Results 1 to 4 of 4

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

05-09-2016, 07:40 PM #1

Wall Street Analyst Calls Clinton Foundation “Charity Fraud"

Wall Street Analyst Who Warned on GE Ahead of Crash Calls Clinton Foundation “Charity Fraud”

Submitted by IWB, on May 7th, 2016

by Michael Krieger, libertyblitzkrieg.com

The Clinton Foundation’s finances are so messy that the nation’s most influential charity watchdog put it on its “watch list” of problematic nonprofits last month.

The Clinton family’s mega-charity took in more than $140 million in grants and pledges in 2013 but spent just $9 million on direct aid.

The group spent the bulk of its windfall on administration, travel, and salaries and bonuses, with the fattest payouts going to family friends.

“It seems like the Clinton Foundation operates as a slush fund for the Clintons,” said Bill Allison, a senior fellow at the Sunlight Foundation, a government watchdog group where progressive Democrat and Fordham Law professor Zephyr Teachout was once an organizing director.

– From last year’s post: Senior Fellow at Sunlight Foundation Calls the Clinton Foundation “A Slush Fund”

Thanks to Charles Ortel, it’s time to prepare ourselves for some more Clinton Foundation revelations.

The Washington Free Beacon reports:

http://investmentwatchblog.com/wall-...charity-fraud/The Wall Street analyst who uncovered financial discrepancies at General Electric before its stock crashed in 2008 claims the Bill, Hillary, and Chelsea Clinton Foundation has a number of irregularities in its tax records and could be violating state laws.

Charles Ortel, a longtime financial adviser, said he has spent the past 15 months digging into the Clinton Foundation’s public records, federal and state-level tax filings, and donor disclosures. That includes records from the foundation’s many offshoots—including the Clinton Health Access Initiative and the Clinton Global Initiative—as well as its foreign subsidiaries.

This week, Ortel is starting to release his findings in the first of a series of up to 40 planned reports on his website. His allegation: “this is a charity fraud.”

The Sunday Times of London described Ortel as “one of the finest analysts of financial statements on the planet” in a 2009 story detailing the troubles at AIG.

“Where you or I see pages of numbers, [Ortel] sees a narrative,” wrote Sunday Times reporter Tim Rayment. “Sometimes the theme is a company’s potential for growth. Sometimes it is the prospect of self-destruction. And at times the story does not make sense, because the figures are hiding a fraud.”

Ortel turned his attention to the Clinton Foundation in February 2015. To learn more about the charity, he decided to take it apart and see how it worked.

“I decided, as I did with GE, let’s pick one that’s complicated,” said Ortel. “The Clinton Foundation is complicated, but it’s really very small compared to GE.”

When Ortel tried to match up the Clinton Foundation’s tax filings with the disclosure reports from its major donors, he said he started to find problems.

“I decided it would be fun to cross-check what their donors thought they did when they donated to the Clinton Foundation, and that’s when I got really irritated,” he said. “There are massive discrepancies between what some of the major donors say they gave to the Clinton Foundation to do, and what the Clinton Foundation said what they got from the donors and what they did with it.”

Last year, the Clinton Foundation was forced to issue corrected tax filings for several years to correct donation errors. But Ortel said many of the discrepancies remain.

“I’m against charity fraud. I think people in both parties are against charity fraud, and this is a charity fraud,” he said.

A spokesperson for the Clinton Foundation did not comment on the claims.

-

05-09-2016, 07:41 PM #2

Senior Fellow at Sunlight Foundation Calls the Clinton Foundation “A Slush Fund”

Michael Krieger | Posted Monday Apr 27, 2015 at 3:31 pm

The hits keep on coming. Just last week, in the post, More Clinton Foundation Cronyism – The Deal to Sell Uranium Interests to Russia While Hillary was Secretary of State, I referred to the Clinton Foundation as “a veritable clearinghouse for cronyism masquerading as a charity.”

Here’s the full opening paragraph to the piece:

If you looked at the U.S. economy under a microscope, what you’d see is a gigantic cancerous blob of cronyism surrounded by tech startups and huge prisons. If you zeroed in on the cancerous tumor, at the nucleus you’d see a network of crony institutions like the Federal Reserve, intelligence agencies, TBTF Wall Street banks and defense contractors. Pretty close to that, you’d probably find the Clinton Foundation. A veritable clearinghouse for cronyism masquerading as a charity.

