Results 1 to 10 of 31

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

-

08-15-2009, 09:02 PM #1Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

As of Friday August 14, 2009, FDIC is Bankrupt

As of Friday August 14, 2009, FDIC is Bankrupt

Bank Failure Friday is in full swing. Tonight there were 5 more failures, numbers 73 through 77 on the year. In the biggest failure since WaMu, BB&T Takes Over Colonial.

Colonial BancGroup Inc., the Alabama lender facing a criminal probe, had its banking operations closed by regulators and taken over by BB&T Corp. in the biggest bank failure since Washington Mutual Inc. collapsed last year.

Branches and deposits of Colonial, Alabamaâs second-largest bank, were turned over to Winston-Salem, North Carolina-based BB&T in a deal brokered by the Federal Deposit Insurance Corp., the regulator said today. The failure of Montgomery-based Colonial followed a Florida expansion that saddled the lender with more than $1.7 billion in soured real-estate loans.

Colonialâs failure will deplete the FDICâs deposit insurance fund by $2.8 billion, the agency said. The fund, which the agency uses to pay customers of a failed bank for deposit losses up to a $250,000 limit and is generated by fees paid by banks, stood at $13 billion at the end of the first quarter, according to the FDIC. The agency has set aside an additional $25 billion for bank failures, agency spokesman David Barr said.

Is There Any Money Left In The Fund?

Tonight, inquiring minds are asking "Is There Any Money Left In The Fund?"

For clues, please consider Saxo Bank Research FDICâs Shrinking Deposit Insurance Fund â A Testimony of Current Accounting Standards.

As late as in the end of April just before the release of the bank stress tests, Ms. Bair Chairman of the FDIC said they would not need any additional bailouts from the U.S Treasury within the immediate future according to The Bulletin. After three new bank failures last Friday, the FDICâs Deposit Insurance Fund (DIF) diminished by another $185 million for a total remaining balance of $648.1 million.

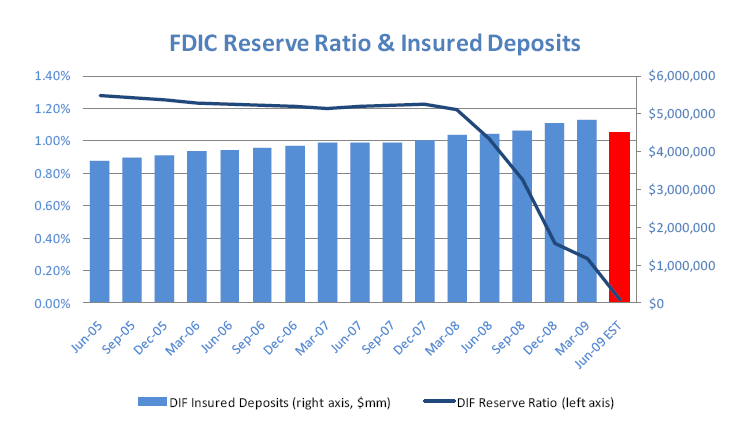

Below is a graph showing the DIF capital as a percentage of total bank deposits insured by the FDIC. Note that this graph is based on the old insurance limit with a maximum coverage of $100.000/account. This limit has been changed to cover up to $250.000/account until January 1st 2014. Estimates say that the change increases the deposits covered under FDIC insurance to approximately $6 trillion in total.

FDIC Reserve Ratios & Insured Deposits

The current reserve ratio of 0.014%1 strongly indicates how bad this crisis has affected U.S financial institutions. However, this is not the entire story. If we take a closer look at non-current loans and charge-offs from banks one realizes that the FDIC still has a lot of work to be done. Combined non-current loans and charge-offs amounted to nearly $100 billion in Q109 compared to $15 billion/quarter pre-crisis. Moreover, according to analysts at the Royal Bank of Canada the U.S still has banking failures in the thousands to face before the crisis is over. In turn that should result in the FDIC requesting the pre-approved funding signed by the Congress in May 2009, including $100 billion from the U.S Treasury Department.

