Results 111 to 120 of 443

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

06-04-2019, 10:16 PM #111

mikehuckabee.com

The "plague" of leftism is evident in our filthy cities

If you want to see the results of leftist policies, go to the cities that are run…If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-05-2019, 07:46 AM #112

The CANCER of the Democrat party is spreading across this great Nation like wildfire destroying blocks and blocks of neighborhoods and entire Cities!

And then to have GAUL to pass a Dream Act to allow millions upon millions of foreigners a path to citizenship and descend on us like a swam of locusts at our borders is despicable!

Not only do these illegal alien adults rape, rob, murder and kill us...their UAC's are too!

GET THEM ALL OUT AND CLEAN UP AMERICA!

WE HAVE OUR OWN PROBLEMS AND ISSUES TO TAKE CARE OF...NOT THE REST OF THE WORLD!ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

06-05-2019, 07:59 AM #113

And the left keeps on doubling down.

Last edited by Airbornesapper07; 06-05-2019 at 08:07 AM.

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-05-2019, 09:39 AM #114

wgrz.com

Medicaid paid for NY sex offenders' erectile dysfunction drugs

A new audit from the New York State Comptroller found registered sex…If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-05-2019, 10:13 PM #115

Illinois Turns To Gambling And Weed Amid Hopeless Financial Picture

"This was all about our being able to pay our bills..."

Wed, 06/05/2019 - 20:45

2 SHARES

Democratic Illinois governor J.B. Pritzker thinks that the solution to fixing Chicago's struggling, blood-soaked streets is legalizing marijuana state-wide and opening a giant casino in Chi-Town, according to Bloomberg.

"We’re putting our fiscal house in order," said Pritzker in a Tuesday interview. "Nothing’s going to be fixed overnight, but we’ve made significant progress. And honestly, I really believe that we have turned this ship in the right direction. Illinois is back."

Pritzker batted away suggestions that his agenda would just amplify the existing crime and corruption across the city, where at Bloomberg notes - " just hours earlier a powerful City Council leader pleaded not guilty to charges he extorted favors from those doing business with the city."The state’s gaming board, not Chicago politicians, will regulate the city’s new casino, which will be twice the size of existing gambling establishments in the state. Lawmakers also legalized sports betting, clearing the way for wagering at the state’s iconic venues including the Chicago Cubs’ Wrigley Field and the Bears’ Soldier Field. -Bloomberg

"This was all about our being able to pay our bills," along with job creation and the construction of necessary infrastructure such as new schools, according to Pritzker, who said that his sweeping victory over Republican challenger Bruce Rauner last November - plus his negotiating skills he learned as an investor - has helped him push through an ambitious agenda. "You need to be able to discern the difference between someone’s posturing and what they really need," said Pritzker of his conversations with Republican legislators at a recent cocktail at the Governor's mansion. He claimed that "they had talked to me more in the first couple months of my tenure in office than they did for four years under Bruce Rauner."The schmoozing paid off with bipartisan support for a $45 billion capital plan. Not so much with the centerpiece of Pritzker’s agenda: A party-line vote passed his proposed constitutional amendment to replace Illinois’s flat income tax of 4.95% to make the wealthiest residents pay nearly twice as much. Voters must approve the amendment in 2020.

In the hour-long interview, Pritzker discussed a wide range of issues, from the cost of the Trump administration’s trade war to his close relationship with the Clintons, including the advice that former senator and presidential candidate Hillary Clinton gave him for how best to govern. -Bloomberg

Pritzker expanded on several other topics, Via Bloomberg:Trade War

Illinois is the largest U.S. soybean growing state and ranks second to Iowa in corn, and Pritzker said President Donald Trump’s trade war with big soy importer China poses a long-term threat as buyers turn to Brazil and other sources.“I can say that from my own experience -- not in agriculture, but of having big customers-- trying to win big customers and losing a big customer. They don’t reverse course fast. So, I’m very concerned.”Pritzker said federal aid to farmers hurt by the trade war is “not enough,” and he’s been lobbying U.S. Agriculture Secretary Sonny Perdue for more. “That’s where most of the dollars that these farmers need are,” Pritzker said.2020 Election

When several Democrats running for president reached out to Pritzker for advice, he said he touted his success in swaying Republican strongholds, including some wealthy Chicago suburbs that hadn’t voted for a Democrat since Franklin Roosevelt was elected.“There were people that voted for me that voted for Donald Trump,” he said. “I think people want to hear the truth.”Clinton Advice

As a newcomer to governing, Pritzker said he sought counsel from other governors and from Hillary Clinton, who he talks to more often than Bill Clinton, the former president.Legal Pot

“Her advice was ... be a listener and a problem solver and make sure you’re reaching across the aisle.”