Unsurprisingly, I’m not the only one who has come to such a conclusion. In a New York Post article from Sunday that is generating a lot of buzz, Bill Allison, a senior fellow at nonpartisan, nonprofit government watchdog group the Sunlight Foundation, is quoted saying:

It seems like the Clinton Foundation operates as a slush fund for the Clintons.

In case you’re wondering what might prompt Mr. Allison to make such a claim, it’s not just the recent pay-to-play scandals that have emerged. It appears that based on Clinton Foundation tax filings, very little of the charity’s donations are going to, well, charity. In fact, this so called “charity” is so shady, a charity watchdog recently put it on its “watch list” of problematic nonprofits.

The New York Post reports:

The Clinton Foundation’s finances are so messy that the nation’s most influential charity watchdog put it on its “watch list” of problematic nonprofits last month.

The Clinton family’s mega-charity took in more than $140 million in grants and pledges in 2013 but spent just $9 million on direct aid.

The group spent the bulk of its windfall on administration, travel, and salaries and bonuses, with the fattest payouts going to family friends.

On its 2013 tax forms, the most recent available, the foundation claimed it spent $30 million on payroll and employee benefits; $8.7 million in rent and office expenses; $9.2 million on “conferences, conventions and meetings”; $8 million on fundraising; and nearly $8.5 million on travel. None of the Clintons is on the payroll, but they do enjoy first-class flights paid for by the foundation.

Charity Navigator, which rates nonprofits, recently refused to rate the Clinton Foundation because its “atypical business model . . . doesn’t meet our criteria.”

Charity Navigator put the foundation on its “watch list,” which warns potential donors about investing in problematic charities. The 23 charities on the list include the Rev. Al Sharpton’s troubled National Action Network, which is cited for failing to pay payroll taxes for several years.

It was the Federalist which first broke the story about the Clinton Foundation spending more money on salaries and travel than grants.

It reported the following back in March:

When anyone contributes to the Clinton Foundation, it actually goes toward fat salaries, administrative bloat, and lavish travel.

Between 2009 and 2012, the Clinton Foundation raised over $500 million dollars according to a review of IRS documents by The Federalist (2012, 2011, 2010, 2009, 2008). A measly 15 percent of that, or $75 million, went towards programmatic grants. More than $25 million went to fund travel expenses. Nearly $110 million went toward employee salaries and benefits. And a whopping $290 million during that period — nearly 60 percent of all money raised — was classified merely as “other expenses.” Official IRS forms do not list cigar or dry-cleaning expenses as a specific line item. The Clinton Foundation may well be saving lives, but it seems odd that the costs of so many life-saving activities would be classified by the organization itself as just random, miscellaneous expenses.

Since then, the Clinton Foundation has tried to defend itself, but this is the Federalist’s response, published today:

After a week of being attacked for shady bookkeeping and questionable expenditures, the Clinton Foundation is fighting back. In a tweet posted last week, the Clinton Foundation claimed that 88 percent of its expenditures went “directly to [the foundation’s] life-changing work.”

There’s only one problem: that claim is demonstrably false. And it is false not according to some partisan spin on the numbers, but because the organization’s own tax filings contradict the claim.

In order for the 88 percent claim to be even remotely close to the truth, the words “directly” and “life-changing” have to mean something other than “directly” and “life-changing.” For example, the Clinton Foundation spent nearly $8.5 million–10 percent of all 2013 expenditures–on travel. Do plane tickets and hotel accommodations directly change lives? Nearly $4.8 million–5.6 percent of all expenditures–was spent on office supplies. Are ink cartridges and staplers “life-changing” commodities?

But what if those employees and those IT costs and those travel expenses indirectly save lives, you might ask. Sure, it’s overhead, but what if it’s overhead in the service of a larger mission? Fair question. Even using the broadest definition of “program expenses” possible, however, the 88 percent claim is still false.

How do we know? Because the IRS 990 forms submitted by the Clinton Foundation include a specific and detailed accounting of these programmatic expenses.

And even using extremely broad definitions–definitions that allow office supply, rent, travel, and IT costs to be counted as programmatic costs–the Clinton Foundation fails its own test.

