Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

04-16-2010, 07:28 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

EXTEND & PRETEND: Gaming the US Tax Payer

EXTEND & PRETEND: Gaming the US Tax Payer

Stock-Markets / Credit Crisis 2010

Apr 16, 2010 - 11:19 AM

By: Gordon_T_Long

Today, April 15th, most of us grudgingly settle our annual obligations with the government tax authorities. But for how long will we keep doing this? How long will we support the governmentâs Ponzi scheme that makes a mockery out of the monies we have annually contributed obediently to our Social Security and Medicare accounts? What I am going to share with you may make this a haunting question for you throughout the next taxation year.

I have been writing extensively about the unregulated $605 Trillion Global Derivatives market http://www.marketoracle.co.uk/Article17469.html along with the âExtend & Pretendâ Program http://lcmgroupe.home.comcast.net/~lcmg ... entary.htm that has resulted in an explosive market rally from the depths of the post financial crisis. Despite my reluctance, my writings and research has forced me to some undeniable conclusions. Our government is presently âgamingâ the US Tax Payer. Let me explain how.

âWHALES MAKE WAVESâ

A smoking gun is seldom found at the scene of the crime. Instead the crime must be pieced together through the linkage of clues. Clues build a case that is based on facts. Facts which can convince a jury of our peers that âbeyond a reasonable doubtâ we know how and by whom a crime was carried out. Therefore I am not going to speculate. I am simply going to lay out the facts of a series of suspicious clues for your consideration that show we are being gamed.

I was an investor in Enron and was on the earnings conference calls with Ken Lay, Jeff Shilling and Andrew Fastow. I knew something was wrong with Enronâs meteoric rise, but I couldnât put my finger on it and consequently I lost money. I subsequently learned during the collapse about the new world of offshore accounting and financial instruments such as SPEâs (Special Purpose Entities). How companies could legally move debt off their asset ledger. A few years later, I again knew something was terribly wrong as I watched housing prices explode and witnessed kids buying McMansions and driving prestigious cars, with jobs that didnât appear to be able to support this life style. I subsequently learned during the financial crisis about the mysterious world of financial instruments such as CDS, CDO CLO et al and the vehicles such as SIVâs (Structured Investment Vehicles) that allowed banks and financial instruments to circumvent capital requirements and move debt off their balance sheet. The resulting Shadow Banking System flooded the global financial markets with cheap, highly available credit to anyone that had a pulse.

I recently discovered and have written about http://lcmgroupe.home.comcast.net/~lcmg ... entary.htm a whole new world of PPP/PPI, Novation Agreements and the SPC (Structured Purpose Company) and how the $437 Trillion Interest Rate Swap business has been broadly employed throughout Europe and the US at all levels of governments: sovereign, state, city and local. It is now just beginning to fill the world courts with legal proceedings and financial entanglements. This is yet another in my experience of witnessing ever increasing levels of financial malfeasants. http://home.comcast.net/~lcmgroupe/2010 ... etaway.htm

What has been conspicuously missing from all these examples is the worldâs biggest debtor.

Missing is the debtor with the most incentive to take advantage of all these innovations and creative ways to hide debt. Missing is the debtor most needing to finance ever increasing expenditures. Surely this debtor is not so pure that they have forsaken what was created in their own country because they saw the inherent risks, that they alone took the high road that almost every country, state, city or local government succumbed to. Of course we are talking about Uncle Sam here. The person we pay our taxes to every year.

SUSPICIOUS CLUE #1 - PLUMMETING US MONEY SUPPLY DESPITE QE (Quantitative Easing)

The chart above from Shadow Government Statistics is more than a little alarming. http://www.shadowstats.com/ The M3 money supply reporting is shown above, which we all used to watch meticulously and was suddenly and suspiciously dropped without explanation in March 2007. John Williams of Shadow Government Statistics still rigorously tracks it. According to Williamâs models it now went negative. This is a major concern that the M3 slope has been heading down since the 2008 financial crisis occurred, but a much bigger concern is that it has now turned negative. This means money supply as measured by the M3 is contracting. We also see that the narrower M2 measure is fast approaching that critical event. This is huge news that is receiving little attention since it is no longer published by the government. A few years ago this news would have shaken financial markets.