Illinois last week became the 11th state to legalize recreational marijuana, which could eventually bring in $300 million to $700 million annually, Pritzker said. The change isn’t going to encourage more use, because “marijuana is readily available now,’’ he said. More importantly, the bill allows some drug convictions to be expunged.“Are we safer with it legalized? Are we safer with it illegal? ... I believe we’re making a more just society,” he said. “This most importantly was about criminal justice reform, expunging records, and safety.”Census Count

Pritzker said the state has set aside $29 million -- the largest per-capita investment in the country -- to ensure a maximum census count. A move by U.S. Commerce Secretary Wilbur Ross to include a citizenship question could hurt the accuracy of the population count, he said. “We have to get our numbers,” Pritzker said.Taxing Issues

While the centerpiece of Pritzker’s agenda is the progressive income tax, his budget also levies another $1 per pack on cigarettes and doubles the state gasoline tax.“To fund infrastructure, it’s important to have significant dollars available to do that, and so we had to look for it wherever we could.’’Pension Liability

Selling the James R. Thompson Center, the state’s bureaucratic center in downtown Chicago, is often mentioned. But Pritzker also pointed to selling or leasing other state buildings around the state that aren’t needed because there are 20,000 fewer state employees than two decades ago.Pritzker also expects “substantial savings” from extending a voluntary pension-buyout program by three years. The progressive income tax would generate more than $3 billion a year, with a portion allocated to pensions.

https://www.zerohedge.com/news/2019-...ancial-pictureIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-05-2019, 11:22 PM #116

STUNNED; ABSOLUTELY STUNNED.... WHO DID NOT SEE THIS COMING

LA Times... 6/4/19... If only CA elected officials recognized they have a "Houston, we have a problem... " sized homelessness issue on their hands and if only that recognition came before political grandstanding...

latimes.com

Homelessness jumps 12% in L.A. County and 16% in the city; officials ‘stunned’If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-06-2019, 12:14 PM #117

And the illegal aliens are taking over the streets in downtown, turning it into the dump of Tijuana with their pop up canopies and garbage they sell on the streets.

ILLEGAL ALIENS HAVE "BROKEN" OUR IMMIGRATION SYSTEM

DO NOT REWARD THEM - DEPORT THEM ALL

-

06-06-2019, 07:15 PM #118

How Connecticut's "Tax On The Rich" Ended: Middle-Class Tax Hikes, Lost Jobs, More Poverty

In the past 30 years, just one U.S. state has adopted a progressive income tax: Connecticut... The results were disastrous.

Wed, 06/05/2019 - 22:25

85 SHARES

Authored by Orphe Divounguy, Bryce Hill, Suman Chattopadhyay via IllinoisPolicy.org,

In the past 30 years, just one U.S. state has adopted a progressive income tax: Connecticut. It made the switch from a flat income tax in 1996, phasing in the progressive income tax over three years.

The results were disastrous. And they should halt, or at least caution, Illinois lawmakers now pushing to do the same.

Connecticut’s experience is a warning that switching to a progressive income tax will eventually end in a tax hike on Illinois’ struggling middle class, result in fewer jobs – particularly for those on the margins of the labor force – and increase poverty. It will fail to combat inequality or fix the state’s finances.

While Connecticut lawmakers sold the progressive tax as a way to provide middle-class tax relief and reduce property taxes, neither occurred. Instead, everyday taxpayers have been hit with recurring income and property tax hikes.

