Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-28-2010, 02:26 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

$3 Trillion In Shaky Comml Real Estate Mortgages

Taxes coming for $1 trillion in commercial real estate. 1.2 million partnerships own over $1 trillion in CRE. Too big to fail dumping CRE debt.

The problems for commercial real estate are deep and significant and have the potential of stifling any sort of recovery. Rather than looking at commercial real estate (CRE) as a reason for more stimulus or bailouts the question should examine why so many CRE locations are defaulting. Can this be a sign that demand for goods, strip malls, condos, and other large projects are simply not in demand from a middle class that is confronting a new austerity? The problems in commercial real estate have the potential of causing the same amount of market volatility as residential loans for a handful of reasons. Unlike residential loans, there is little sympathy for CRE owners. It is expected that those who buy into million and billion dollar projects understand what they are doing (even if this assumption is wrong as we are finding out). So the potential for massive support here is limited from the public but we have seen the U.S. Treasury and Federal Reserve bail out virtually anything with a connection to the banking industry.

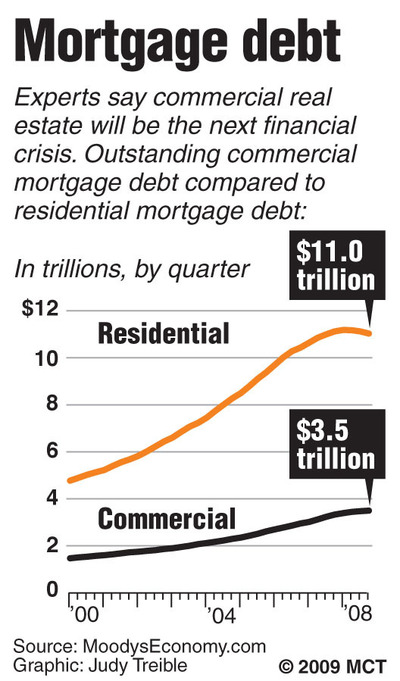

The CRE market is enormous:

Source: McClatchy

$3.5 trillion in commercial real estate loans are out in the market. The problems will be magnified for smaller regional banks that went into this market hand over fist. There are little mechanisms to bailout this industry. Yet why should there be a bailout function for real estate developers and investors that purchased land at overvalued prices and now expect to be made whole by the American public? The middle and working class are largely opening their eyes to the massive wealth transfer that is taking place. On the one hand you hear representatives telling the public to tighten their belts and be cautious with their money while trillions of dollars are transferred to the banking industry with no strings attached. After 29 months of crisis, it looks like there is movement against the real estate industry as we heard last week that the Feds charged 1,200 people with mortgage fraud. This is a step in the right direction.

Yet there is a growing examination of how commercial real estate loans are structured and who is making money from this. As we all know, our government is spending large amounts of money it does not have. Put aside the problems this will cause for the U.S. dollar down the line. In order to come back into balance, two things can happen. Either spending is cut to run on a leaner machine. This is very unlikely given that last month without the government there would be no job growth. The other option is to find other additional revenues meaning raising taxes. Commercial real estate has caught the attention of many as a potential source of new found income:

â(Zanesville) Despite this, Congress might pass the American Jobs and Closing Tax Loopholes Act. This bill raises taxes on investment partnerships in real estate and other ventures by more than 150 percent and will stifle economic activity. Rep. Zack Space joined his Democrat colleagues in voting âyes,âJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Oklahoma House passes bill making illegal immigration a state...

04-19-2024, 05:14 AM in illegal immigration News Stories & Reports