers to hire illegal aliens and later be charged with serious offenses while their employers go free.70

- Building good will by demonstrating to the community that the employer is actively working to protect them from individuals committing document fraud and identity theft.

- Protecting employers using E-Verify, who cannot be charged with a verification violation should an employee present the employer with documents that reasonably appear to be genuine and related to the employee presenting them.71

- Elimination of any pretense that an identity thief didn’t knowingly use another person’s identity because, in the case of total identity theft, the identity thief deliberately uses the victim’s exact name in place of his or her own true name.

2. Enforce State Laws

State and local authorities should examine existing state laws on document fraud and identity theft to determine if they provide an option to address illegal employment problems. Some jurisdictions have found good options at the state level, and they provide an effective alternative that is cost-effective and independent of federal prosecutorial or enforcement capacity. In jurisdictions that have launched such programs, communities report experiencing an outflow of illegal aliens, regardless of whether the illegal aliens prosecuted for fraud and theft are actually removed by ICE.

One such successful program was developed by a group of sheriffs in the Florida Panhandle. After an influx of illegal workers attracted to construction jobs created following a major hurricane, the sheriffs’ offices noticed a spike in incidences of false documents and identity theft. The perpetrators included both illegal aliens and U.S. citizens with criminal warrants trying to avoid detection. After many frustrating months spent trying to work with the regional ICE office to try to address the problem, they researched Florida statutes and found two sections that were appropriate:Section 817.568, Criminal Use of Personal Identification Information:After consulting with a State’s Attorney, the Sheriffs proceeded to expand the investigative scope of an existing multi-county task force. Acting on tips from members of the communities, officers launched investigations at four businesses and their subcontractors. The task force also received requests for inspections from many businesses seeking confirmation that they employ a legal workforce.

“Any person who willfully and fraudulently creates or uses, or possesses with intent to fraudulently use, counterfeit or fictitious personal identification information concerning a fictitious individual, or concerning a real individual without first obtaining that real individual’s consent, with intent to use such counterfeit or fictitious personal identification information for the purpose of committing or facilitating the commission of a fraud on another person, commits the offense of fraudulent creation or use, or possession with intent to fraudulently use, counterfeit or fictitious personal identification information, a felony of the third degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.”72

Section 440.105(4)(b)9, False Information to Obtain Employment.

“It shall be unlawful for any person . . . To knowingly present or cause to be presented any false, fraudulent, or misleading oral or written statement to any person as evidence of identity for the purpose of obtaining employment or filing or supporting a claim for workers’ compensation benefits. . . . If the monetary value of any violation of this subsection:

- Is less than $20,000, the offender commits a felony of the third degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.

- Is $20,000 or more, but less than $100,000, the offender commits a felony of the second degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.

- Is $100,000 or more, the offender commits a felony of the first degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.”73

According to records obtained from the Santa Rosa County Sheriff’s Office, as of June 2008 the task force inspected 24 businesses and 171 employees. Twenty-seven individuals were arrested and jailed. The Sheriff’s Offices planned to notify ICE’s Office of Detention and Removal of any felony convictions.

Within three months of the first inspections, communities in the Panhandle region began to report that noticeable numbers of illegal immigrants and their families were leaving the area.74 Illegal aliens interviewed by local news media stated that they had difficulty finding jobs. As a result of the inspections, businesses become better informed of their responsibilities to review documents. These results are achieved without agencies having to conduct large numbers of inspections or make large numbers of arrests. Similar programs in other locations have achieved comparable results.75

3. Spread the Word

In addition to a robust employment verification program, governments, businesses, and charitable, educational, religious, and civic organizations should undertake a comprehensive outreach program to emphasize the rule of law to illegal aliens and that document fraud and identity theft are not acceptable in the United States. Messaging should make it clear that document fraud and forgery, signing an I-9 under penalty of perjury, and identity theft are serious crimes that have real victims and consequences. These crimes can result in incarceration, deportation, and eliminate the possibility of ever attaining legal status.

Community leaders also should assist the American citizens and legal residents who are the victims of these crimes. The families of illegal aliens committing these crimes should receive the same level of sympathy and assistance that would be accorded to the family of an American who has fallen on hard times, committed a crime, and is then arrested and jailed.

4. Use No-Match Letters

In addition to employment verification, employers should be required to take appropriate action on all Social Security mismatch letters, as proposed by the Bush administration,76 thereby sending the message that hiring individuals using fraudulent documents and stolen identities is not acceptable and will not be condoned. The Obama administration is still reviewing this rule, pending the outcome of a lawsuit filed by a group of organizations opposed to immigration law enforcement.77 There are reportedly 140,000 such letters ready to be mailed to employers with 10 or more employees whose records have SSN discrepancies, possibly identifying more than a million illegal workers. This measure is important, because other electronic verification programs cover only new hires or benefits applicants, while the no-match letters cover all current employees.

5. Confirm Arrestees’ Documents

When document fraud and identity theft are discovered, appropriate charges should be brought and following the resolution of the case, the illegal alien should be deported. ICE provides local law enforcement agencies an opportunity to team with them to combat specific challenges in their communities, including the use of fraudulent documents and identity theft. The Law Enforcement Support Center (LESC) provides timely, accurate information and assistance to federal, state, and local law enforcement, corrections, and court system communities on immigration status and identity information on aliens suspected, arrested, or convicted of criminal activity. Electronic access to LESC records is available through the Immigration Alien Query screen on the International Justice and Public Safety Network.78

In addition, ICE offers local law enforcement agencies advanced training in documents and immigration status screening through its 287(g) delegation of authority program. Alabama and Georgia have used this training to prevent the issuance of drivers licenses to illegal aliens or others using fraudulent immigration documents, and officers in South Carolina and Florida use the program to address job-related identity fraud. Condensed versions of this training (without the delegation of authority) are available in the private sector.