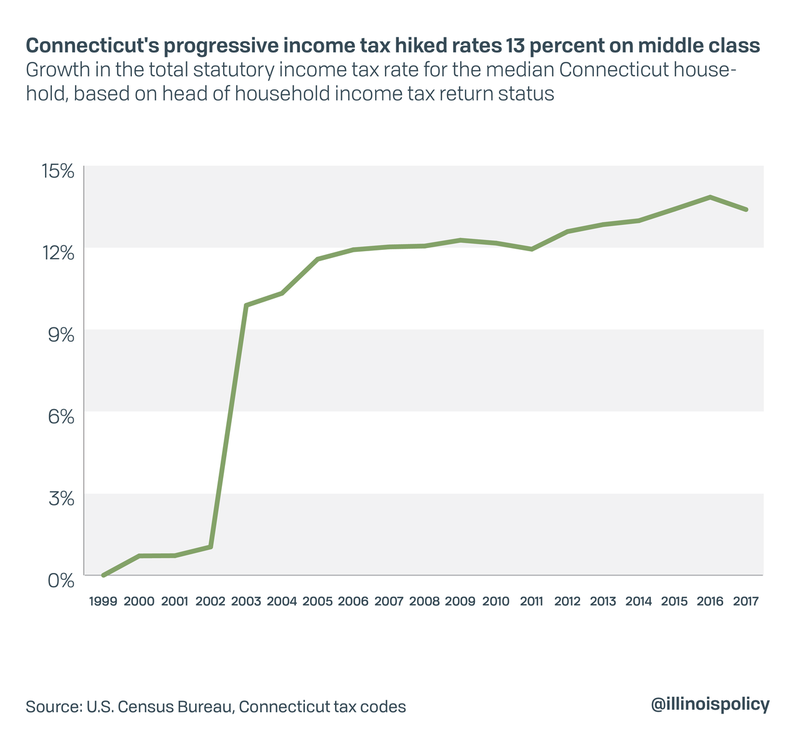

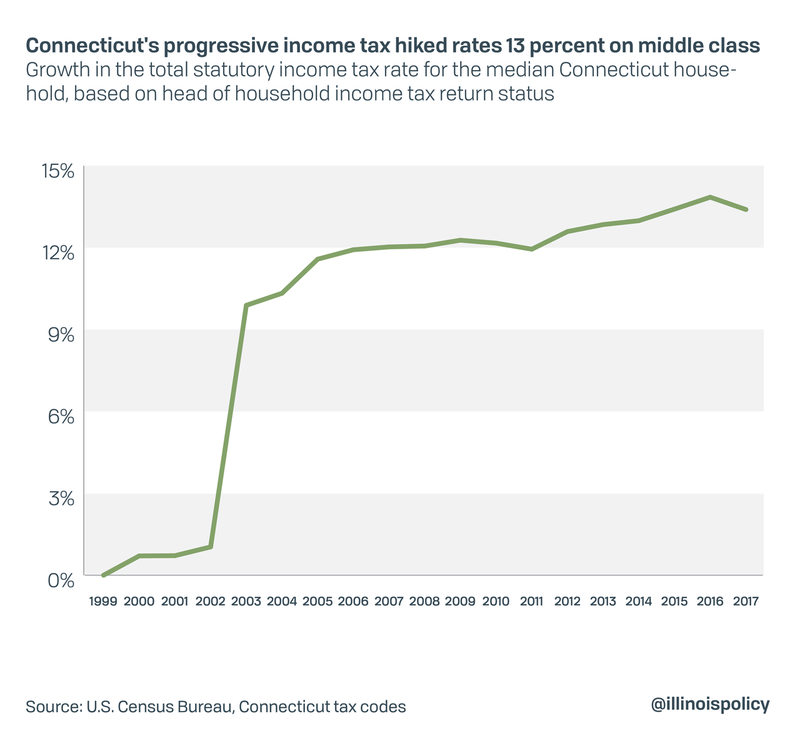

The typical Connecticut household has seen its income tax rates increase more than 13 percent since 1999. At the same time, property tax burdens (property taxes as a share of income) have risen by more than 35 percent.

The typical Connecticut household has seen its income tax rates increase more than 13 percent since 1999. At the same time, property tax burdens (property taxes as a share of income) have risen by more than 35 percent.