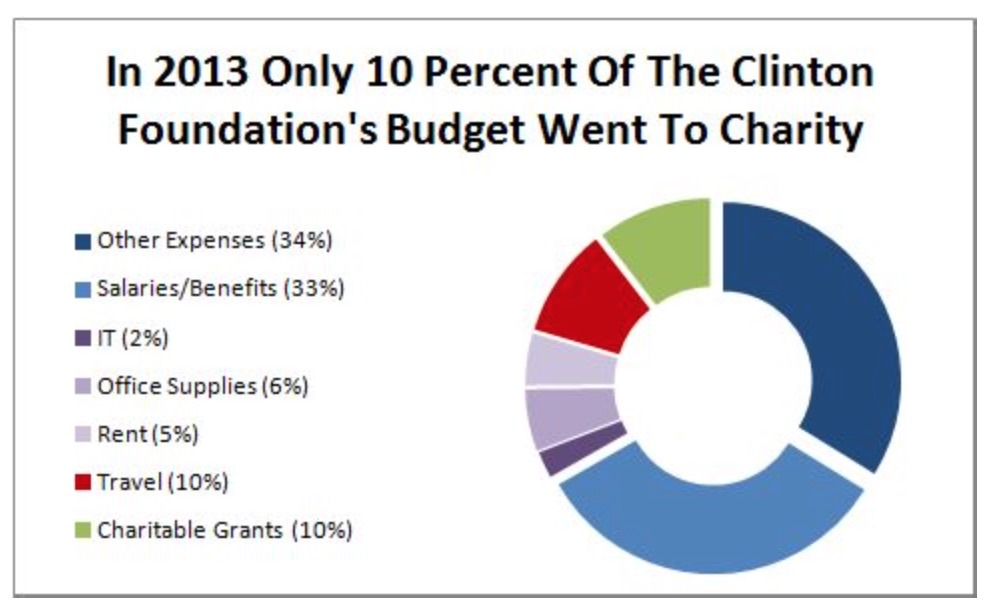

If you take a narrower, and more realistic, view of the tax-exempt group’s expenditures by excluding obvious overhead expenses and focusing on direct grants to charities and governments, the numbers look much worse. In 2013, for example, only 10 percent of the Clinton Foundation’s expenditures were for direct charitable grants. The amount it spent on charitable grants–$8.8 million–was dwarfed by the $17.2 million it cumulatively spent on travel, rent, and office supplies. Between 2011 and 2013, the organization spent only 9.9 percent of the $252 million it collected on direct charitable grants.

While some may claim that the Clinton Foundation does its charity by itself, rather than outsourcing to other organizations in the form of grants, there appears to be little evidence of that activity in 2013. In 2008, for example, the Clinton Foundation spent nearly $100 million purchasing and distributing medicine and working with its care partners. In 2009, the organization spent $126 million on pharmaceutical and care partner expenses. By 2011, those activities were virtually non-existent. The group spent nothing on pharmaceutical expenses and only $1.2 million on care partner expenses. In 2012 and 2013, the Clinton Foundation spent $0. In just a few short years, the Clinton’s primary philanthropic project transitioned from a massive player in global pharmaceutical distribution to a bloated travel agency and conference organizing business that just happened to be tax-exempt.

Now here’s the money shot:

https://libertyblitzkrieg.com/2015/0...-a-slush-fund/

-

05-09-2016, 08:17 PM #3

Wall Street Whistleblower Turns His Scrutiny on the Clinton Foundation

Charles Ortel: ‘This is a charity fraud’

EMAIL

AP

AP

BY: Alana Goodman

May 5, 2016 9:45 am

The Wall Street analyst who uncovered financial discrepancies at General Electric before its stock crashed in 2008 claims the Bill, Hillary, and Chelsea Clinton Foundation has a number of irregularities in its tax records and could be violating state laws.

Charles Ortel, a longtime financial adviser, said he has spent the past 15 months digging into the Clinton Foundation’s public records, federal and state-level tax filings, and donor disclosures. That includes records from the foundation’s many offshoots—including the Clinton Health Access Initiative and the Clinton Global Initiative—as well as its foreign subsidiaries.

According to Ortel’s reports, the contribution disclosures from the Clinton Foundation don’t match up with individual donors’ records. He also argued that the foundation is not in compliance with some state laws regarding fundraising registration, disclosure requirements, and auditing rules.

This week, Ortel is starting to release his findings in the first of a series of up to 40 planned reports on his website. His allegation: “this is a charity fraud.”

“Starting almost 20 years ago in 1997, the Clinton Foundation spread its activities from Little Rock, Arkansas, to all U.S. states and to numerous foreign countries without taking legally required steps to function and solicit as a duly constituted public charity,” wrote Ortel, in a letter posted on his website.

Although Ortel has been a commentator for conservative outlets, his findings might not be easy for authorities to ignore. After spending decades working in mergers and acquisitions at some of Wall Street’s top firms, he has been an early whistleblower on financial irregularities at companies such as General Electric and AIG.

