Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-08-2010, 03:38 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Crude Oil Distillate Demand Falling off a Cliff

U.S. Crude Oil Distillate Demand Falling off a Cliff

Commodities / Crude Oil

Aug 08, 2010 - 09:58 AM

By: Dian_L_Chu

Crude Oil had a breakout this week as the risk trade was put on, it benefitted from the short the dollar, and go long commodities play. Plus equities have been testing the higher levels, and trying to establish a higher trading range.

The problem with market participants today is that they become too bearish when indications appear bad and too bullish when indications appear good. For example on July 5th you couldn`t give crude oil away for $71 a barrel, and one month later, you couldn`t get anybody to sell it for $82.70 a barrel either. And the odd paradox of oil trading is that this is exactly what you should have been doing as a market participant.

The issue with getting too bullish on crude oil right now is that there are weekly inventory reports that give great insight into the fundamentals of the commodity. Unlike other commodities such as wheat or copper whose precise inventory levels are often a mystery at best, the EIA does an excellent job of providing a detailed report each week that comes out on Wednesday. And the current fundamentals do not support a strong bullish case for crude; in fact, they are quite bearish for the near term. Enough so that crude oil most likely will not go above $84 a barrel on this breakout. And if it does, statistically speaking, the odds favor being on the other side of the trade. It only pays to buy at the top of the market if there's a runaway bull market, and the current dismal fundamentals of crude oil preclude such a scenario. Of course, we are also assuming no disruptive category 5 hurricanes wipe out the Gulf Oil Infrastructure, or Israel doesn`t attack Iran in the middle of the night.

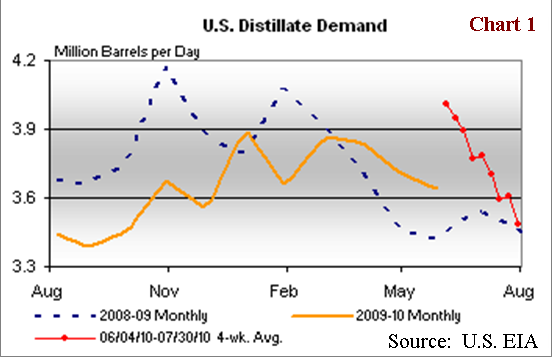

The distillate picture is the most problematic for bulls. The main driver of distillates demand, which tends to track economic output closely, is heavy use by industrial sector, which has been severely lacking in the second quarter, when it was expected to be much stronger. The U.S. actually had a year-on-year increase for distillate demand between 2009 and 2010 as high as 17.1% for the last week in May; but it has cratered to +2.2% year-on-year in two months time.

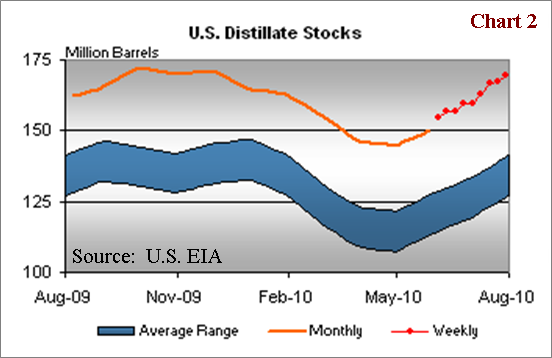

Some of this statistic could have been distorted due to calendar timing. But what is worth taking note of is the huge rate of decrease in distillate demand over the last two months; it is literally falling off a cliff. (Chart 1) Stockpiles of distillate fuel are now at the highest level since the week ended Oct. 16. 2009 (Chart 2) And this distillate inventory builds will be problematic for any bull run for the near term, regardless of what happens with the other commodities.

This slowdown is also captured in all the economic reports over the last two months, from housing and manufacturing, to employment and GDP. All these economic reports are missing expectations, and prior reports are being revised down. It appears the US economy really slowed down over the last two months in particular, and this is problematic for oil inventories as this is their bullish season. The bulk of the summer driving season is over, and now we have less demand and rising inventories occurring at the same time in this commodity.

So, what is the outlook for crude Oil? It will probably trade back down on the next major move as the product`s inventory levels weigh on crude oil prices to in a range from $83 on the high side to $73 on the low side for the next couple of months until the inventory levels are slowly worked off.

This analysis assumes the economy picks up steam, and this economic stall was a normal pause in the inventory restocking cycle. Also that Washington finally gets it going into the election cycle, and starts proposing more business friendly solutions to the worrisome employment picture like some sort of payroll tax incentive for major corporations to hire US workers. And that Europe, China, or the US staves off any further near-term debt catastrophes, property bubbles, and or geo-political maelstroms.

However, currently crude oil prices are on the high side, and could be heading lower as the fundamentals overtake the recent liquidity inflows that have occurred over the last month. The really hard part with the future analysis of crude oil is how long it will take for the US and the global economy to work its way through the myriad of current economic woes, and deflationary deleveraging process that we are in the midst of currently.

But when the US economy does finally get its act together, banks start lending again, the unemployment rate dips below 7%, and private sector demand replaces the governmental stimulus role in the economy, look out above for crude oil prices.

http://www.marketoracle.co.uk/Article21728.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Long Beach Declares Public Health Emergency Due to ‘Surprising’...

05-04-2024, 07:58 PM in illegal immigration News Stories & Reports