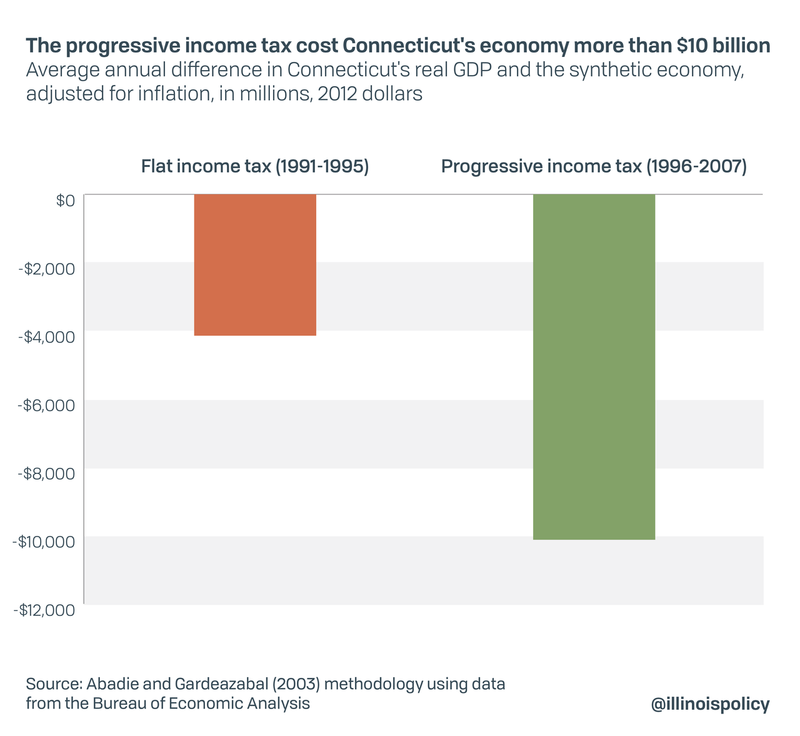

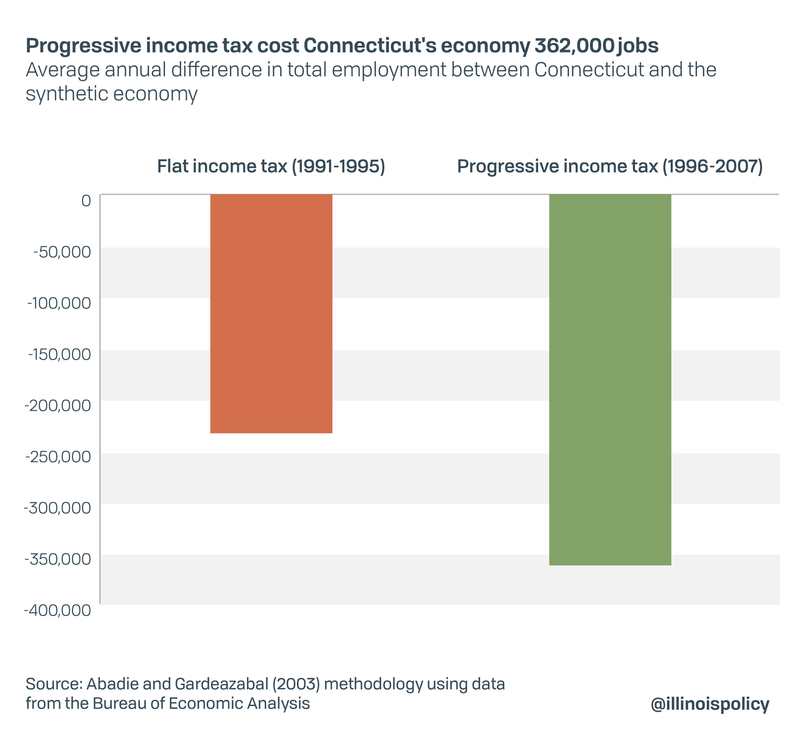

Making matters even worse, the policy change cost the state’s economy more than $10 billion and 360,000 jobs, ultimately shrinking the labor force by an estimated 362,000 workers.

The Connecticut progressive income tax failed to fix state finances. In the wake of its progressive income tax experiment, Connecticut has continually raised taxes on the middle class, has a chronic outmigration problem, and finds itself in a financial situation that is just as dire as Illinois’. Connecticut has run state budget deficits in 12 of the past 15 years, and is holding more debt per capita than almost any other state.2

Illinois Gov. J.B. Pritzker’s argument for the progressive tax relies on the same myths – that a progressive income tax will allow for middle-class tax relief and lower property taxes, and shore up the state’s finances. On the contrary, if Illinois ditches its constitutionally protected flat income tax, Illinoisans will face the same fate as Connecticut – higher taxes for everyone, fewer jobs and an even more sluggish economy.

