Results 1 to 3 of 3

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

11-03-2011, 12:10 AM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Day of reckoning for shadow inventory & distressed prope

Day of reckoning for shadow inventory and distressed properties â 40 percent of properties in foreclosure have not made a payment in two years or more.

2 Nov, 2011

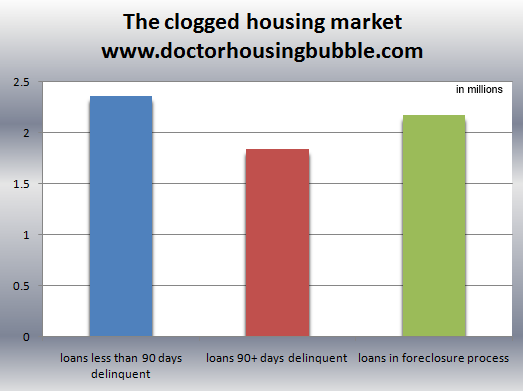

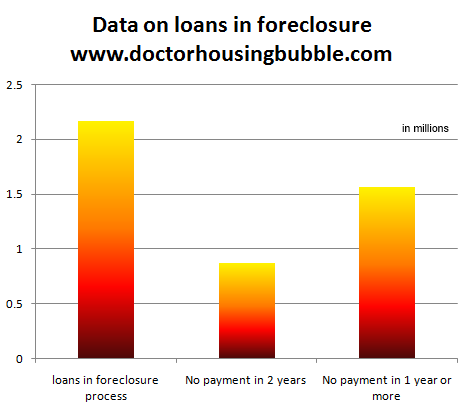

What we are witnessing on a large scale is an economy that has it completely backwards when it comes to banking and housing. Homes and the financial grease that keep the system running should be an extrapolation of an underlying healthy employment market. Today we have a misfit system of denial, outright corruption, and graft that is largely making our banking system unrecognizable. It is astounding to see how many people simply assume that the distressed pipeline has somehow miraculously disappeared. It emphatically has not. Data released this week shows that 2.17 million loans are actively in foreclosure. Of these loans, 40 percent have not made a payment in over two years! 72 percent have not made a payment in over one year! In essence, just like with our financial fixes, this has been the equivalent of covering up our eyes like a child fearing the boogieman and pretending there was no issue in the system. Psychologically you have many that bought in bubble markets the last few years trying to convince each other that they somehow made a wise decision simply because they did not purchase at the peak. The data on the clogged toilet of housing distressed properties shows us that we still have some serious plumbing problems ahead.

The pipeline of distressed properties sits at 6.37 million

Given the dismal re-default rates and cure opportunities most loans that get behind will end up as lower priced sales either through a short sale or a full-fledged foreclosure. It might help to get a full snapshot of the current situation:

In all some 6.37 million homes can be considered distressed. This is a large pipeline. Given the astounding reality that over 40 percent of the loans in foreclosure have made no payment in two years, you can understand why the other two columns are brimming to the top. When we splinter out the foreclosure column the data looks daunting:

Not much has improved on this front largely because the economy is still mired in an economic mess and Europe is dealing with what else, a giant debt crisis. We are inextricability linked to global banking markets and our entire financial edifice rests on debt. Not just a little bit of debt but heaping amounts of debt. The game can only go on for as long as you can convince enough suckers to jump into the system to believe that the next decade will follow similar patterns to those that they know in the 1970s, 1980s, 1990s, or 2000s. You can rest assured that the upcoming decade will not resemble any of those.

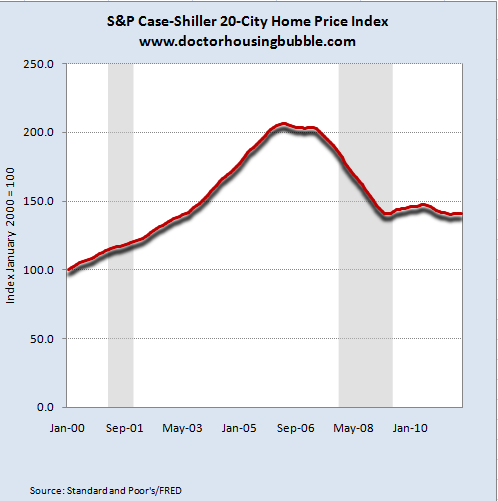

The name of the game is confidence. The housing bubble was largely a giant psychological ploy based on easy access to debt and a large cult like mentality that home values would only go up irrespective of underlying economic fundamentals. Bubbles work this way and play on consumer behavior and the flaws of our primordial brains. Deep down we still have a few things to work out and we are seeing these things play out on a global stage. Around the world you are seeing housing bubbles from Australia to China to the United States. Prices have done very little in the last four years after collapsing:

