Results 1 to 2 of 2

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

02-23-2014, 08:50 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

The Worst Run States in America

The Worst Run States in America

Sunday February 23rd, 2014

Posted by Craig Eyermann at 10:30am PST • 1 Comment

For several years now, 24/7 Wall Street has analyzed how well each state within the United States is run by its elected officials and government bureaucrats. To determine how well each state is run, they looked at each state’s financial data as well the services that each provides to its residents, while also factoring in their standard of living.

For several years now, 24/7 Wall Street has analyzed how well each state within the United States is run by its elected officials and government bureaucrats. To determine how well each state is run, they looked at each state’s financial data as well the services that each provides to its residents, while also factoring in their standard of living.

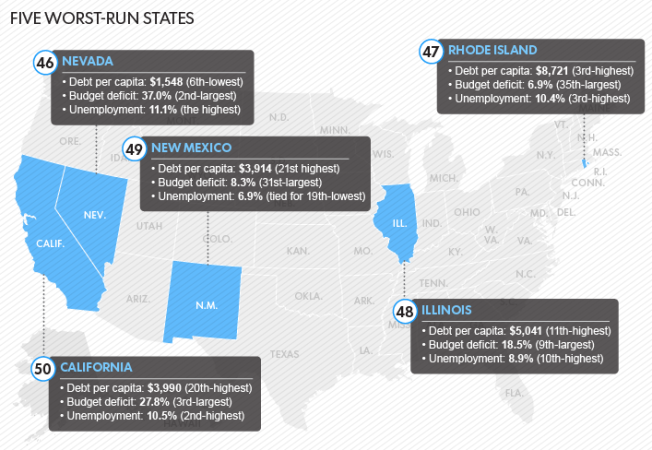

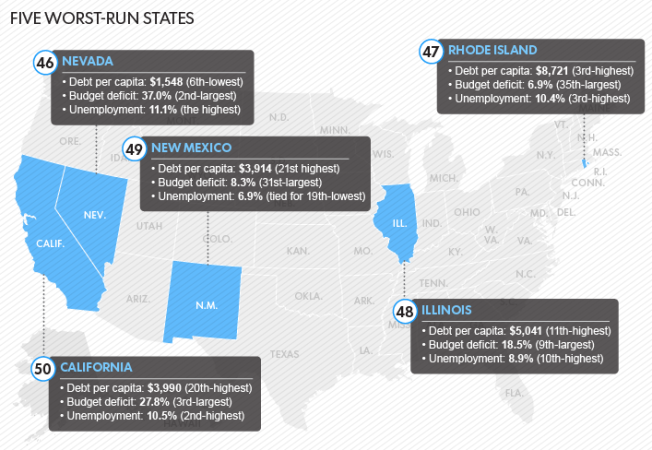

To determine how well the states are run, 24/7 Wall St. reviewed hundreds of data sets from dozens of sources. We looked at each state’s debt, revenue, expenditure, and deficit to determine how well it was managed fiscally. We reviewed taxes, exports, and GDP growth, including a breakdown by sector, to identify how each state was managing its resources. We looked at poverty, income, unemployment, high school graduation, violent crime and foreclosure rates to assess the well-being of the state’s residents.We won’t keep you in suspense – the map below, which was produced by USA Today from 24/7 Wall Street’s data, reveals which states were reported to be the worst run in 2013:

While each state is different, the best-run states share certain characteristics, as do the worst run. For example, the populations of the worse-off states tended to have lower standards of living. Violent crime rates in these states were usually higher and residents were much less likely to have a high school diploma.

The worst-run states also tended to have weak fiscal management reflected in higher budget shortfalls and lower credit ratings by Moody’s Investors Service and Standard & Poors.

The better-run states tended to display stable fiscal management. Pensions were more likely to be fully funded, debt was lower, and budget deficits smaller. Credit ratings agencies also were much more likely to rate the well-run states favorably. Only two poorly run states received a perfect credit rating from either agency. California and Illinois, which are ranked worst and third worst, received the lowest ratings from both agencies.

The states that were well-managed also tended to have lower unemployment rates.

The four runner-up worst-run states, in order from least badly run to most badly run, were Nevada, Rhode Island, Connecticut and Illinois. Meanwhile, the most badly run state in America is California.

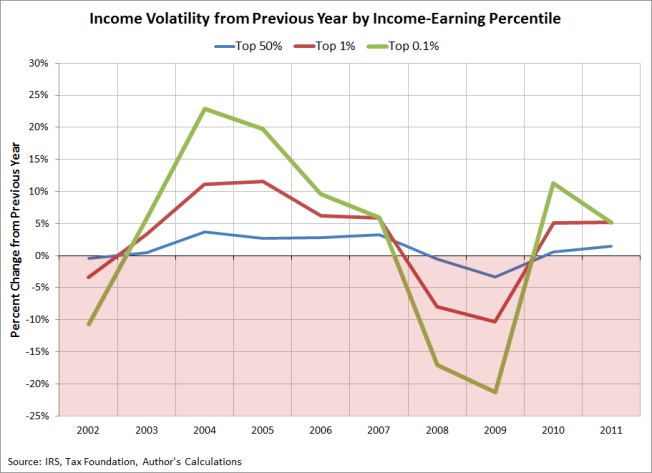

24/7 Wall Street notes their 2013 finding isn’t the first time California has come out on the bottom:For the third year in a row, California is the worst-run state in America. California faced a nearly $24 billion in budget shortfall in fiscal 2012, including a mid-year shortfall of $930 million and $8.2 billion carried over from the year before. California carries an A credit rating from Standard & Poor’s, and an A1 from Moody’s — both worse than any other state except for Illinois. Explaining its rating, Moody’s pointed to the state’s history of one-time solutions to resolve its budgetary gaps. It also noted the state’s “highly volatile revenue structure,” due to its over reliance on wealthy taxpayers. The Golden State was also among the worst states in the nation for educational attainment, health coverage, and unemployment.California’s over reliance upon high income-earning taxpayers for the state’s revenues, counting upon them having good years to sustain their spending, virtually ensures that the state will experience a fiscal crisis in the future. To understand why that’s the case, just consider how much the income threshold to be in the Top 50%, Top 1% or the very Top 0.1% has changed from year to year over the most recent 10 years for which the IRS has published data:

With volatility like that in just the past 10 years, the bottom line is that if any state government is counting upon millionaires and billionaires for the revenue needed to sustain their spending, it is being run very badly indeed, as its fiscal house is out of whack. So badly, in fact, that the state’s residents can expect to experience a major government fiscal crisis whenever the state’s highest income earning residents have a bad year.

Featured Image:

Federal Bureau of Investigation

http://www.mygovcost.org/2014/02/23/...es-in-america/Join our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

02-23-2014, 09:40 PM #2

ALL MECCA, HAVEN, REFUGES AND SANCTUARIES OF ILLEGAL ALIENS ..

Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

Join our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

"YOU WILL FOOT THE BILL FOR ILLEGAL IMMIGRANTS!" GOVERNOR HOCHUL...

04-23-2024, 05:46 AM in Videos about Illegal Immigration, refugee programs, globalism, & socialism