Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-04-2010, 04:13 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold Jumps $50 in 21 Hours as Fed Devalues the Dollar QE2

Gold Jumps $50 in 21 Hours as Fed Devalues the Dollar with $600bn QE2

Commodities / Gold and Silver 2010

Nov 04, 2010 - 02:28 PM

By: Adrian_Ash

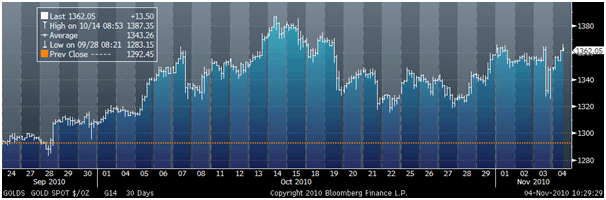

THE PRICE OF GOLD in wholesale dealing leapt at the start of US trading on Thursday, extending an overnight rise to within 0.5% of last month's record highs â and gaining $50 per ounce inside 21 hours â as the US Dollar sank in response to the Federal Reserve's hotly-anticipated "QEII" asset purchase program.

"Currency devaluation remains firmly en vogue," said one London bullion dealer this morning.

The weakening Dollar "is what's helping gold," notes commodity strategist Jesper Dannesboe at SocGen.

Crude oil today hit a 6-month high as the Euro and Sterling both jumped to fresh 10-month highs vs. the Dollar, capping the gold price for European investors at a 1-day high.

Asian and European stock markets added almost 2% on average. New York stocks opened the day over 1% higher.

"We remain bullish on gold," says UBS chief metals strategist Edel Tully, because of "inflation expectations on the rise, low real interest rates, the fear of currency debasement, resilient physical demand, and limited scrap sales."

The Fed said late Wednesday it hopes to pump $600 billion into the US economy between now and June 2011, buying $75bn of long-dated government Treasury bonds each month and then reviewing the program.

The US central bank also voted to reinvest (and again into T-bonds) the money it's being repaid from earlier mortgage-bond purchases.

"[That means] bringing the total closer to $800bn," notes Walter de Wet at Standard Bank today. "Given the relationship between precious metals and liquidity, we view this as extremely positive for precious metal prices."

The New York Federal Reserve meantime confused bond-market analysts overnight by "temporarily relaxing" the 35% limit imposed on its purchase of any single issue of US government debt, but moving to breach it in what a press release called "only modest increments".

The New York Fed's operational account â where QEII purchases will be held â already owns 30% of T-bonds maturing between 2014 and 2020.

Two-thirds of the Fed's newly created $600bn will be spent on T-bonds maturing between those dates, notes Tracy Alloway at the FT's Alpha blog.

"The economy isn't measuring up, so the Fed is going to change the ruler," said James Grant, editor since 1983 of Grants Interest Rate Observer, to Bloomberg last night.

"They talk about quantitative easing or long-term asset purchasing...No. It is money printing...They intend to make everything seem better with a devalued Dollar."

But "gold has [already] flown up in price," says Gordon Fowler, CIO at Philadelphia-based wealth manager Glenmede, speaking to Reuters this week at the newswire's Wealth Management Summit in New York.

"Inflation would have to go up 90% in this country for [the current gold price] to get back in line."

"That [gold investment] play has already passed by," agrees Lawrence Hughes, chief executive of BNY Mellon Wealth Management.

"Investors need to be careful not to do what people do in line at the grocery store: always jump to the fastest-moving line or, in this case, to the hot-performing category."

Dollar gold prices have risen 25% so far this year. India's BSE stock index has gained 26% for US investors, while the Japanese Yen has risen 36% on the currency market.

By today's new 30-year record-high London Fix, the price of silver had risen by more than 50% from New Year's Eve.

"Investors need to get the money from under the mattress and working again," reckons Robert McCann, chief executive of Swiss bank UBS's American wealth management office, also advising his clients to quit gold and move back to "risk assets", according to Reuters.

New data meantime showed stronger-than-expected new US jobless claims for last week, plus a sharp rise in productivity and a fall in per-person labor costs.

Eurozone factory input prices rose 4.2% year-on-year in Sept., the 16-nation's data agency said, while Germany's services sector expanded for the sixth consecutive month.

The European Central Bank, however â like the Bank of England in London â voted today to keep its interest rates at a record low for the 20th month running.

Over in Moscow on Thursday, the Finance Ministry cut Ireland and Spain from its approved list of countries whose government bonds can be bought and held by Russia's two sovereign wealth funds.

By Adrian Ash

BullionVault.com

http://www.marketoracle.co.uk/Article24028.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-04-2010, 04:20 PM #2Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Gold Higher as Risk of Competitive Currency Devaluation and Debasement Underestimated

Commodities / Gold and Silver 2010

Nov 04, 2010 - 08:05 AM

By: GoldCore

Gold fell initially after the QE2 announcement yesterday prior to recovering and it then rose steadily in after hours Asian and again in early European trading. Gold has risen to $1,362/oz due to the dollar falling and oil and commodities rising significantly in the aftermath of the announcement of the new $600 billion of quantitative easing.

