Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-15-2012, 10:10 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

A brave new economy – California budget implications for real estate

A brave new economy – California budget implications for real estate

Submitted by drhousingbubble on 05/14/2012 23:52 -0400

Over the weekend it was announced that California’s large $9 billion budget deficit was no longer $9 billion but $16 billion. Whoops. Last week J.P. Morgan Chase, a darling of the Federal Reserve, reported a $2 billion trading loss on “synthetic derivatives” yet still had the audacity to state no further regulation was needed.

Whoops. What we have here is a system of phony numbers and massive speculation. This plays into the giant pool of shadow inventory sitting in bank balance sheets while trillions of dollars went to bailout these banks. Even accounting standards were frozen for these speculators. Instead of working to increase transparency and help the overall American taxpayer they instead are using the same leverage to gamble on global stock markets. The system is interconnected and that is why the California budget figures this weekend came as no surprise. What is surprising is the cheerleaders narrowly focused on real estate and pretending the economy around them is completely sound. Do they have ear plugs and blinders on as to what is really transpiring?

Employment

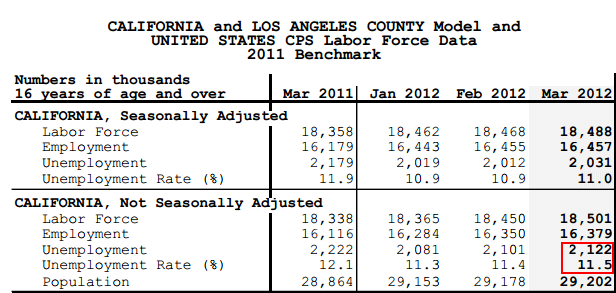

California’s unemployment rate is officially back to 11 percent but the underemployment rate is above 20 percent. If we look at “not seasonally adjusted” numbers the unemployment rate is 11.5 percent:

Over 2,000,000+ Californians are out of work. The participation rate continues to decline similar to trends across the country yet very few even address this. This is absolutely crucial especially when it comes to housing. Are all the retiring baby boomers going to be the next segment that will boost the housing market? The unemployment and underemployment figures are very important because as long as the employment situation is weak, there is little reason to expect higher home prices.

Unemployment Insurance

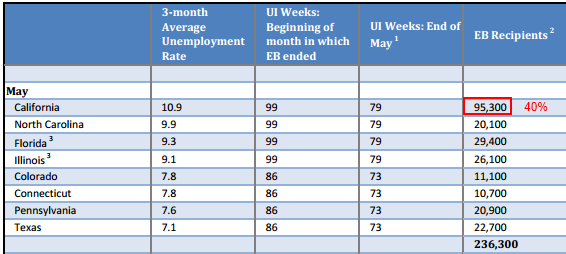

A report this weekend discusses how over 200,000+ people on unemployment insurance will lose their coverage this weekend:

Of those losing unemployment insurance coverage 40 percent will be here in California. I’m sure this is a big plus for the housing market. There is only so much fudging of numbers that can be done until people start realizing what a giant mess we are in. Besides this, we now have the government trying to obscure even more numbers to keep their crony financial friends protected.

Cutting off Census

I saw this posted last week and found it astonishing. Many in the non-mainstream financial press use the Census data to crunch numbers and bring a new perspective to what is happening in the market. I certainly use this data as I’m sure many of you do as well. Take a look at this:

This is mind boggling but plays into the statistics deception that is being pushed on the public. Similar to those trying to forewarn about the housing bubble bursting, the system is trying to hide data to keep the illusion moving forward. This is madness. Do people realize that good statistical measuring tools came about right after the Great Depression? You know why? So analysts, educators, and all citizens can dig in and keep the system honest. The fact that we spend billions of dollars building streets in other nations and can’t spend a few million to actually audit our own books is nothing more than a purposeful hiding of the obvious. Those that continue to act under the “business as usual” mindset are largely not open to seeing what is going on.

“(Census) The Appropriations Bill eliminates the Economic Census, which measures the health of our economy. It terminates the American Community Survey, which produces the social and demographic information that monitors the impact of economic trends on communities throughout the country. It halts crucial development of ways to save money on the next decennial census.”

This is why I find it fascinating what is going down in Greece. People have been living in austerity for well over two years and now, for lack of a better word, are revolting. They realize the financial system has them by the scruff of their neck. They have nothing left to lose with a 25 percent unemployment rate. Here in the US, it seems like the folks in charge would rather keep the data obscure and feel that as long as you get your steady dose of iPhones, Dancing with the Stars, and double-lattes that things will just keep marching forward. By the way, we’ve been in recovery since the summer of 2009 so all this data must be imaginary right?

Budget Gap

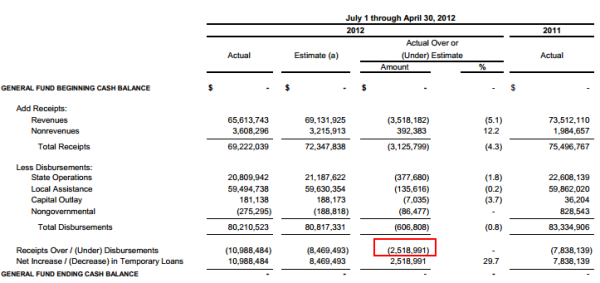

The budget gap announced this weekend was stunning but not surprising. Just look at the April revenue data:

Source: State Controller, CA

April is a big month for tax receipts and revenues came in $2.44 billion below expectations. The California budget is a mess. So we are now assured that we have two items that will hit in the next year:

“SACRAMENTO – State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in April, showing monthly revenues came in $2.44 billion below (-20.2 percent) the latest projections contained in the Governor's proposed 2012-13 Budget.”

-Tax increases

-Service cuts

Both of these are unlikely to boost real estate values. I hear arguments of people saying they are buying homes near prime schools and colleges like UCLA or UC Berkeley. These are public colleges with large support from the state! What do you think this does if prices keep on increasing and put students into deeper debt? These institutions were built with public funds and those funds are running dry. So what do they do? They raise fees. We have a lot of hidden benefits in California paid for by taxpayers and many in the state suffer from the “I want it all but don’t want to pay for it” mentality. Well the time is coming when choices will need to be made. Real estate is no sacred cow like some would think. Heck, even 30 percent of those that own their home in the state are underwater on their mortgages. Just looking at all of this in context makes you realize that some of those diving into the housing market today are suffering from cognitive dissonance when it comes to real estate. The low mortgage rates are a siren call to jump in but just look at the above metrics. What are we going to do, live in homes and trade them to one another continuously as our major source of economic growth? We tried that during the housing bubble and look how that turned out. Beyond artificially low interest rates, why in the world would housing values go up in the state given broader economic conditions?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

A brave new economyJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Rep. Grothman: DHS monitoring over 600,000 illegals with...

04-23-2024, 07:07 PM in General Discussion