Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

01-24-2012, 02:30 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Catastrophe Of Our Economy For The Young American Worker

The catastrophe of our economy for the young American worker. Average college debt higher than typical new automobile cost, annihilation of pensions, and younger Americans moving back home because of financial necessity.

- Posted by mybudget360 in baby boomers, bailout, economy, education, gambling, i-banking, middle class, recession, savings, student loans, wall street

- 4 Comments

The old and the new

The cost of living has soared across many sectors with food, healthcare, college tuition, and energy all outpacing the growth in the typical paycheck. For these reasons including fewer jobs, young Americans are facing harder times when it comes to saving money:

Source: CNN Money

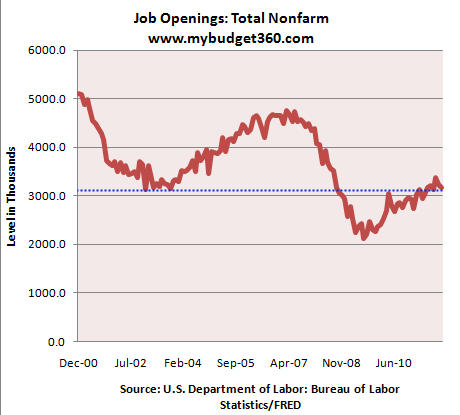

“Ultimately we are pumping out hundreds of thousands of graduates each year that are starting with a negative net worth.”Contrary to what is being spouted on the media, the employment market is still very weak:

Source: Census

You have nearly two million job openings less than we did before the recession gained full steam. Yet our population is expanding and recent graduates are entering the workforce in higher numbers. The recent job growth is positive but the underlying data shows that many of the jobs are coming from low wage fields. Many companies, like those in the S&P 500, are exporting jobs to other countries where they can push for lower labor costs. The question remains, how does this benefit domestic workers? To the point, this is more momentum when it comes to squeezing out the middle class.

Diluting education

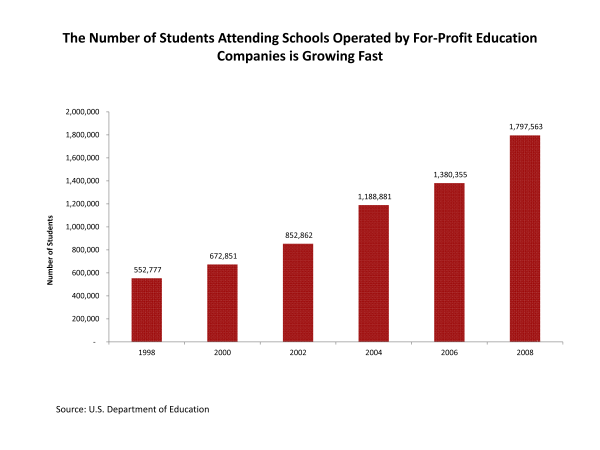

Part of the reason recent college graduates have also confronted lower wages is the dilution in higher education:

Source: Senator Harkin

For-profit institutions that largely run as full-time systems to devour government financial aid, increased enrollments by a stunning amount over the last decade. A large number of students entered the workforce with large debt and degrees that meant little to current employers. This is only one reason we have seen a dilution to the earning potential of college graduates:

Source: BusinessWeek

Now think of someone coming out with $50,000 in debt and only being able to land a part-time job at Wal-Mart making $9 or $10 an hour. What will they do when those monthly student loan payments start coming in? With college debt going over $1 trillion this year this doesn’t seem like a trend that is reversing anytime soon. Tuition has gone up across all higher-education systems:

Source: CNN Money

This is not a trend that is favorable to younger Americans. And this is why millions have moved back home during this recession:

“(Salon) Is this current generation a bunch of lazy loafers? Your research doesn’t seem to indicate this.I think the above is very important to consider since there seems to be a perception that many of these younger Americans are lazier than older generations. In other words they are not pulling hard enough on those bootstraps. I think there is a large combination of forces coming together here. For example, in the early 1980s you had 60 percent of workers with some sort of pension. Today that figure is in the low 20 percent range. New workers are thrown into 401k style investment plans and are left dealing with a stock market that is built on a riskier foundation than betting at the horse track. With high frequency traders and investment bankers that make billions of dollars on short-term bets that actually destabilize the economy, many younger workers are simply trying to get by let alone coming up with an investment plan.

No. They are a generation that has been caught by a series of unfortunate, overlapping trends that put them at a disadvantage for becoming independent the way their parents did. They’re entering a very unfriendly labor market that is particularly punishing to young workers. With the housing implosion in the United States, they’re still entering a housing system in which owner-occupied housing is very expensive. So, they have lower wages, if they have wages at all; they have high housing cost; and, in the advanced countries, there are ever more demanding credential races to qualify for professional employment. If they’re aspiring to be middle- or upper-middle class, the length of time it takes to pile up the education you need to qualify for the jobs to make that possible is getting longer and longer and more and more expensive. When you put all those things together, it’s not all that surprising that the accordion family has developed the way it has. It’s just a bunch of really bad circumstances that have coincided and affected this generation in ways that have not been the case before.”

Keep in mind that this is a crisis of generations. Many retired Americans depend on younger workers paying into the system to keep it going. So there is a two-way road here. If we do not find common ground you are going to have more protests, frustration, and struggles between young and old. This is a challenging economy for the young American worker.

The catastrophe of our economy for the young American worker. Average college debt higher than typical new automobile cost, annihilation of pensions, and younger Americans moving back home because of financial necessity.Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Call Congress Now To Stop Invasion Votes!

05-14-2024, 02:28 PM in Non-Citizen & illegal migrant voters