6. Make IRS and SSA Help

Congress should pass legislation requiring the Internal Revenue Service and Social Security Administration to report all misuse of SSNs to appropriate law enforcement authorities including the Department of Homeland Security. In addition, the IRS and Social Security Administration should use the authority they already have to go after individuals who are misusing SSNs.

Congress also should make it an unambiguous felony to use another person’s SSN or other identifying information, either knowingly or unknowingly, to obtain employment, government benefits, or anything else of value. Legislation should require that any fines or fees paid by illegal aliens who have committed identity theft be put into a fund that can be accessed by victims of illegal-alien identity theft in order to help offset the financial costs and the time spent recovering their identities.

Furthermore, Congress should pass legislation that requires the federal government and private entities to notify individuals when someone else is using their identity. Consideration should be given to legislation that would authorize victims of illegal-alien identity theft to sue the illegal alien’s employer unless the employer used an employment verification program.

7. Reform Immigration Laws

Any future immigration reform bill should contain the following:

- A specific prohibition against granting immigration benefits of any kind, including legalization, if the alien has committed document fraud and identity theft, either knowingly or unknowingly, and a requirement that all such discoveries be turned over to law enforcement for prosecution if action has not already been taken.

- Alternatively, a provision requiring that when identity theft is discovered during the course of reviewing an illegal alien’s application for a change of immigration status or for a visa, that all action on the application be immediately suspended until the identity theft victims are made whole. No further action will be taken on the application until (1) all of the damage caused by the identity theft, whether intentional or not, has been cleared up and (2) the victim has been fully reimbursed for all money and time expended in order to recover his or her identity or the identity of his or her child.

- Sanctions on employers who are found to have committed illegal acts when an illegal alien’s application for change of status or for a visa is processed. Illegal acts include, but are not limited to, employing illegal aliens “off the books,” not paying payroll taxes on illegal labor, employing multiple individuals using the same SSN, failing to take action on Social Security mismatch letters and/or knowingly hiring illegal aliens. In addition, all such discoveries should be turned over to law enforcement for prosecution.

Summary and Conclusion

A nation flourishes when people respect the rule of law and abhor corruption in all its forms. As demonstrated by the current financial crisis, corruption can be devastating for millions of people.

Under the rule of law, when people disagree with a law, they work to change it while upholding it until such time as it is amended, abolished, or totally rewritten. However, today millions of men, women, and children are the victims of illegal-alien-driven identity theft because America’s political, civic, education, business, religious, education, and media leaders endorse and allow fraud to permeate our immigration system.

Leaders and citizens must individually and collectively take action to protect Americans and legal residents against illegal immigration-driven document fraud and identity theft. All employers must verify the employment eligibility and identities of new hires and existing employees. Illegal aliens must understand that the corruption of their home countries will not be tolerated in the United States and that document fraud, perjury on I-9 forms, and identity theft to obtain jobs is not acceptable. They must also understand that individuals committing these crimes will be held accountable.

Any eventual immigration reform must recognize and compensate the victims of illegal-alien-driven identity theft while denying amnesty from these crimes to illegal aliens, regardless of whether they have previously been convicted of these crimes or not. Finally, any immigration reform has to end the corruption associated with illegal immigration.

https://cis.org/Report/Illegal-Not-Undocumented

Last edited by 6 Million Dollar Man; 03-01-2018 at 11:32 PM.

-

03-01-2018, 11:30 PM #4

Maybe eventually, people will understand why the FairTax legislation needs to be passed as soon as possible. HR 25 in the US House of Representatives.

A Nation Without Borders Is Not A Nation - Ronald Reagan

Save America, Deport Congress! - Judy

Support our FIGHT AGAINST illegal immigration & Amnesty by joining our E-mail Alerts at https://eepurl.com/cktGTn

-

03-01-2018, 11:31 PM #5

IRS: Stop Letting Taxpayers Use Stolen Social Security Numbers

By Adam Levin

SHUTTERSTOCK

SHUTTERSTOCK

While you’d never know it if you listen to politicians on the right and left argue, there are some truths out there, things that don’t yield to debate. I’m talking basics, like it’s easier to walk through an open door, and the Internal Revenue Service shouldn’t be in the business of providing open doors to pervasive forms of fraud.

Are you rolling your eyes? Well, it’s happening once again at everyone’s favorite punching bag, the Internal Revenue Service. Granted, past fails haven’t been intentional — whether we’re talking about the “Get Transcript” hack that affected 700,000 taxpayers or this year’s E-File PIN attack that involved more than 464,000 unique Social Security numbers. There was incompetence and a lack of farsightedness in those instances, for sure, but the latest wrinkle at the IRS has the agency turning a blind eye to crime. It has been happening in broad daylight without the slightest twinge of worry that maybe someone should, you know, maybe do something about it — that is, until this month.

Undocumented Workers Using Stolen Social Security Numbers

Forget about Obama’s “path to citizenship.” Forget about “amnesty.” This goes beyond partisan bickering over a label.

I first became aware of the issue through the lens of right-wing media and almost dismissed it due to my own political assumptions. To be fair, it was so poorly reported and exclusively discussed on conservative websites like Breitbart, All That’s News and the Tea Party Patriots.

The story, featuring undocumented workers stealing Social Security numbers to apply for jobs and fill out W-2s under the watchful eye of the IRS, was first made public during a Senate Finance Committee meeting, when Sen. Dan Coats of Indiana asked IRS Commissioner John Koskinen to explain why the IRS doesn’t inform certain victims of employment-related identity theft — specifically people whose Social Security numbers have been used by undocumented immigrants to get work or fill out W-2 forms.