INTRODUCTION

A constitutional amendment filed Jan. 29 by state Sen. Don Harmon, D-Oak Park, would eliminate Illinois’ flat income tax in exchange for a progressive income tax.3 But no one has filed a bill in the current General Assembly telling Illinoisans what the rates would be. Pritzker backed a progressive tax throughout his campaign, but putting the amendment to voters requires its passage by a supermajority in each chamber of the General Assembly; it would not require the governor’s signature.

As state lawmakers consider scrapping the state’s flat income tax, they should look at what happened in the last state to do so.

In the past three decades only one state has adopted a progressive income tax. That state was Connecticut, which first introduced a state income tax in 1991 and introduced a graduated rate structure in 1996.

This report employs the “synthetic control method” as in Abadie and Gardeazabal (2003)4 and investigates the economic impact of the tax changes in Connecticut. A full description of the methodology is included in Appendix A.

WHAT WERE THE EFFECTS OF THE CONNECTICUT TAX HIKES?

Connecticut became the last state to enact an income tax in 1991, introducing a flat 4.5 percent income tax rate. In 1996, the state decided to phase in a progressive income tax featuring tax brackets with a 3 percent tax rate and a 4.5 percent tax rate. This income tax relief was short lived. In the time since phasing in the income tax, the median household has seen their income tax rates increase by more than 13 percent. Today, Connecticut has seven income tax brackets with marginal income tax rates ranging from 3 to 6.99 percent.

Effects of the tax hikes on real GDP

Connecticut’s decision to enact an income tax had immediate negative effects on the state’s economy, initially costing the state’s economy more than $4 billion, with the economic cost growing to $10 billion following the decision to make the income tax progressive and to gradually raise rates.

The effects of the tax changes are consistent with the expert literature on the subject. Economists widely agree that tax hikes have adverse effects on economic output (see Appendix B). They also agree that progressive tax structures reduce economic growth even more than flat tax structures (see Appendix C). Connecticut’s results provide additional evidence that tax increases are highly contractionary.5

The effects of the tax changes are consistent with the expert literature on the subject. Economists widely agree that tax hikes have adverse effects on economic output (see Appendix B). They also agree that progressive tax structures reduce economic growth even more than flat tax structures (see Appendix C). Connecticut’s results provide additional evidence that tax increases are highly contractionary.5