The demarcation from zero, means the money supply is now contracting and therefore there is less money available in circulation to buy such financial assets as US Treasury securities. Since there is less money available, it should indicate that new US Treasury bond offering would be facing lower prices and hence higher yields. Minimally, we should be seeing pressures in the bid to cover ratios in the US Treasury Auction. Surprisingly, we are not.

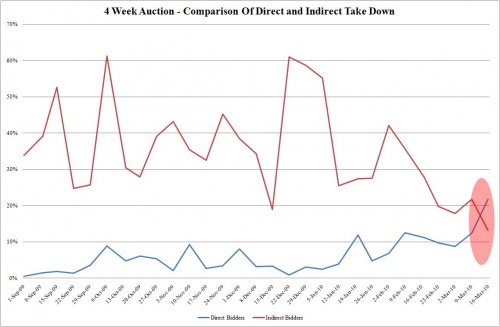

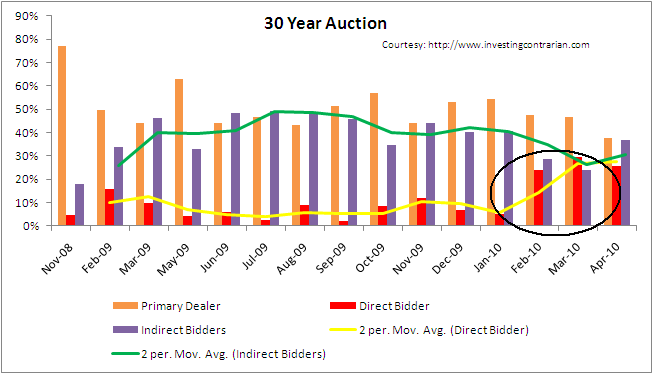

SUSPICIOUS CLUE #2 â US TREASURY AUCTION â Historic Direct versus Indirect Bids

With a historic and massive $1.6 Trillion of new US government debt to be financed in 2010, as tax payers on the hook for this debt, we need to listen to what is concerning those that participate in the critically important US Treasury Auction. Additionally, we need to remember besides new debt we also have roll-over of existing debt. The rollover debt is also huge because of government policy to shorten maturity duration over the last few years. This policy was meant to keep debt payments down by taking advantage of lower shorter term rates. The US Treasury on our behalf, accepted the risk and gambled against interest rates increasing. This was one way our elected officials hid the actual size of growing fiscal imbalances from 'we, the tax payer'.

What we presently find in the Treasury Auction is the professionals scratching their head and wanting to know who the mysterious Direct Bidder is.

For those who donât understand the world of Treasury Auctions, let me simplistically say there are a few key measures we watch to determine the health of the US debt market. One is the Direct to Indirect bids. Indirect Bids are the Dealer / Broker community. They are the major players that make up the volume of the transactions and who sell the debt securities in the open market. The Direct Bidders are smaller players such as the public and foreign investors, amongst others who want to avoid the broker/dealer fees and buy direct. From Suspicion #1 above, we would expect to see volume falling off. Well it isnât,

The reason is that we have a mysterious Direct bidder (or possibly more than one) taking up unprecedented auction volume and thereby achieving acceptable bid to cover ratios, which the market also watches closely.

Who this mysterious bidder is, no one is being told. There is endless speculation because if they fail to show up at the next auction, all hell will break loose. Someone has deep pockets somewhere and for some reason is buying US Treasuries. This is extremely convenient for the US government because it is presently keeping interest rates down and not allowing the Auction to fail. Remember the panic when people perceived the Greek auction bond offering would fail? This would be a thermonuclear explosion in comparison.

If you still believe in the tooth fairy, then you believe this sudden Direct Bidder emergence is not suspicious. Meanwhile, the world cannot figure out why interest rates in America havenât already vaulted higher. Most professionals are highly puzzled and perplexed.

SUSPICIOUS CLUE #3

According to a report by Bloomberg, "PIMCOâs Bill Gross, who manages the worldâs biggest bond fund, has reduced holdings of U.S. Government-related debt, while increasing his holding of emerging market debt the most since 2008. According to a report on the Newport Beach, California-based PIMCOâs website, Gross has reduced the proportion of U.S. government and related securities in the 219.7 Billion total return fundâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Biden Overwhelms Immigration Courts with Over 3.5 Million Cases...

05-07-2024, 07:50 PM in illegal immigration News Stories & Reports