The Sunday Times of London described Ortel as “one of the finest analysts of financial statements on the planet” in a 2009 story detailing the troubles at AIG.

“Where you or I see pages of numbers, [Ortel] sees a narrative,” wrote Sunday Times reporter Tim Rayment. “Sometimes the theme is a company’s potential for growth. Sometimes it is the prospect of self-destruction. And at times the story does not make sense, because the figures are hiding a fraud.”

Ortel started on Wall Street at age 24, going straight from Harvard Business School to the prominent mergers and acquisition firm Dillon Read, which has since closed. He later moved on to boutique firms before retiring early in 2002 to focus on raising his children as a single father.

Ortel said in early 2007 he decided to start his own financial advisory firm. As a refresher, he set out to analyze a few complex companies to see how the market was currently valuing those stocks. He said he chose 25 big ones, including the well-regarded conglomerate GE.

“To my shock and horror, as I tore it apart, I realized it was overvalued in the hundreds of millions of dollars,” he said. “It was a bad bank masquerading as a good industrial company.”

Ortel said he started alerting investor friends and sending out memos about his findings. He pitched some media outlets, without much success.

Finally, Ortel said, he reached out to the Sunday Times and got some traction. The paper published an article raising concerns in February 2008 called “The Nagging Worries at Mighty GE.”'''

Two months after the story, GE stunned investors by missing its earning projections for the first time in decades, sending its stock crashing. By the next spring, the financial giant’s stock prices had dropped from nearly $40 a share to under $6, an 18-year low.

Ortel turned his attention to the Clinton Foundation in February 2015. To learn more about the charity, he decided to take it apart and see how it worked.

“I decided, as I did with GE, let’s pick one that’s complicated,” said Ortel. “The Clinton Foundation is complicated, but it’s really very small compared to GE.”

When Ortel tried to match up the Clinton Foundation’s tax filings with the disclosure reports from its major donors, he said he started to find problems.

“I decided it would be fun to cross-check what their donors thought they did when they donated to the Clinton Foundation, and that’s when I got really irritated,” he said. “There are massive discrepancies between what some of the major donors say they gave to the Clinton Foundation to do, and what the Clinton Foundation said what they got from the donors and what they did with it.”

Last year, the Clinton Foundation was forced to issue corrected tax filings for several years to correct donation errors. But Ortel said many of the discrepancies remain.

Ortel said his reports in the coming months would also provide evidence that the foundation is not complying with state laws on fundraising, financial disclosure, and audits.

“I’m against charity fraud. I think people in both parties are against charity fraud, and this is a charity fraud,” he said.

Ortel said he hoped the reports would encourage investigative journalists to follow up on his findings.

A spokesperson for the Clinton Foundation did not comment on the claims.

Ethics watchdogs also said they hope the reports will lead to renewed scrutiny. Ken Boehm, chairman of the National Legal and Policy Center, said he was “very impressed with the points [Ortel] makes in his letter regarding the release of his analyses.”

“Charles Ortel has clearly done a yeoman job identifying the legal, tax and accounting problems plaguing years of filings relating to the Clinton Foundation,” said Boehm. “His planned release of his analyses represents an important public service which will result in the scrutiny these filings deserve. Mr. Ortel’s experienced eye has already caught numerous issues never before disclosed and his future disclosures deserve close attention.”

http://freebeacon.com/issues/wall-st...on-foundation/

Read about Ortel's invesitgation at;

http://charlesortel.com/Last edited by Newmexican; 05-10-2016 at 06:20 AM.

-

10-20-2016, 11:14 AM #4

Similar Threads

-

Charity Watchdog: Clinton Foundation A ‘Slush Fund’

By Newmexican in forum General DiscussionReplies: 14Last Post: 05-11-2015, 10:17 AM -

WALL STREET ANALYST UNCOVERS CLINTON FOUNDATION FRAUD

By Newmexican in forum General DiscussionReplies: 2Last Post: 04-24-2015, 10:25 AM -

Occupy Wall Street is A Fraud

By Newmexican in forum Other Topics News and IssuesReplies: 1Last Post: 10-08-2011, 03:48 PM -

Obama called "Foolish" "Slave to Wall Street

By JohnDoe2 in forum Other Topics News and IssuesReplies: 2Last Post: 04-20-2011, 07:00 PM -

FBI Investigating Wall Street Fraud

By avenger in forum Other Topics News and IssuesReplies: 1Last Post: 09-26-2008, 10:09 AM

4Likes

4Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Number of American teens being arrested for HUMAN SMUGGLING on...

04-19-2024, 10:20 PM in General Discussion