Results 1 to 1 of 1

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

09-29-2010, 08:41 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

U.S. Unemployment Rate Could be Higher in September vs. Aug

U.S. Unemployment Rate Could be Higher in September vs. August

Economics / US Economy

Sep 29, 2010 - 02:46 AM

By: Asha_Bangalore

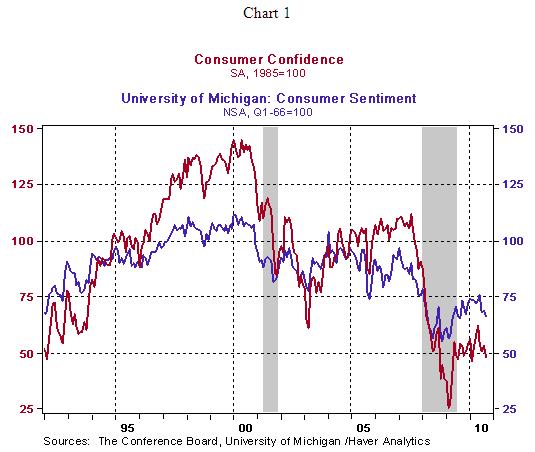

The Conference Board's Consumer Confidence Index slipped to 48.5 in September from 53.2 in August. The September reading is the lowest since February 2010 (46.4). The historical low is 25.3, registered in February 2009. The University of Michigan Consumer Sentiment index also declined in September (66.6 vs. 68.9 in August). The decline in consumer outlook appears to be tied to the prevailing conditions in the job market. Although the recent recession officially ended in June 2009 and real GDP has posted growth for four straight quarters, the 9.6% unemployment rate in August is an elevated level playing an important role in the pessimistic outlook of consumers.

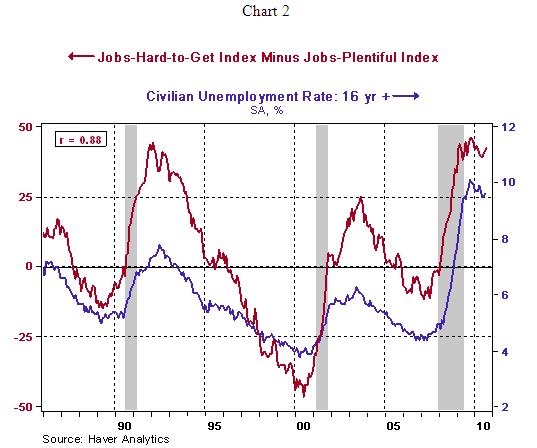

The Conference Board's survey results show that the number of respondents indicating "jobs are hard to get" moved up to 46.1% in September vs. 45.5% in the prior month. At the same time, the number responding that "jobs are plentiful" inched down to 3.8% from 4.0% in August. The net of these two indexes has a positive correlation with the unemployment rate (see chart 2). The larger net difference between the two indexes in September (42.3 vs. 41.5 in August) suggest a higher jobless rate in September.

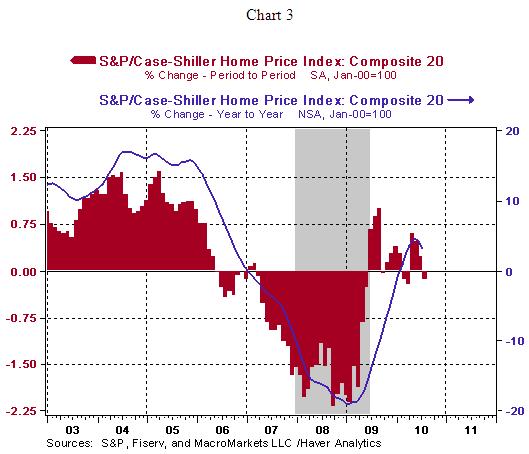

Large Number of Unsold Homes in Marketplace Will Continue to Trim House Price Gains

The seasonally adjusted Case-Shiller Home Price Index of 20 metro areas fell 0.1% in July (see chart 3) after posting gains in each of the three months of the second quarter. On a year-to-year basis, the not seasonally adjusted Case-Shiller Price Index increased 3.2%, the smallest increase in the last four months. What conclusions can be drawn from these numbers? Home prices continue to show a positive trend on a year-to-year basis, albeit a smaller gain during July compared with readings of the second quarter. Last week's inventories data of unsold new and existing homes point to continued downward pressure on prices, particularly given the fact that foreclosures make up roughly a third of existing home sales.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

http://www.marketoracle.co.uk/Article23069.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Number of American teens being arrested for HUMAN SMUGGLING on...

04-19-2024, 10:20 PM in General Discussion