Those that make the case for diving in right now usually have simplistic visions of the new financial system. The dynamics of the current system move much faster and some are using outdated models and assuming the demographics of yesterday will apply to the future. These people even miss simple benefits of renting; like the flexibility offered especially for younger professional couples who need to move around and with careers shifting so quickly, many may end up in New York, Chicago, Los Angeles, or any other large city. Renting provides quick mobility. Buy now and you can expect to stay put for a very long time. Iâve talked with a few younger and bright professional couples and some are actually very happy to talk about renting. Even four years ago this was rare to hear. Today the oneâs arguing for buying in this market may largely be justifying their purchase and assuming some kind of Mad Men era of prosperity.

A quick glance on Realtor.com shows that roughly 4.3 million properties are up for sale nationwide:

The clogged housing pipeline is up over 6.37 million! I find this comparison interesting because much of the distressed pipeline is behind the scenes. Take California as an example:

Non-distressed for sale: 169,000

Notice of default: 85,000

Scheduled for auction: 55,000

Bank owned homes: 64,000

The bank owned category is large at 64,000 but more troubling is you have 55,000 properties scheduled for auction that are likely to be inventory shortly (even after delaying the inevitable for years). What will this do to prices? Push them lower:

CA median price

September 2010: $265,000

September 2011: $249,000

Keep in mind the above price decline has occurred from a peak median price drop from $484,000 in 2007. Maybe the 22+ percent underemployment rate has something to do with it or the fact that with lower wages, more money is being floated to housing and taking away from the productive side of the economy. Ironically some of the best boom times for the nation occurred when home prices were moderately priced and people didnât need maximum leverage to squeeze into the party dress house to think they looked good.

It is interesting to hear some people have a âI got mine so screw you attitudeâJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

11-03-2011, 05:13 AM #2

Re: Day of reckoning for shadow inventory & distressed p

============================================= Originally Posted by AirborneSapper7

Originally Posted by AirborneSapper7

I saw figures last month that 25% of American households are bankrupt, barely able to keep food on the table, let alone make their mortgage payment.

The monster has a vicious and rabid appetite, and feeds off of debt and greed, and mainly foreign debt to foreign banks and bankers.

And people wonder how this plundering of our national wealth could have ever happened, bringing down the wealthiest nation in the history of the world to one of the most financially desperate in less than a single decade.

Banks are now allowing people to live in these houses instead of foreclosing on them since the sheer volume of 'bad paper, upside down' mortgages is greater than mortgages still actually worth more than or at least equal to the appraised property values.

To add great torment to deep pain, PROPERTY TAXES levied by corrupt county and state governments who can barely pay their own payrolls, let alone provide for any real property or utility improvements are still GOING UP while property values are falling like meteors from the sky.

Not until the American People strip Congress, The Senate, and the President of the Unconstitutional powers they have been wielding over us for the past fifty years will this country ever return to being the Republic it was founded upon.

Not until congress and senate terms are reduced to FOUR YEARS with ZERO * ZERO * RETIREMENT and no higher annual income than the AVERAGE NATIONAL AMERICAN INCOME will we be able to clean out this RAT'S NEST.

What company, business, corporation, or organization is there other than the congress and the senate who can hold secret meetings late at night behind closed doors without the consent of their constituents and VOTE THEMSELVES PAY RAISES?

CORRUPTION REIGNS!

[quote][i][b] âIf the American people ever allow private banks to control the issue of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.âJoin our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

-

11-03-2011, 05:48 AM #3

RELATED

Too Big to Fail Banks Wouldnât Be So Big and Dangerous If People Moved Their Money

http://www.washingtonsblog.com/2011/11/ ... money.html

Big Banks Refuse to Let People Close Accounts

http://www.washingtonsblog.com/2011/10/ ... ounts.html

The Only Way to Save the Economy: Break Up the Giant, Insolvent Banks

http://www.washingtonsblog.com/2011/10/ ... banks.htmlJoin our FIGHT AGAINST illegal immigration & to secure US borders by joining our E-mail Alerts at http://eepurl.com/cktGTn

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

GALLUP POLL: Immigration the most pressing issue in America for...

05-03-2024, 11:30 PM in General Discussion