Effects of the tax hikes on the labor market

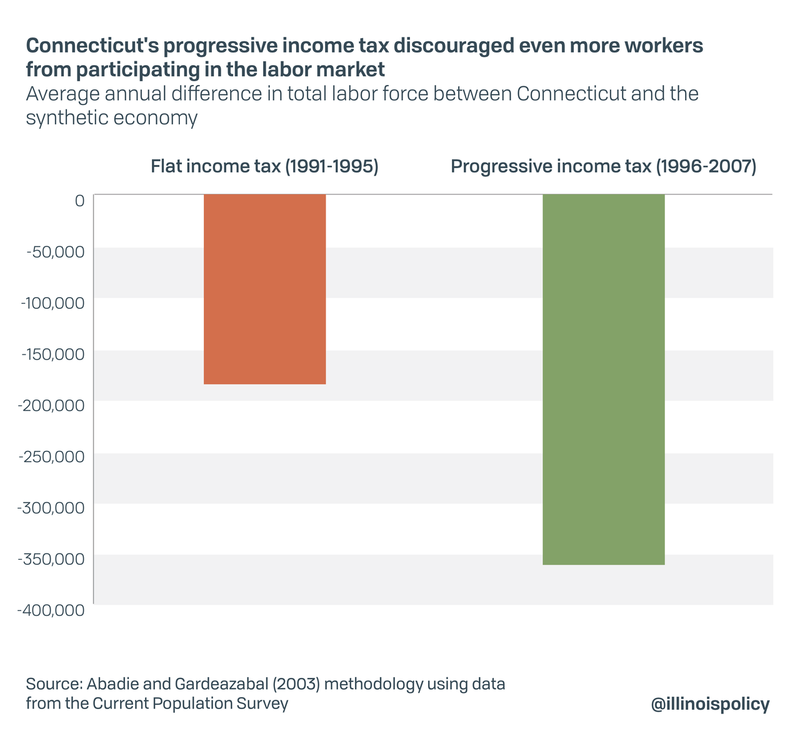

Connecticut’s tax changes had similar effects for workers. The tax increase initially cost the state nearly 233,000 jobs and worsened after the switch to a progressive income tax, with the state losing a total of 362,000 jobs.

While the progressive income tax is often touted as a way to achieve more equal economic outcomes, employment losses hurt everyone. Job losses after Connecticut’s switch to a progressive tax were primarily concentrated among higher paying jobs, meaning that jobs that allow individuals to move up the income ladder were either destroyed or never created.

While the progressive income tax is often touted as a way to achieve more equal economic outcomes, employment losses hurt everyone. Job losses after Connecticut’s switch to a progressive tax were primarily concentrated among higher paying jobs, meaning that jobs that allow individuals to move up the income ladder were either destroyed or never created.

This is a typical experience for states with progressive income taxes. These states tend to have persistently higher income inequality, with the gap between the rich and the poor often growing faster than states with flat or no income taxes.

These outcomes show why the academic literature remains divided as to whether progressive income taxation reduces inequality (see Appendix D).

The initial passage of the flat income tax reduced Connecticut’s labor force by nearly 186,000 individuals. In the time since the income tax became progressive, the job market shrank by 362,000.

The large declines in the labor force and employment that followed the tax increase aren’t surprising. Blundell (2014) finds that labor force participation, employment and hours worked respond to tax incentives, especially at early and late stages of an individual’s work life.6

Effects of the tax hike on poverty

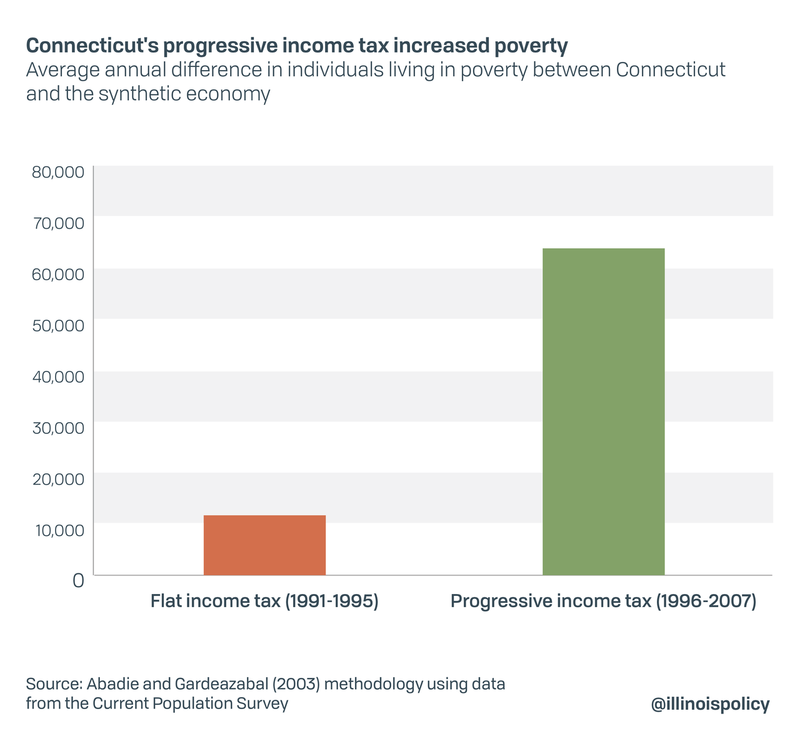

When compared to the rest of the nation, Connecticut has historically been a wealthy state with fewer of its residents falling below the official poverty line. However, following the introduction of an income tax, poverty rates in Connecticut began to increase while falling in other states.7 From 1980 to 1991, before the introduction of the income tax, Connecticut had a poverty rate of 5.5 percent. That rate had soared to 8.1 percent in the period after the progressive income tax was implemented, from 1996 to 2007.