Tonight's Bank Failures

Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.8 million. PNC Bank, National Association's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Dwelling House Savings and Loan Association is the 73rd FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania. The last FDIC-insured institution to be closed in the state was Metropolitan Savings Bank, Pittsburgh, on February 2, 2007.

Colonial Bank, Montgomery, Alabama

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $2.8 billion. BB&T's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Colonial Bank is the 74th FDIC-insured institution to fail in the nation this year, and the first in Alabama. The last FDIC-insured institution to be closed in the state was Birmingham FSB, Birmingham, on August 21, 1992.

Union Bank, National Association, Gilbert, Arizona

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $61 million. MidFirst Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Union Bank, N.A. is the 75th FDIC-insured institution to fail in the nation this year, and the second in Arizona. The last FDIC-insured institution to be closed in the state was Community Bank of Arizona, Phoenix, also today.

Community Bank of Arizona, Phoenix, Arizona

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.5 million. MidFirst Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Community Bank of Arizona is the 76th FDIC-insured institution to fail in the nation this year, and the first in Arizona. The last FDIC-insured institution to be closed in the state was NextBank, Phoenix, on February 7, 2002.

Community Bank of Nevada, Las Vegas, Nevada

The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million. Community Bank of Nevada is the 77th bank to fail this year and the third in Nevada. The last bank to be closed in the state was Great Basin Bank, Elko, on April 17, 2009.

Taxpayers Bailout FDIC

If indeed $641 million was all that remained of the DIF, the FDIC is now bankrupt. Of the $641 million left, Community bank used up 781.5 million and Colonial Bank $2.8 billion

Here is more from the Saxo Report

The real total cost for Q1 09 turned out to be almost twice the amount of the estimates. If that will be even close to reality for Q2 09 the FDICâs DIF will (very) soon be out of funds completely. [Mish: as of tonight the DIF is bankrupt.]

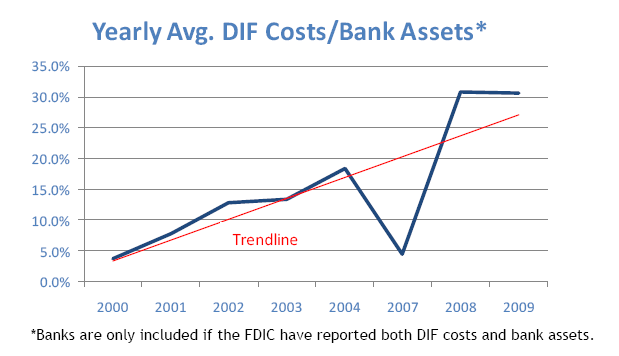

We believe the main reason for this observation lies in a de facto relaxation of accounting standards, even before the FASB 157 amendment on March 15th earlier this year. Basically the relaxation allows banks to only write-off parts of their losses due to market impairment and they may themselves decide a fair price that the asset could have been sold for during normal market conditions to keep in their books. Allowing banks to control how they mark-to-market their assets, will likely backfire and when they ultimately end up failing, imply greater closure costs for the FDIC. From the graph [below] one can infer that the average yearly DIF costs/bank assets have increased at an alarming rate to almost reach 31% in 2008 and 2009.

Yearly Average DIF Costs / Bank Assets

So, what does that imply? Basically it means that when valuating any U.S bank, their assets should probably be marked down significantly relative to their book value, much because of how they nowadays are allowed to manipulate their balance sheets in order to appear more solvent than they in fact are.

The Moral Hazard of FDIC Insurance

Friday, In reference to Colonial, Shelia Bair made the following galling claim:

"The past 18 months have been a very trying period in the financial services arena, but the FDIC and its staff have performed as Congress envisioned when it created the corporation more than 75 years ago," said FDIC Chairman Sheila C. Bair. "Today, after protecting almost $300 billion in deposits since the current financial crisis began, the FDIC's guarantee is as certain as ever. Our industry funded reserves have covered all losses to date. In fact, losses from today's failures are lower than had been projected. I commend our staff for their excellent work in assuring once again a smooth transition for bank customers with these resolutions. The FDIC continues to stand by the nation's insured deposits with the full faith and credit of the U.S. government. No depositor has ever lost a penny of their insured deposits."