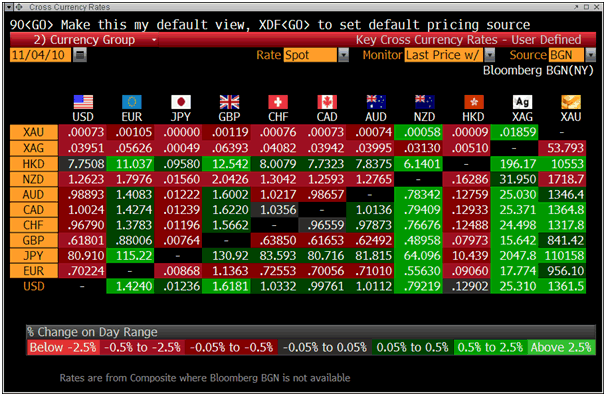

Gold is currently trading at $1,362.30/oz, â¬957.21/oz, £843.20/oz.

Gold is now only 2% below its recent nominal record high on October 14th ($1,387.35/oz) and after a period of consolidation the trend would suggest that $1,400/oz remains a near term target. Silver traded erratically yesterday with unusual price swings prior to reasserting its upward momentum and rising to new 30 year highs at $25.40/oz this morning.

Equities internationally have surged but it is hard to know if this is due to a belief that the US and global economic recovery might continue or is it due to some market participants using equities as an inflation hedge. Long dated US treasury bonds fell sharply yesterday and concerns about significant overvaluation in bond markets, particularly as commodity prices are back near the higher levels seen in mid 2008, are valid.

The assumption that commodities are in a bubble is wrong as many commodities are well below their recent highs in mid 2008 when the Thomson Reuters/Jefferies CRB Index was trading as high as 473 (see chart). Today the benchmark commodities index is trading 55% lower at just 305and is close to its average price in 2005, 2006 and 2007. More importantly, most commodities remain well below their inflation adjusted highs of more than 30 years ago. With currency debasement and currency wars in the form of quantitative easing and competitive currency devaluations set to continue, oil, commodities and other tangible, finite markets may continue to rise in price. This will likely leadto inflation - particularly in the food and energy sector.

Complacency about the these inflation risks and risks posed to the dollar and other fiat currencies remains widespread with incorrect assumptions made. Those warning of the risk of inflation are many of the same people who correctly warned about property bubbles and were ignored leading to some the problems that we are experiencing today.

Silver

Silver is currently trading at $25.33/oz, â¬17.80/oz and £15.67/oz.

Platinum Group Metals

Palladium for immediate delivery climbed as much as 2.5 percent to $671/oz this morning which is the highest price since May 2001.

Platinum is trading at $1,732.00/oz, palladium is at $666/oz and rhodium is at $2,175/oz.

News

(Bloomberg) - Germans own over twice as much gold as the country's central bank, Bild-Zeitung reported, citing a report by the Steinbeis University in Berlin. Germans own 7,500 metric tons of gold. The amount equals 5 percent of global holdings and is over twice the 3,500 tons held by the Bundesbank, the newspaper cites the report by the management school as saying.

(PRNewswire) - JP Morgan Chase & Co. (NYSE: JPM) and HSBC Securities Inc. (NYSE: HBC) face charges of manipulating the market for silver futures and options in violation of federal commodities and racketeering laws, according to a new lawsuit filed Tuesday in the U.S. District Court for the Southern District of New York.

(Bloomberg) - Demand for 1-ounce Krugerrand gold coins increased by 54 percent in the past month, the South African Gold Coin Exchange said in an e-mail received today, without giving further figures.

(Reuters) Turkish gold imports rise to 9.07 tonnes in October. Turkey's gold imports rose to 9.07 tonnes in October, compared with 2.45 tonnes the previous month, the Istanbul Gold Exchange said on Tuesday. Turkey is the world's third-biggest gold consumer.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

http://www.marketoracle.co.uk/Article24023.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-04-2010, 04:42 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

market pulse

Gold rallies to record as Fed feeds inflation fear

Nov. 4, 2010, 2:28 p.m. EDT

By Laura Mandaro

SAN FRANCISCO (MarketWatch) -- Gold futures rallied to a record over $1,380 an ounce Thursday, and silver futures rocketed more than 6%, after investors piled into precious metals as a hedge against the sinking U.S. dollar after the Federal Reserve rolled out a new, $600 billion of extraordinary stimulus measures to prevent deflation. Gold for December delivery closed up $45.50, or 3.4%, to $1,383.10 an ounce. Silver for December delivery surged $1.61, or 6.6%, to $26.04 an ounce. December copper rose 13 cents, or 3.4%, to $3.91 a pound. Palladium rallied $32.05, or 5%, to $674.75 an ounce. And January platinum advanced $58.70 an ounce, or 3.5%, to $1,755.90 an ounce.

http://www.marketwatch.com/story/gold-r ... 2010-11-04Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Migrants Breach Fortified Border Barrier, March Through Texas...

05-16-2024, 08:20 PM in illegal immigration News Stories & Reports