With fewer jobs available and an increased tax burden, more residents found themselves below the poverty line than before the state began raising its income tax.8

After the flat income tax was enacted, 12,000 more Connecticut residents found themselves living in poverty. After the tax became progressive the problem worsened, with 64,000 individuals falling below the line.

After the flat income tax was enacted, 12,000 more Connecticut residents found themselves living in poverty. After the tax became progressive the problem worsened, with 64,000 individuals falling below the line.

Despite the tax being touted as a tool to combat poverty and help struggling citizens, the policy made matters worse for the most vulnerable. As noted above, while the academic literature is divided as to whether the progressive tax reduces inequality (see Appendix D), in Connecticut, it did not provide relief to lower-income residents and actually increased poverty.

Did progressive income tax hikes stabilize Connecticut’s budget?

Connecticut’s progressive income tax hasn’t done anything to alleviate the state’s dire fiscal condition. The state has run budget deficits in 12 of the past 15 years and has more debt per capita than any other state.9 The state is also plagued by persistent population decline driven by domestic outmigration in recent years.

Lack of structural reforms to the state’s budget has led to years of middle-class tax hikes.

WHAT DOES THIS MEAN FOR ILLINOIS?

WHAT DOES THIS MEAN FOR ILLINOIS?

Connecticut’s experience suggests Illinois could suffer a similar fate if lawmakers push for a progressive income tax. That means less economic growth, fewer jobs, a shrinking labor force and deterioration in economic conditions that would result in more individuals falling below the poverty line.

Contrary to claims that a progressive tax would only hit high earners, such a policy would harm everyone. The results in Connecticut suggest the tax led to a large increase in the poverty rate.

It is worth asking: Who is most at risk of falling below the poverty line in Illinois? The empirical evidence suggests Illinois residents who live in non-metro areas, don’t have college degrees and are non-white are at increased risks of being below the poverty line.10Add a progressive tax, and those most likely to take the hit are Illinois workers who lack a college degree, are minorities and live in rural areas.

Residents throughout Illinois, particularly in places such as Alexander, Cass, Scott and Pulaski counties would be most harmed. In the Chicago area, residents of Calumet, Cicero, Thornton, Rich Township and Berwyn would be most harmed.

Instead of protecting Illinois’ most vulnerable residents, a progressive income tax may end up harming already vulnerable communities.

A BETTER PATH FORWARD

Rejecting a progressive income tax would spare Illinoisans from Connecticut’s sorry fate. Changes to the state tax code will not fix the structural flaws with the state’s finances or reform the main cost-drivers, pensions and government employee healthcare costs. Those two items have led state spending to increase 48 percent faster than Illinoisans’ personal incomes in the past decade.

So long as state expenditures continue to outpace the growth in the state’s economy, Illinoisans will be forced to endure tax hikes regardless of the structure of the state income tax. A progressive income tax will only make it easier for politicians to gradually raise middle-class taxes, as in Connecticut.

A progressive tax is a bad deal for Illinoisans. They would be giving up constitutional protections for an illusory promise from lawmakers to lower taxes for some. But a look at Illinois’ history and the outcomes of progressive tax states show that promise is unlikely to be kept. Any progressive tax rates will almost certainly rise to the level of spending in Springfield – and that means tax hikes on the middle class.

Illinois’ families and the state’s economy simply can’t afford more tax hikes.

Illinois is already experiencing the weakest economic expansion in state history, and a progressive income tax hike will only serve to hinder the state’s sluggish economy.

Instead, Springfield needs to spend within taxpayers’ means. That is why lawmakers should limit growth in spending to the growth in Illinois’ economy – to what taxpayers can afford.

https://www.zerohedge.com/news/2019-...s-more-povertyIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-06-2019, 08:09 PM #119Liberalism destroys everything it touches.

thehayride.com

This Morning In Baton Rouge We Saw What Comes From 15 Years Of Friendly Socialism

June 6th, 2019MacAoidh

2.0K shares

As I was busy raking out storm drains rather than doing any professional work this morning in the aftermath of a somewhat-worse-than-normal rainstorm, with my phone quivering out emergency flood-warning messages about Baton Rouge every few minutes, an idea popped into my head that I can’t seem to shake.