The Seen and the Unseen

Nowhere does "Shelia the Fool" state the cost of this insurance. Without FDIC, banks like Colonial, Bank United, Corus Bank, and possibly even banks like Washington Mutual would have failed long before they mattered.

By offering above market rates on CDs, those bank attracted plenty of capital to the detriment of banks lending responsibly. In order to offer high rates on CDs and deposits, the banks had to take high risks.

Bank United and Corus Bank funded all sorts of risky housing projects including condo towers in the biggest bubble cities. Colonial Bank is under investigation for Fraud.

No one in their right minds would have deposited money at those institutions without FDIC. And if they did it should be their problem not yours or mine.

Total Up The Unseen

* Looming taxpayer bailouts of the FDIC

* Taxpayer bailouts of failed banks

* Taxpayer bailouts of mortgage reductions to keep people in their homes

* Rising property taxes because of increased speculation

* The FDIC's role in the housing boom and bust

* Fraud costs

* Investigatory costs

* Stock market crash

* Cost to pension plans dumb enough to buy debt in failed banks simply because they were "growing"

For more on the Seen and Unseen please see Government Bailouts and the Stock Market - The Seen and the Unseen and Cash For Clunkers For Housing Market Is 'No Brainer'

FDIC Is Asinine Model

There were no bank failures for a very long time during the credit boom. Thus, FDIC insurance seemed to work very well for a while. The reality is such schemes always produce fat tails.

Instead of spreading a small number of small bank failures out over a large number of years, a large number of big failures are all clustered together.

If this is not an asinine model what is? Note this is a failure caused by regulation. There should not be an FDIC in the first place.

Shelia brags "In fact, losses from today's failures are lower than had been projected."

She needs a math lesson. The cost of FDIC is staggering, and the benefits are negative.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

http://globaleconomicanalysis.blogspot. ... ic-is.htmlJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2009, 04:28 PM #2

If this were true doesn't it seem like some employee of some media someplace in the world would have mentioned it by now?

RELATED

FDIC says it doesnât need to borrow, for now

http://www.alipac.us/ftopict-168521.html

RELATED

FDIC to soften stance, luring private capital

http://www.alipac.us/modules.php?name=F ... c&p=944781NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-16-2009, 04:43 PM #3Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

your either very very stupid or you are fusion center plant... I am convinced of it

Mike "Mish" Shedlock is very well known in the financial sector and you either do not know how many bank falures there have been this year alone; OR you are not very financially inclined; OR you look to dispell anything you do not believe just to pick a fight; or you work for a fusion center... which is it?

I would suggest if you are not a fusion center plant you pick up the financial times and do a little reading

Since early 2007, 143 banks have failed, all of that taking money from the FDIC to prop them up ... all that means is they come back and beg for more money from the federal governmentJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2009, 04:46 PM #4Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

Mike "Mish" Shedlock

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

You are currently viewing my global economics blog which typically has commentary every day of the week. I am also a contributing "professor" on Minyanville, a community site focused on economic and financial education.

Every Thursday I do a podcast on HoweStreet and on an ad hoc basis contribute to many other sites.

When not writing about stocks or the economy I spend a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2009, 05:19 PM #5You keep saying that, and I don't know what that is, so I figured that some other people wouldn't know what it is either so I did some research and came up with this info to share with everyone.

Originally Posted by AirborneSapper7

Originally Posted by AirborneSapper7

It sounds exciting, like being 007 or something. Does it pay good? Will they hire old retire guys, or do you have to be young? Where do you send your resume to try to get hired?