Which is that maybe one reason the Democrat Party won’t shut up about global warming – er, “climate change” – despite not a whole lot of evidence it’s actually happening and zero evidence that any of their predictive computer models have actually been right so far is that climate change is a good excuse for failing to provide basic infrastructure. We saw an example of this last year in New Orleans, when the former head of the Sewerage and Water Board blamed climate change for his agency’s failure to stop that city from flooding in a rainstorm similar to the one which hit Baton Rouge today. Nobody much bought his line, largely because everybody knew the storm drains were clogged because they hadn’t been cleaned in decades and because everybody knew about the dilapidated physical plants of the S&WB’s pumping stations – something they’d received $2 billion from FEMA to upgrade after Katrina and that money was almost completely wasted and/or stolen.

But if it’s climate change then it’s bigger than a poor bureaucrat or politician can fix, you know.

The excuse-making is part and parcel of American governance, particularly on the local level, in this day and age. And voters, who take basic infrastructure for granted and aren’t conversant in the art and science underlying it anymore, don’t demand it.

Which is one reason why you’ve got drainage issues in Baton Rouge far worse than you should, particularly for a city-parish government which runs through a staggering billion dollars a year.

Another take on this comes via Facebook. A friend of mine, Anthony Oster, posted this…I’m just going to say this once Baton Rouge.

This is what happens when you put pet projects like a ridiculous library system and attempting to attract businesses to a dead part of town, ahead of more important issues such as roads and infrastructure.

Yes, our libraries are amazing. Yes, there is a societal need to bring equality to this city.

https://thehayride.com/2019/06/this-...s9jiPqNWD4YORA

But seriously, what is it worth of we can’t go through a thunderstorm without the entire area going underwater?

You want it to change, start voting in people who put basic infrastructure first, and pet projects second. There’s no excuse for our libraries to to have more funding than emergency response units when we can’t handle 5 inches of rain without drowning in the streets…

Exactly right, and just what I’m talking about.

Baton Rouge has a library system that’s the envy of the modern world. That’s kind of like holding the Guinness record for putting the most straws up your nose. You’re where you are because you’ve misused your resources and done something others wouldn’t have thought to do.

The money spent on having a massive, overfunded library system is completely misspent when you can’t drain your streets and your traffic situation is apocalyptic every day. We see this up and down our property tax bill – funds dedicated to dubious purposes or clearly overspent on their intended use while the unsexy things local government is constructed to do go starving.

It can’t continue, this happy-face socialism. You can’t give out candy all day and have no vegetables to offer. This is how every city run by Democrats has plunged into decline. It’s why there are trash piles and typhus in Los Angeles and human feces covering the streets of San Francisco, and why Detroit is an urban hellscape populated more by feral cats than feral people.

New Orleans and Baton Rouge are quite far down this road. There is no u-turn in sight. You’ll want to clean your own storm drains if you don’t want to flood – because the city isn’t coming for that anytime soon.

If you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

06-06-2019, 10:55 PM #120The beauty of Socialized Medicine:

mirror.co.uk

Man with Down's Syndrome dies as hospital leaves him without food for 20 daysIf you're gonna fight, fight like you're the third monkey on the ramp to Noah's Ark... and brother its starting to rain. Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

Similar Threads

-

Study: 42 of the 50 Most Violent Peacetime Cities in the World Are in Latin America

By lorrie in forum illegal immigration News Stories & ReportsReplies: 3Last Post: 03-10-2018, 11:06 AM -

Paul Craig Roberts: The Collapsing US Economy and the End of the World

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 07-08-2012, 07:12 PM -

US Airways is hiring in 3 cities, including Phoenix & NV

By Newmexican in forum Other Topics News and IssuesReplies: 0Last Post: 11-02-2011, 06:49 PM -

Williams: Obama/Cong Plan America Down 3rd World Status

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 0Last Post: 10-28-2010, 01:39 AM -

AMERICA REDUCED TO THIRD WORLD STATUS

By AirborneSapper7 in forum Other Topics News and IssuesReplies: 3Last Post: 09-22-2008, 10:25 AM

280Likes

280Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Durbin pushes voting rights for illegal aliens without public...

04-25-2024, 09:10 PM in Non-Citizen & illegal migrant voters