Fusion Centers and Intelligence Sharing

The Fusion Center Guidelines: Law Enforcement Intelligence, Public Safety ... Fusion Center Guidelines: Executive Summary Criminal Intelligence Sharing Plan ...

www.it.ojp.gov/default.aspx?area=nationalInitiatives... - Cached - Similar

[PDF] Fusion Center GuidelinesFile Format: PDF/Adobe Acrobat

Fusion Center GuidelinesâDeveloping and Sharing Information in a New Era. Fusion Center. Guidelines. Developing and Sharing. Information and Intelligence ...

it.ojp.gov/documents/fusion_center_guidelines_law_enforcement.pdf - Similar

Show more results from it.ojp.gov

Fusion center - Wikipedia, the free encyclopedia

A Fusion Center is a terrorism prevention and response center that was started as a joint project between the Department of Homeland Security and the US ...

en.wikipedia.org/wiki/Fusion_center - Cached - Similar

'Fusion center' data draws fire over assertions - ColumbiaTribune.comMar 14, 2009 ... Tim Neal of Miller County was shocked recently when he heard a radio program about a strategic report compiled by state and federal law ...

www.columbiatribune.com/.../fusion-cent ... ssertions/ - Cached - Similar

Fusion Center Guidelines

As part of the U.S. Department of Justice's (DOJ) Global Justice Information Sharing Initiative's (Global) efforts to develop fusion center guidelines, ...

www.iir.com/global/guidelines.htm - Cached - Similar

Commonwealth Fusion Center - Executive Office of Public Safety

The Fusion Center provides 24 hours a day statewide information sharing among local, state and federal public safety agencies and private sector ...

www.mass.gov/?pageID...Fusion+Center... - Cached - Similar

'Fusion Centers' Expand Criteria to Identify Militia Members

...Mar 23, 2009 ... ACLU officials blasted a Texas fusion center last month for distributing a "Prevention Awareness Bulletin" that called on law enforcement ...

www.foxnews.com/.../fusion-centers-expa ... a-members/ - Cached - Similar

Virginia Fusion Center - Virginia State PoliceThe Virginia Fusion Center was created to improve the Commonwealth of Virginia's preparedness against terrorist attacks. The Center is essential to ...

www.vsp.state.va.us/FusionCenter/index.shtm - Cached - Similar

Oklahoma Fusion Center Coordinator Vague On NLE 09Aug 4, 2009 ... Andrew W. Griffin | [b]âThere really wasn'ta lot of media interest. I saw and read very little about it. Not a lot of media coverage about it.âNO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-16-2009, 06:12 PM #6

Speaking of getting paid, who pays AirborneSapper7 to post hundreds of articles here every day, 7 days a week, sometimes 20 hours a day.

Is AirborneSapper7 just one person or a group of people who take turns working around the clock posting article?NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-16-2009, 07:28 PM #7Senior Member

- Join Date

- May 2007

- Location

- South West Florida (Behind friendly lines but still in Occupied Territory)

- Posts

- 117,696

you are a fusion center employee or a Democrat working for special interest groups

either way, I see through your frontJoin our efforts to Secure America's Borders and End Illegal Immigration by Joining ALIPAC's E-Mail Alerts network (CLICK HERE)

-

08-16-2009, 08:29 PM #8

As exciting as being an undercover agent sounds I must admit that I am not a Democrat, a Republican, or an agent to the federal government, or what ever working for Fuson makes you.

I am an Independent voter who can think for himself and doesn't need any political party, or anyone else, to tell him what to thing or how to vote.NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

-

08-16-2009, 09:03 PM #9I for one, come here each day to read some of the articles AirborneSapper7 has posted. I would say he's invaluable to this site and can't understand why anyone would criticize his efforts to bring us some news from around the world when most media outlets are Liberal owned and bias.

Originally Posted by JohnDoe2

Originally Posted by JohnDoe2

-

08-16-2009, 09:39 PM #10

I'm retired and all of this is just inexpensive entertainment for me.

NO AMNESTY

Don't reward the criminal actions of millions of illegal aliens by giving them citizenship.

Sign in and post comments here.

Please support our fight against illegal immigration by joining ALIPAC's email alerts here https://eepurl.com/cktGTn

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

BORDER INSANITY: Illegal Immigrants Now Working With Criminal...

05-11-2024, 09:19 AM in illegal immigration News Stories & Reports